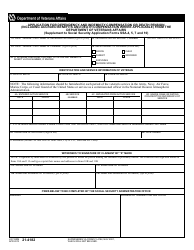

This version of the form is not currently in use and is provided for reference only. Download this version of

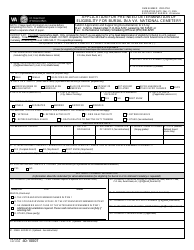

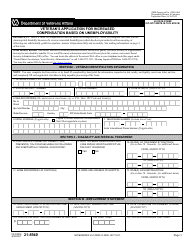

VA Form 21P-534A

for the current year.

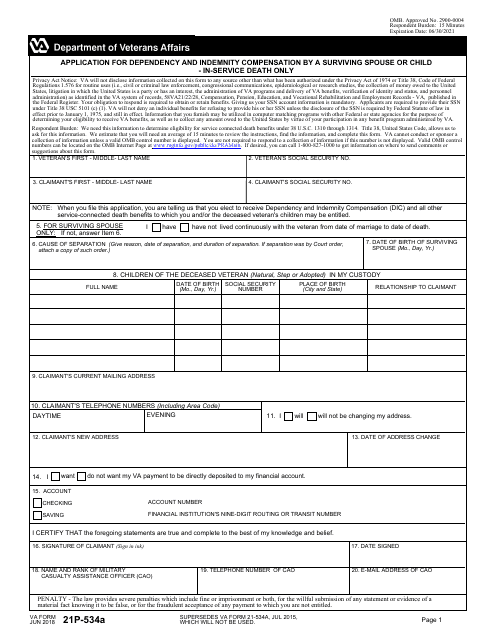

