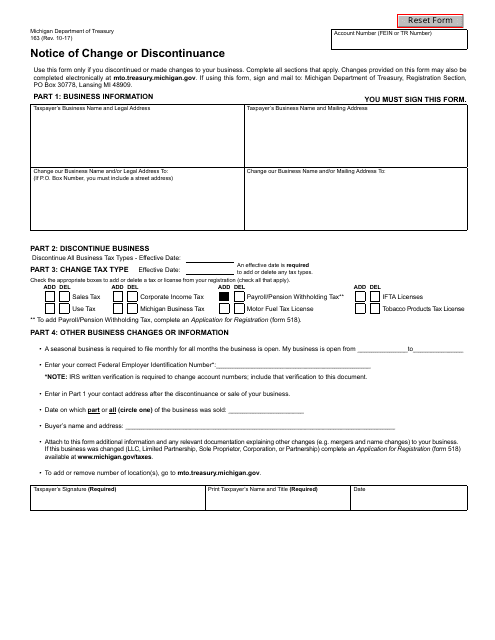

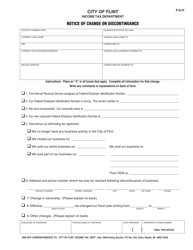

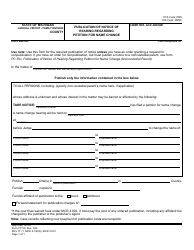

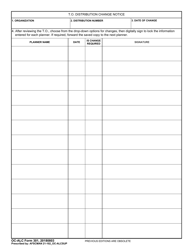

Form 163 Notice of Change or Discontinuance - Michigan

What Is Michigan Form 163?

