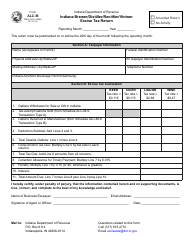

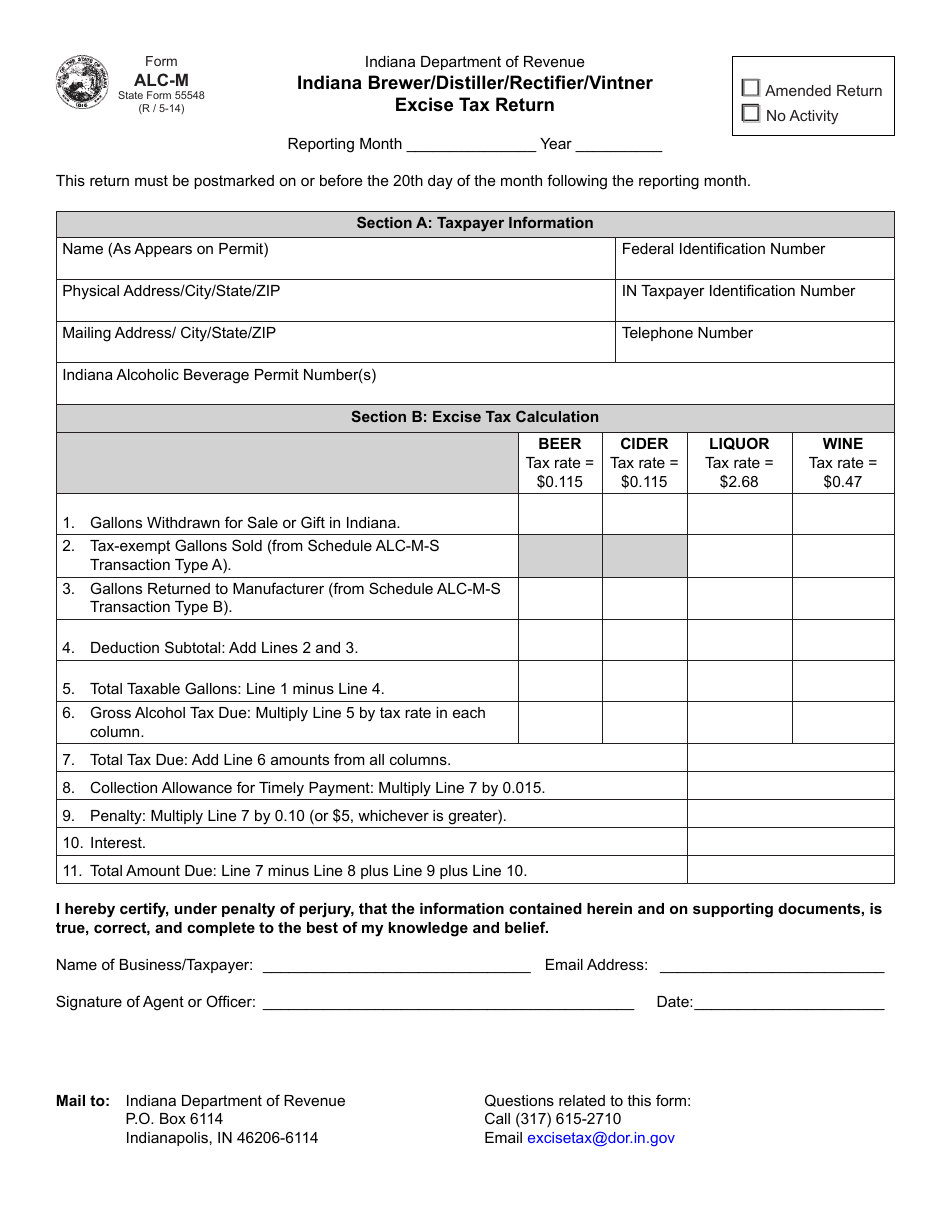

State Form 55548 (ALC-M) Indiana Brewer / Distiller / Rectifier / Vintner Excise Tax Return - Indiana

What Is State Form 55548 (ALC-M)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55548 (ALC-M)?

A: State Form 55548 (ALC-M) is the Indiana Brewer/Distiller/Rectifier/Vintner Excise Tax Return form.

Q: Who needs to file State Form 55548 (ALC-M)?

A: Brewers, distillers, rectifiers, and vintners in Indiana need to file State Form 55548 (ALC-M).

Q: What is the purpose of State Form 55548 (ALC-M)?

A: The purpose of State Form 55548 (ALC-M) is to report and pay excise taxes related to the production and sale of alcoholic beverages in Indiana.

Q: How often do I need to file State Form 55548 (ALC-M)?

A: State Form 55548 (ALC-M) must be filed on a monthly basis.

