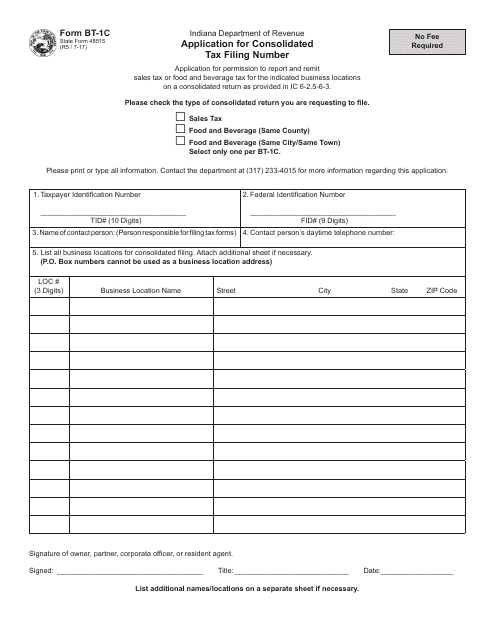

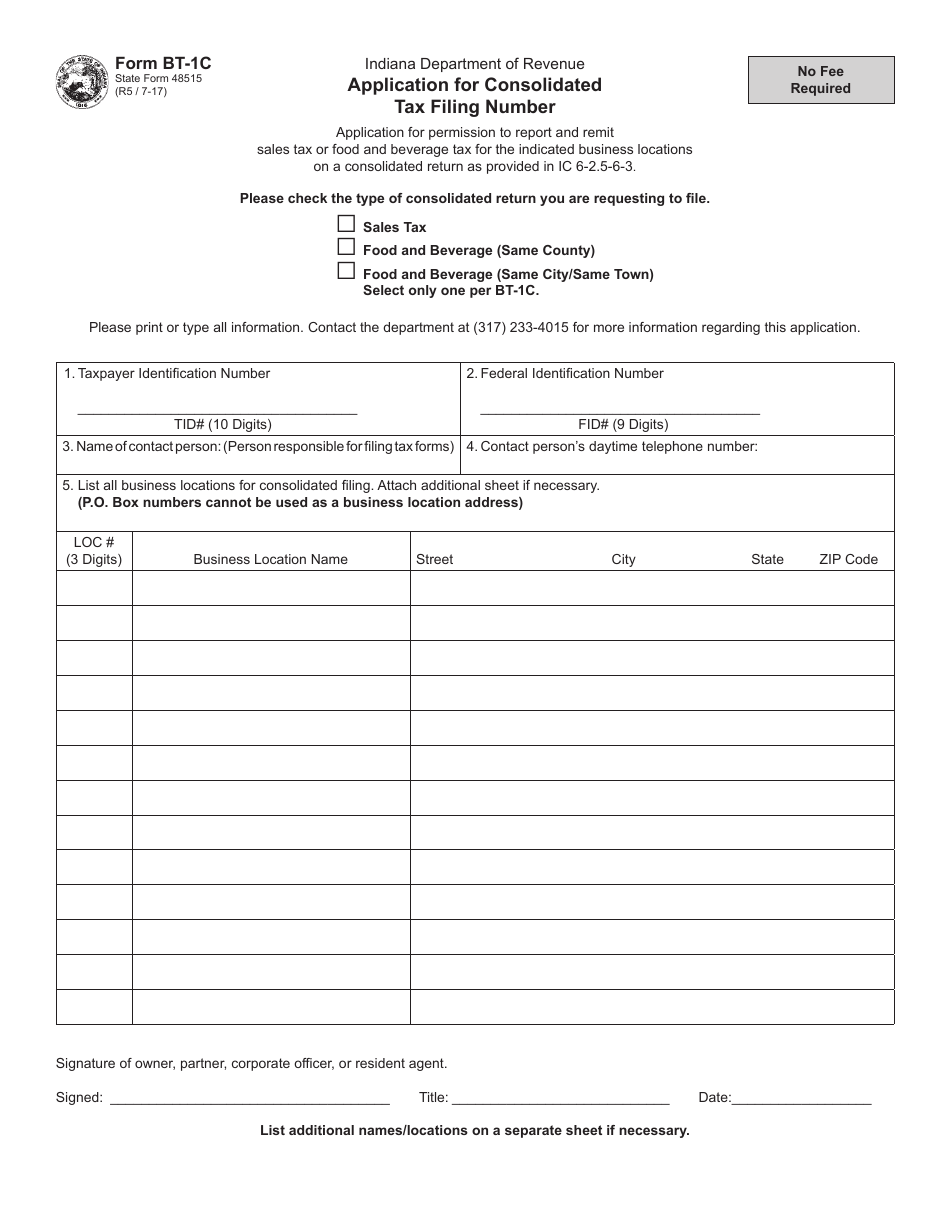

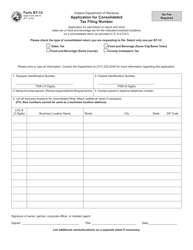

State Form 48515 (BT-1C) Application for Consolidated Tax Filing Number - Indiana

What Is State Form 48515 (BT-1C)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 48515 (BT-1C)?

A: State Form 48515 (BT-1C) is the Application for Consolidated Tax Filing Number in Indiana.

Q: What is the purpose of State Form 48515 (BT-1C)?

A: The purpose of State Form 48515 (BT-1C) is to apply for a Consolidated Tax Filing Number in Indiana.

Q: Who needs to fill out State Form 48515 (BT-1C)?

A: Any taxpayer in Indiana who wants to file consolidated tax returns needs to fill out State Form 48515 (BT-1C).

Q: Are there any fees associated with filing State Form 48515 (BT-1C)?

A: There are no fees associated with filing State Form 48515 (BT-1C).

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48515 (BT-1C) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.