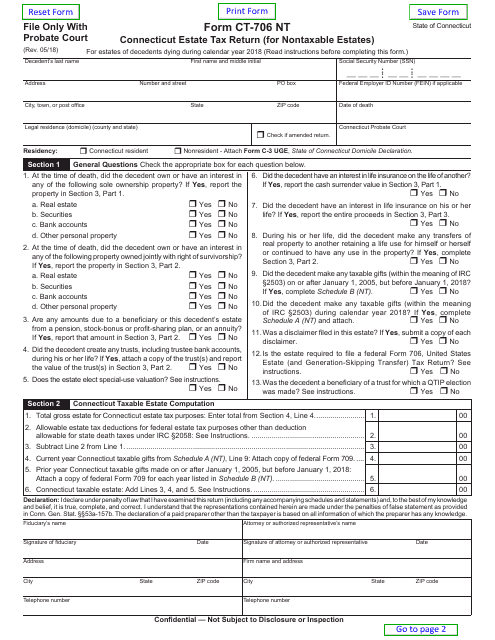

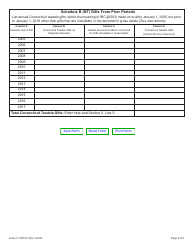

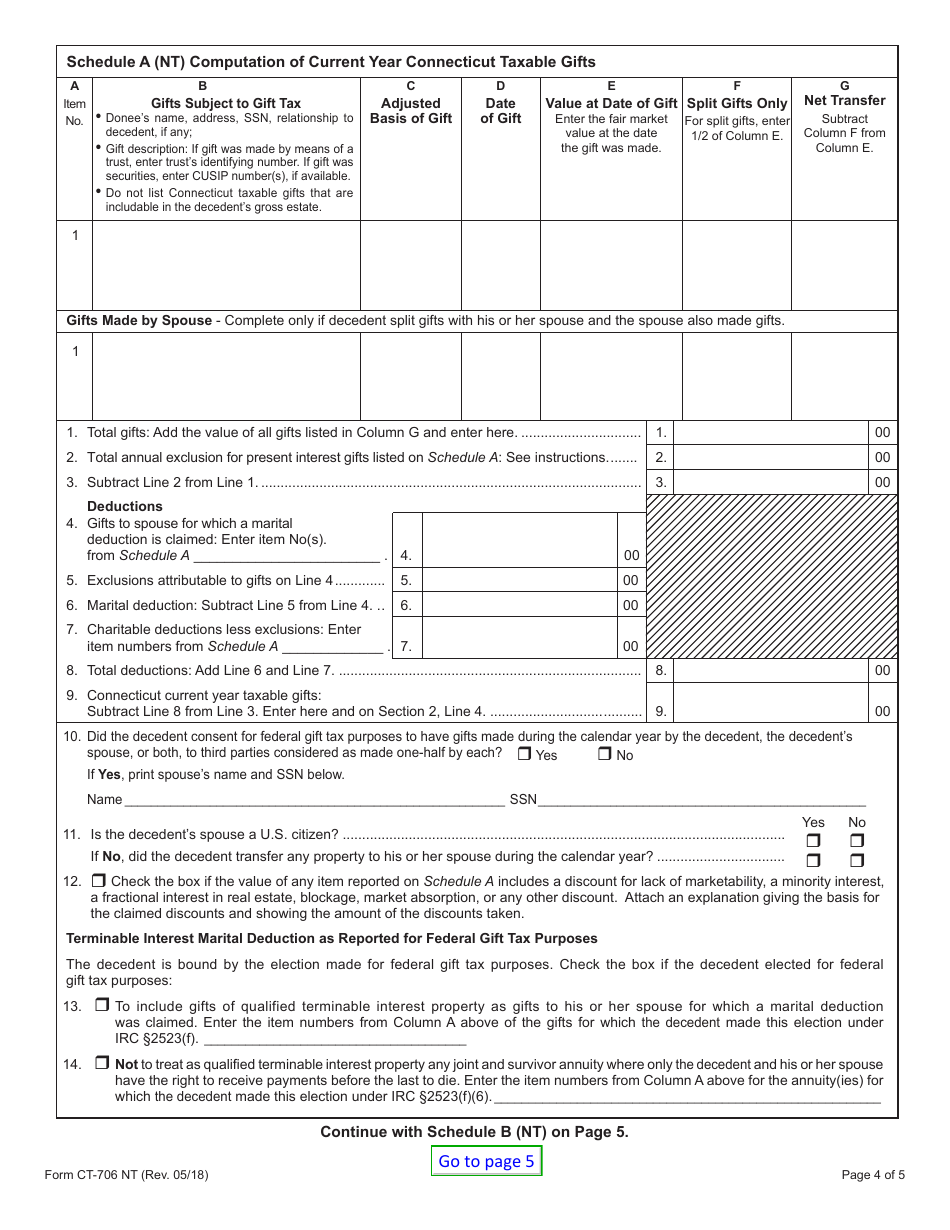

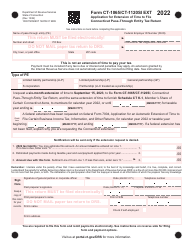

Form CT-706 NT Connecticut Estate Tax Return (For Nontaxable Estates) - Connecticut

What Is Form CT-706 NT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-706 NT?

A: Form CT-706 NT is the Connecticut Estate Tax Return specifically for nontaxable estates.

Q: Who needs to file Form CT-706 NT?

A: Form CT-706 NT needs to be filed by the executor or administrator of an estate that is not subject to Connecticut estate tax.

Q: What is considered a nontaxable estate in Connecticut?

A: A nontaxable estate in Connecticut is one where the total value of the estate is less than the minimum threshold for Connecticut estate tax.