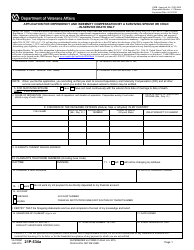

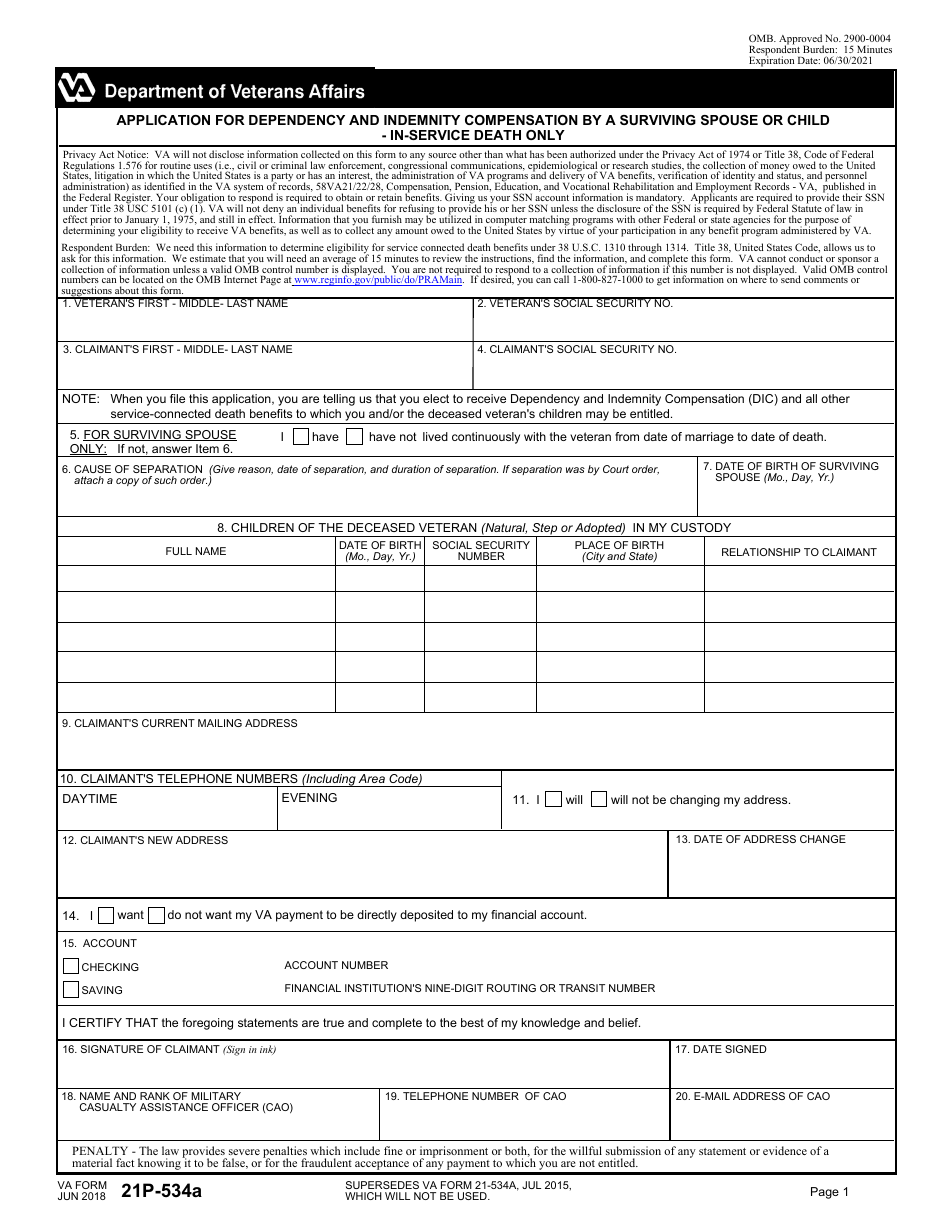

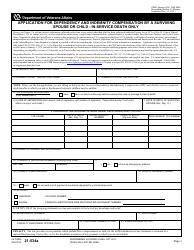

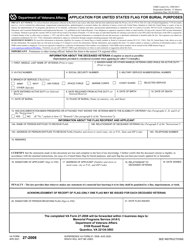

VA Form 21P-534A Application for Dependency and Indemnity Compensation by a Surviving Spouse or Child - In-Service Death Only

What Is VA Form 21P-534A?

