This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-342A

for the current year.

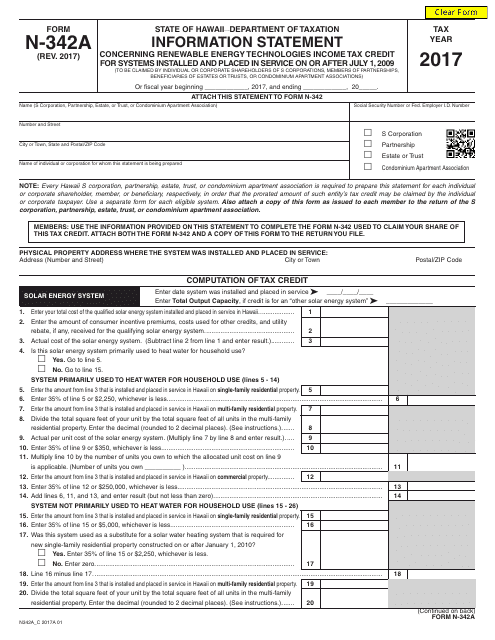

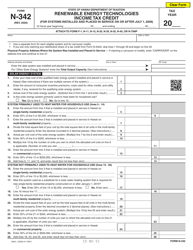

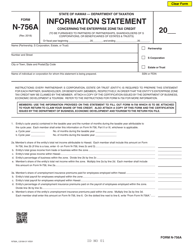

Form N-342A Information Statement Concerning Renewable Energy Technologies Income Tax Credit for Systems Installed and Placed in Service on or After July 1, 2009 - Hawaii

What Is Form N-342A?

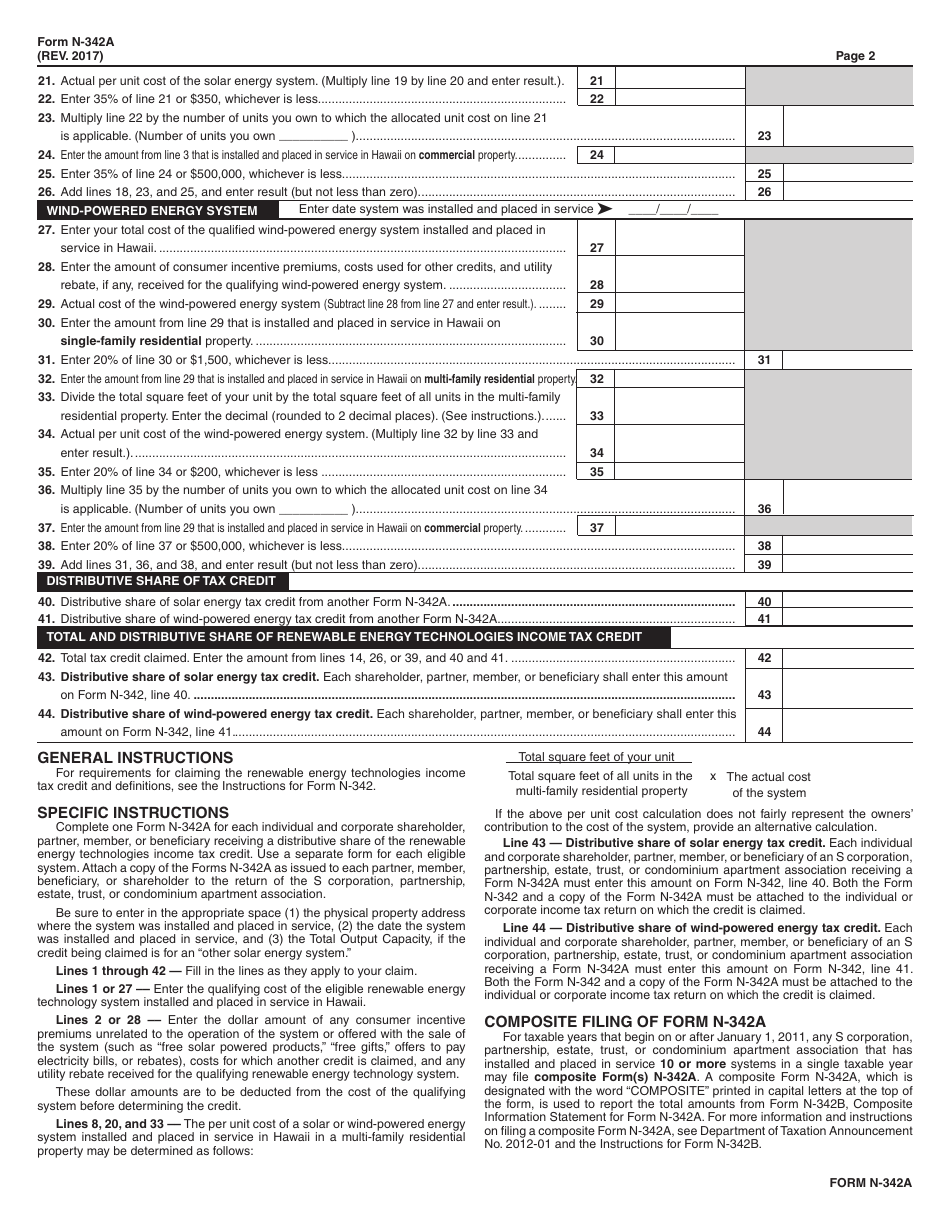

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-342A?

