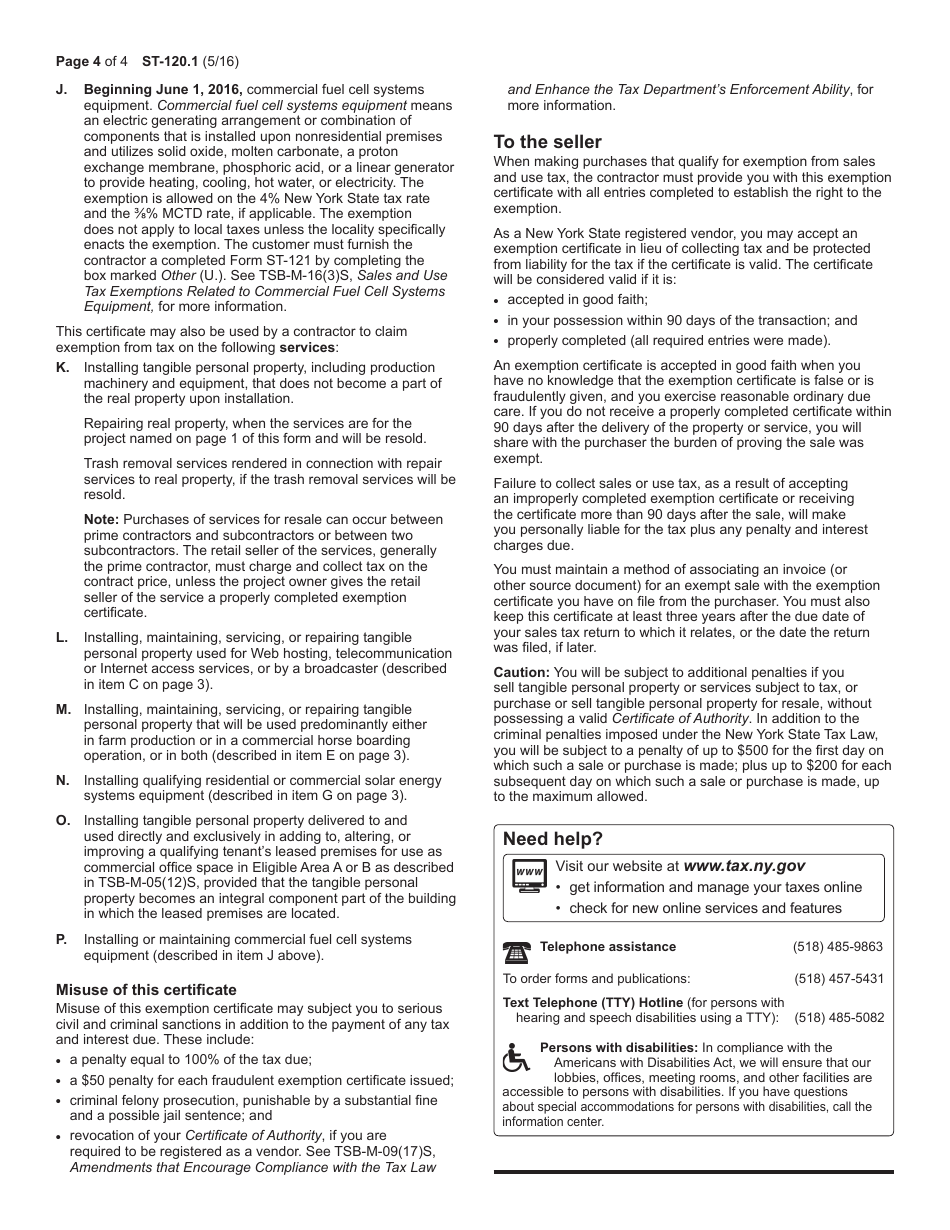

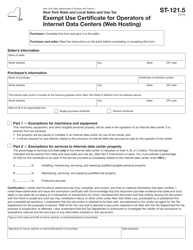

This version of the form is not currently in use and is provided for reference only. Download this version of

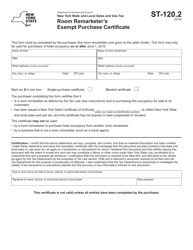

Form ST-120.1

for the current year.

