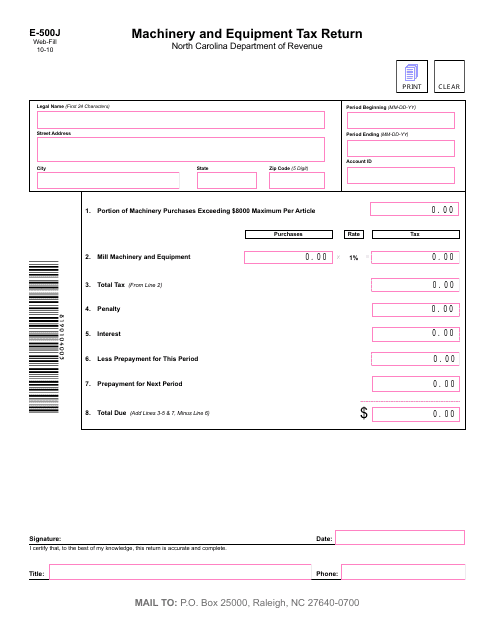

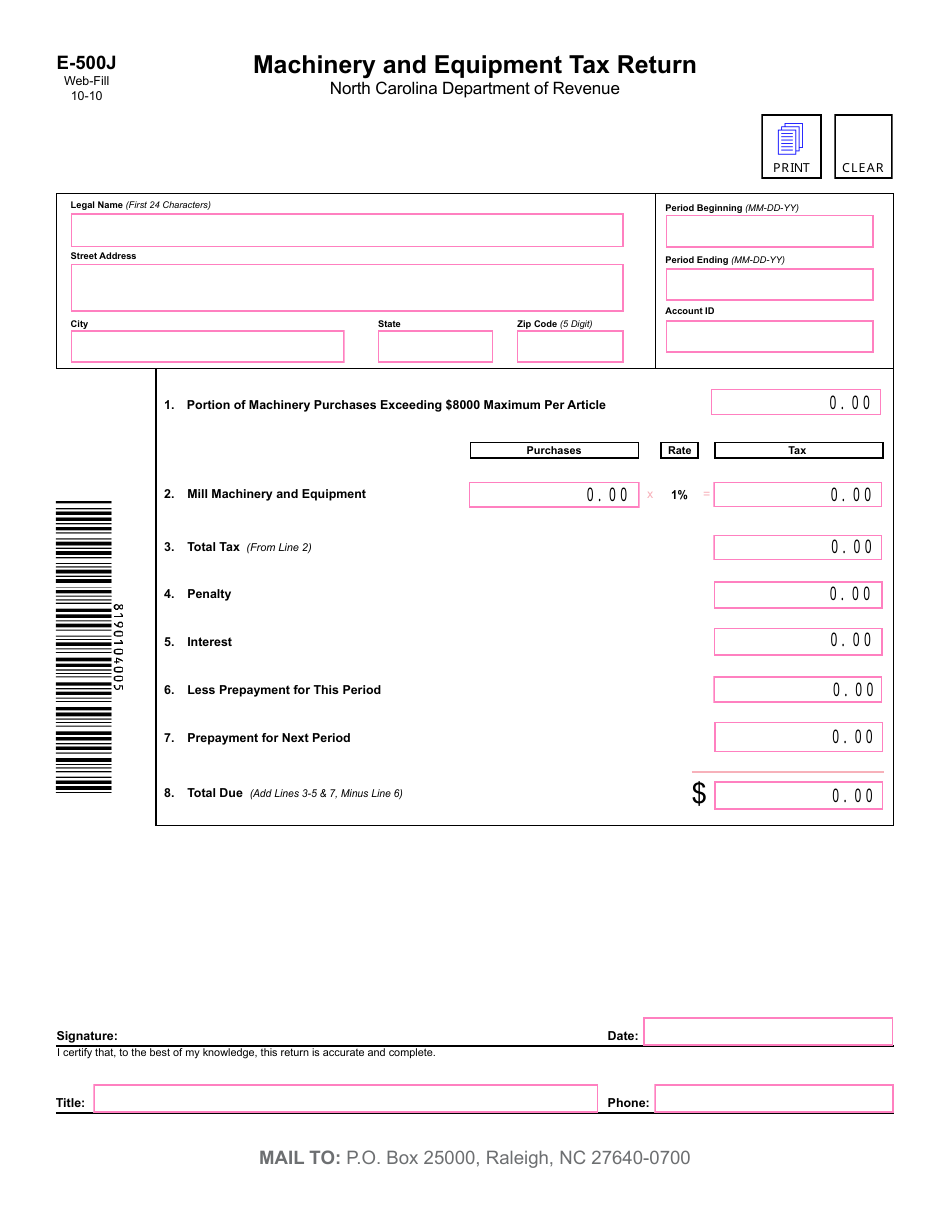

Form E-500J Machinery and Equipment Tax Return - North Carolina

What Is Form E-500J?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-500J?

A: Form E-500J is the Machinery and Equipment Tax Return in North Carolina.

Q: Who needs to file Form E-500J?

A: Businesses in North Carolina that own machinery and equipment are required to file Form E-500J.

Q: What is the purpose of Form E-500J?

A: The purpose of Form E-500J is to report and pay taxes on machinery and equipment owned by businesses in North Carolina.

Q: What information is required on Form E-500J?

A: Form E-500J requires information about the business, including the machinery and equipment owned and their respective values.

Q: When is Form E-500J due?

A: Form E-500J is due on January 31st of each year.

Q: What happens if Form E-500J is not filed?

A: Failure to file Form E-500J may result in penalties and interest being assessed by the North Carolina Department of Revenue.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-500J by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.