This version of the form is not currently in use and is provided for reference only. Download this version of

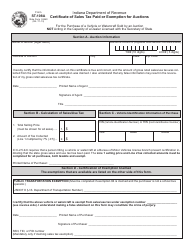

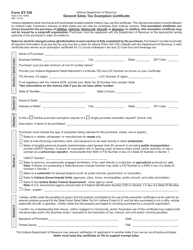

State Form 49065 (ST-105)

for the current year.

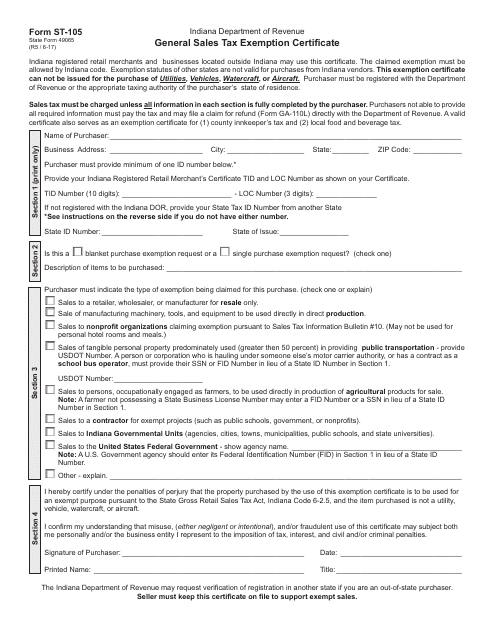

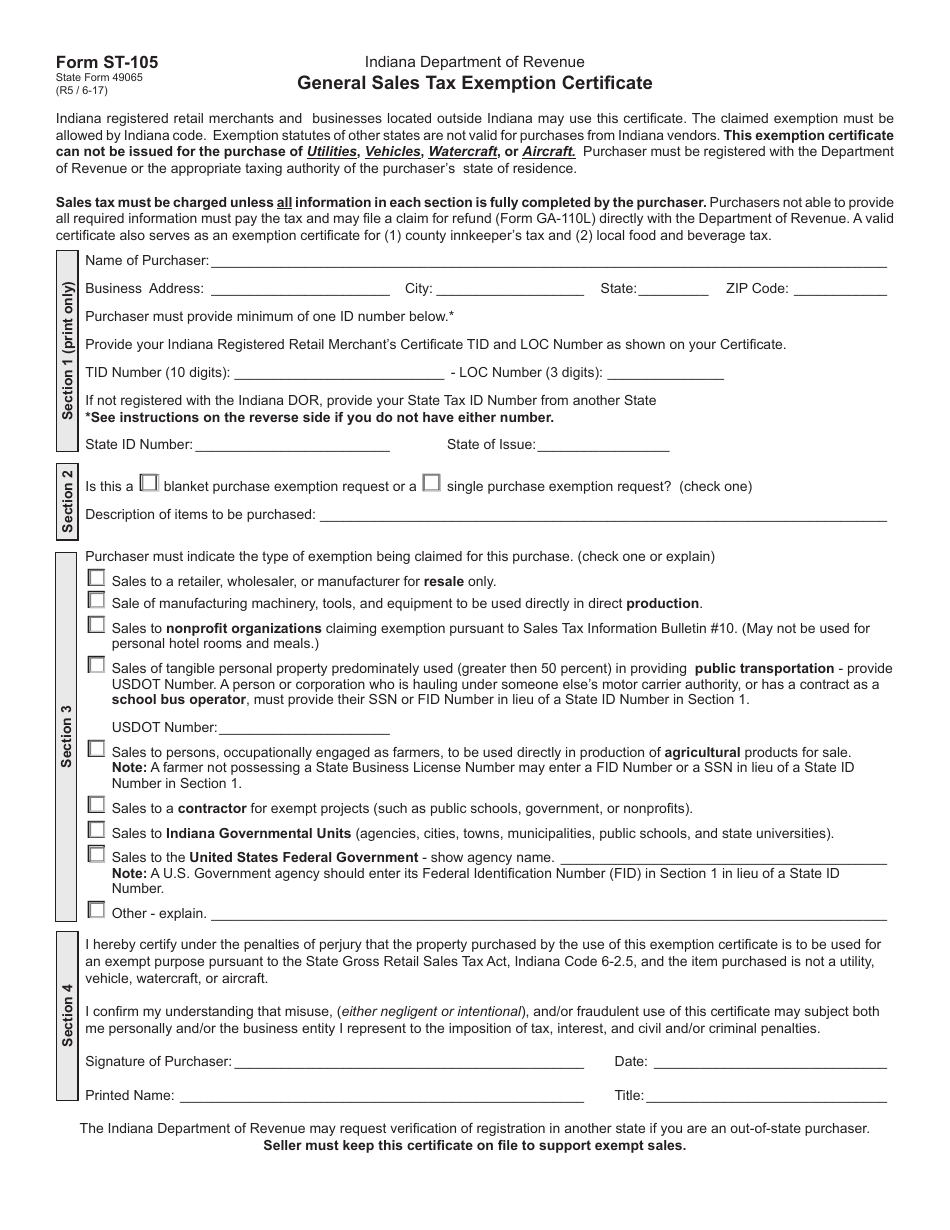

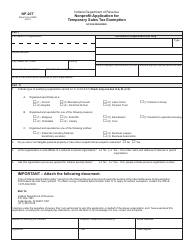

State Form 49065 (ST-105) General Sales Tax Exemption Certificate - Indiana

What Is State Form 49065 (ST-105)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 49065 (ST-105)?

