This version of the form is not currently in use and is provided for reference only. Download this version of

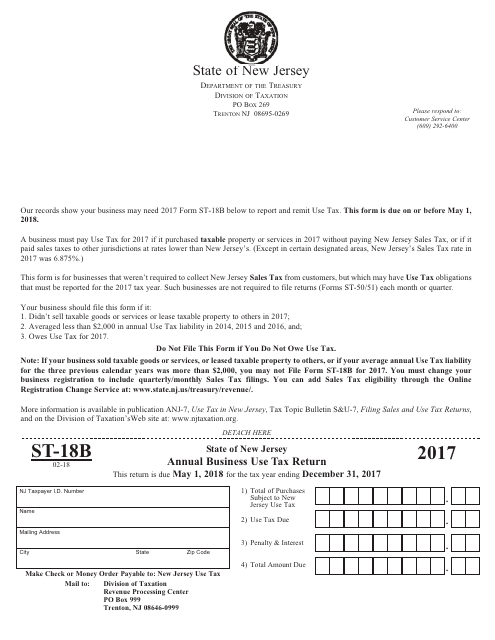

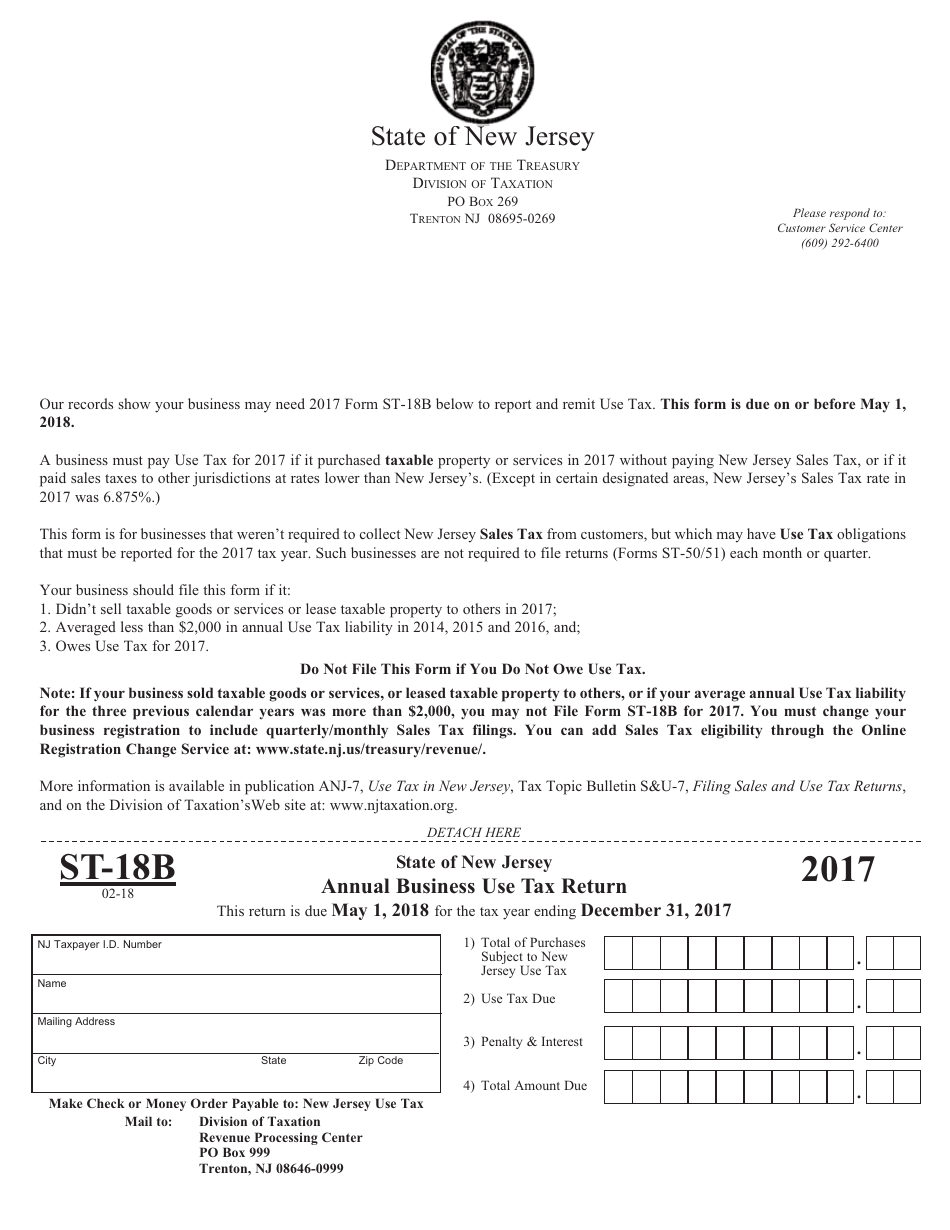

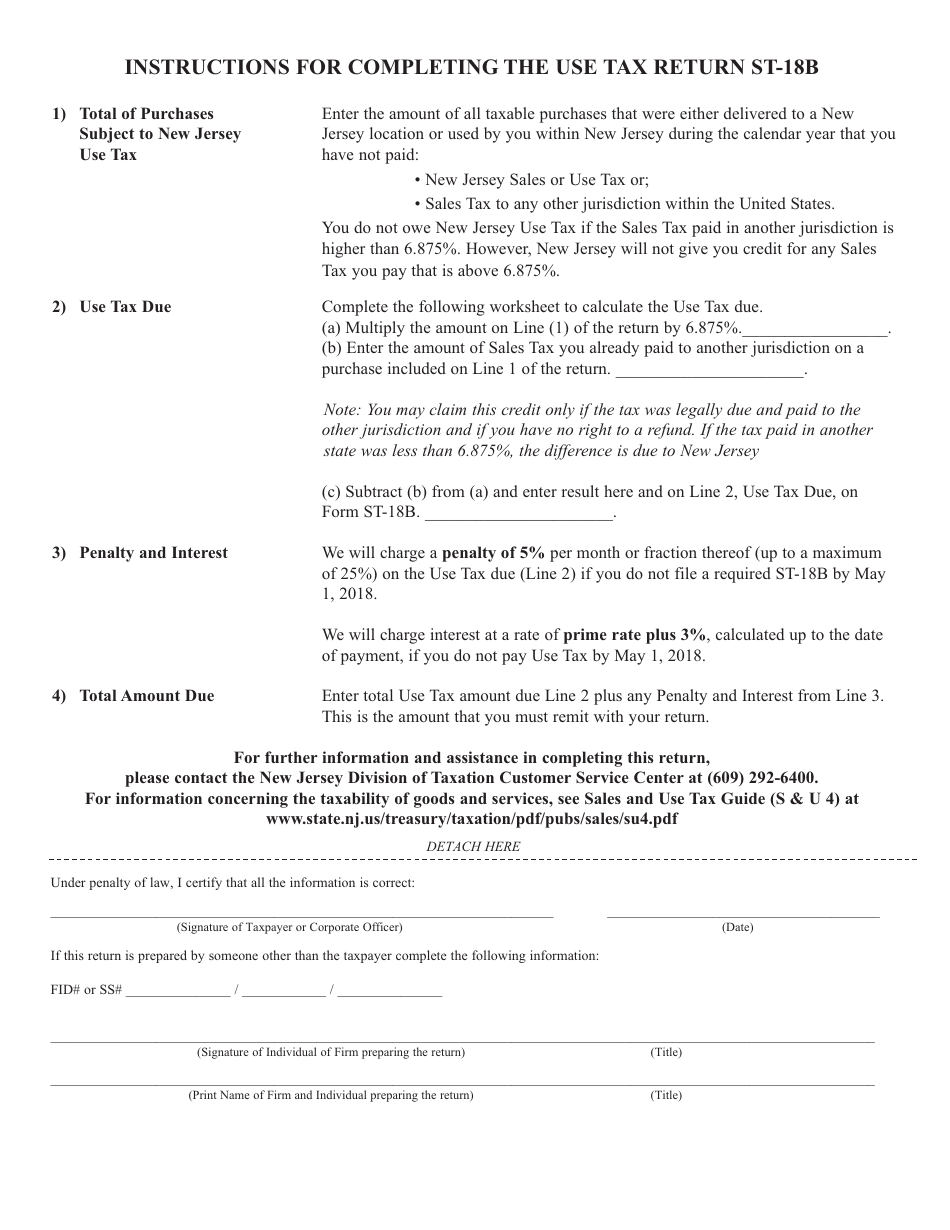

Form ST-18B

for the current year.

Form ST-18B Annual Business Use Tax Return - New Jersey

What Is Form ST-18B?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-18B?

A: Form ST-18B is the Annual Business Use Tax Return for businesses in New Jersey.

Q: Who needs to file Form ST-18B?

A: Businesses in New Jersey that have made taxable purchases or leases of tangible personal property for business use.

Q: When is the deadline to file Form ST-18B?

A: Form ST-18B must be filed on or before February 28th of each year.

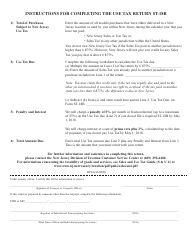

Q: What information is required to complete Form ST-18B?

A: Businesses need to provide their name, address, federal employer identification number, and a detailed list of their taxable purchases or leases.

Q: Are there any exemptions or exclusions available?

A: Yes, certain purchases such as sales for resale or manufacturing purposes may be exempt.

Q: Is there a penalty for late filing or non-filing of Form ST-18B?

A: Yes, failure to file or late filing may result in penalties and interest charges.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-18B by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.