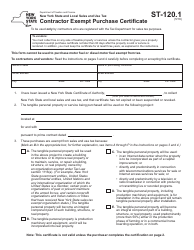

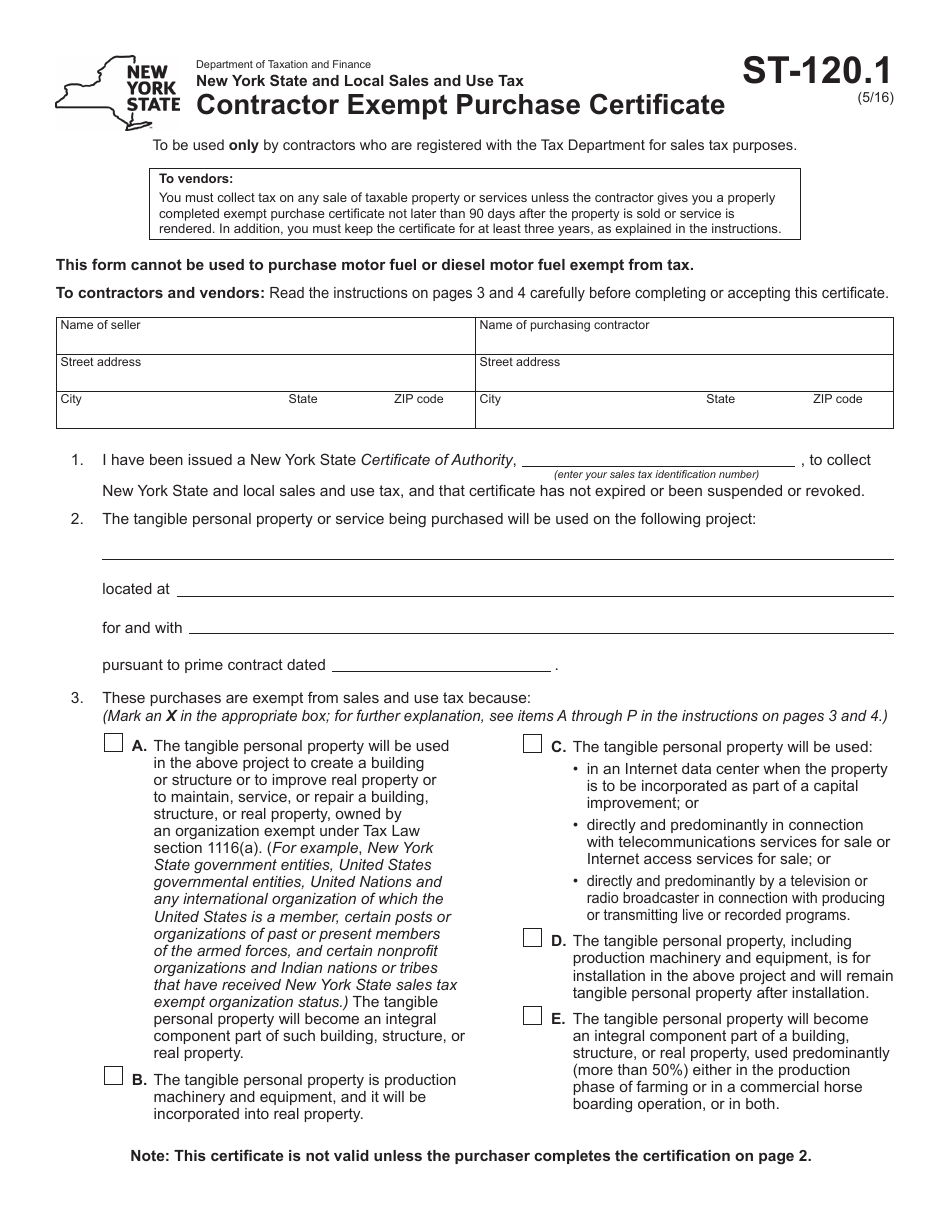

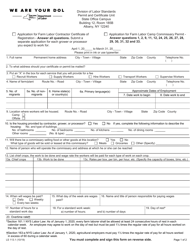

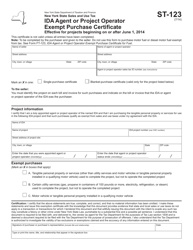

Form ST-120.1 Contractor Exempt Purchase Certificate - New York

What Is Form ST-120.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

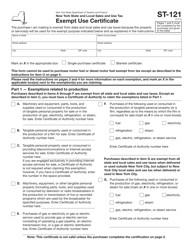

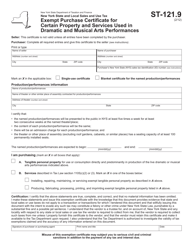

Q: What is Form ST-120.1?

A: Form ST-120.1 is the Contractor Exempt Purchase Certificate for the state of New York.

Q: Who uses Form ST-120.1?

A: Contractors in New York use Form ST-120.1.

Q: What is the purpose of Form ST-120.1?

A: The purpose of Form ST-120.1 is to claim exemption from sales tax on purchases related to certain construction projects.

Q: How do I fill out Form ST-120.1?

A: You need to provide your contractor information, project information, and certify that the purchases are eligible for exemption.

Q: Are there any filing fees for Form ST-120.1?

A: No, there are no filing fees for Form ST-120.1.

Q: How often do I need to file Form ST-120.1?

A: Form ST-120.1 should be filed for each eligible construction project.

Q: Are there any penalties for incorrect or late filing of Form ST-120.1?

A: Yes, there may be penalties for incorrect or late filing of Form ST-120.1. It is important to file the form accurately and on time.

Q: What should I do with Form ST-120.1 after filling it out?

A: You should provide a copy to the seller at the time of purchase and keep a copy for your records.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-120.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.