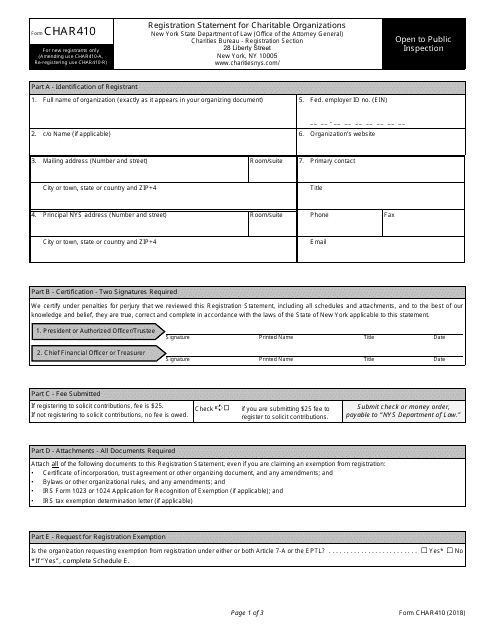

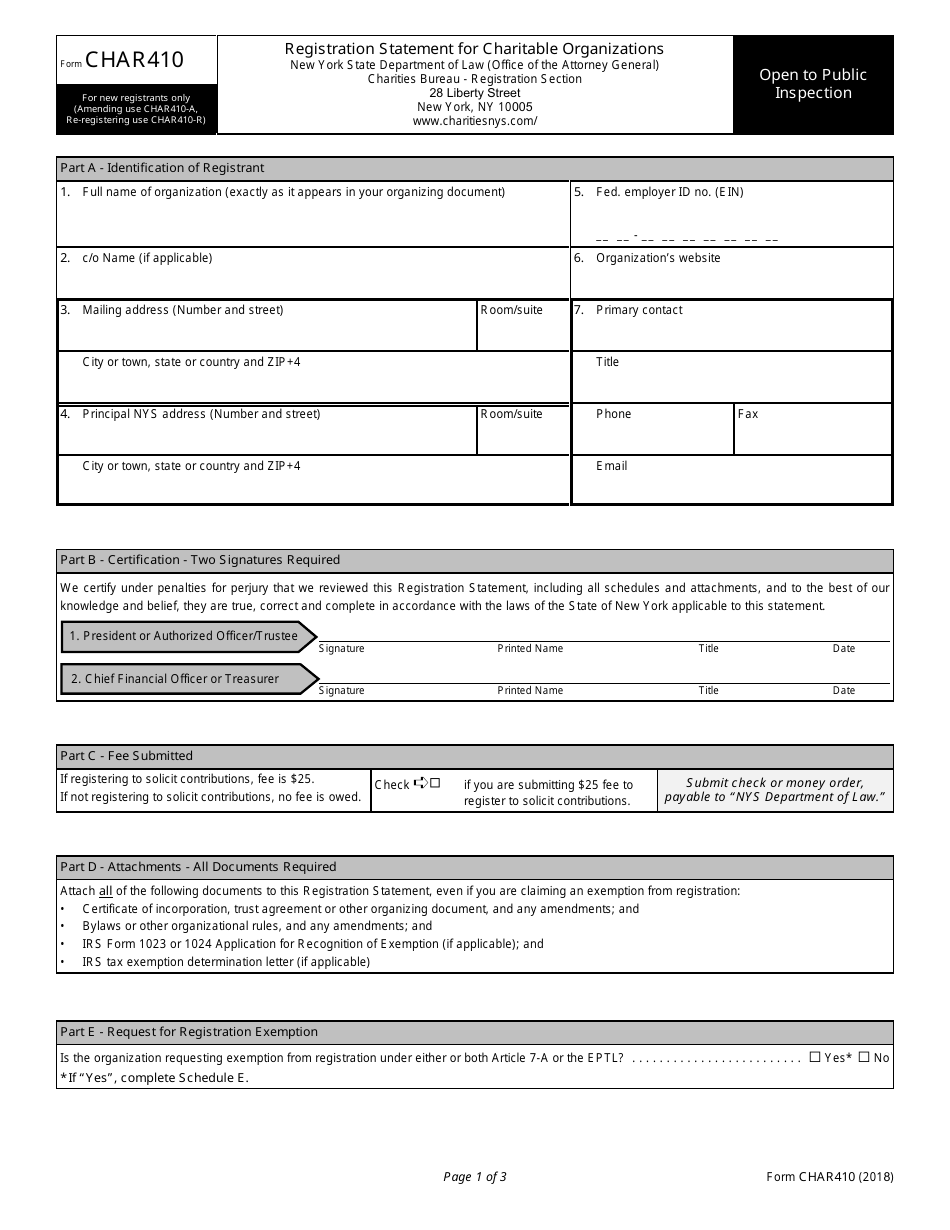

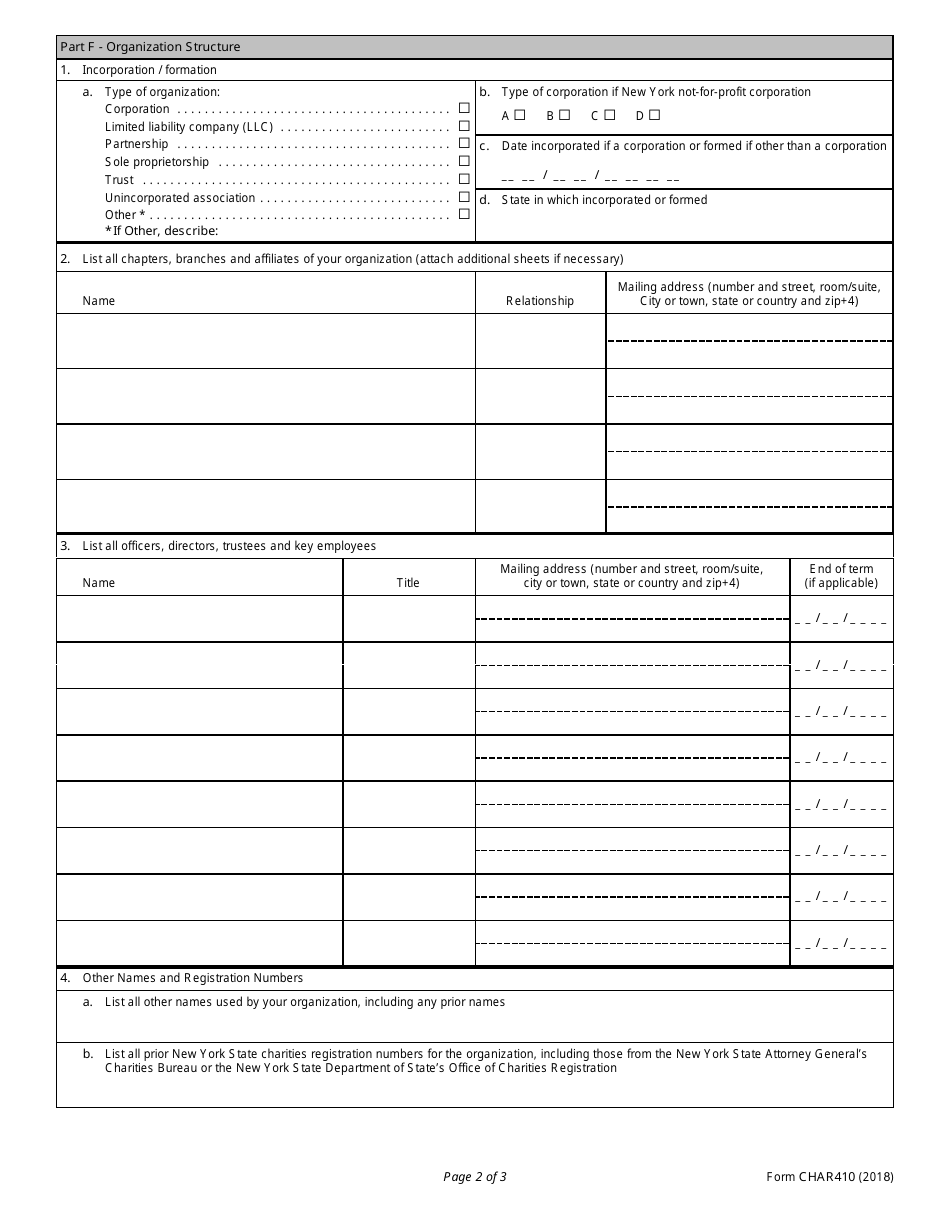

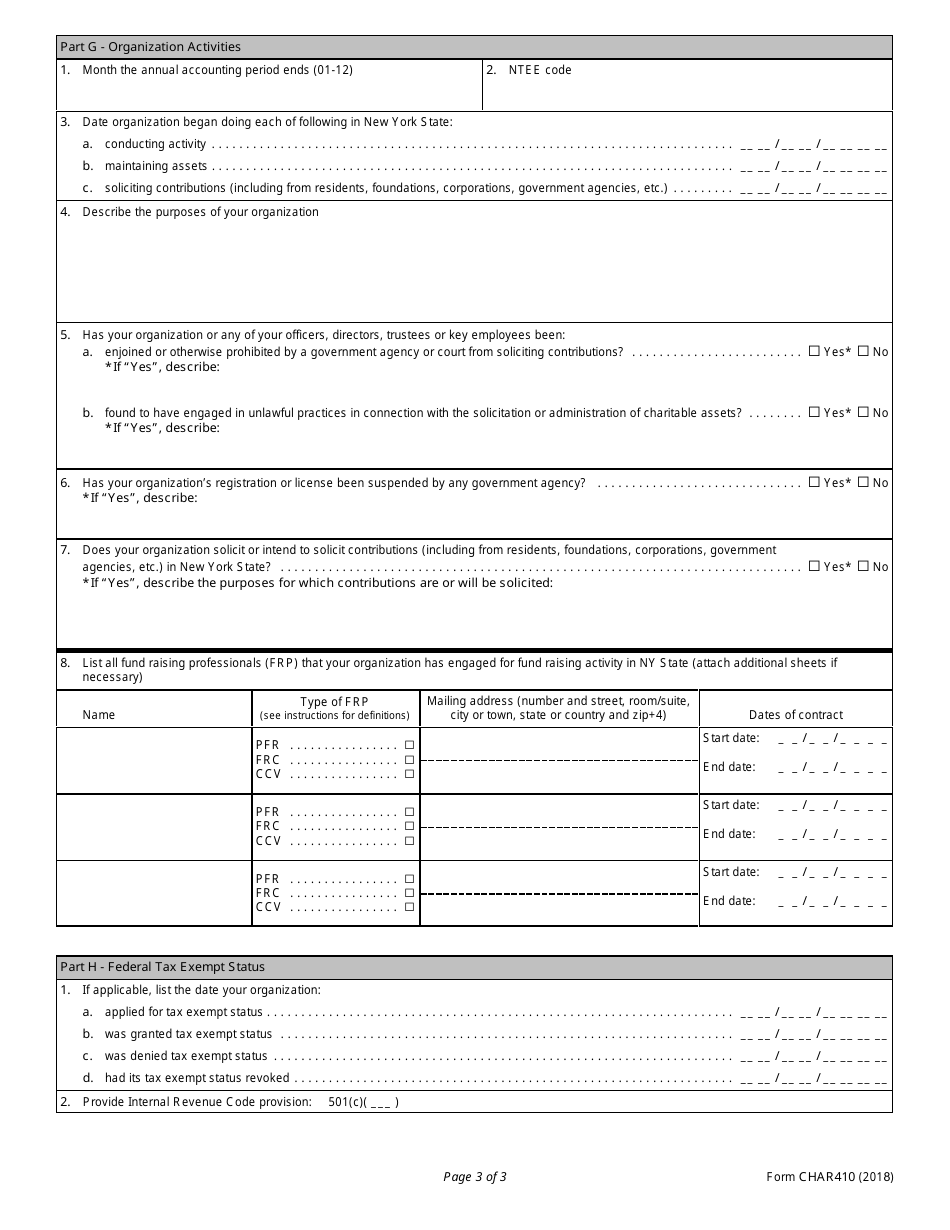

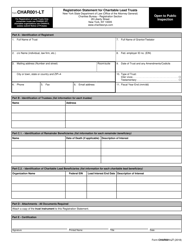

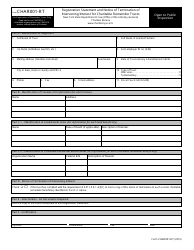

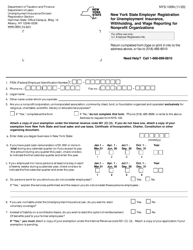

Form CHAR410 Registration Statement for Charitable Organizations - New York

What Is Form CHAR410?

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CHAR410?

A: CHAR410 is a registration statement for charitable organizations in New York.

Q: Who needs to file CHAR410?

A: Charitable organizations operating in New York need to file CHAR410.

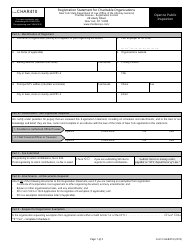

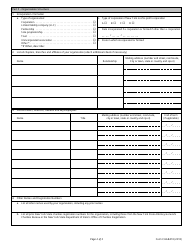

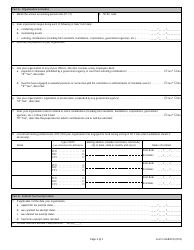

Q: What information is required in CHAR410?

A: CHAR410 requires information about the organization's purpose, activities, finances, and governance.

Q: How often do charitable organizations need to file CHAR410?

A: Charitable organizations in New York need to file CHAR410 annually, within 6 months of the end of their fiscal year.

Q: Are there any fees for filing CHAR410?

A: Yes, there is a filing fee for CHAR410 based on the organization's gross revenue.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CHAR410 by clicking the link below or browse more documents and templates provided by the New York State Attorney General.