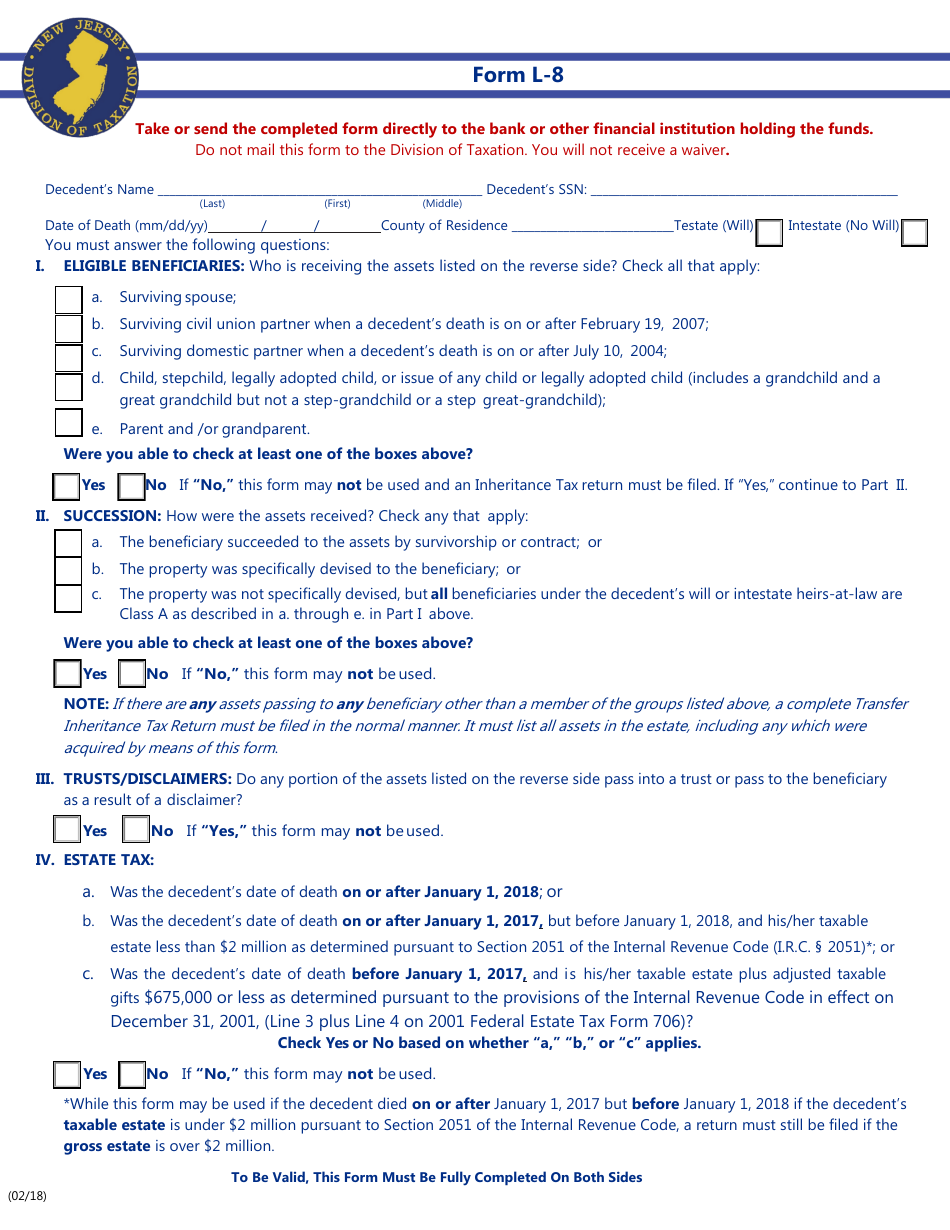

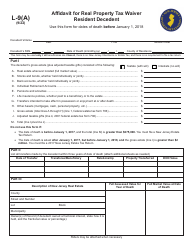

Form L-8 Affidavit for Non-real Estate Investments: Resident Decedents - New Jersey

