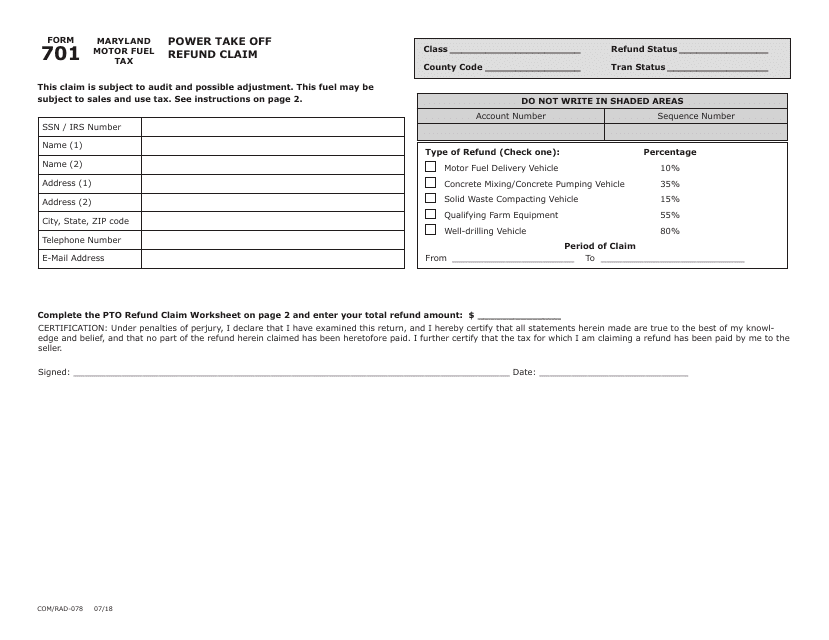

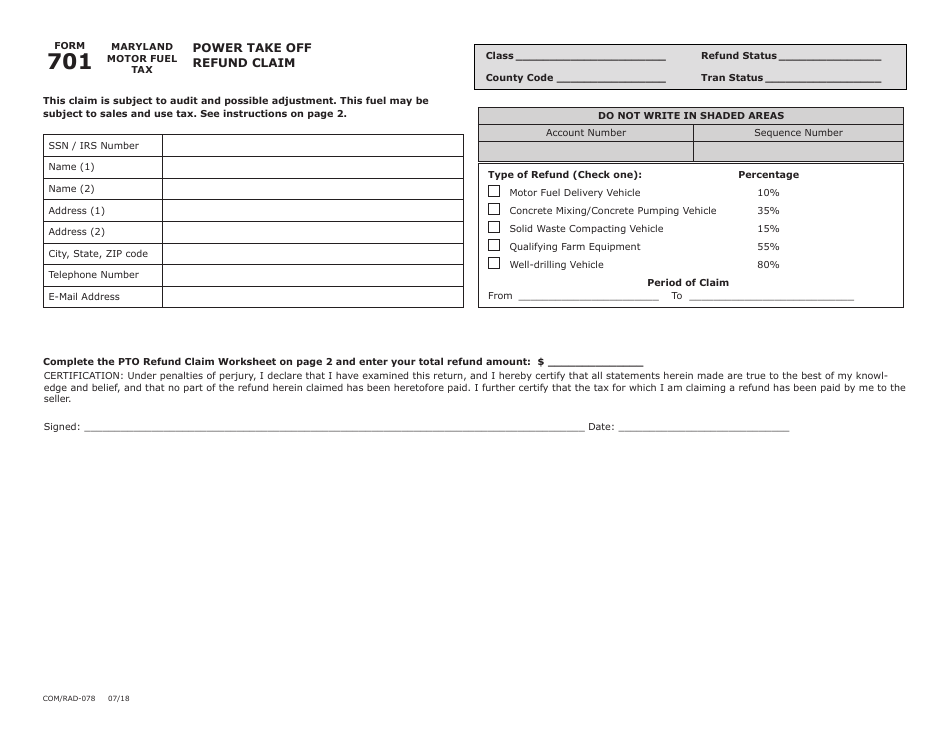

Form 701 Power Take off Refund Claim - Maryland

What Is Form 701?

