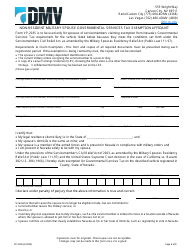

This version of the form is not currently in use and is provided for reference only. Download this version of

Form VP-203

for the current year.

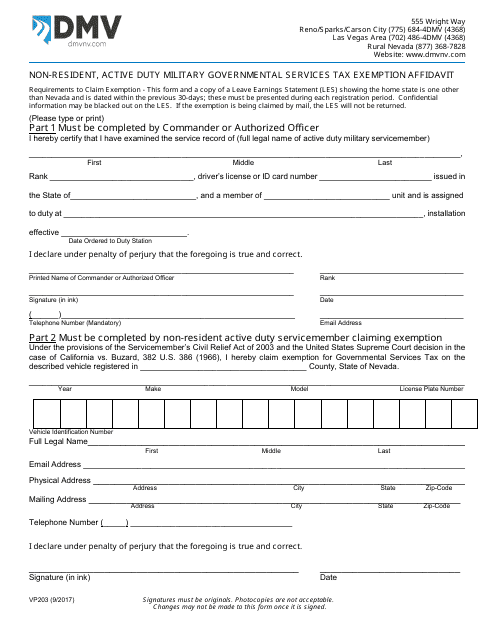

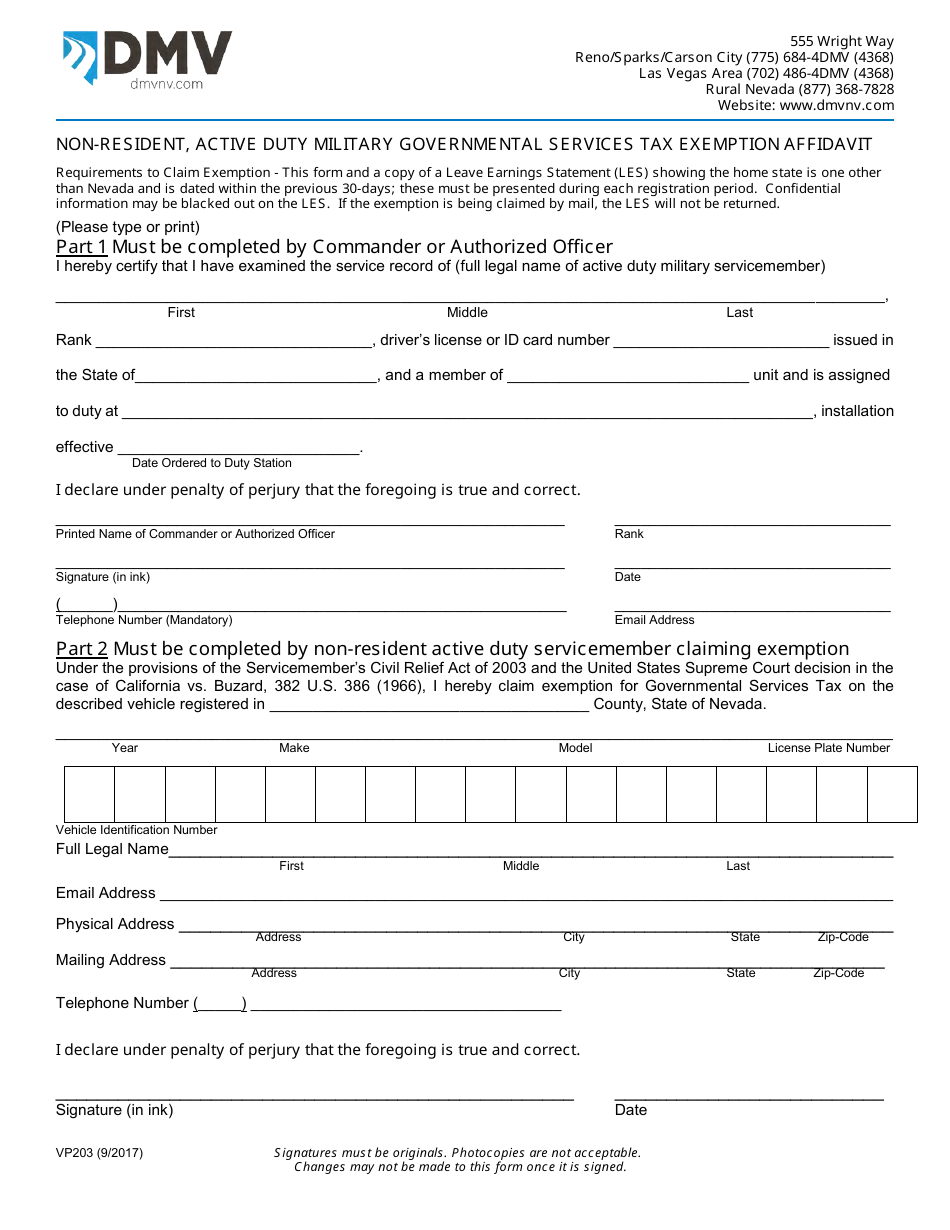

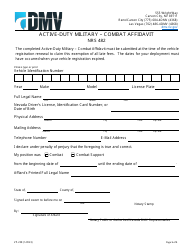

Form VP-203 Non-resident, Active Duty Military Governmental Services Tax Exemption Affidavit - Nevada

What Is Form VP-203?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VP-203?

A: Form VP-203 is the Non-resident, Active Duty Military Governmental Services Tax Exemption Affidavit in Nevada.

Q: Who is eligible to use Form VP-203?

A: Active duty military personnel who are non-residents of Nevada and are stationed in the state for military service are eligible to use Form VP-203.

Q: What is the purpose of Form VP-203?

A: The purpose of Form VP-203 is to claim exemption from certain governmental services taxes for active duty military personnel who are non-residents of Nevada.

Q: What taxes can be exempted using Form VP-203?

A: Form VP-203 can be used to claim exemption from sales tax, use tax, and governmental services tax.

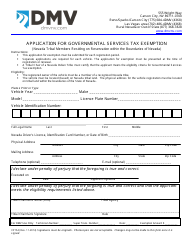

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VP-203 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.