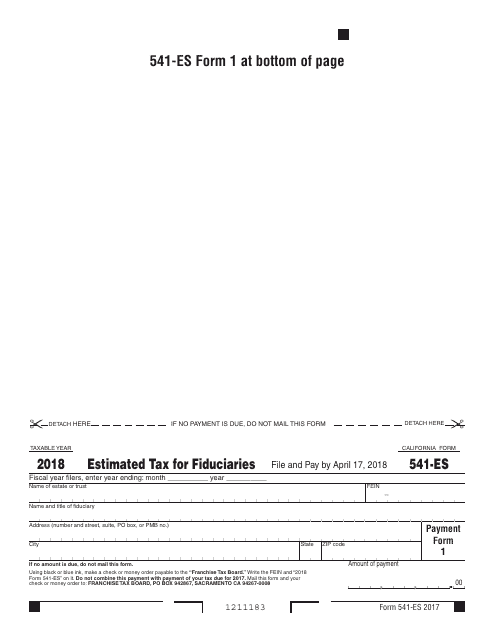

Form 541-ES Estimated Tax for Fiduciaries - California

What Is Form 541-ES?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 541-ES?

A: Form 541-ES is a form used by fiduciaries in California to make estimated tax payments.

Q: What is the purpose of Form 541-ES?

A: The purpose of Form 541-ES is for fiduciaries to make estimated tax payments on behalf of the estate or trust.

Q: Who needs to file Form 541-ES?

A: Fiduciaries in California who expect to owe $500 or more in tax for the tax year must file Form 541-ES.

Q: When do I need to file Form 541-ES?

