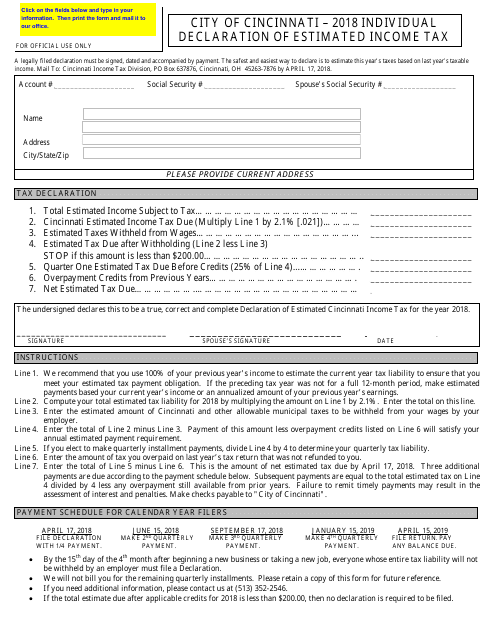

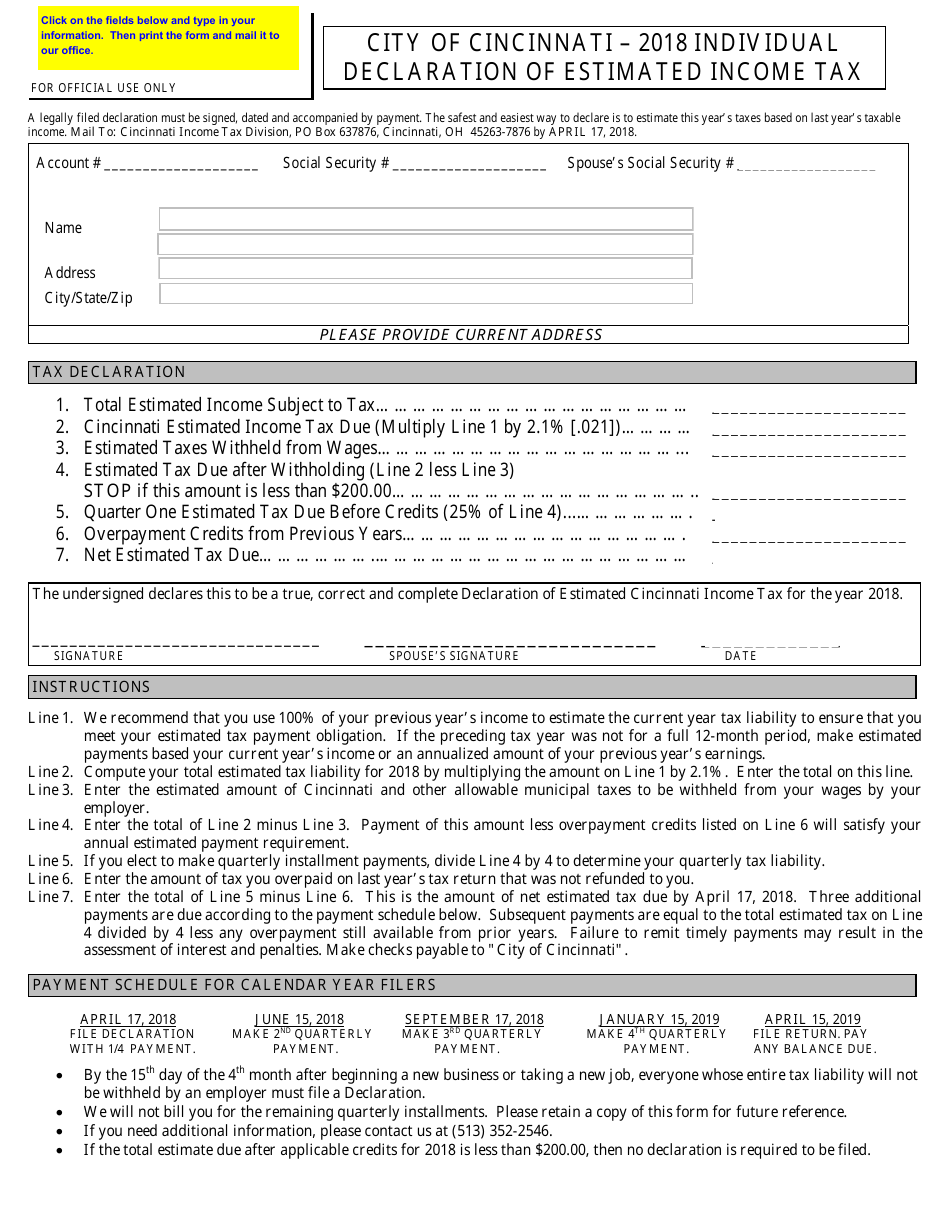

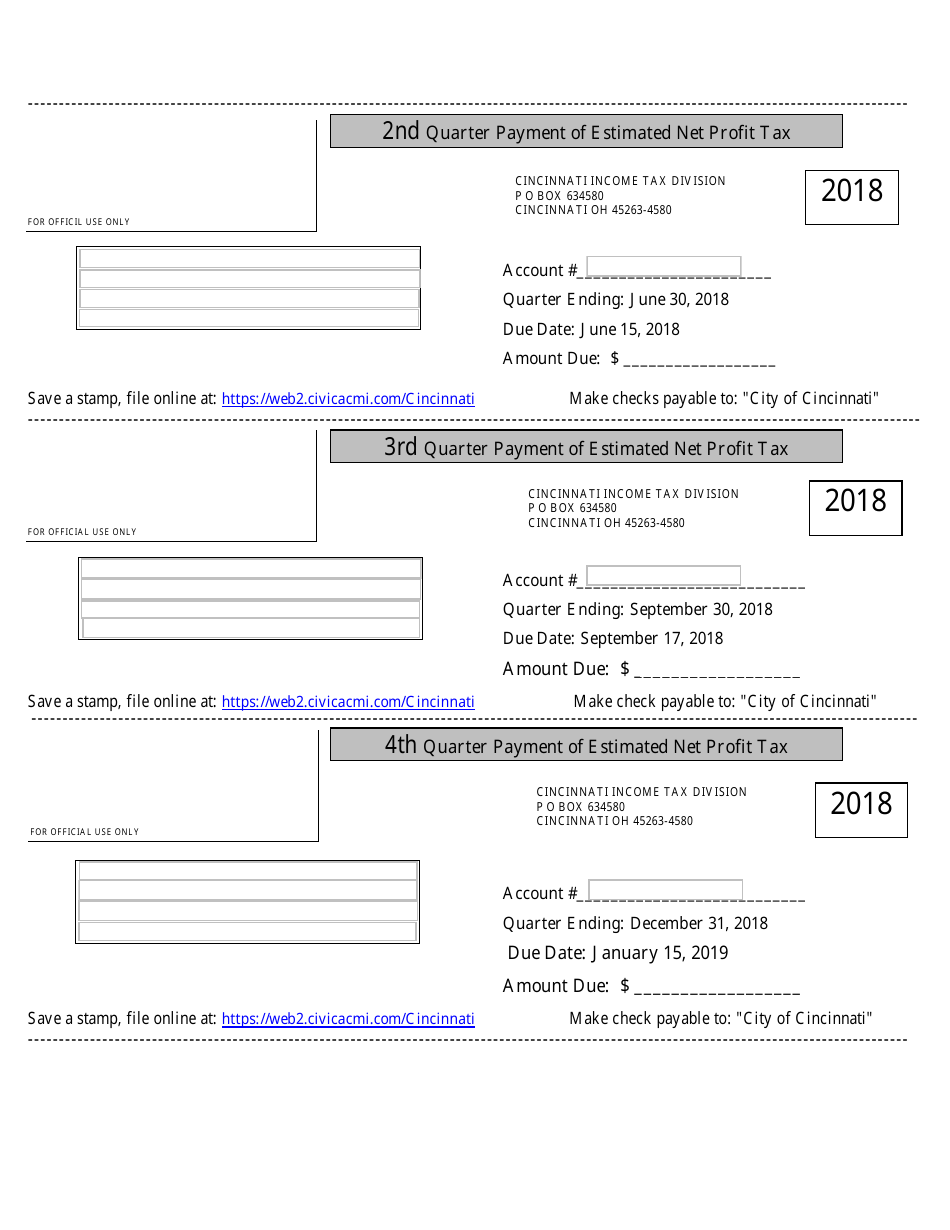

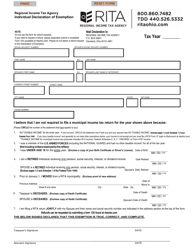

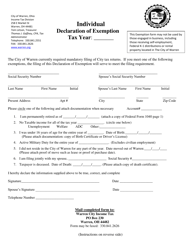

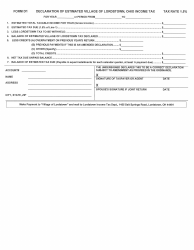

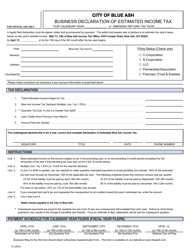

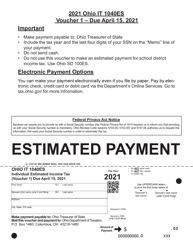

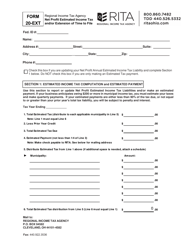

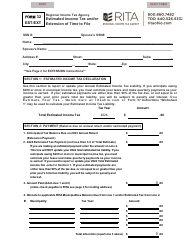

Individual Declaration of Estimated Income Tax - City of Cincinnati, Ohio

Individual Declaration of Estimated Income Tax is a legal document that was released by the Ohio Department of Taxation - a government authority operating within Ohio. The form may be used strictly within City of Cincinnati.

FAQ

Q: What is the Individual Declaration of Estimated Income Tax?

A: The Individual Declaration of Estimated Income Tax is a form used by residents of Cincinnati, Ohio to report and pay their estimated income tax.

Q: Who needs to file the Individual Declaration of Estimated Income Tax?

A: Residents of Cincinnati, Ohio who expect to owe more than $200 in income tax for the year are required to file the Individual Declaration of Estimated Income Tax.

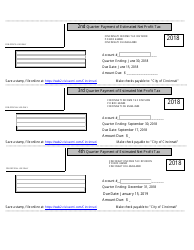

Q: When is the deadline to file the Individual Declaration of Estimated Income Tax?

A: The deadline to file the Individual Declaration of Estimated Income Tax is April 15th of each year.

Q: What happens if I don't file the Individual Declaration of Estimated Income Tax?

A: Failure to file the Individual Declaration of Estimated Income Tax may result in penalties and interest being assessed on any unpaid tax.

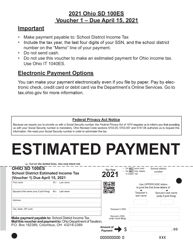

Form Details:

- The latest edition currently provided by the Ohio Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.