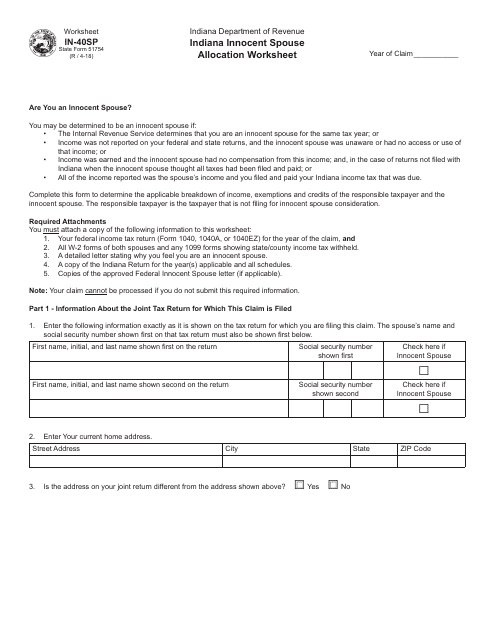

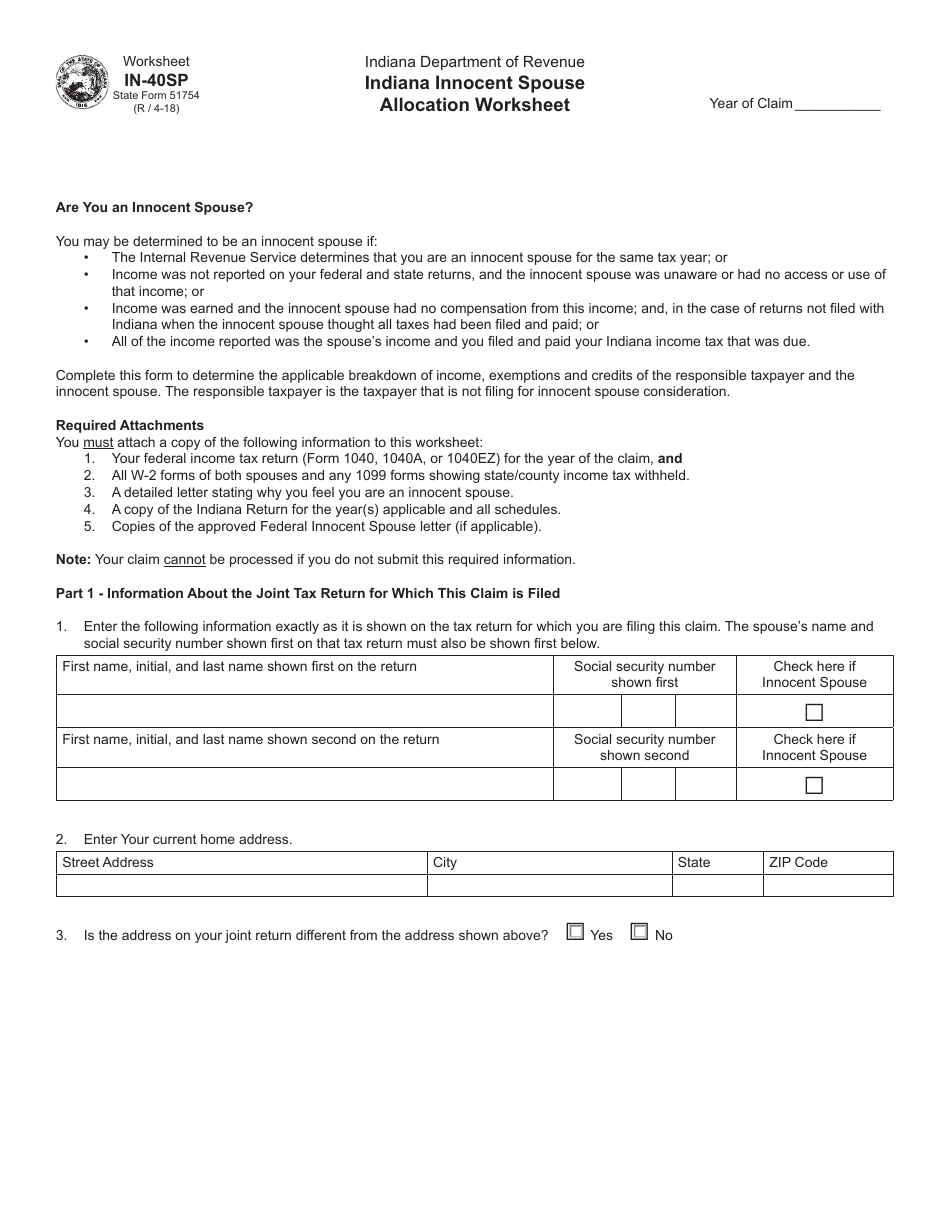

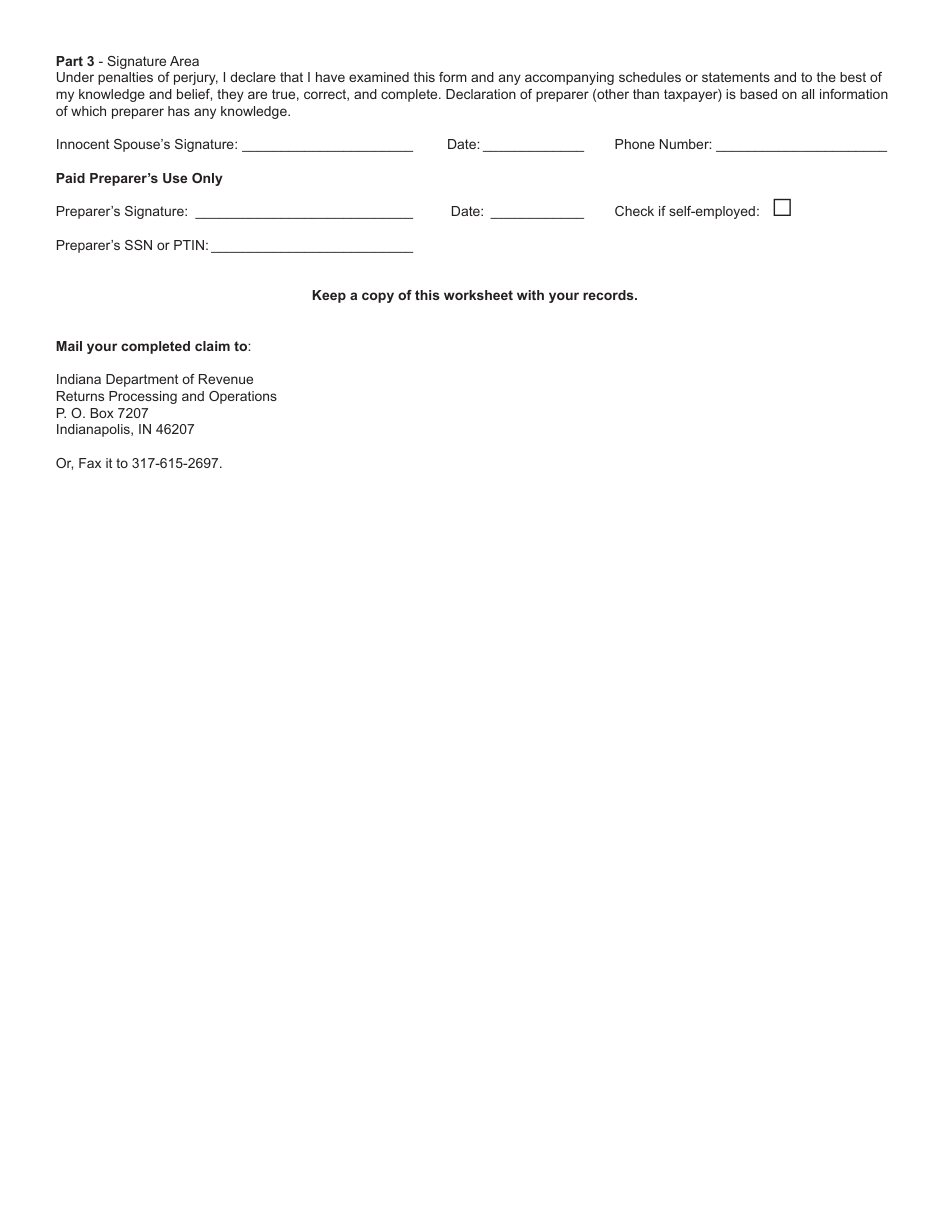

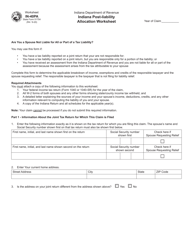

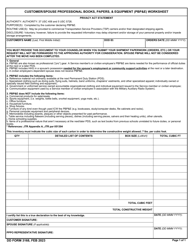

State Form 51754 (IN-40SP) Indiana Innocent Spouse Allocation Worksheet - Indiana

What Is State Form 51754 (IN-40SP)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 51754 (IN-40SP)?

A: State Form 51754 (IN-40SP) is the Indiana Innocent Spouse Allocation Worksheet.

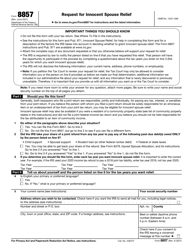

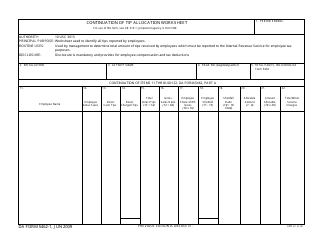

Q: What is the purpose of State Form 51754 (IN-40SP)?