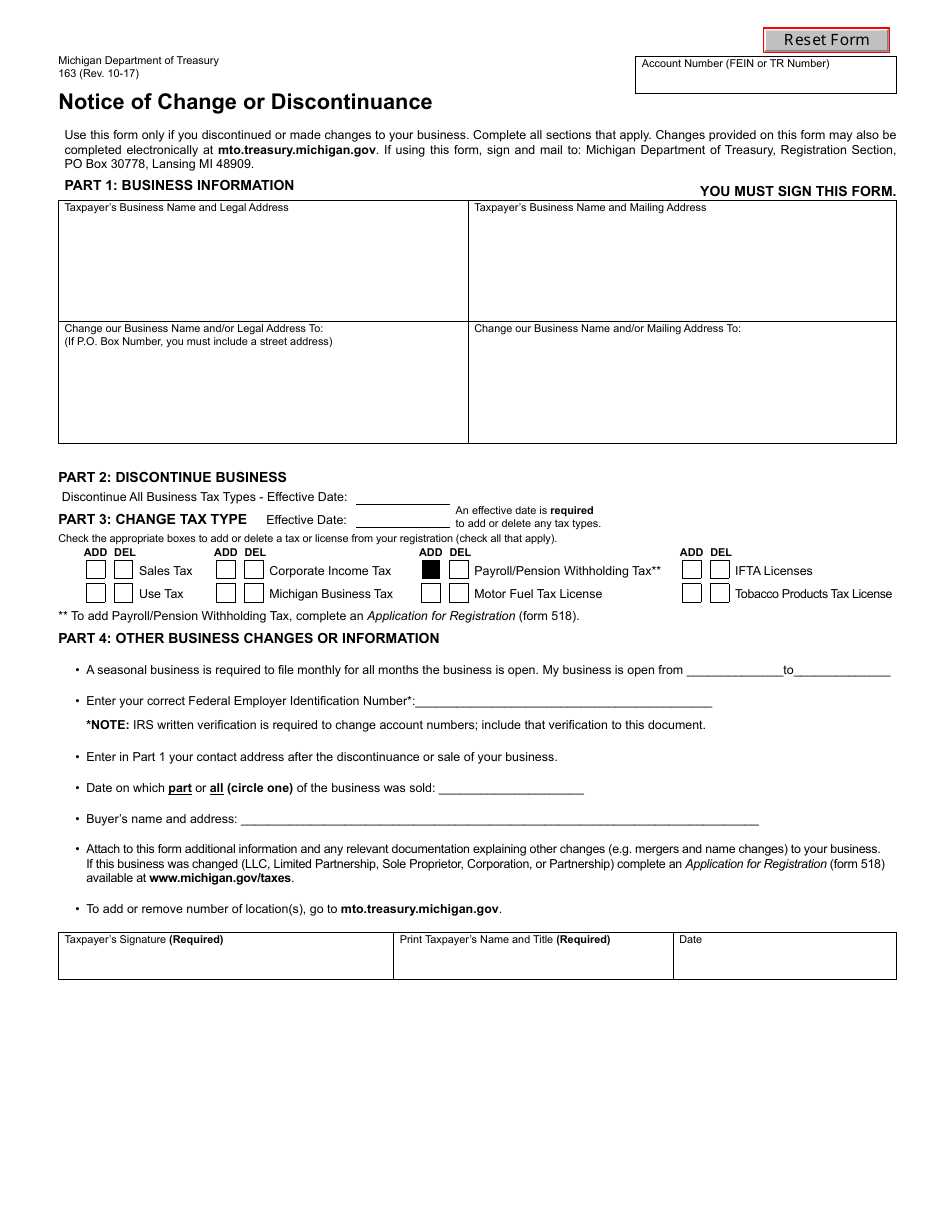

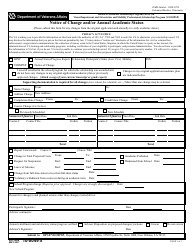

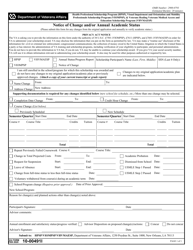

Form 163, Notice of Change or Discontinuance , is a legal document completed by a business representative to notify authorities about their business undergoing certain changes, sale, or discontinuance. Use this form if you wish to discontinue all business and associated accounts. It allows a taxpayer to describe changes to their business, add or delete new types of taxes, and pay delinquent taxes owed to the Department of Treasury, along with any penalties and/or interest.

This form was released by the Michigan Department of Treasury . The latest version of the form was issued on October 1, 2017 , with all previous editions obsolete. A fillable Form 163 is available for download below.

Michigan Form 163 Instructions

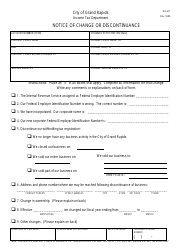

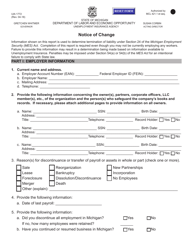

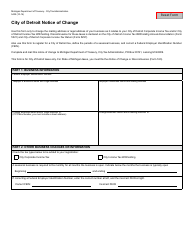

Provide the following details in Michigan Form 163:

- State the name of the business, an account number - either a federal employer identification number (FEIN) or a Michigan Treasury (TR) number assigned to the business, and a phone number.

- If you're changing the name or address of the business, check all applicable boxes in the second part of the form - write down a new business name or legal address. When you want to report a discontinued business, complete the second line by providing a contact address to receive business-related correspondence.

- Complete the third part of the form if you are selling or closing your business. Indicate whether you're closing the entire business, selling part of it, or the entire business. Do not forget to file all final tax returns for the year if you discontinue your business. When you discontinue a business on behalf of a deceased taxpayer, attach a copy of the death certificate. State the effective date of sale or discontinuance. Enter the name, address, and FEIN of the buyer of the business.

- If the business remains open and you need to add or delete specific taxes, provide this information in the fourth part. For your convenience, the form lists the numbers you need to call to add or delete Motor Fuel, IFTA (International Fuel Tax Agreement), or Tobacco licenses.

- Check the appropriate boxes if your business goes through other changes, like becoming a seasonal business or updating the number of business locations. The form also allows you to update the FEIN or change the North American Industry Classification System (NAICS) code.

- Certify that all of the statements on the form are true and complete to the best of your knowledge. Sign the form, write down your name and title, and indicate the date of signing.

If you need to explain other changes not mentioned in the Notice, for instance, name changes and mergers, you may attach any relevant documentation to clarify them.

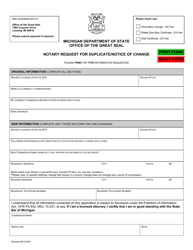

Where to Mail Form 163?

Once you complete the Notice of Change or Discontinuance, you must file it with the Registration Section of the Michigan DOT. Send the document to the Michigan Department of Treasury, Registration Section, PO Box 30788, Lansing MI 48909 .