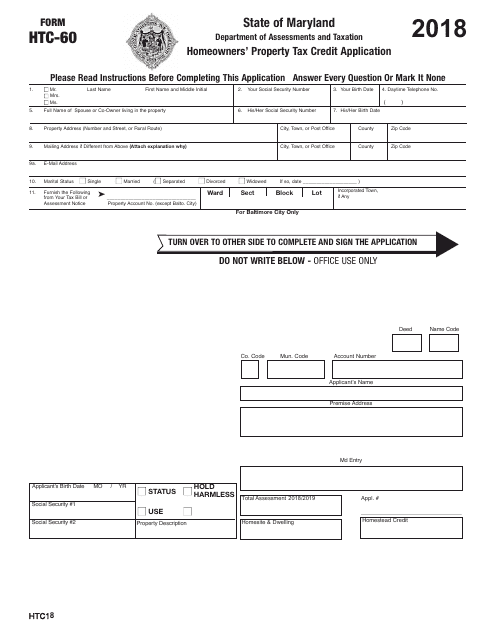

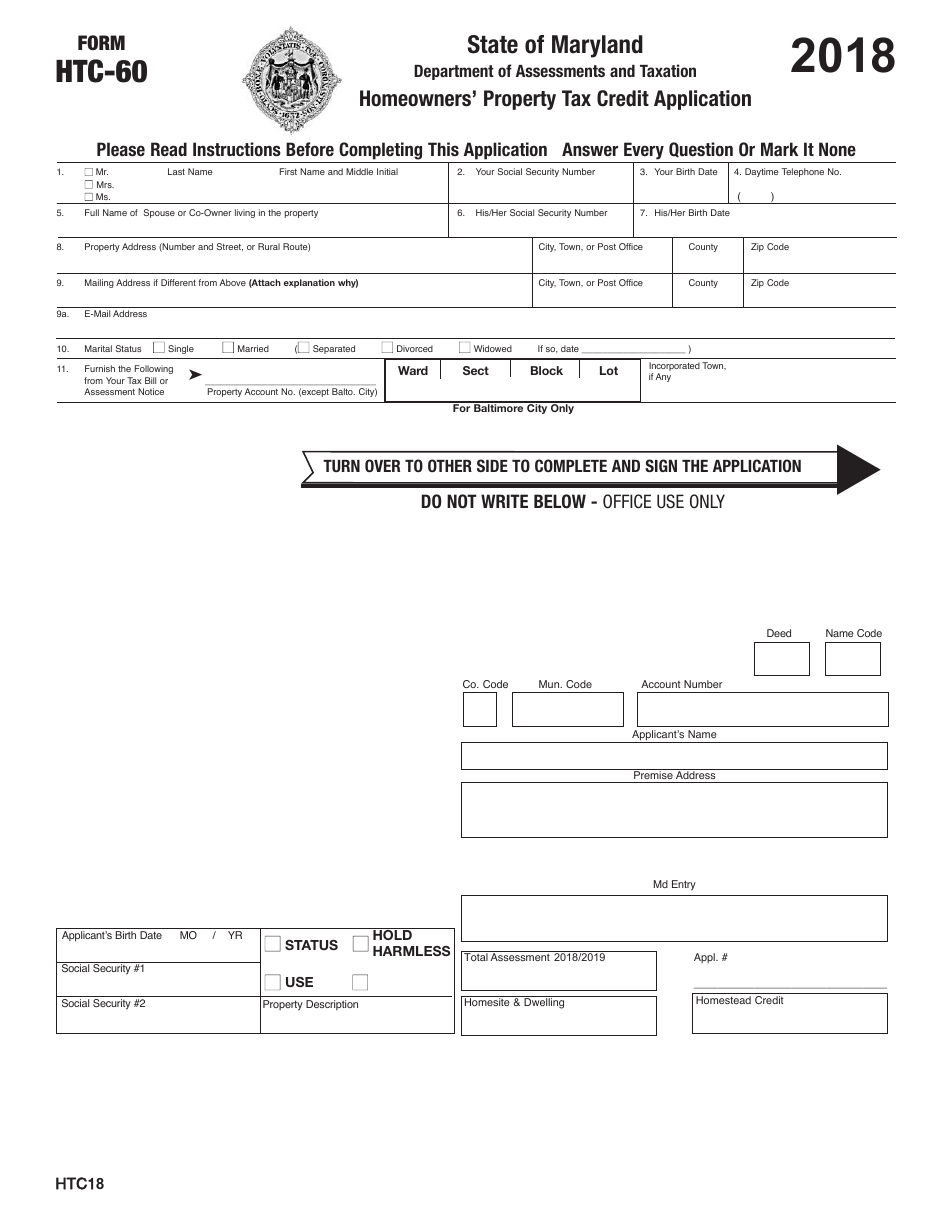

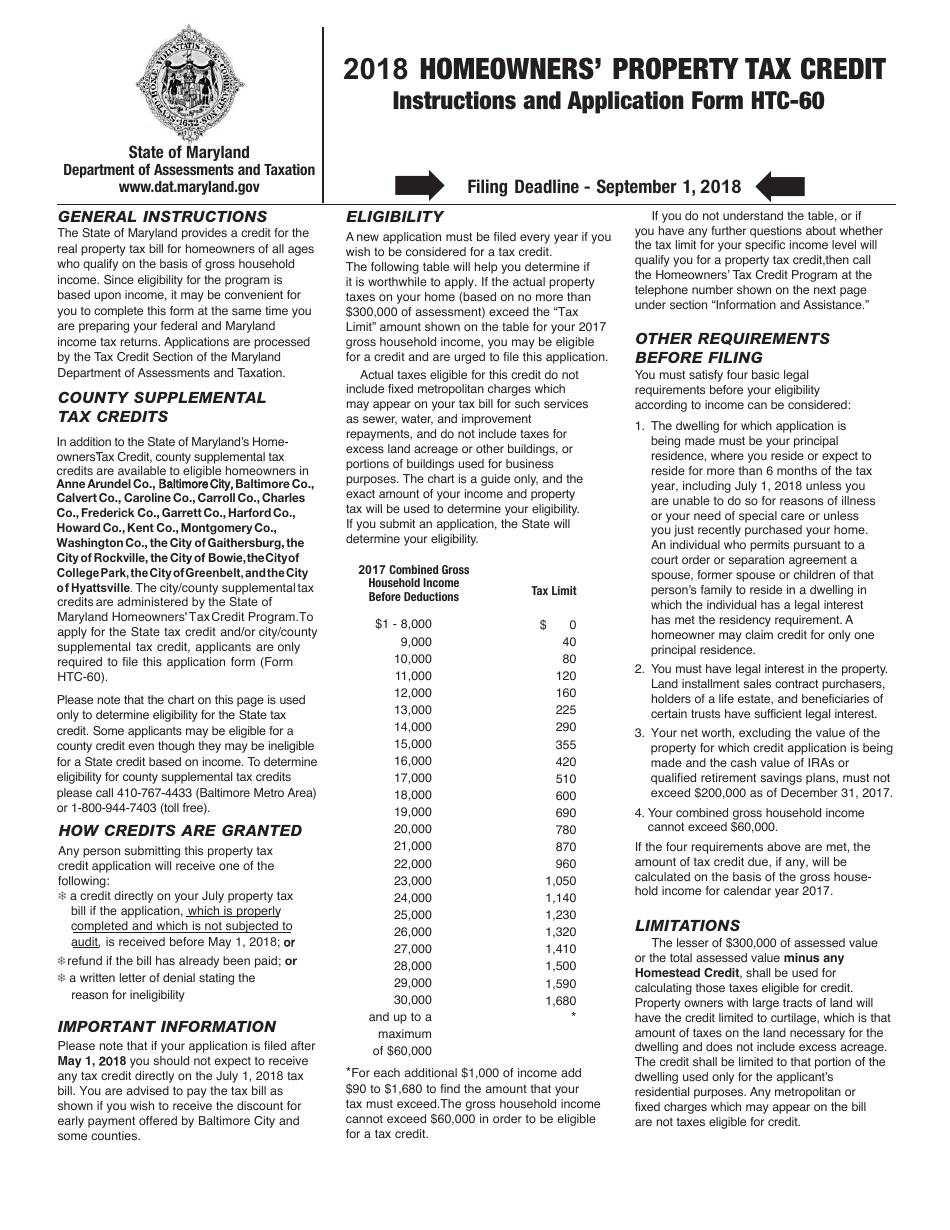

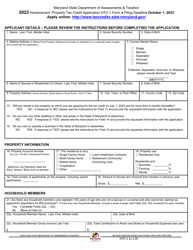

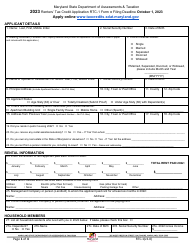

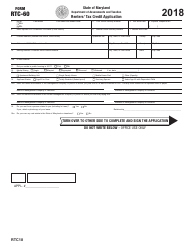

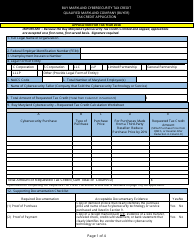

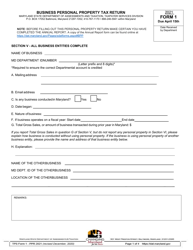

Form HTC-60 Homeowners' Property Tax Credit Application - Maryland

What Is Form HTC-60?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HTC-60?