A: Form 49065 (ST-105) is the General Sales Tax Exemption Certificate for Indiana.

Q: Who is eligible to use Form 49065 (ST-105)?

A: Individuals or businesses in Indiana who qualify for a sales tax exemption.

Q: What is the purpose of Form 49065 (ST-105)?

A: The purpose of the form is to claim exemption from sales tax on qualified purchases.

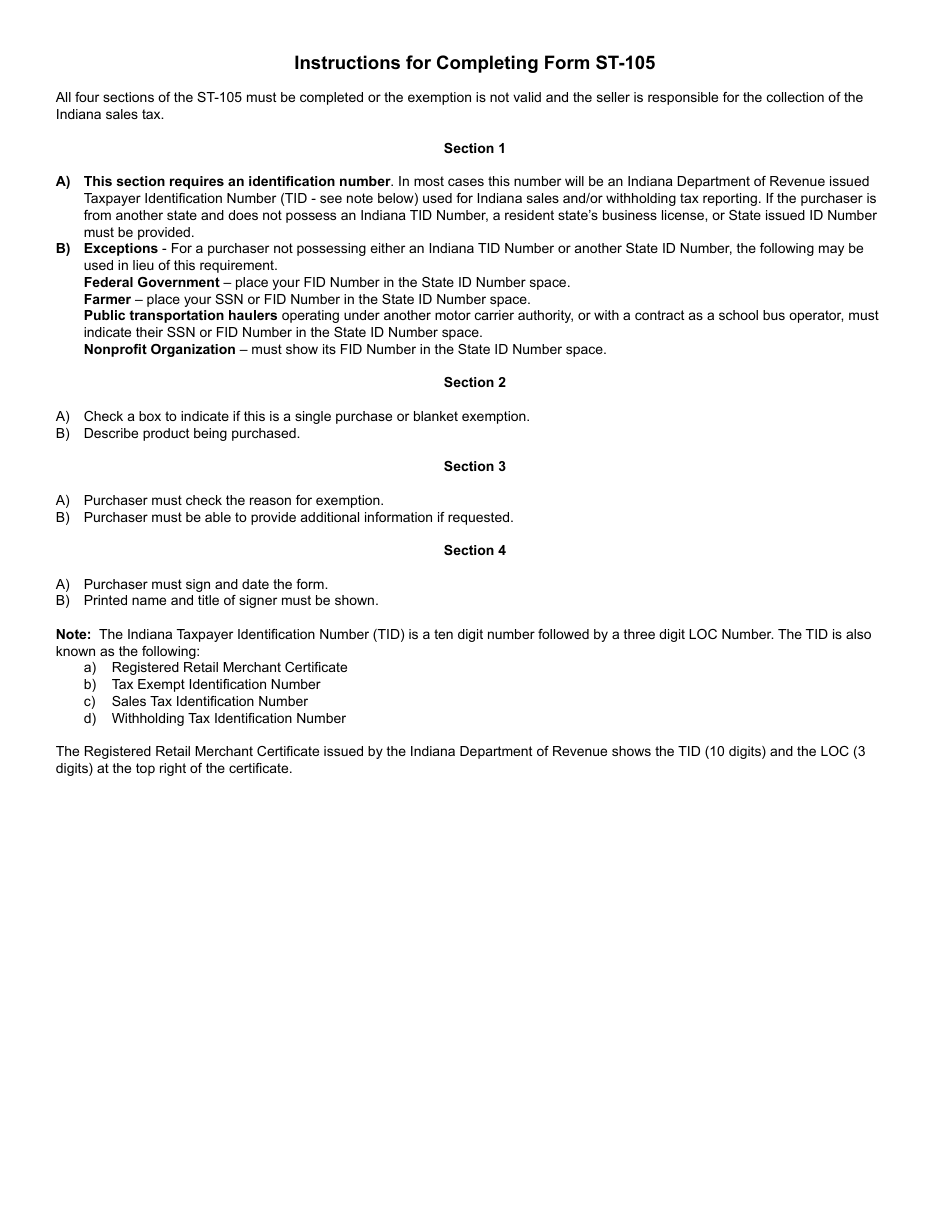

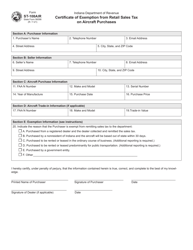

Q: What information is required on Form 49065 (ST-105)?

A: The form requires information about the purchaser, seller, and details of the purchase.

Q: How long is Form 49065 (ST-105) valid?

A: The certificate is valid for four years from the date of issuance.

Q: Are there any limitations to using Form 49065 (ST-105)?

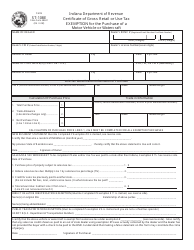

A: Yes, the form cannot be used for certain types of purchases, such as motor vehicles and gasoline.

Q: What should I do with Form 49065 (ST-105) after completing it?

A: You should provide a copy of the completed form to the seller and keep a copy for your records.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49065 (ST-105) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.