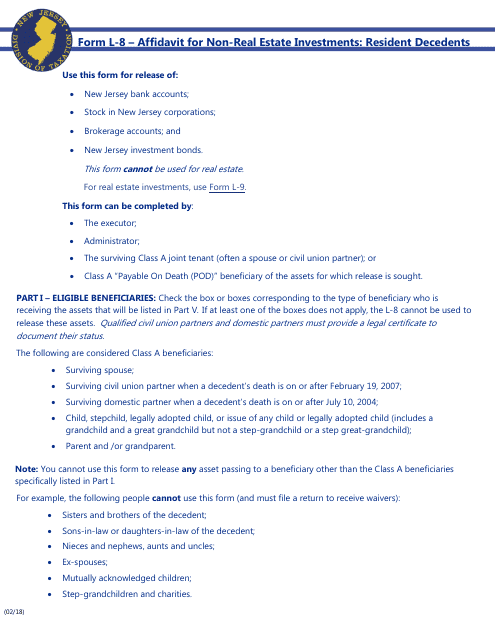

What Is Form L-8?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

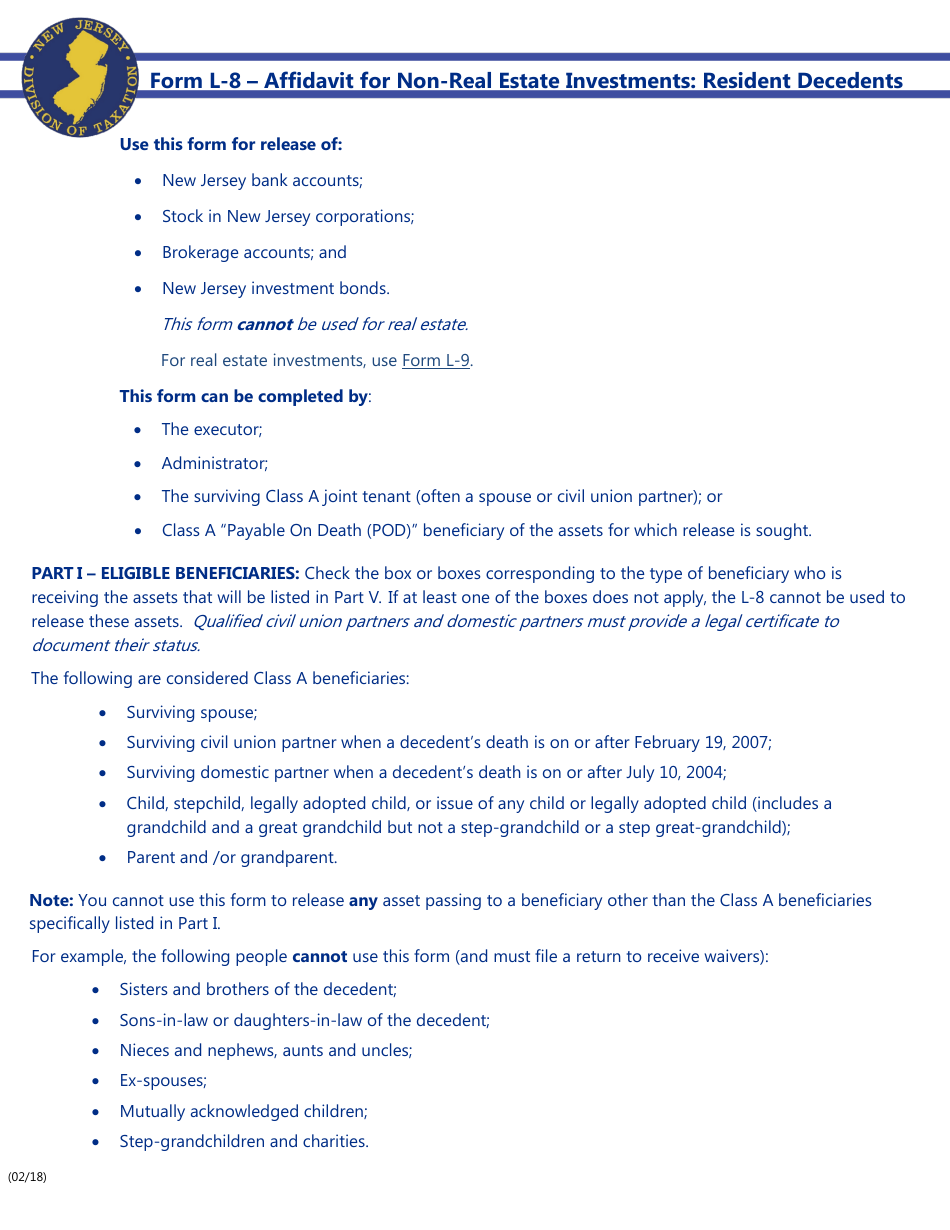

Q: What is Form L-8?

