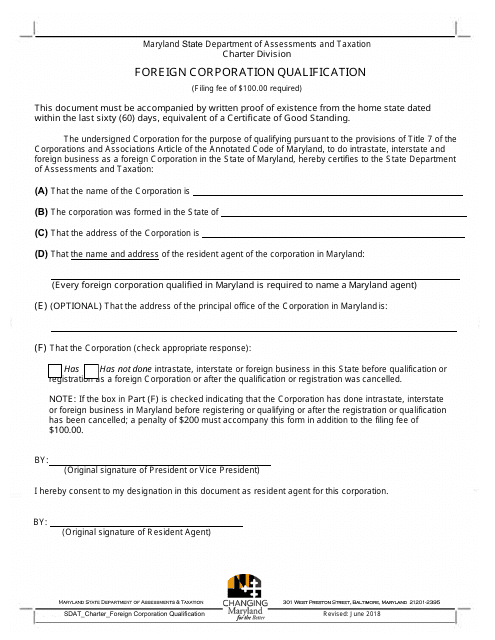

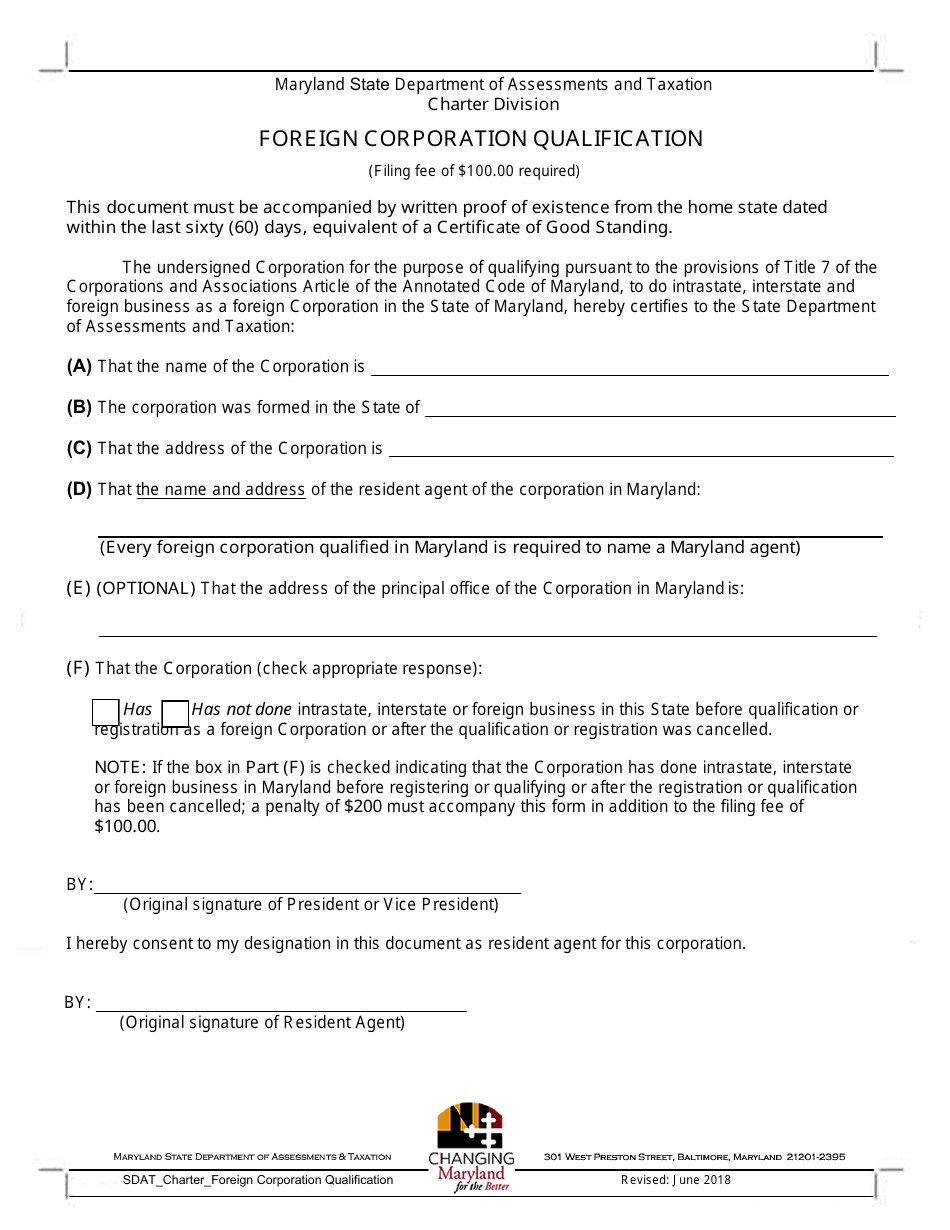

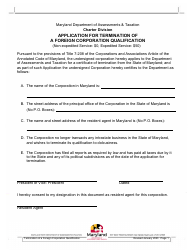

Foreign Corporation Qualification Form - Maryland

Foreign Corporation Qualification Form is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a Foreign Corporation?

A: A Foreign Corporation is a business entity that is formed in a state other than Maryland but wishes to operate in Maryland.

Q: Why do I need to file a Foreign Corporation Qualification Form in Maryland?

A: You need to file the form to legally conduct business in Maryland as a corporation that was formed in another state.

Q: How do I file a Foreign Corporation Qualification Form in Maryland?

A: To file the form, you need to fill out the Foreign Corporation Qualification Form provided by the Maryland Department of Assessments and Taxation and submit it along with the required fees.

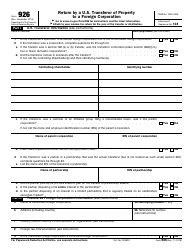

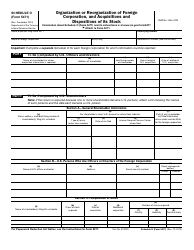

Q: What information do I need to provide when filing the Foreign Corporation Qualification Form?

A: You need to provide information such as the name and address of your corporation, the state of formation, the purpose of your business, and the name and address of a registered agent in Maryland.

Q: What are the fees for filing the Foreign Corporation Qualification Form in Maryland?

A: As of 2021, the filing fee is $100.

Q: Is there an annual fee for maintaining a Foreign Corporation qualification in Maryland?

A: Yes, there is an annual report fee of $300 for maintaining your qualification.

Q: Are there any additional requirements for maintaining a Foreign Corporation qualification in Maryland?

A: You must file an annual report with the Maryland Department of Assessments and Taxation, which includes updated information about your corporation and pay the annual report fee.

Q: What happens if I fail to file the Foreign Corporation Qualification Form in Maryland?

A: If you fail to file the form, your corporation may not have legal authority to conduct business in Maryland, and you may be subject to penalties or other consequences.

Q: How long does it take to process the Foreign Corporation Qualification Form in Maryland?

A: Processing times can vary, but typically it takes around 7-10 business days for the form to be processed by the Maryland Department of Assessments and Taxation.

Form Details:

- Released on June 1, 2018;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.