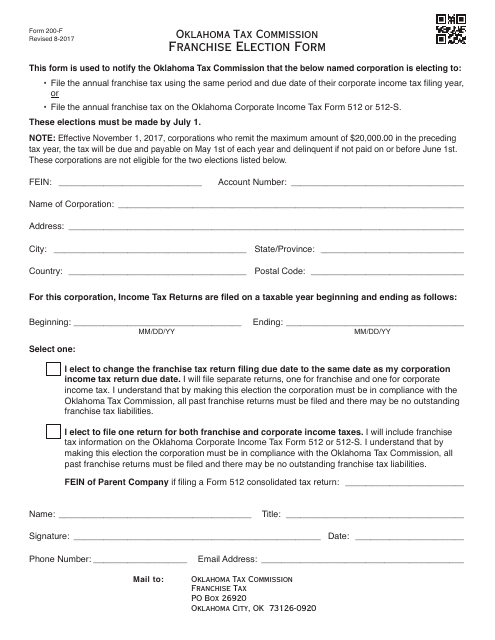

OTC Form 200-F Franchise Election Form - Oklahoma

What Is OTC Form 200-F?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form 200-F?

A: The OTC Form 200-F is the Franchise Election Form used in Oklahoma.

Q: What is the purpose of the OTC Form 200-F?

A: The purpose of the OTC Form 200-F is to elect to be treated as a franchise under Oklahoma law.

Q: Who needs to file the OTC Form 200-F?

A: Any entity or individual who wants to be treated as a franchise in Oklahoma needs to file the OTC Form 200-F.

Q: What information is required on the OTC Form 200-F?

A: The OTC Form 200-F requires information such as the entity's name, address, federal ID number, and the tax year for which the election is being made.

Q: Is there a deadline for filing the OTC Form 200-F?

A: Yes, the OTC Form 200-F must be filed by the due date of the entity's Oklahoma income tax return for the tax year the election is being made.

Q: What happens after filing the OTC Form 200-F?

A: After filing the OTC Form 200-F, the entity will be treated as a franchise under Oklahoma law for the tax year specified in the election.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 200-F by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.