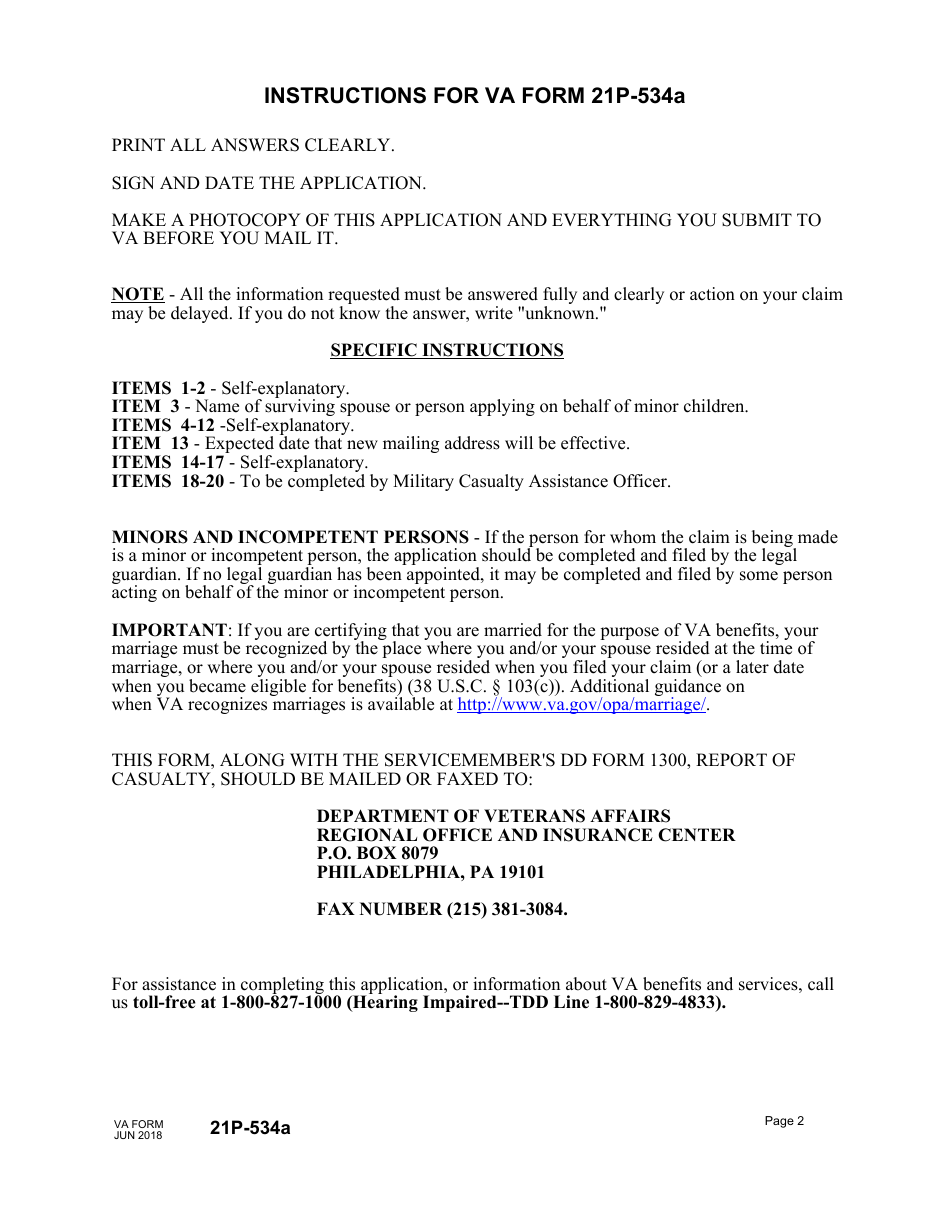

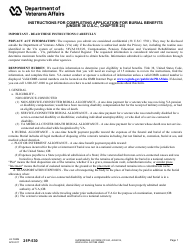

This is a legal form that was released by the U.S. Department of Veterans Affairs on June 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

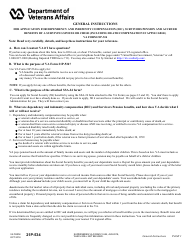

Q: What is VA Form 21P-534A?

A: VA Form 21P-534A is the Application for Dependency and Indemnity Compensation by a Surviving Spouse or Child - In-Service Death Only.

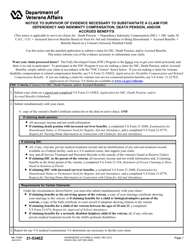

Q: What is Dependency and Indemnity Compensation?

A: Dependency and Indemnity Compensation (DIC) is a tax-free monetary benefit paid to eligible survivors of military service members who died in the line of duty or as a result of a service-connected disability.

Q: Who can apply for DIC?

A: A surviving spouse or child of a deceased military service member who died in the line of duty or as a result of a service-connected disability can apply for DIC.

Q: What is an in-service death?

A: An in-service death refers to a death that occurred during active military service.

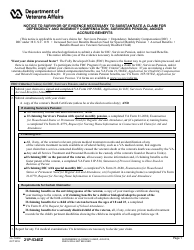

Q: What documents are required for the application?

A: The required documents may include the service member's death certificate, marriage certificate, and birth certificates of dependent children.

Q: Is DIC taxable income?

A: No, DIC is a tax-free monetary benefit.

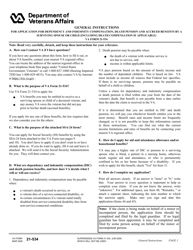

Form Details:

- Released on June 1, 2018;

- The latest available edition released by the U.S. Department of Veterans Affairs;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VA Form 21P-534A by clicking the link below or browse more documents and templates provided by the U.S. Department of Veterans Affairs.