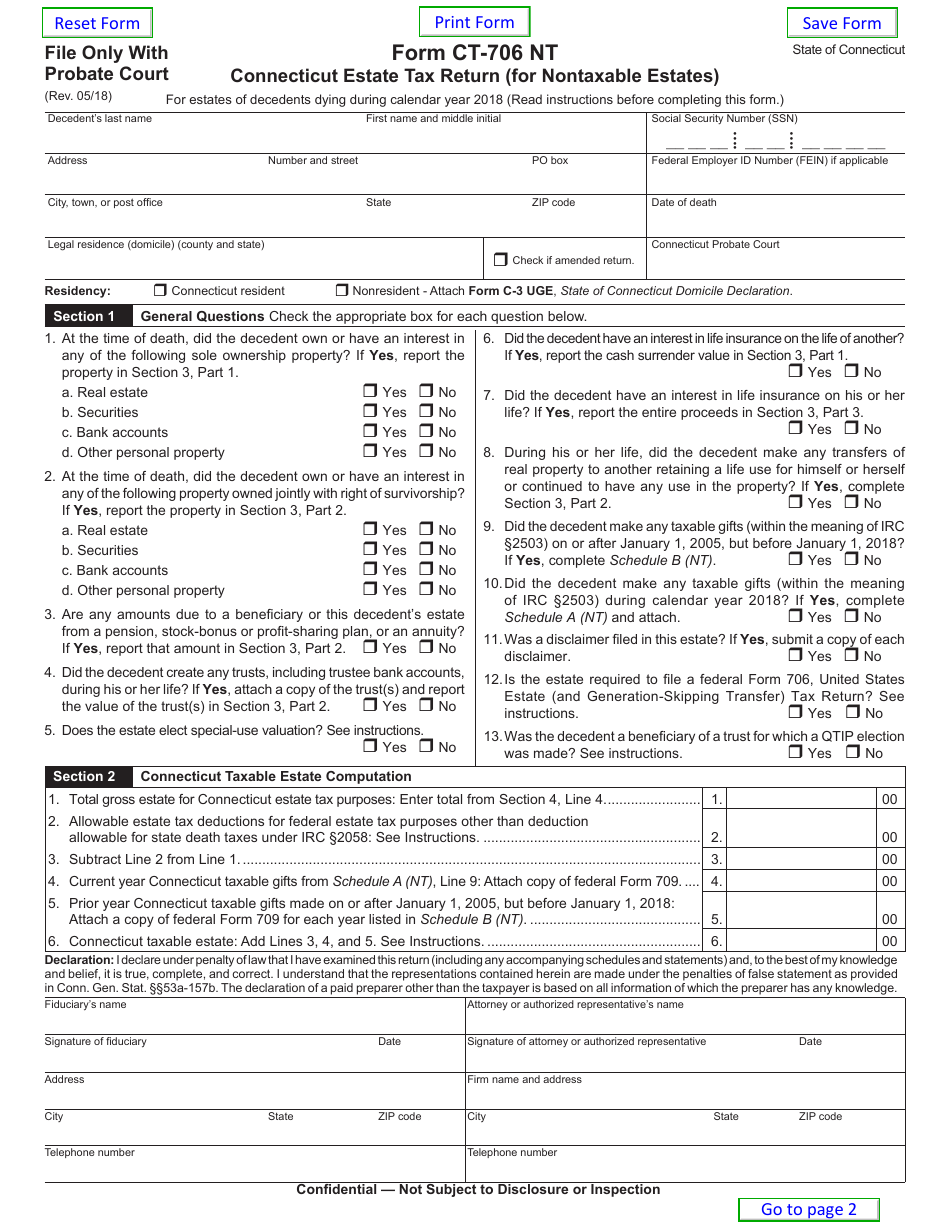

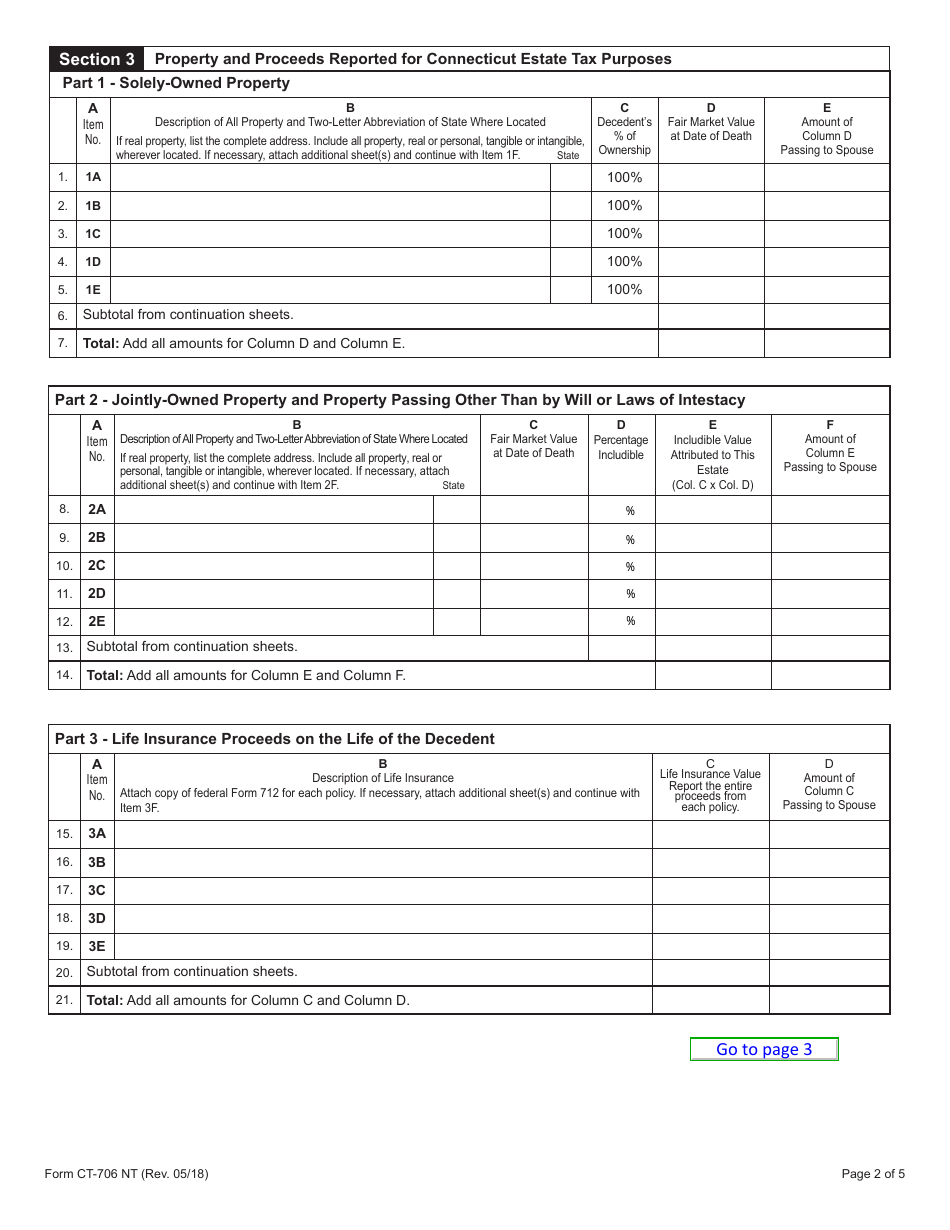

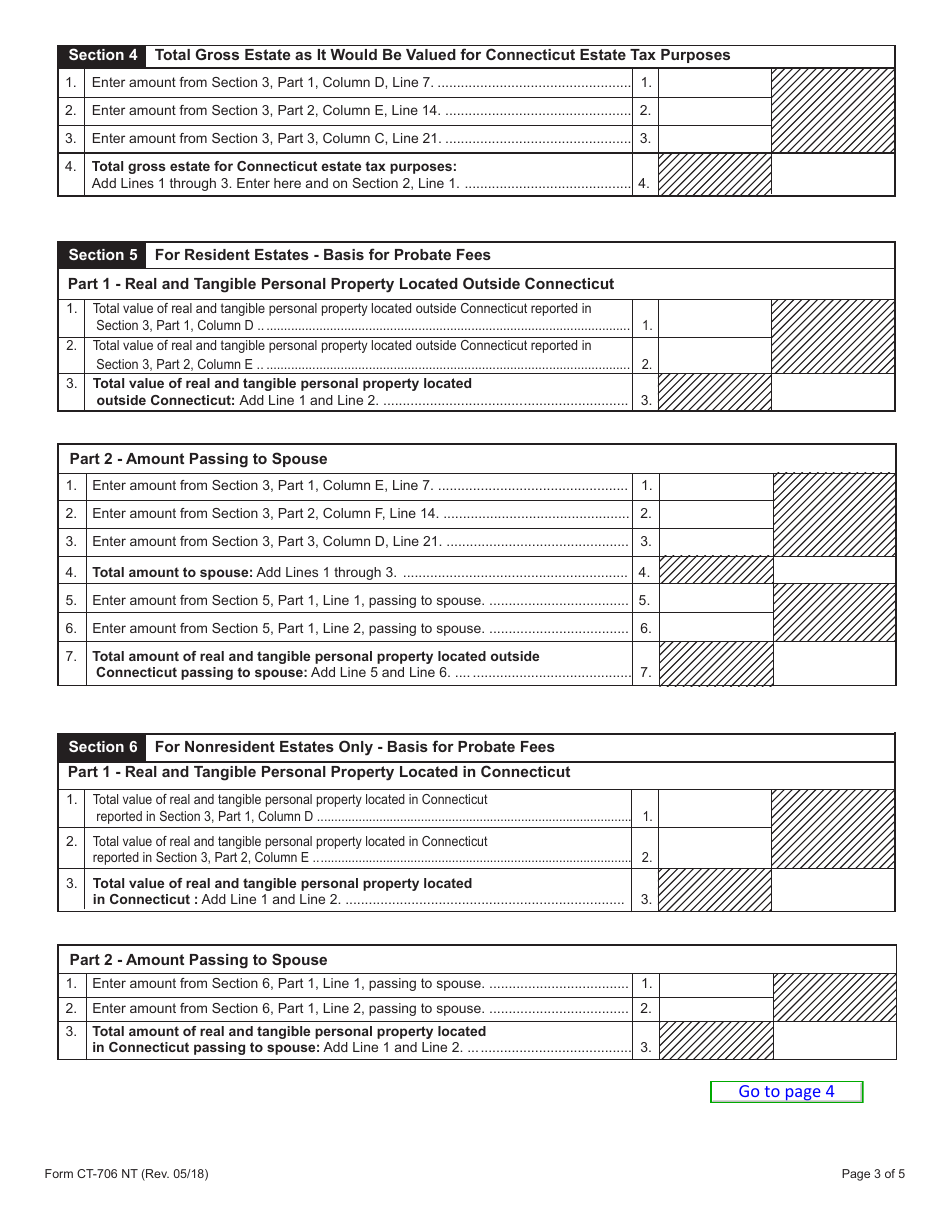

Q: What information is required to complete Form CT-706 NT?

A: To complete Form CT-706 NT, you will need information about the deceased person, their estate, and any exemptions or deductions they may be eligible for.

Q: When is Form CT-706 NT due?

A: Form CT-706 NT is due within 6 months of the date of death, or within 30 days of receiving a federal closing letter if the estate is required to file a federal estate tax return.

Q: Are there any filing fees for Form CT-706 NT?

A: No, there are no filing fees for Form CT-706 NT.

Q: Is it possible to file Form CT-706 NT electronically?

A: No, Form CT-706 NT cannot be filed electronically. It must be printed and mailed to the Connecticut Department of Revenue Services.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-706 NT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.