A: Form HTC-60 is the Homeowners' Property Tax Credit Application.

Q: Who should use Form HTC-60?

A: Maryland homeowners who want to apply for the Homeowners' Property Tax Credit should use Form HTC-60.

Q: What is the purpose of Form HTC-60?

A: The purpose of Form HTC-60 is to apply for the Homeowners' Property Tax Credit in Maryland.

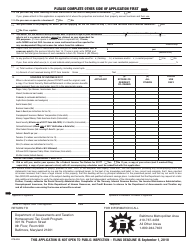

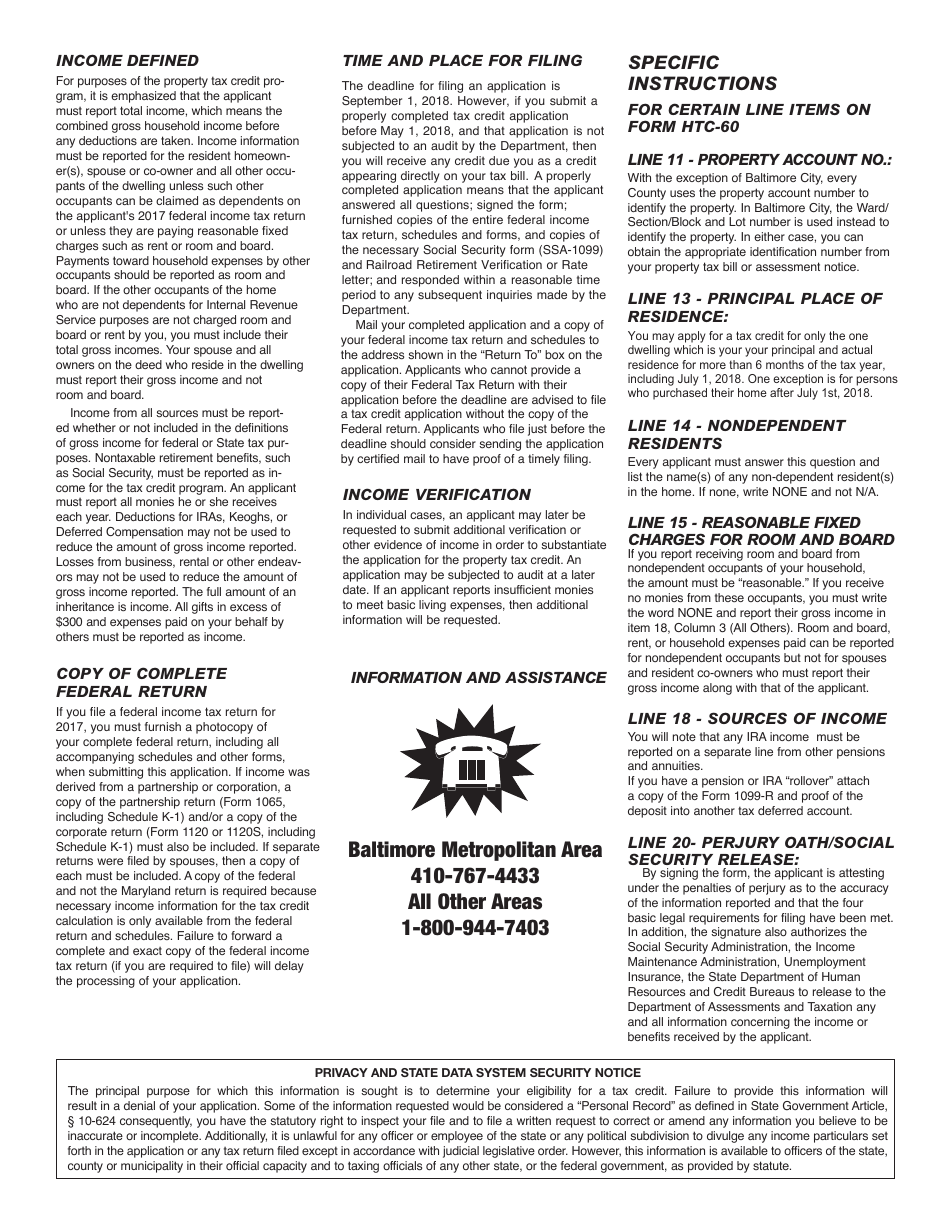

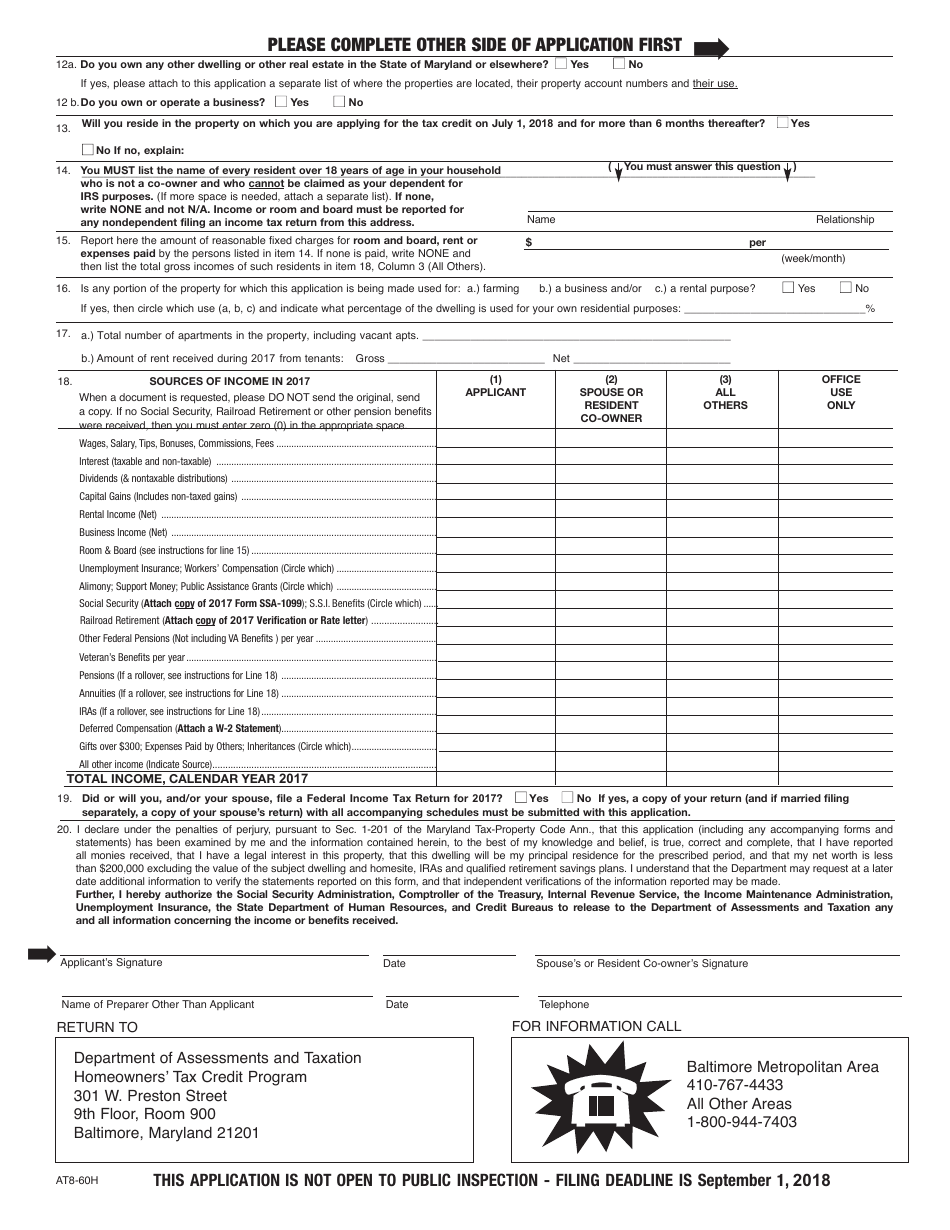

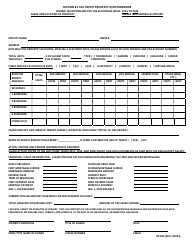

Q: What information do I need to fill out Form HTC-60?

A: You will need information about your property, income, and other eligibility requirements to fill out Form HTC-60.

Q: When is the deadline to submit Form HTC-60?

A: The deadline to submit Form HTC-60 is September 1st of the tax year. However, it is recommended to submit it as soon as possible.

Q: Is there a fee to file Form HTC-60?

A: There is no fee to file Form HTC-60.

Form Details:

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HTC-60 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.