This version of the form is not currently in use and is provided for reference only. Download this version of

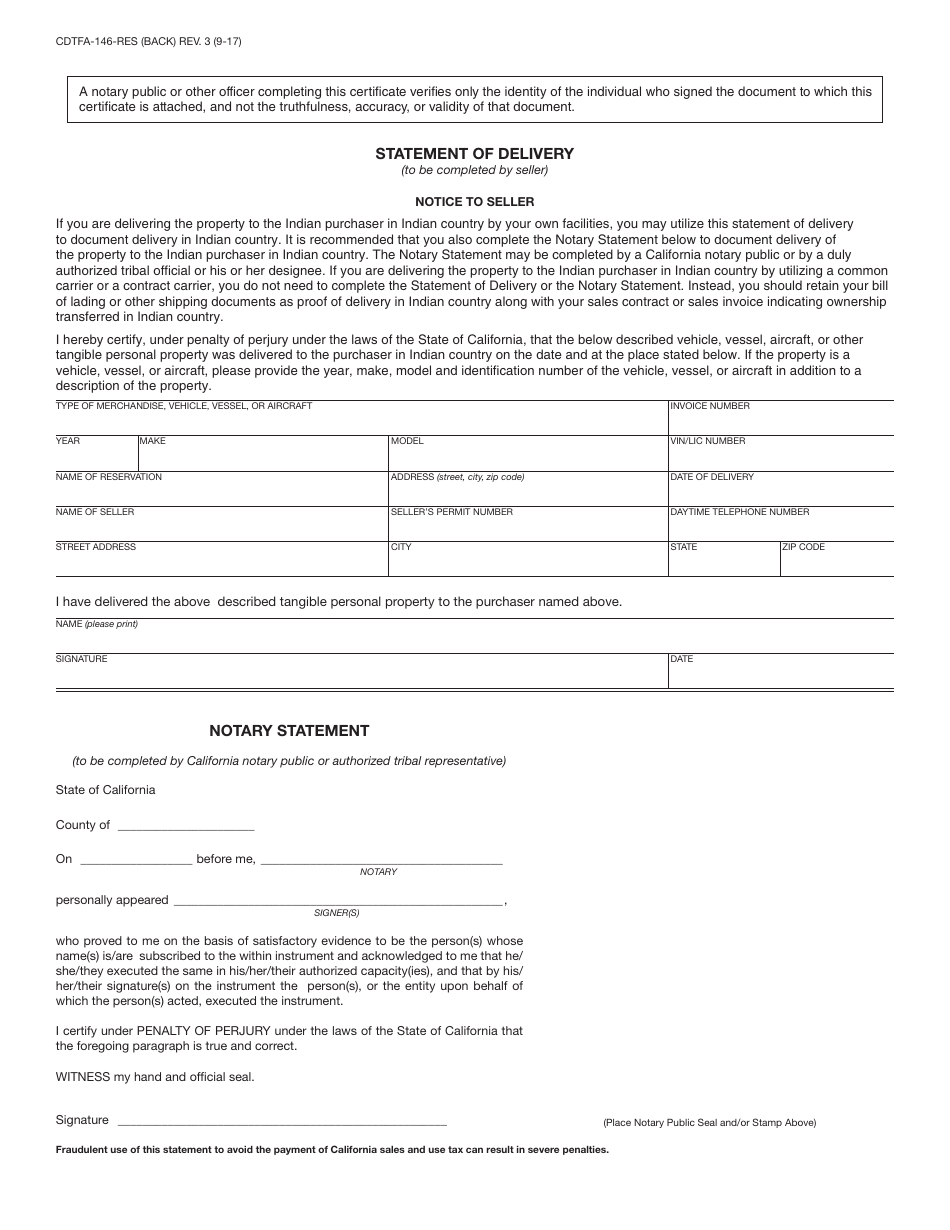

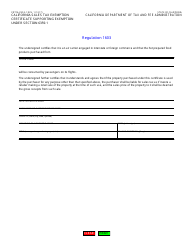

Form CDTFA-146-RES

for the current year.

