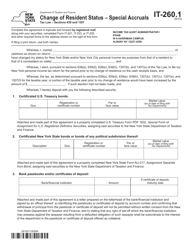

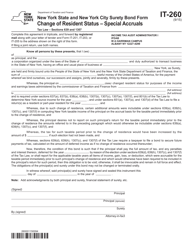

This version of the form is not currently in use and is provided for reference only. Download this version of

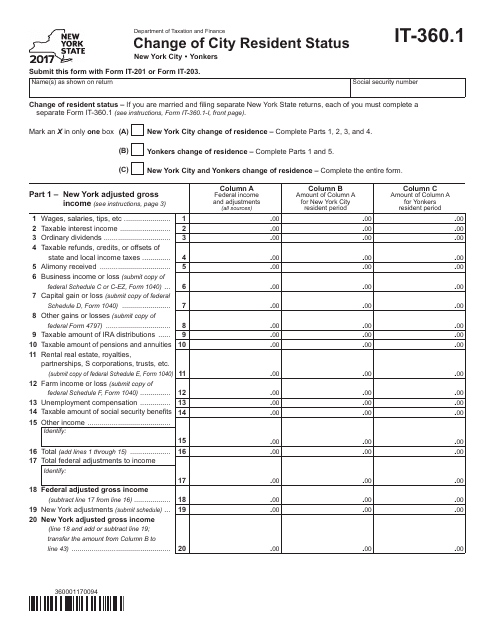

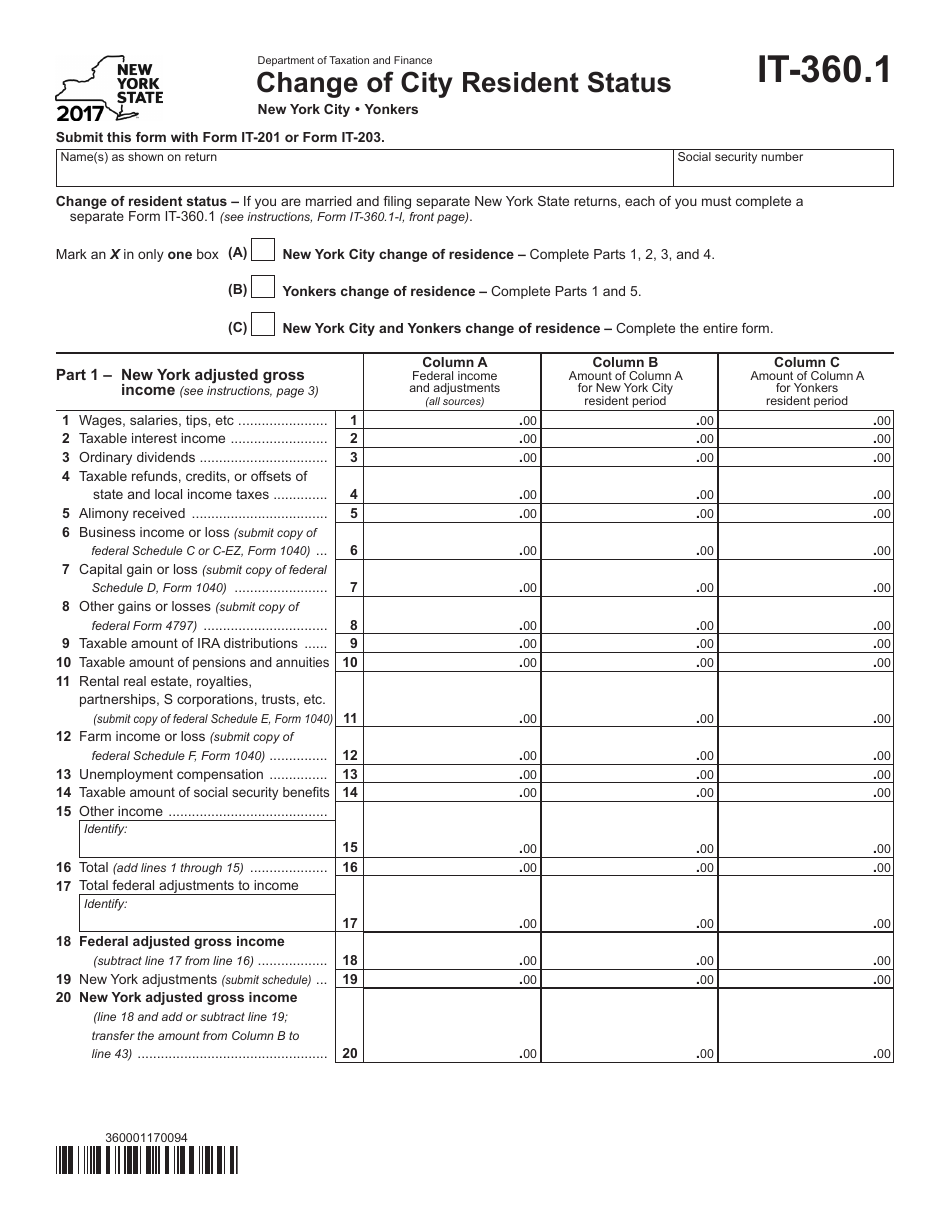

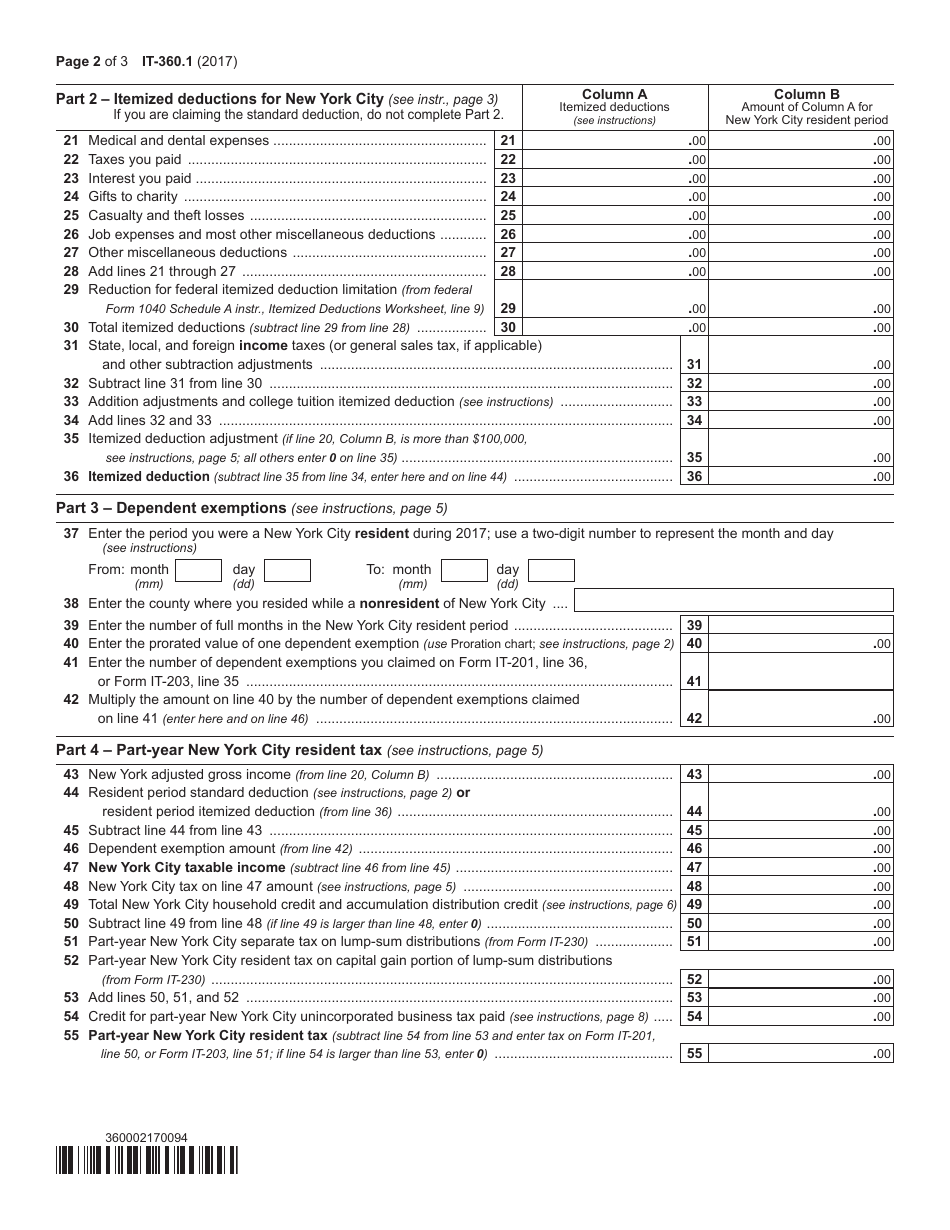

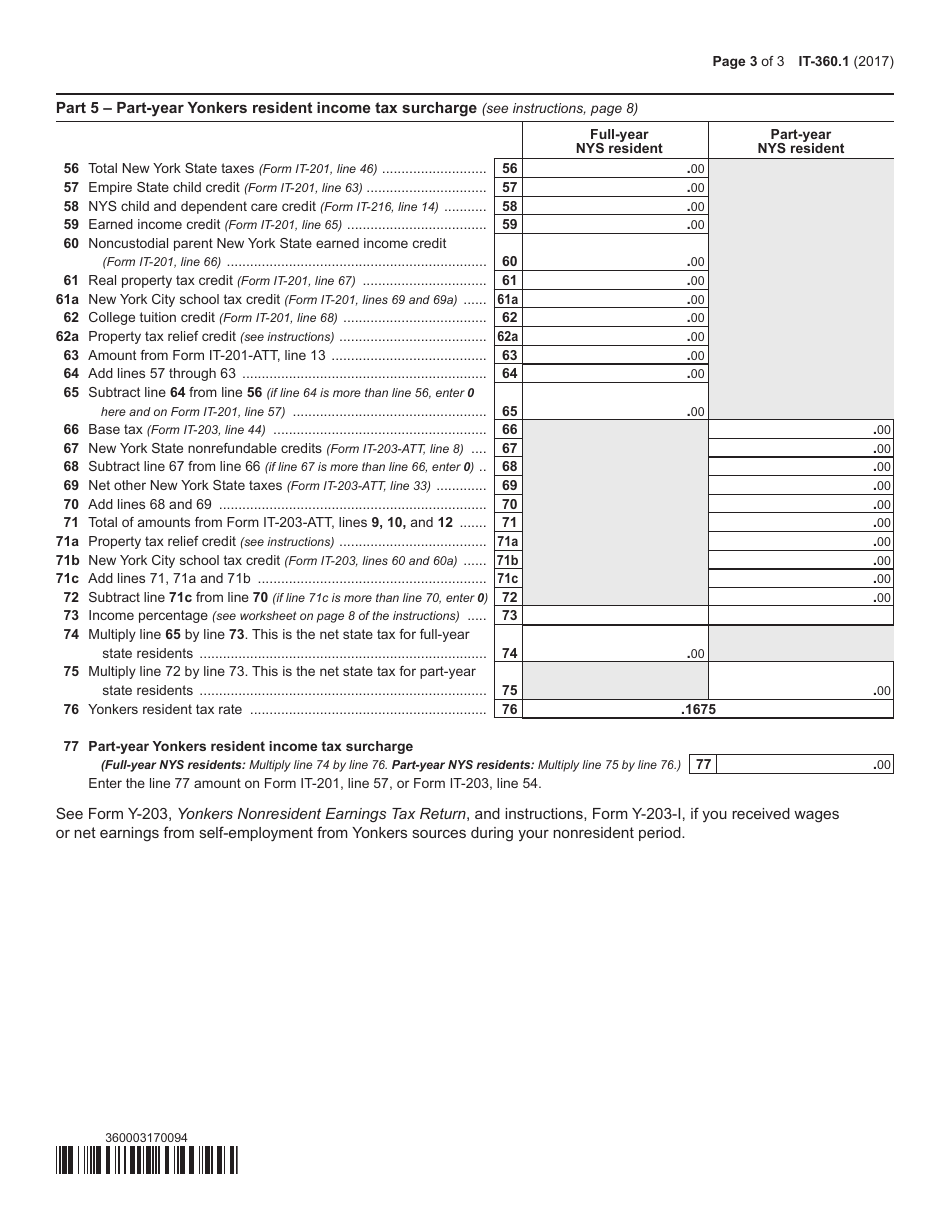

Form IT-360.1

for the current year.

Form IT-360.1 Change of City Resident Status - New York

What Is Form IT-360.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-360.1?

A: Form IT-360.1 is a tax form used by residents of New York to report a change in city resident status.

Q: Who needs to file Form IT-360.1?

A: Residents of New York who have changed their city resident status during the tax year need to file Form IT-360.1.

Q: What is considered a change in city resident status?

A: A change in city resident status includes moving into or out of a New York City residence during the tax year.

Q: When is Form IT-360.1 due?

A: Form IT-360.1 is due by April 15th of the year following the tax year in which the change in city resident status occurred.

Q: What information do I need to provide on Form IT-360.1?

A: You will need to provide your personal information, details about your old and new residences, and information about the change in city resident status.

Q: Is there a fee for filing Form IT-360.1?

A: No, there is no fee for filing Form IT-360.1.

Q: What happens if I don't file Form IT-360.1?

A: If you don't file Form IT-360.1 when required, you may be subject to penalties and interest charges.

Q: Can I file Form IT-360.1 for a previous tax year?

A: Yes, you can file Form IT-360.1 for a previous tax year within three years of the original due date.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-360.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.