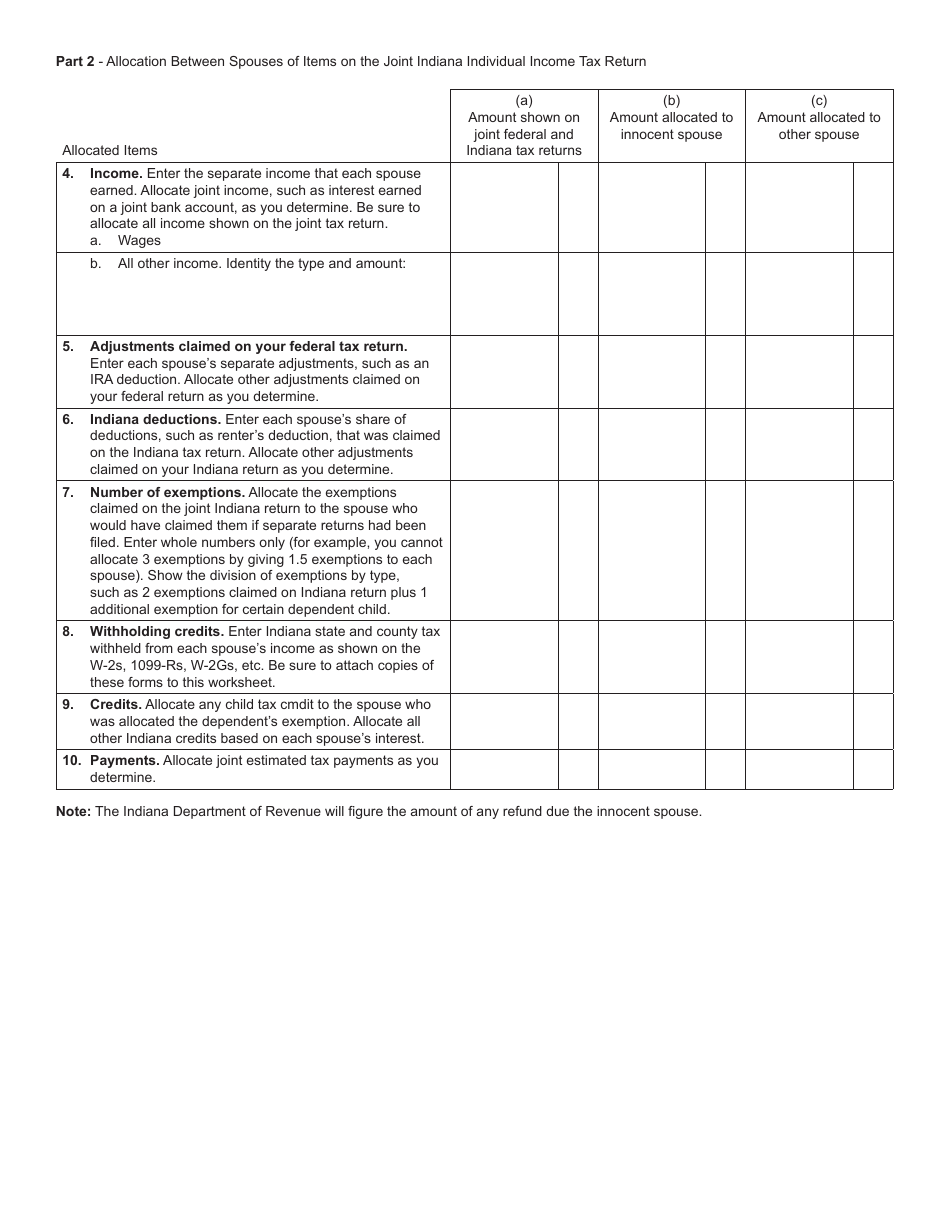

A: The purpose of State Form 51754 (IN-40SP) is to allocate income, deductions, and credits between spouses when filing taxes in Indiana.

Q: Who should use State Form 51754 (IN-40SP)?

A: State Form 51754 (IN-40SP) should be used by individuals who are seeking innocent spouse relief and need to allocate income, deductions, and credits between themselves and their spouse.

Q: Is State Form 51754 (IN-40SP) specific to Indiana?

A: Yes, State Form 51754 (IN-40SP) is specific to Indiana and should be used for state tax purposes in Indiana only.

Q: What information is required to complete State Form 51754 (IN-40SP)?

A: To complete State Form 51754 (IN-40SP), you will need to provide information about your income, deductions, and credits, as well as information about your spouse's income, deductions, and credits.

Q: Can State Form 51754 (IN-40SP) be filed electronically?

A: Yes, State Form 51754 (IN-40SP) can be filed electronically if you are using an electronic filing method for your state taxes in Indiana.

Q: Is there a deadline for filing State Form 51754 (IN-40SP)?

A: Yes, State Form 51754 (IN-40SP) should be filed with your Indiana tax return by the same deadline for filing your state taxes in Indiana, which is usually April 15th.

Q: What should I do if I have questions or need assistance with State Form 51754 (IN-40SP)?

A: If you have questions or need assistance with State Form 51754 (IN-40SP), you can contact the Indiana Department of Revenue or seek help from a tax professional.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51754 (IN-40SP) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.