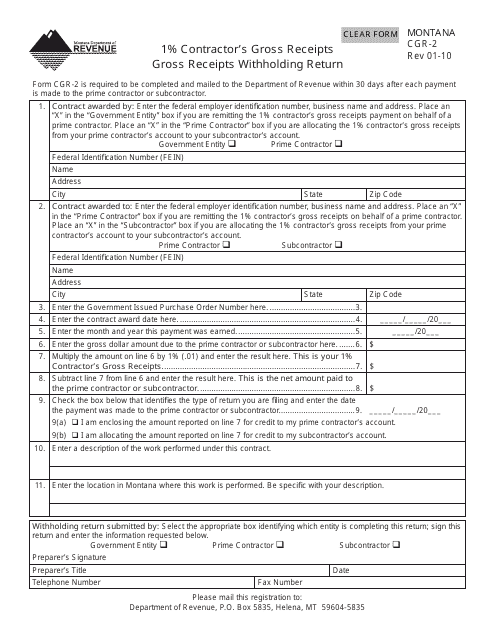

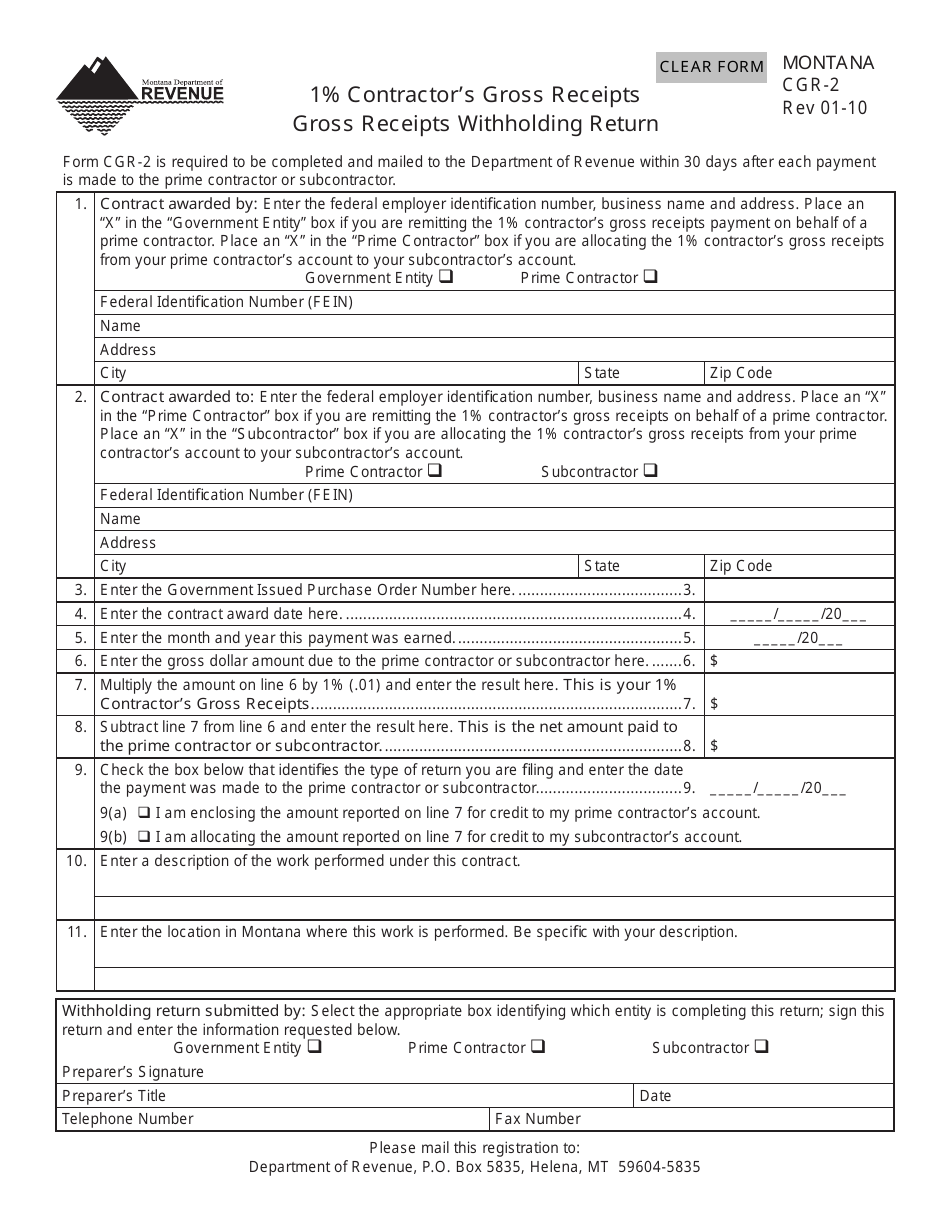

Form CGR-2 1% Contractor's Gross Receipts Gross Receipts Withholding Return - Montana

What Is Form CGR-2?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CGR-2?

A: Form CGR-2 is the Contractor's Gross Receipts Gross Receipts Withholding Return.

Q: What is the purpose of Form CGR-2?

A: The purpose of Form CGR-2 is to report and pay the withholding tax on contractor's gross receipts.

Q: Who needs to file Form CGR-2?

A: Contractors who have gross receipts from construction services in Montana need to file Form CGR-2.

Q: What is the withholding tax rate for contractor's gross receipts?

A: The withholding tax rate for contractor's gross receipts is 1%.

Q: When is Form CGR-2 due?

A: Form CGR-2 is due on the last day of the month following the end of the reporting period.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CGR-2 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.