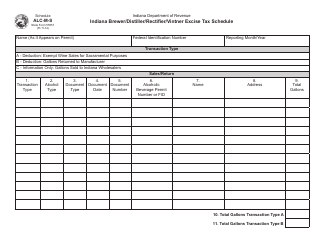

Q: What information do I need to provide on State Form 55548 (ALC-M)?

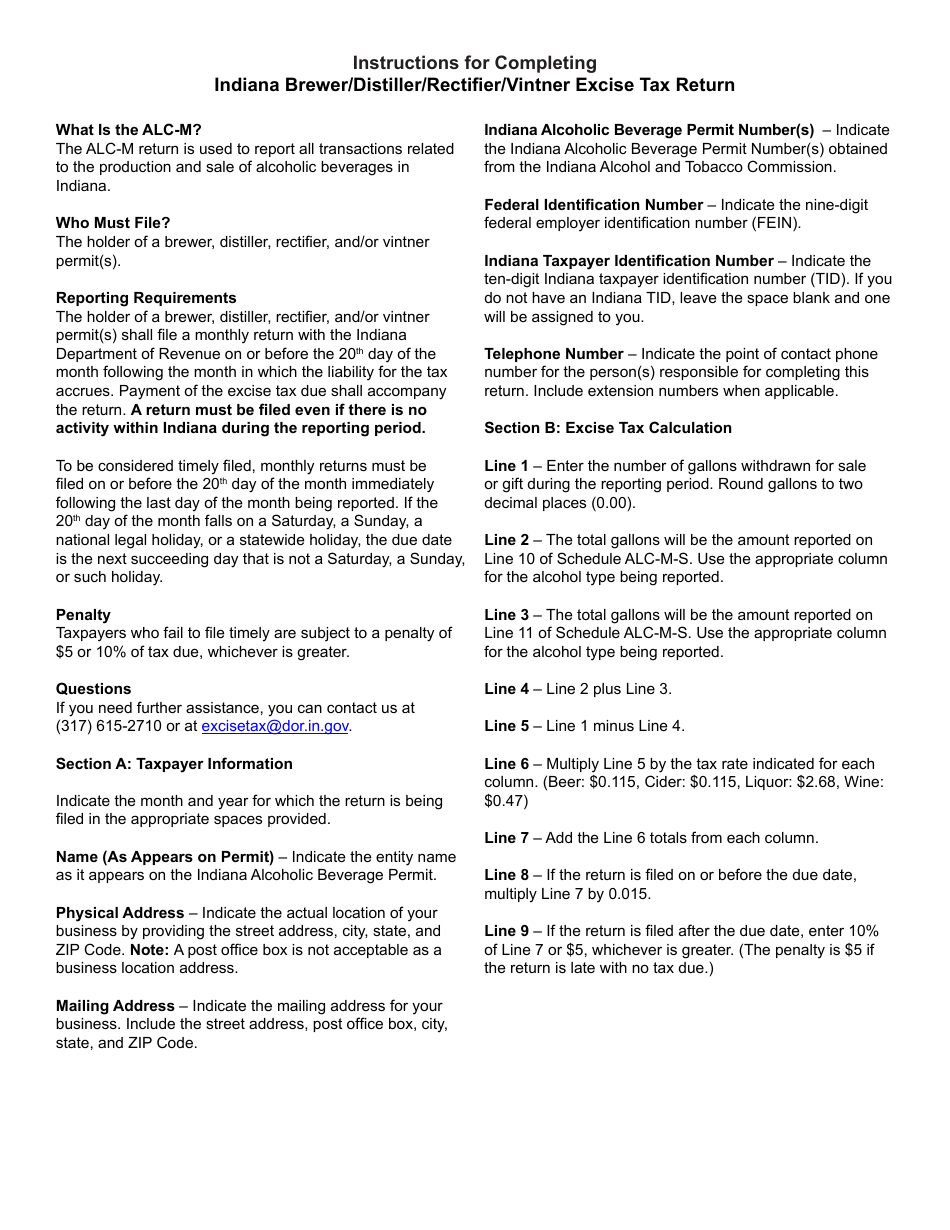

A: You need to provide information about the quantity and value of alcoholic beverages produced and sold, as well as other required details like permits and licenses.

Q: When is the due date for filing State Form 55548 (ALC-M)?

A: The due date for filing State Form 55548 (ALC-M) is usually the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of State Form 55548 (ALC-M)?

A: Yes, there are penalties for late filing, including interest charges and possible suspension of permits and licenses.

Q: Can I file State Form 55548 (ALC-M) electronically?

A: Yes, you can file State Form 55548 (ALC-M) electronically through the Indiana Department of Revenue's INtax system.

Q: What should I do if I have questions or need assistance with State Form 55548 (ALC-M)?

A: If you have questions or need assistance, you can contact the Indiana Department of Revenue's Alcoholic Beverage Division for guidance and support.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55548 (ALC-M) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.