A: Form L-8 is an affidavit used in New Jersey for reporting non-real estate investments of a deceased resident.

Q: Who needs to file Form L-8?

A: Form L-8 must be filed by the executor or administrator of the estate of a deceased resident of New Jersey.

Q: What is the purpose of Form L-8?

A: The purpose of Form L-8 is to report non-real estate investments held by a deceased resident of New Jersey.

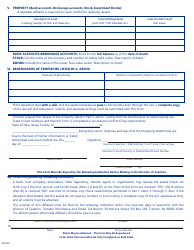

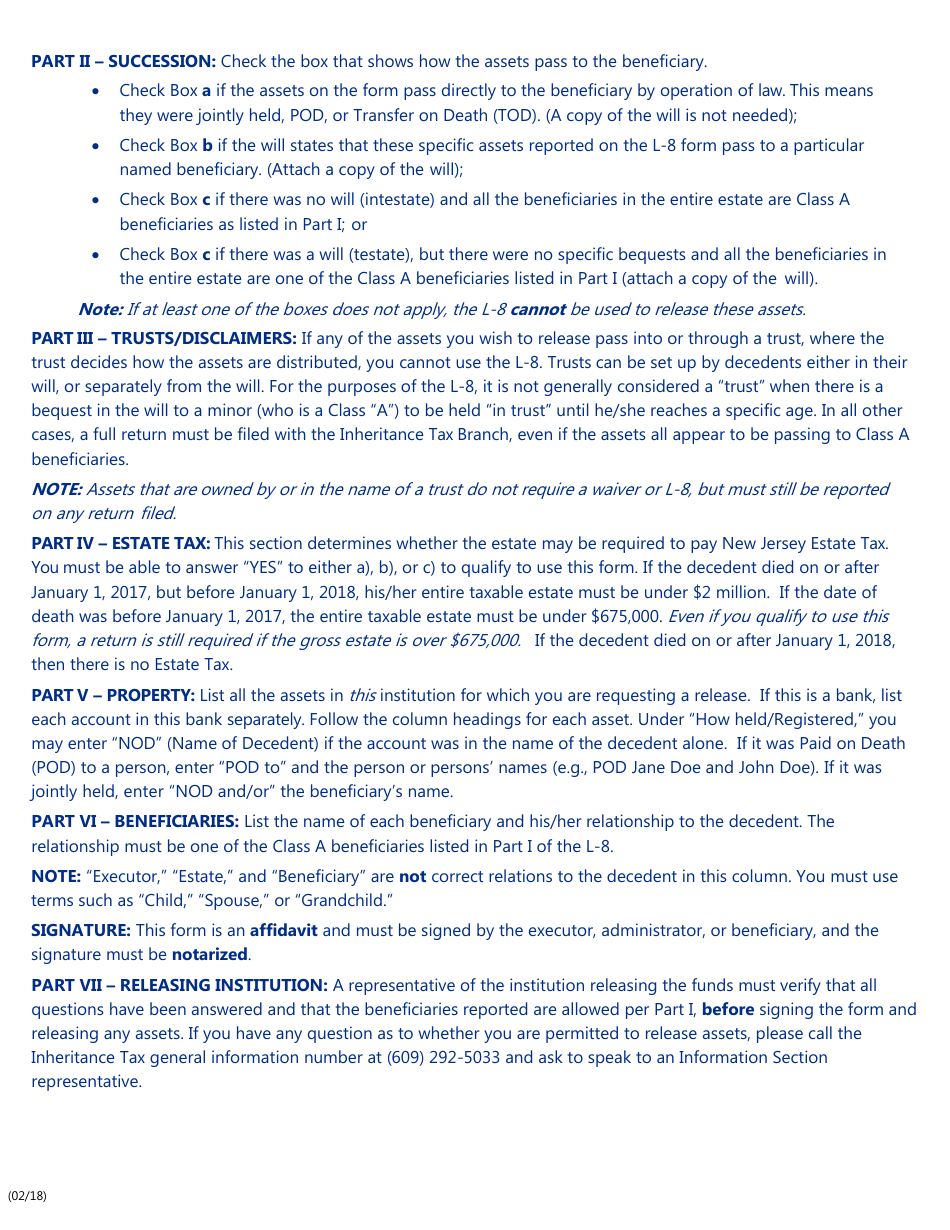

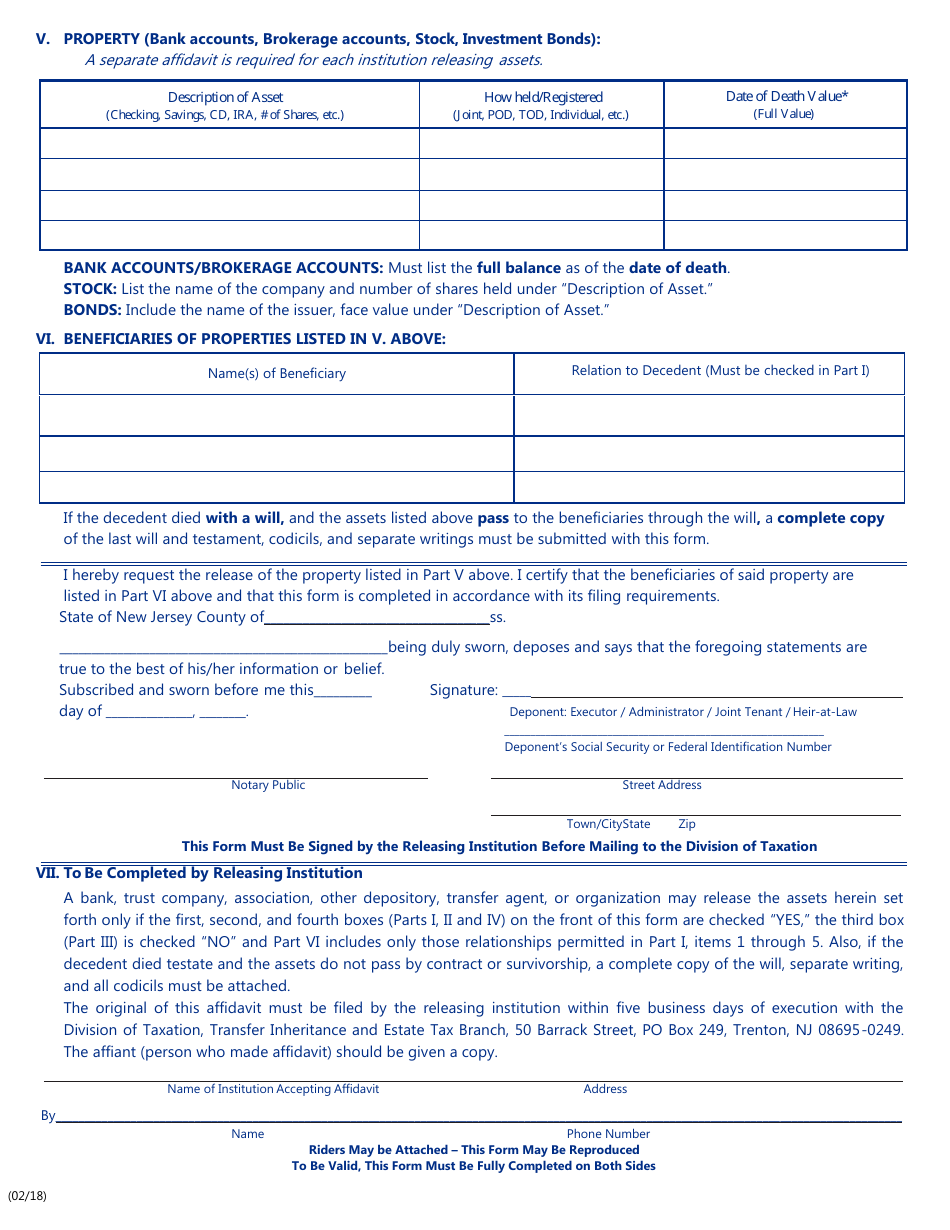

Q: What information is required on Form L-8?

A: Form L-8 requires information about the decedent, the executor or administrator, and details of the non-real estate investments.

Q: When should Form L-8 be filed?

A: Form L-8 should be filed within 9 months from the date of the decedent's death.

Q: Are there any penalties for late filing of Form L-8?

A: Yes, there may be penalties for late filing of Form L-8.

Q: Is there a filing fee for Form L-8?

A: No, there is no filing fee for Form L-8.

Q: Can I file Form L-8 electronically?

A: No, Form L-8 cannot be filed electronically and must be filed by mail or in person.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-8 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.