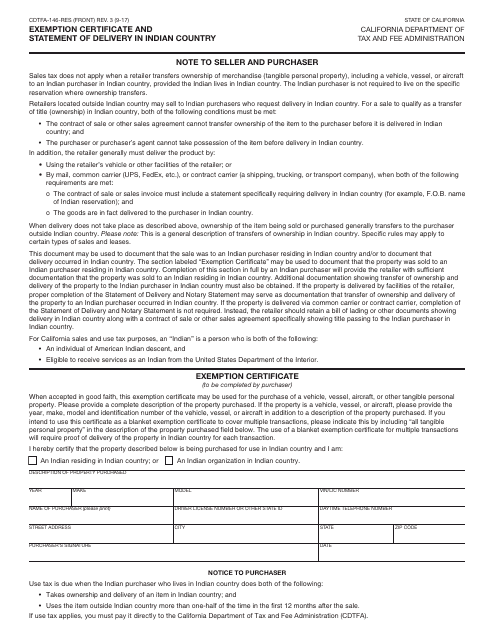

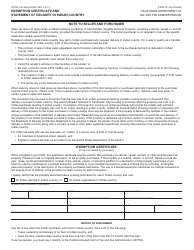

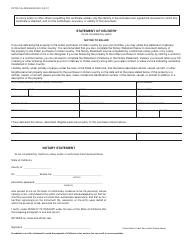

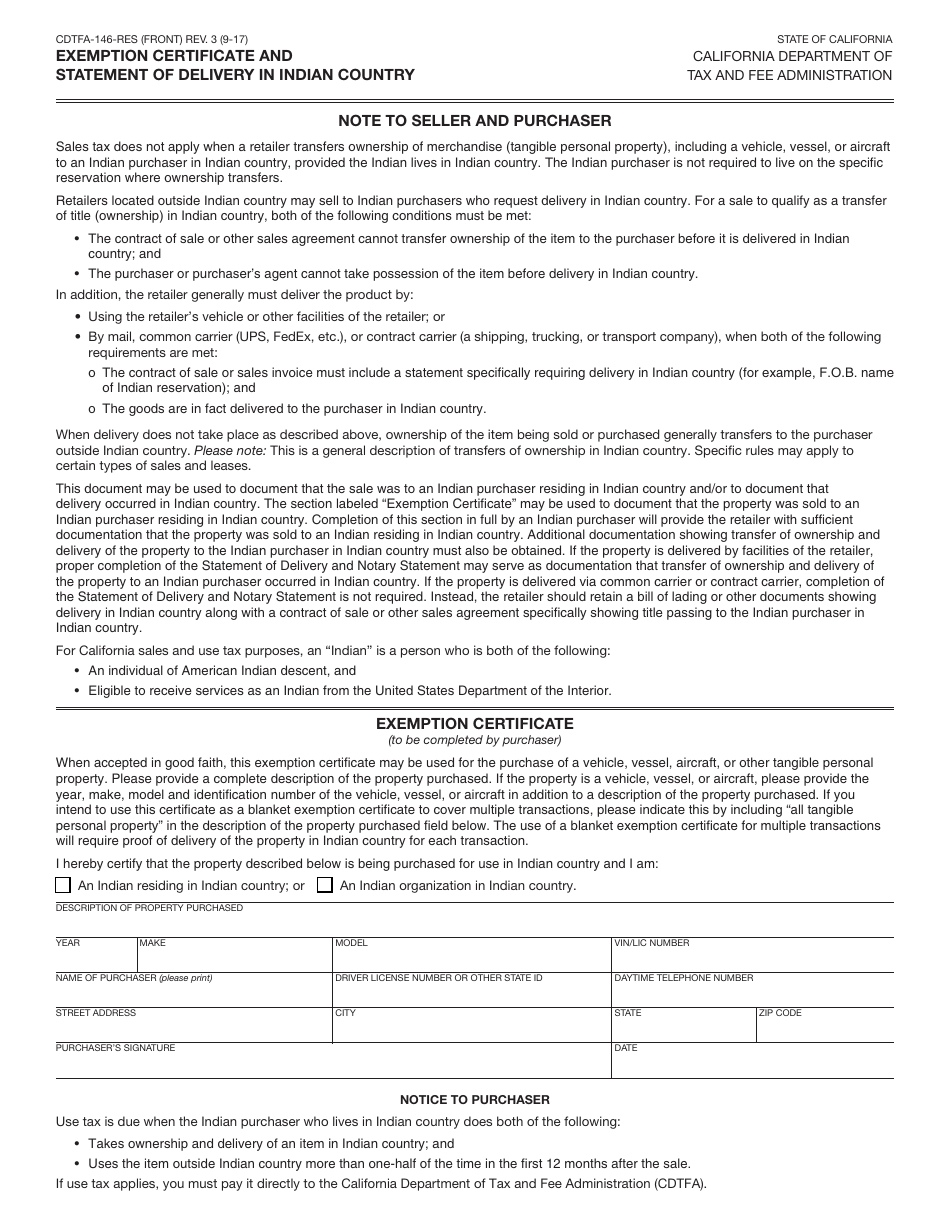

Form CDTFA-146-RES Exemption Certificate and Statement of Delivery in Indian Country - California

What Is Form CDTFA-146-RES?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

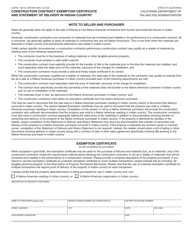

Q: What is Form CDTFA-146-RES?

A: Form CDTFA-146-RES is an exemption certificate and statement of delivery in Indian Country in California.

Q: What is the purpose of Form CDTFA-146-RES?

A: The purpose of Form CDTFA-146-RES is to claim an exemption from certain taxes on deliveries in Indian Country in California.

Q: What taxes does Form CDTFA-146-RES exempt?

A: Form CDTFA-146-RES exempts certain sales and use taxes.

Q: Who should use Form CDTFA-146-RES?

A: Form CDTFA-146-RES should be used by sellers making deliveries in Indian Country in California.

Q: Is Form CDTFA-146-RES mandatory?

A: No, Form CDTFA-146-RES is not mandatory. It is optional for sellers to use.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-146-RES by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.