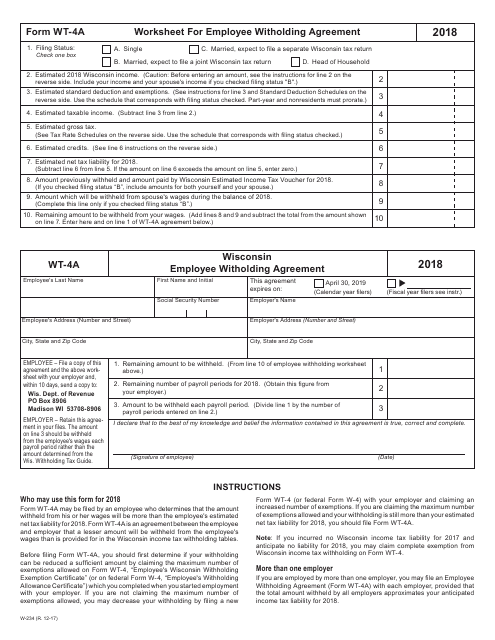

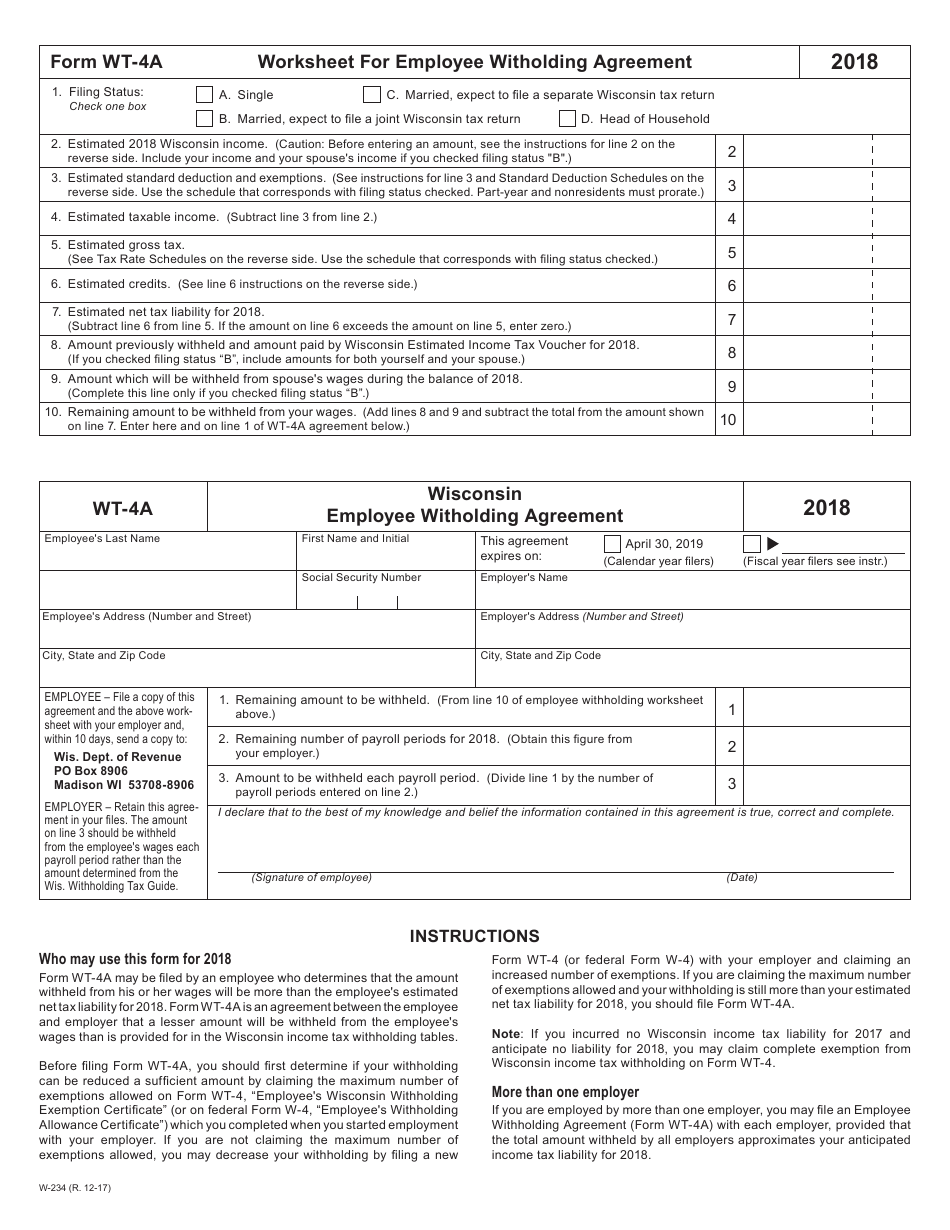

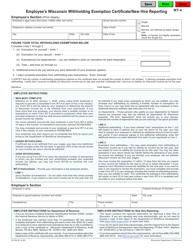

Form WT-4A Worksheet for Employee Witholding Agreement (W-234) - Wisconsin

What Is Form WT-4A?

This is a legal form that was released by the Wisconsin Department of Public Instruction - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WT-4A?

A: Form WT-4A is a worksheet for an employee withholding agreement.

