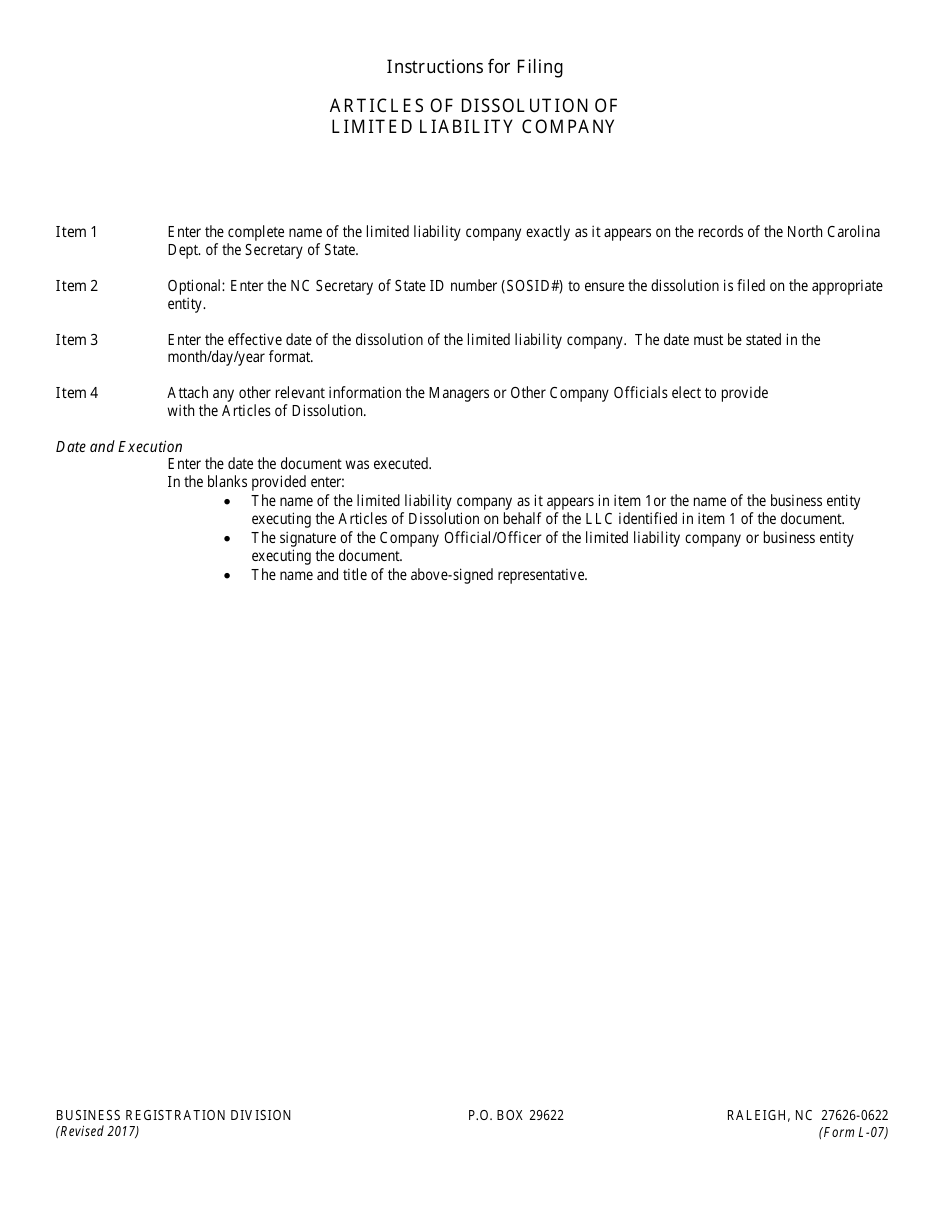

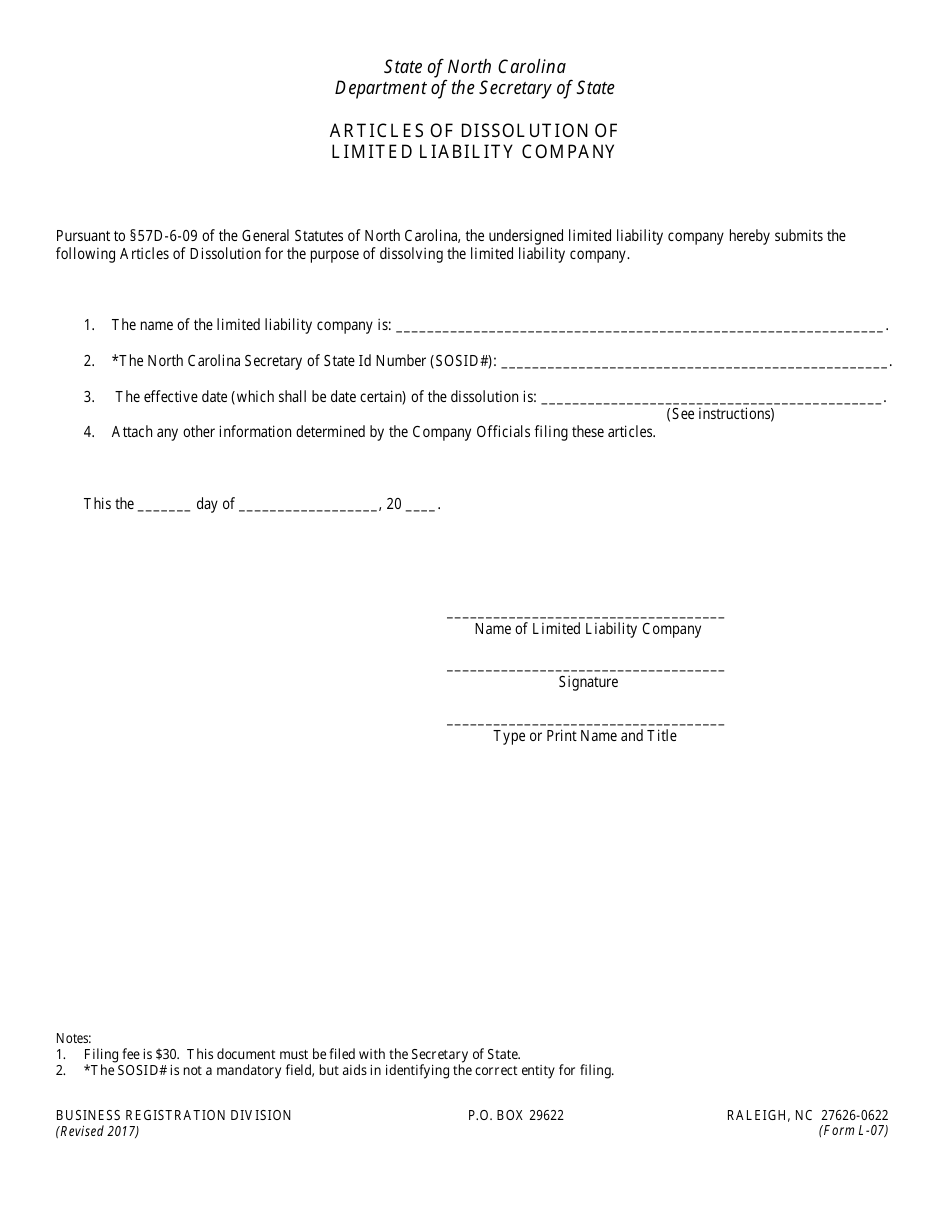

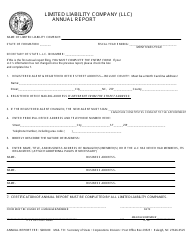

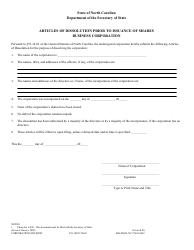

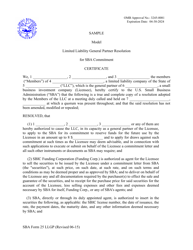

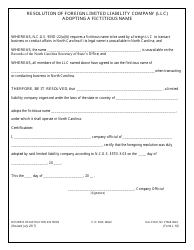

Form L-07 Articles of Dissolution of Limited Liability Company - North Carolina

What Is Form L-07?

This is a legal form that was released by the North Carolina Secretary of State - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-07?

A: Form L-07 is the Articles of Dissolution for a Limited Liability Company (LLC).

Q: What is the purpose of filing Form L-07?

A: The purpose of filing Form L-07 is to formally dissolve a Limited Liability Company in North Carolina.

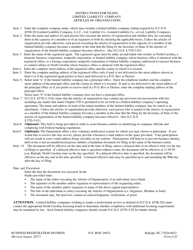

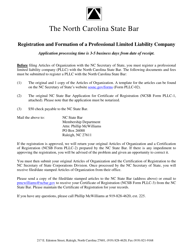

Q: Are there any requirements for filing Form L-07?

A: Yes, the LLC must be in good standing with the state and all fees must be paid before filing Form L-07.

Q: What information is required on Form L-07?

A: Form L-07 requires information such as the LLC's name, date of dissolution, and the signature of an authorized representative.

Q: How long does it take to process Form L-07?

A: The processing time for Form L-07 can vary, but it generally takes several business days.

Q: What happens after Form L-07 is approved?

A: Once Form L-07 is approved, the LLC will be officially dissolved and its existence will cease.

Q: Are there any post-dissolution requirements for an LLC?

A: Yes, even after dissolution, there may be post-dissolution requirements such as filing final tax returns and notifying creditors and business partners.

Q: Can a dissolved LLC be reinstated?

A: Yes, a dissolved LLC can be reinstated by filing a reinstatement form and paying any outstanding fees or penalties.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the North Carolina Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-07 by clicking the link below or browse more documents and templates provided by the North Carolina Secretary of State.