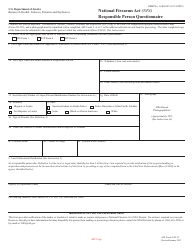

This version of the form is not currently in use and is provided for reference only. Download this version of

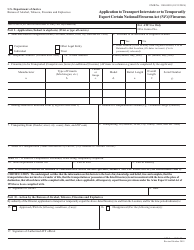

ATF Form 5630.7

for the current year.

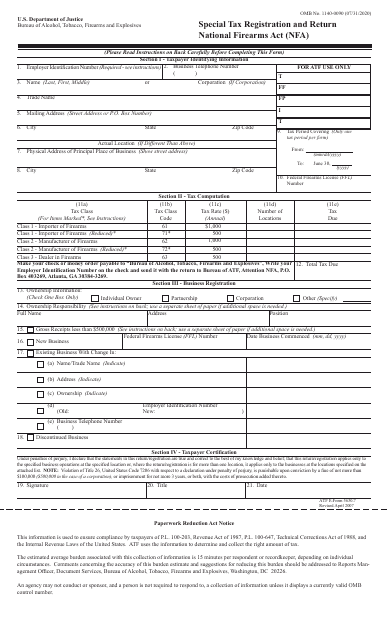

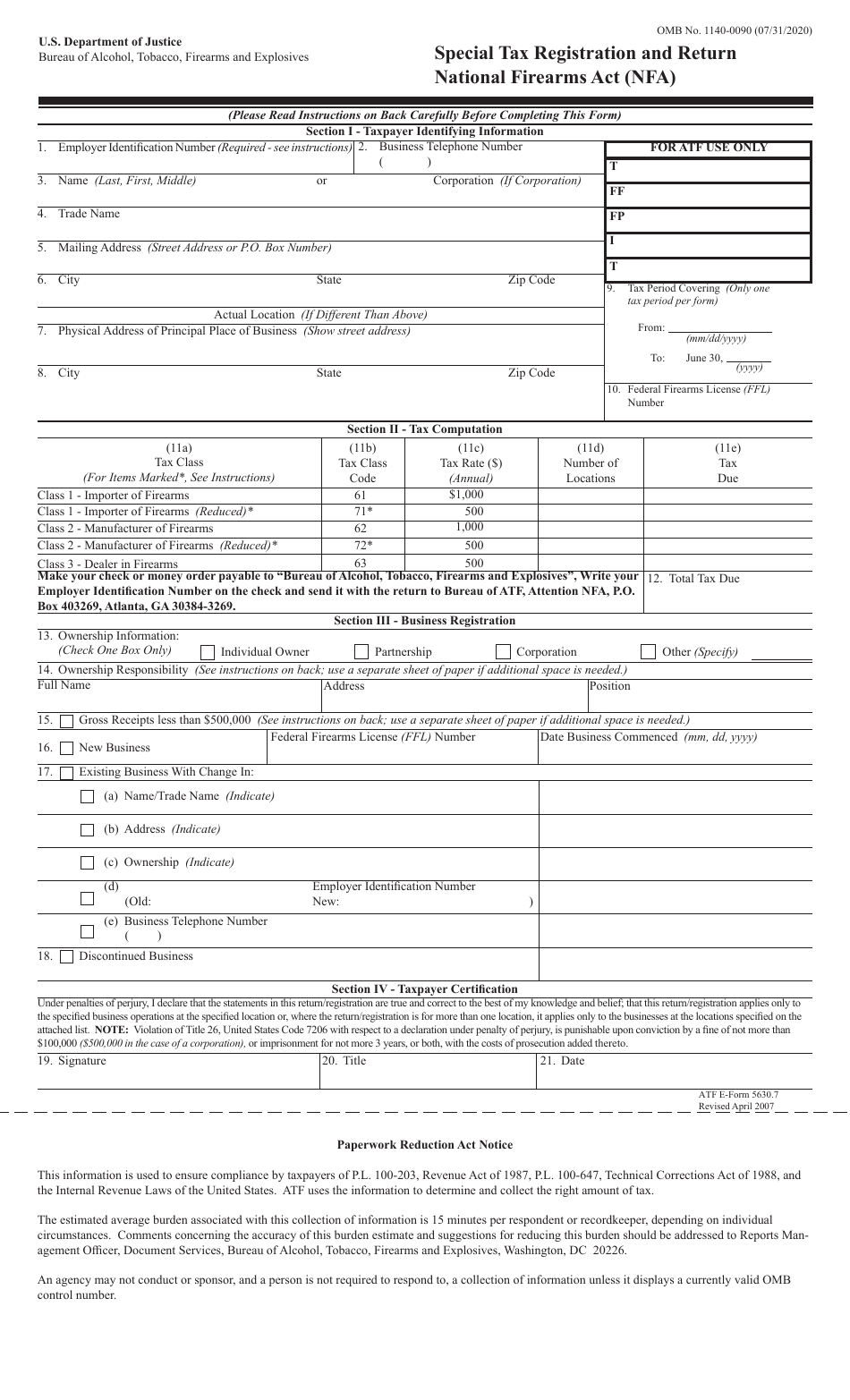

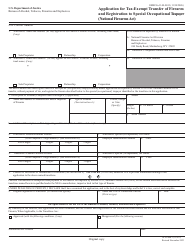

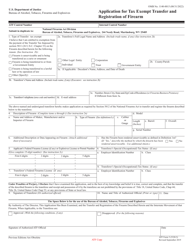

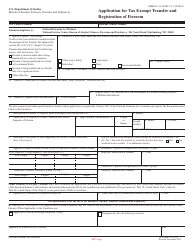

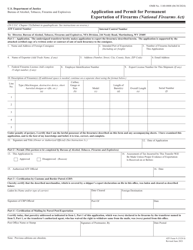

ATF Form 5630.7 Special Tax Registration and Return - National Firearms Act (Nfa)

What Is ATF Form 5630.7?

