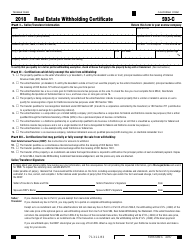

This version of the form is not currently in use and is provided for reference only. Download this version of

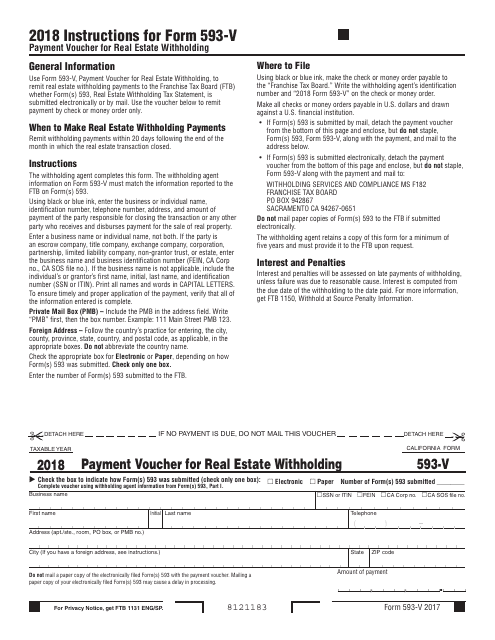

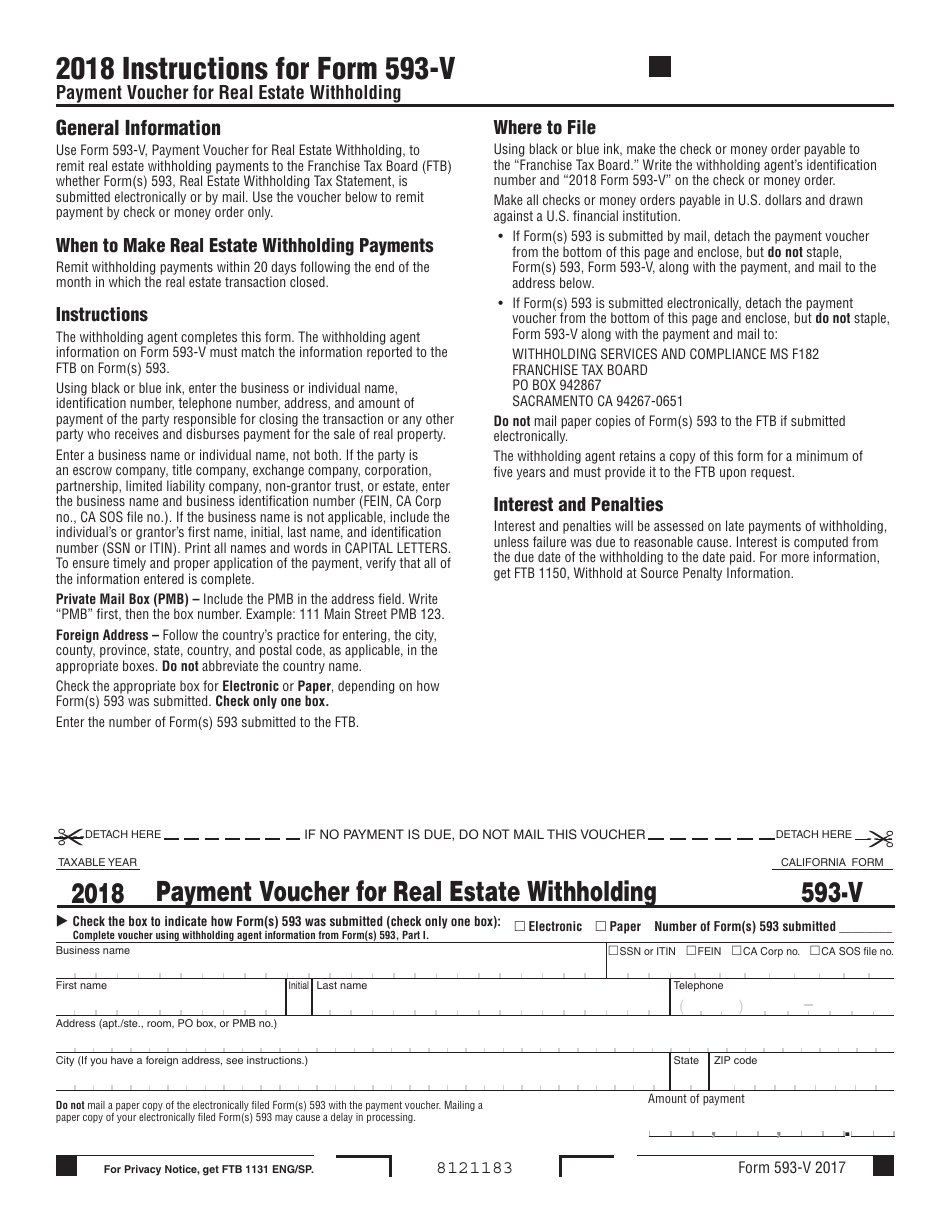

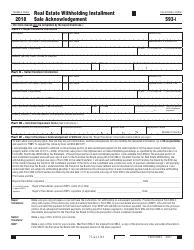

Form 593-V

for the current year.

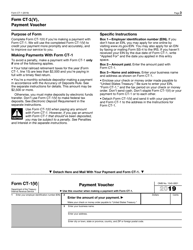

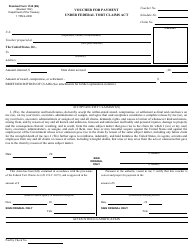

Form 593-V Payment Voucher for Real Estate Withholding - California

What Is Form 593-V?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

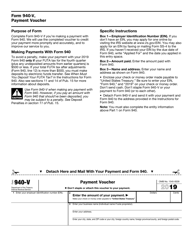

Q: What is Form 593-V?

A: Form 593-V is the payment voucher for submitting real estate withholding payments in California.

Q: Who needs to use Form 593-V?

A: Individuals and entities who are required to withhold and remit taxes from real estate transactions in California need to use Form 593-V.

Q: When should Form 593-V be used?

A: Form 593-V should be used when making a payment of real estate withholding to the Franchise Tax Board (FTB) in California.

Q: How do I fill out Form 593-V?

A: To fill out Form 593-V, you will need to provide information about the payer, recipient, property, and the amount of withholding.

Q: What is the deadline for filing Form 593-V?

A: Form 593-V must be filed and the payment must be made by the 20th day of the month following the close of escrow.

Q: Are there any penalties for late filing of Form 593-V?

A: Yes, there are penalties for late filing of Form 593-V, so it is important to submit the form and payment on time.

Q: What should I do with the completed Form 593-V?

A: You should send the completed Form 593-V along with the payment to the address provided on the form.

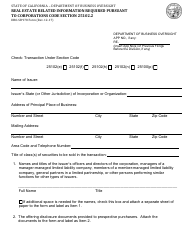

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 593-V by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.