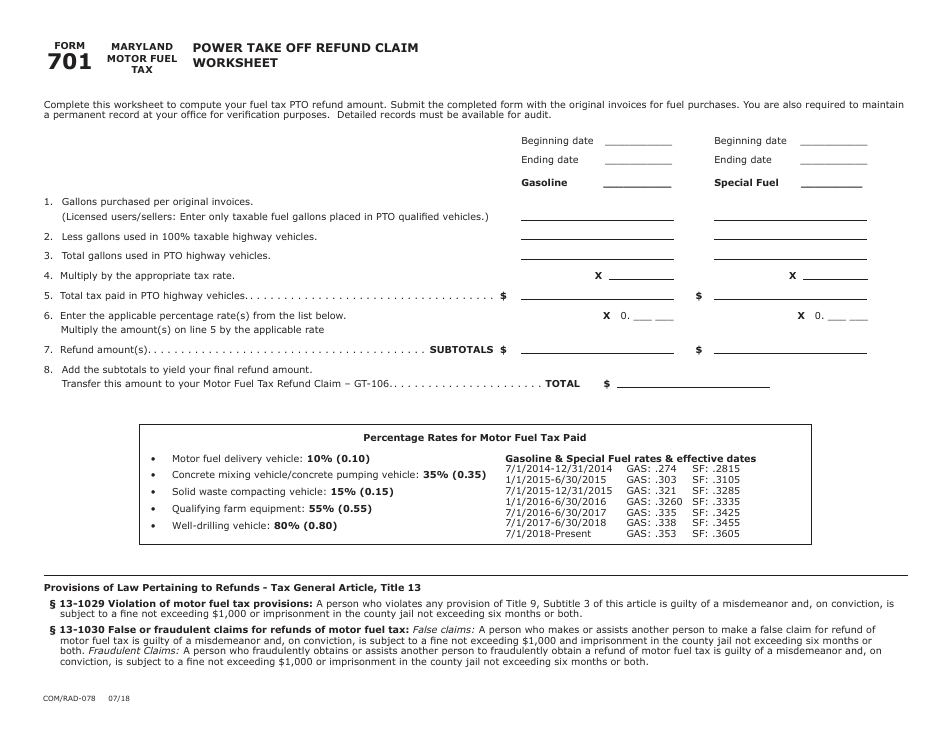

This is a legal form that was released by the Comptroller of Maryland - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 701 Power Take off Refund Claim?

A: Form 701 is a refund claim form for the Power Take Off (PTO) tax paid in Maryland.

Q: Who is eligible to use Form 701?

A: Businesses or individuals who have paid Power Take Off (PTO) tax in Maryland.

Q: What is the purpose of the Power Take Off (PTO) tax?

A: The PTO tax is imposed on certain vehicles that use power take off equipment in Maryland.

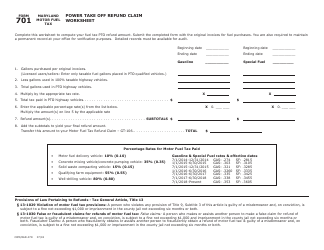

Q: What information is required on Form 701?

A: Form 701 requires information such as the vehicle details, PTO equipment information, and the amount of PTO tax paid.

Q: Is there a deadline for submitting Form 701?

A: Yes, Form 701 must be submitted within three years from the due date of the tax paid.

Q: Will I receive a refund if my Form 701 is approved?

A: If your Form 701 is approved, you may be eligible for a refund of the Power Take Off (PTO) tax paid in Maryland.

Q: What should I do if I have additional questions about Form 701?

A: If you have additional questions about Form 701, you can contact the Maryland Comptroller's Office for assistance.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Comptroller of Maryland;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 701 by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.