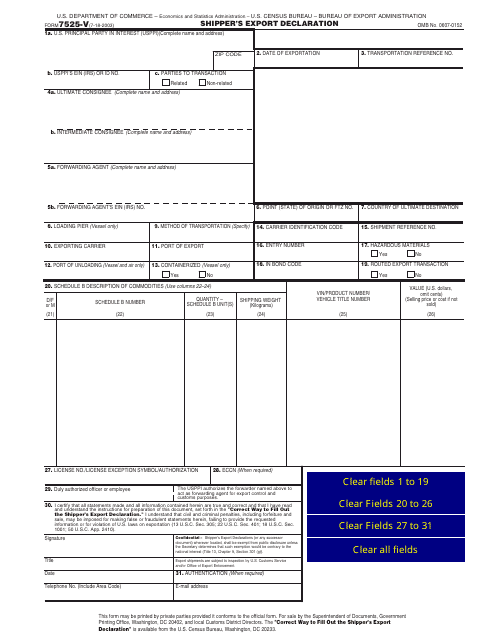

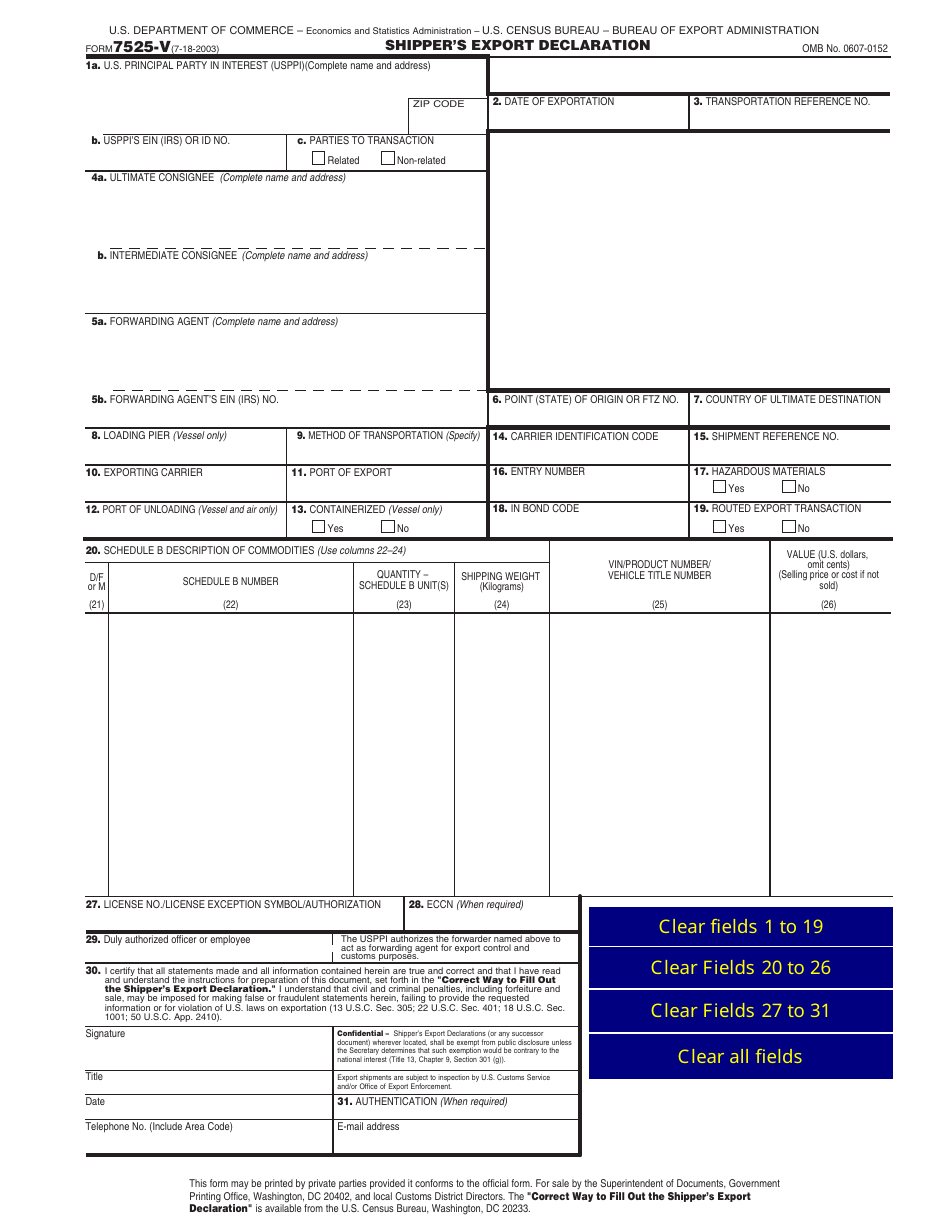

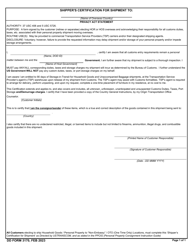

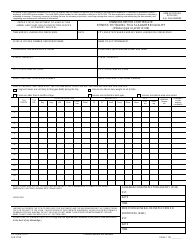

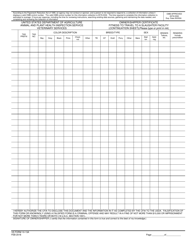

Form 7525-V Shipper's Export Declaration

What Is Form 7525-V?

This is a legal form that was released by the U.S. Department of Commerce - Economics and Statistics Administration on July 18, 2003 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 7525-V?

A: Form 7525-V is the Shipper's Export Declaration.

Q: What is the purpose of Form 7525-V?

A: Form 7525-V is used for reporting export shipments from the United States.

Q: Who needs to fill out Form 7525-V?

A: Form 7525-V needs to be filled out by the exporter or their authorized agent.

Q: Are there any fees associated with Form 7525-V?

A: No, there are no fees associated with Form 7525-V.

Q: What information is required on Form 7525-V?

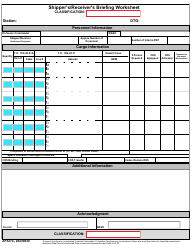

A: Form 7525-V requires information such as the exporter's name and address, consignee's name and address, description of goods, and other export-related details.

Q: Are there any penalties for not filing Form 7525-V?

A: Yes, failure to file Form 7525-V may result in civil and criminal penalties.

Q: Is Form 7525-V only used for exports to Canada?

A: No, Form 7525-V is used for reporting export shipments to any country, not just Canada.

Q: Is Form 7525-V required for all export shipments?

A: No, Form 7525-V is not required for all export shipments. There are certain exemptions and exceptions.

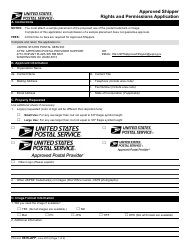

Q: Can I file Form 7525-V electronically?

A: Yes, you can file Form 7525-V electronically through the Automated Commercial Environment (ACE) or other authorized electronic data interchange systems.

Form Details:

- Released on July 18, 2003;

- The latest available edition released by the U.S. Department of Commerce - Economics and Statistics Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 7525-V by clicking the link below or browse more documents and templates provided by the U.S. Department of Commerce - Economics and Statistics Administration.