A: Form N-342A is an Information Statement concerning the Renewable Energy Technologies Income Tax Credit for systems installed and placed in service in Hawaii on or after July 1, 2009.

Q: What does Form N-342A apply to?

A: Form N-342A applies to the Renewable Energy Technologies Income Tax Credit for systems installed and placed in service in Hawaii on or after July 1, 2009.

Q: What is the purpose of Form N-342A?

A: The purpose of Form N-342A is to provide information regarding the Renewable Energy Technologies Income Tax Credit.

Q: When should Form N-342A be filed?

A: Form N-342A should be filed annually by taxpayers claiming the Renewable Energy Technologies Income Tax Credit. The due date is usually April 20th.

Q: Is the Renewable Energy Technologies Income Tax Credit available for systems installed before July 1, 2009?

A: No, the Renewable Energy Technologies Income Tax Credit is only available for systems installed and placed in service on or after July 1, 2009.

Q: What are Renewable Energy Technologies?

A: Renewable Energy Technologies include solar energy, wind energy, hydroelectric power, geothermal energy, and ocean thermal energy conversion.

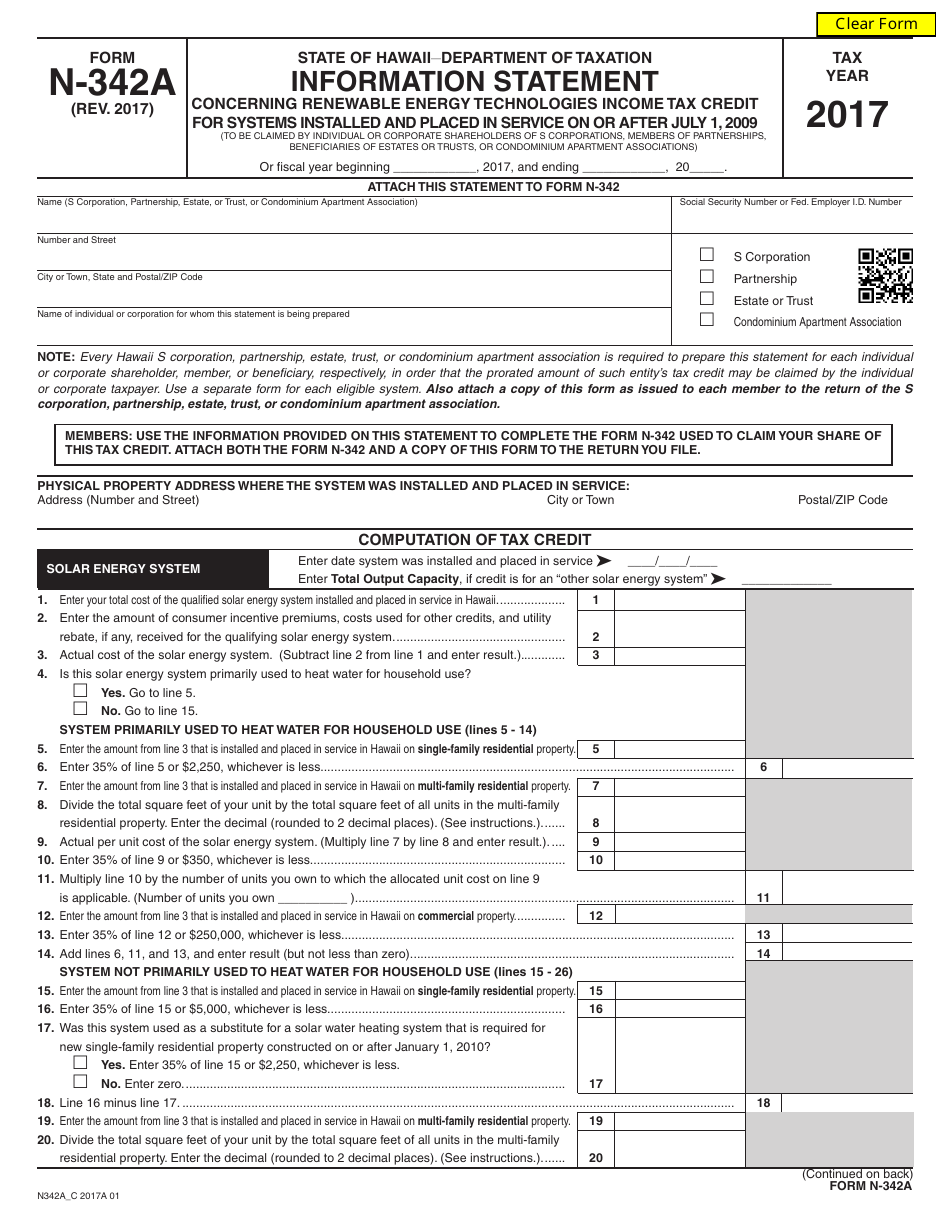

Q: What is the income tax credit amount for Renewable Energy Technologies?

A: The income tax credit amount for Renewable Energy Technologies is 35% of the actual cost or $5,000 per system, whichever is less.

Q: Can the Renewable Energy Technologies Income Tax Credit be carried forward?

A: No, the Renewable Energy Technologies Income Tax Credit cannot be carried forward to future years.

Q: Are there any limitations or restrictions for claiming the Renewable Energy Technologies Income Tax Credit?

A: Yes, there are certain limitations and restrictions, such as a cap on the total credit amount available each year and a limit on the credit for each individual system.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-342A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.