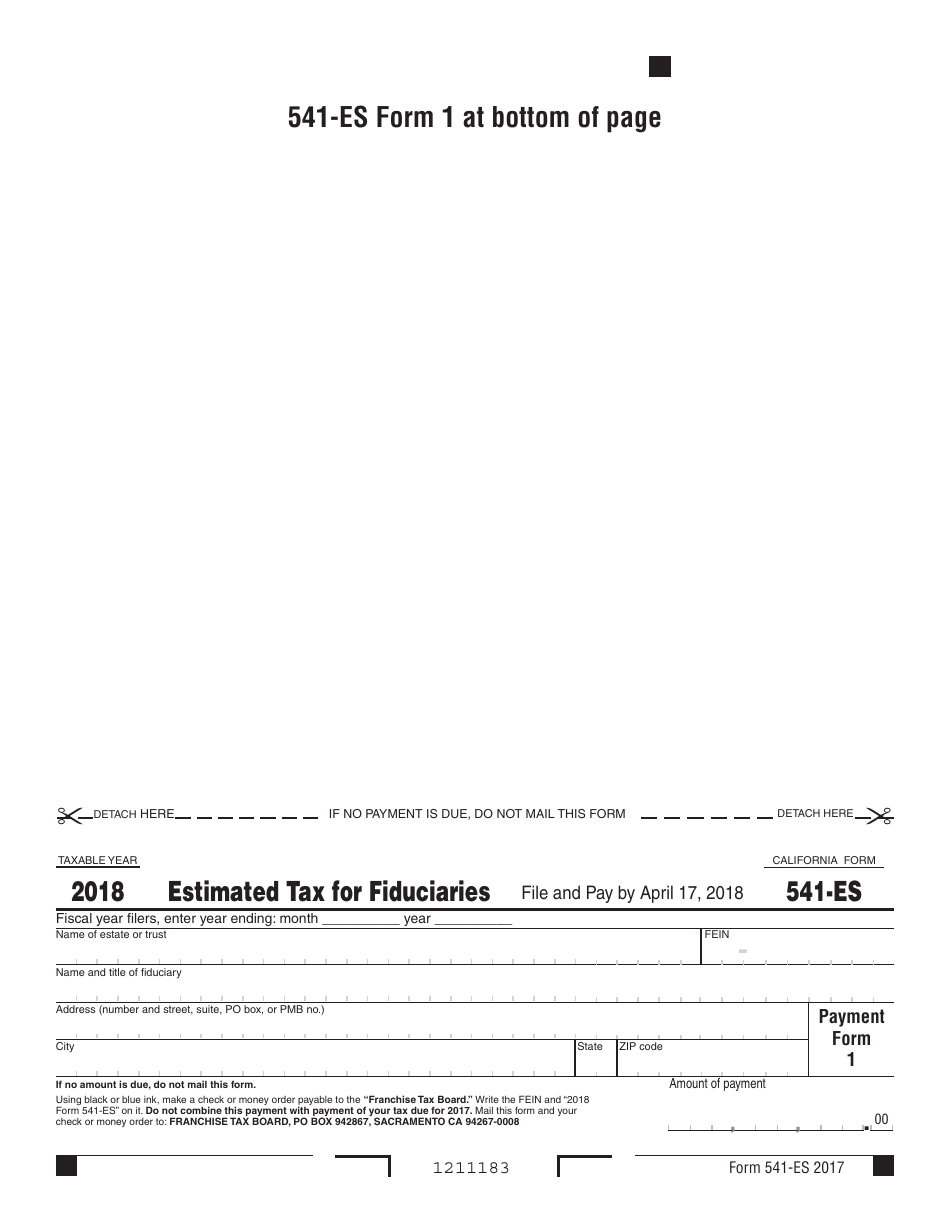

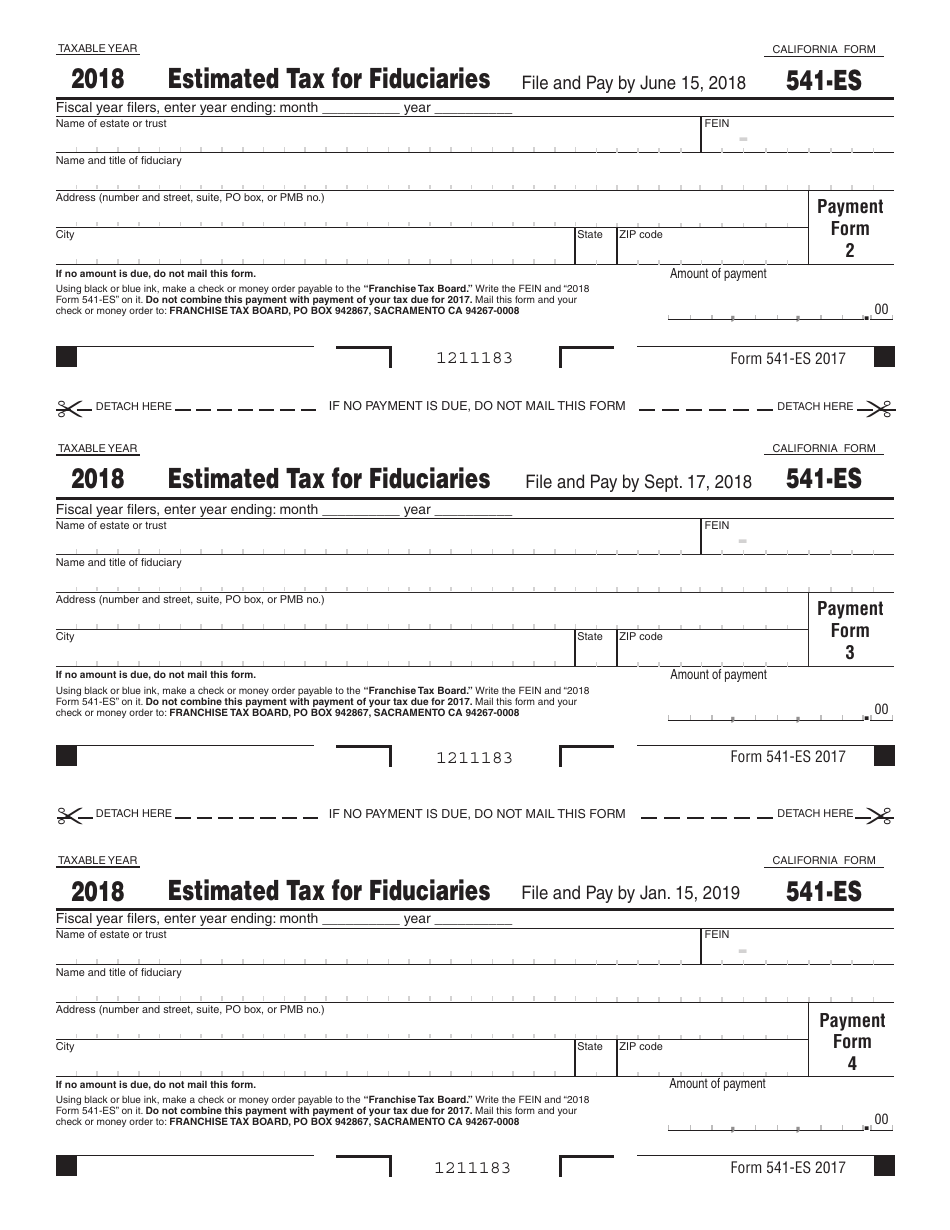

A: Form 541-ES must be filed on a quarterly basis, with estimated payments due on April 15, June 15, September 15, and January 15 of the following year.

Q: What happens if I don't file Form 541-ES?

A: If you don't file Form 541-ES or make the required estimated tax payments, you may be subject to penalties and interest on the underpaid amount.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 541-ES by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.