Q: What is the purpose of Form WT-4A?

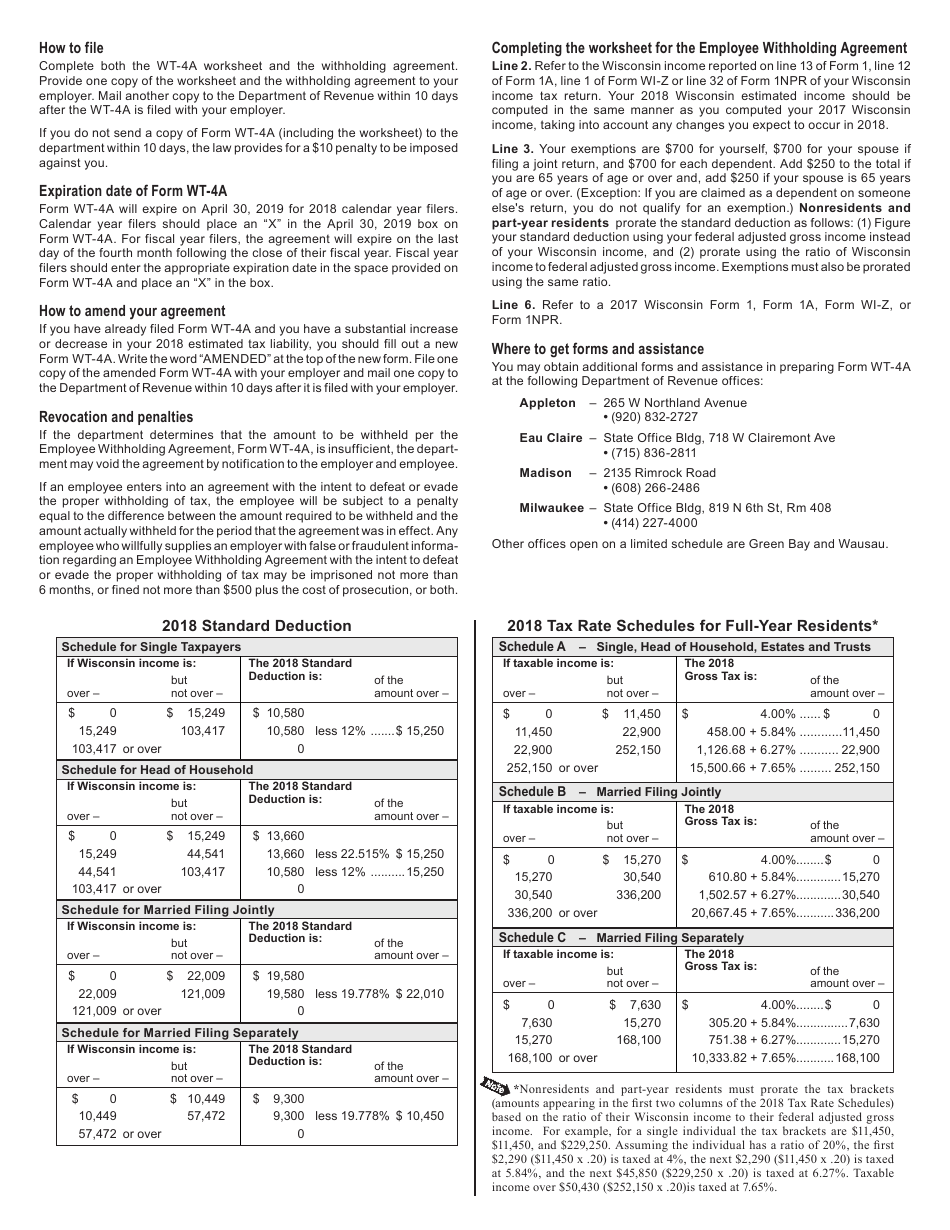

A: The purpose of Form WT-4A is to calculate the correct amount of income tax to withhold from an employee's wages in Wisconsin.

Q: Who should use Form WT-4A?

A: Form WT-4A should be used by employees in Wisconsin to determine their withholding amount.

Q: Is Form WT-4A specific to Wisconsin?

A: Yes, Form WT-4A is specific to the state of Wisconsin.

Q: Can I use Form WT-4A for federal withholding?

A: No, Form WT-4A is only for Wisconsin withholding. You will need to use a federal form, such as Form W-4, for federal withholding.

Q: What information is required on Form WT-4A?

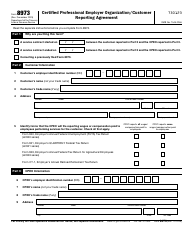

A: Form WT-4A requires information such as the employee's name, Social Security number, filing status, and number of exemptions.

Q: When should I submit Form WT-4A?

A: Form WT-4A should be submitted to your employer as soon as possible after starting a new job, or if you need to make changes to your withholding.

Q: Can I make changes to my withholding throughout the year?

A: Yes, you can make changes to your withholding at any time by submitting a new Form WT-4A to your employer.

Q: What happens if I don't submit Form WT-4A?

A: If you don't submit Form WT-4A, your employer will withhold tax based on the default withholding rates, which may not accurately reflect your tax liability.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Wisconsin Department of Public Instruction;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WT-4A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Public Instruction.