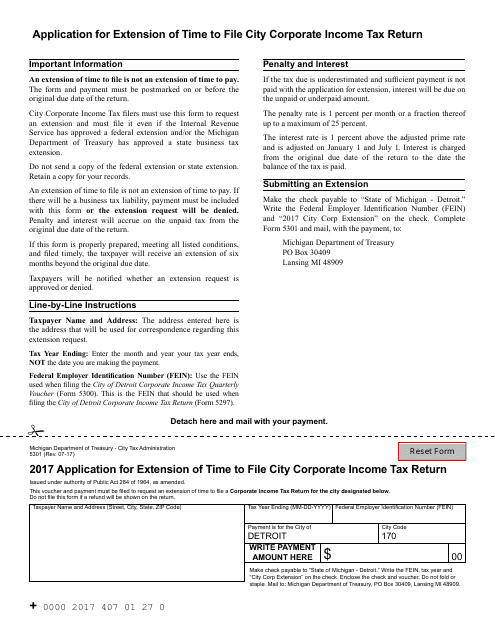

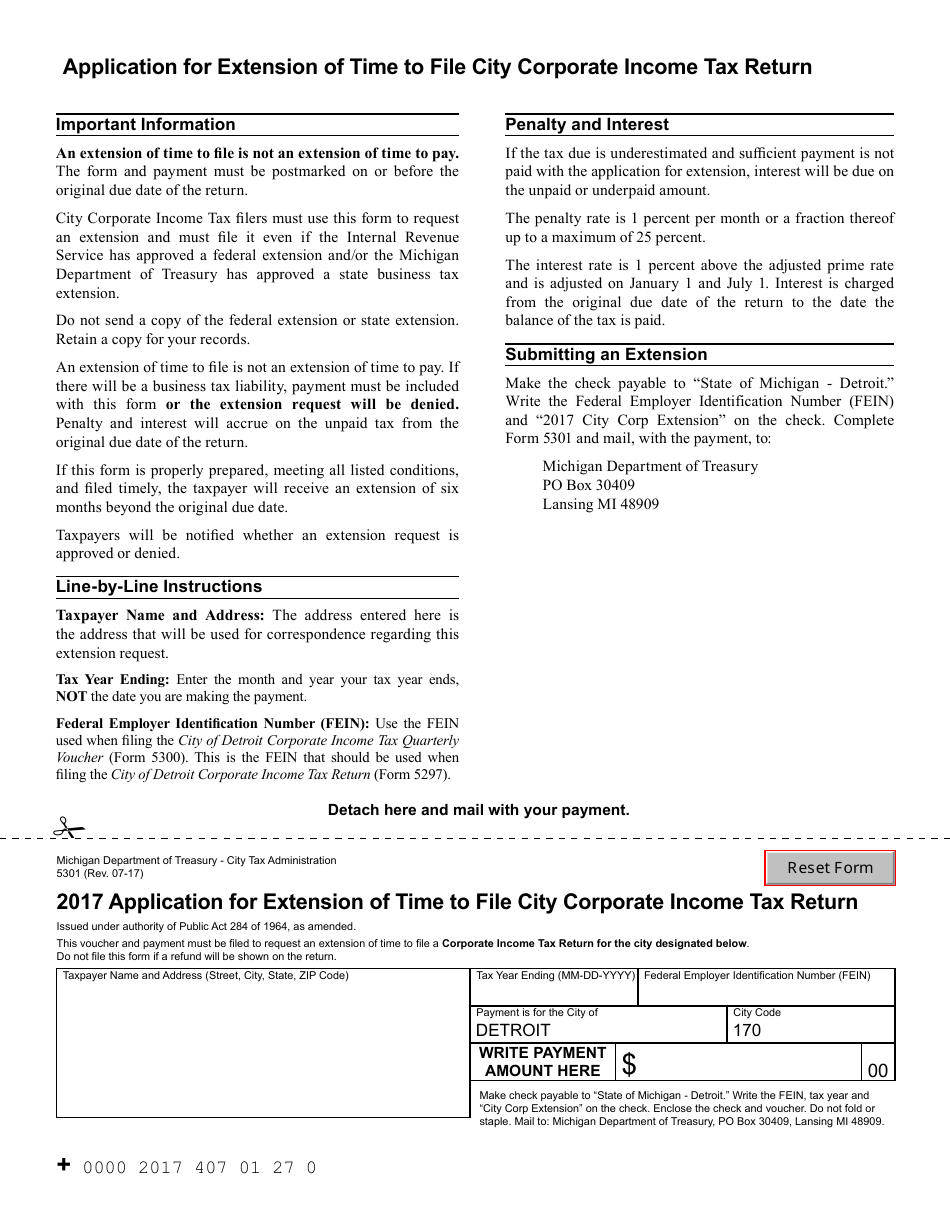

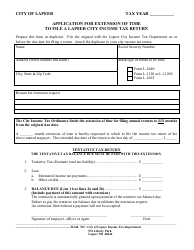

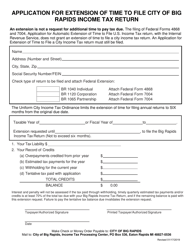

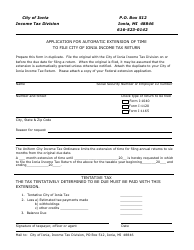

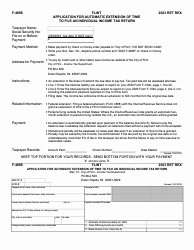

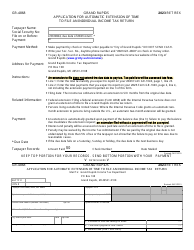

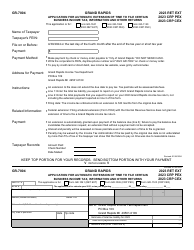

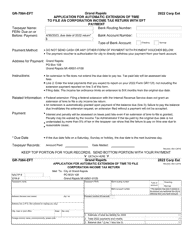

Application for Extension of Time to File City Corporate Income Tax Return - City of Detroit, Michigan

Application for Extension of Time to File City Corporate Income Tax Return is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan. The form may be used strictly within City of Detroit.

FAQ

Q: What is the City Corporate Income Tax Return?

A: The City Corporate Income Tax Return is a tax return that needs to be filed by corporations in the City of Detroit, Michigan.

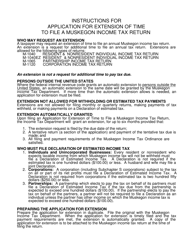

Q: What is an extension of time?

A: An extension of time is a request to the government to extend the deadline for filing a tax return.

Q: Why would I need an extension of time?

A: You would need an extension of time if you are unable to file your City Corporate Income Tax Return by the original deadline.

Q: How do I apply for an extension of time?

A: To apply for an extension of time, you need to file Form 5126: Application for Extension of Time to File City Corporate Income Tax Return.

Q: What is the deadline for filing an extension of time?

A: The deadline for filing an extension of time for the City Corporate Income Tax Return in the City of Detroit, Michigan is the same as the regular deadline for filing the tax return, which is generally the 15th day of the fourth month after the end of the tax year.

Q: Is there a penalty for not filing a tax return on time?

A: Yes, there can be penalties for not filing a tax return on time. It is important to request an extension of time if you need one.

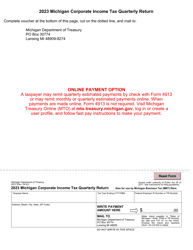

Q: Can I e-file an extension of time?

A: Yes, you can e-file an extension of time for the City Corporate Income Tax Return in the City of Detroit, Michigan.

Q: Can I e-file the tax return itself?

A: Yes, you can e-file the tax return itself for the City Corporate Income Tax Return in the City of Detroit, Michigan.

Q: Is there a fee for filing an extension of time?

A: No, there is no fee for filing an extension of time for the City Corporate Income Tax Return in the City of Detroit, Michigan.

Form Details:

- Released on July 1, 2017;

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.