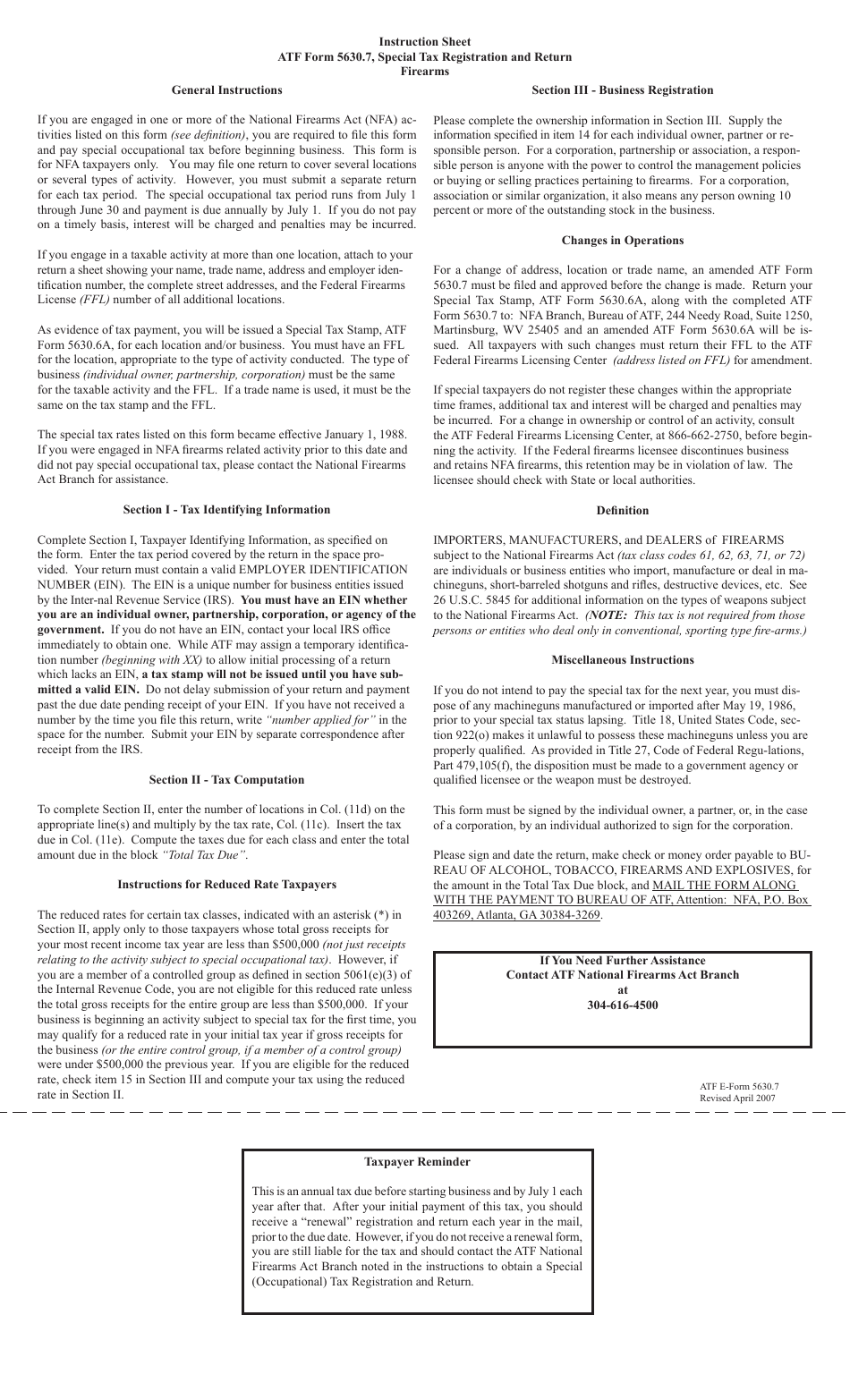

This is a legal form that was released by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives on April 1, 2007 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ATF Form 5630.7?

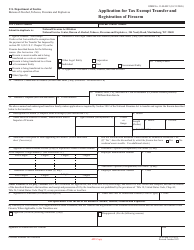

A: ATF Form 5630.7 is the Special Tax Registration and Return Form for the National Firearms Act (NFA).

Q: What is the National Firearms Act (NFA)?

A: The National Firearms Act (NFA) is a federal law that regulates the sale and possession of certain firearms, including machine guns, silencers, and short-barreled rifles.

Q: Who needs to submit ATF Form 5630.7?

A: Any individual or business that is engaged in activities regulated by the NFA, such as manufacturing or selling firearms covered by the NFA, needs to submit ATF Form 5630.7.

Q: What is the purpose of ATF Form 5630.7?

A: The purpose of ATF Form 5630.7 is to register with the ATF and pay the special occupational tax required under the NFA.

Q: Is there a fee for submitting ATF Form 5630.7?

A: Yes, there is a fee associated with submitting ATF Form 5630.7. The amount of the fee depends on the type of firearms-related activity being registered.

Q: Are there any penalties for not submitting ATF Form 5630.7?

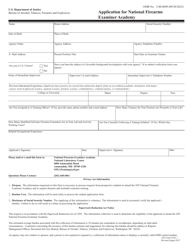

A: Yes, failure to submit ATF Form 5630.7 or pay the required special occupational tax can result in penalties, including fines and imprisonment.

Q: Do I need to submit ATF Form 5630.7 every year?

A: Yes, ATF Form 5630.7 must be submitted annually to maintain compliance with the NFA.

Q: What should I do if there are changes to my registration information?

A: If there are changes to your registration information, you must submit an updated ATF Form 5630.7 to the ATF within 30 days of the change.

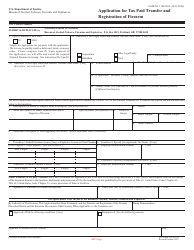

Form Details:

- Released on April 1, 2007;

- The latest available edition released by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ATF Form 5630.7 by clicking the link below or browse more documents and templates provided by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives.