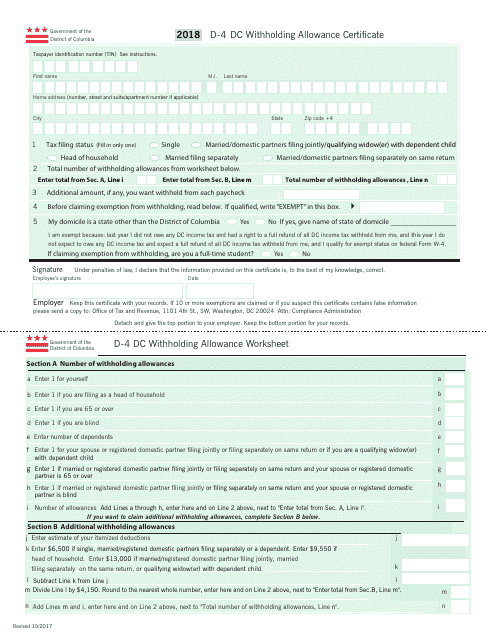

Form D-4 Dc Withholding Allowance Certificate - Washington, D.C.

What Is Form D-4?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-4?

A: Form D-4 is the Washington, D.C. Withholding Allowance Certificate.

Q: What is the purpose of Form D-4?

A: Form D-4 is used to determine the amount of income tax to be withheld from an employee's wages in Washington, D.C.

Q: Who needs to fill out Form D-4?

A: Employees who work in Washington, D.C. and are subject to income tax withholding need to fill out Form D-4.

Q: What information do I need to fill out Form D-4?

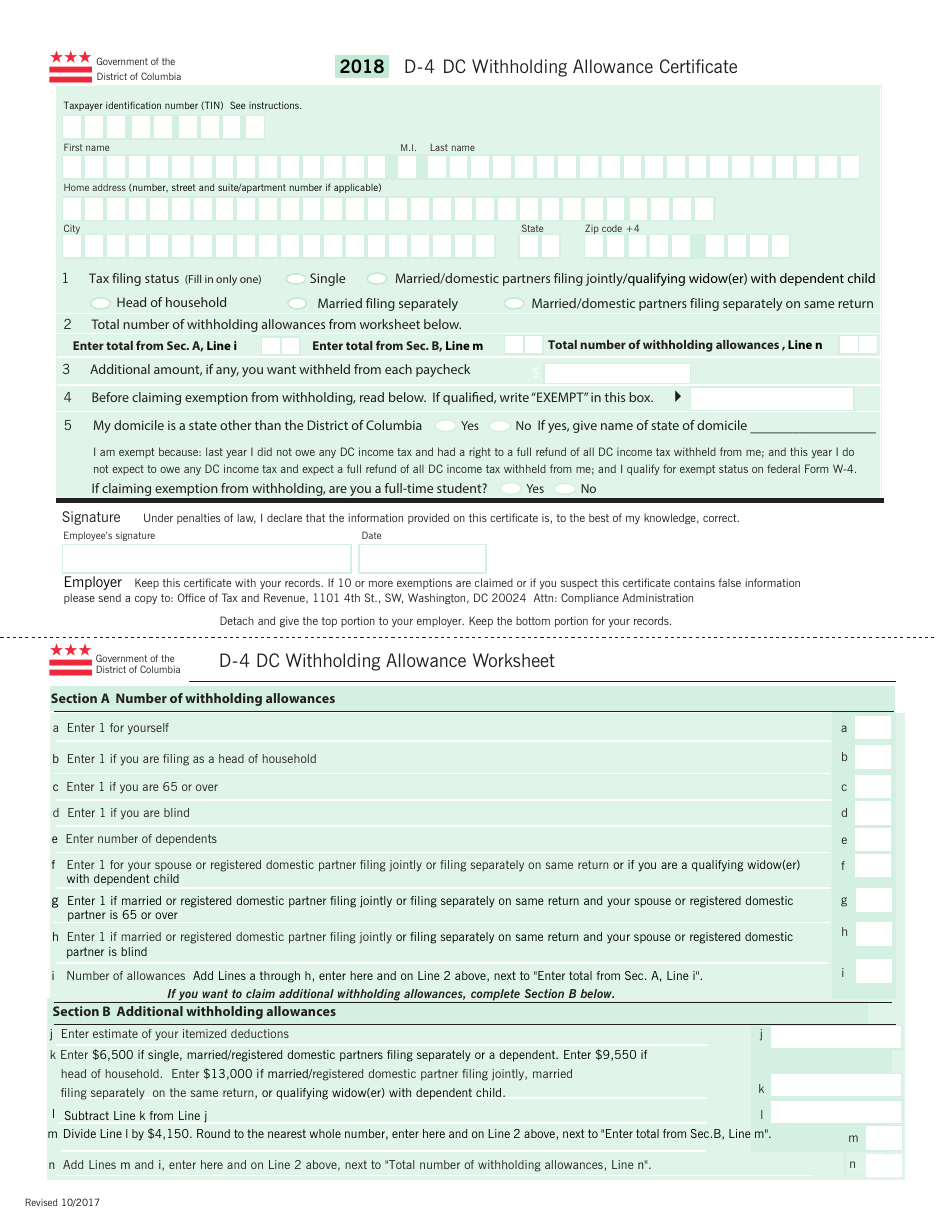

A: You will need to provide personal information, such as your name, address, and social security number, as well as information about your filing status and allowances.

Q: How often do I need to fill out Form D-4?

A: You need to fill out Form D-4 when you start a new job or whenever you need to update your withholding information.

Q: Can I claim exemptions on Form D-4?

A: Yes, you can claim exemptions if you qualify for them.

Q: Are there any additional withholding requirements in Washington, D.C.?

A: Yes, there may be additional local withholding requirements that you need to take into account.

Q: Can I change my withholding allowance during the year?

A: Yes, you can change your withholding allowance at any time by submitting a new Form D-4 to your employer.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form D-4 by clicking the link below or browse more documents and templates provided by the Washington Dc Office of Tax and Revenue.