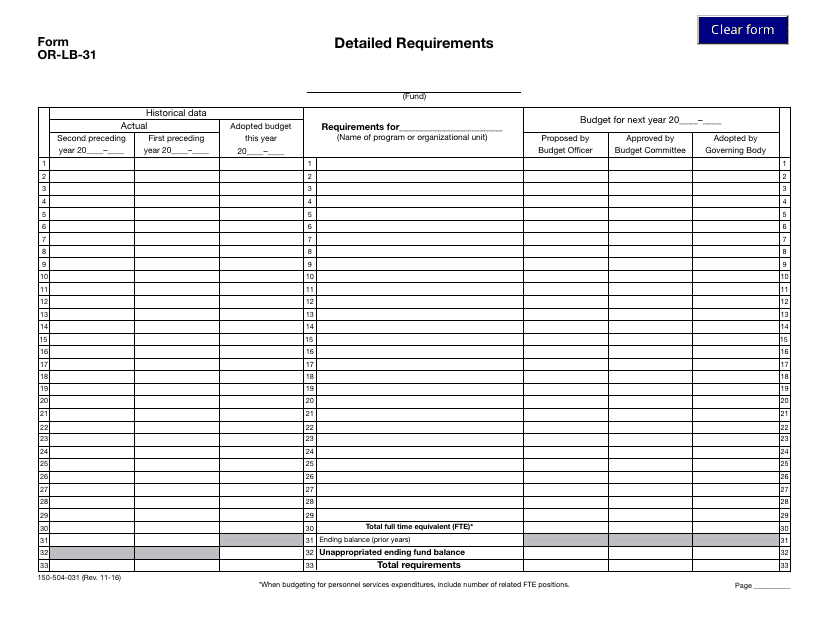

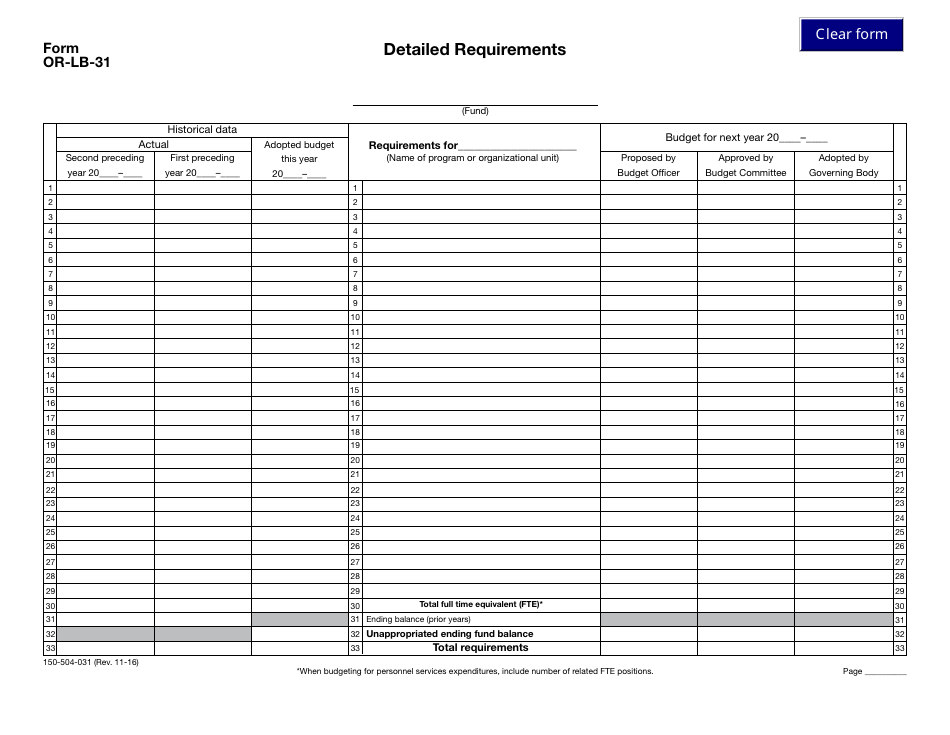

Form 150-504-031 (OR-LB-31) Detailed Requirements - Oregon

What Is Form 150-504-031 (OR-LB-31)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-504-031 (OR-LB-31)?

A: Form 150-504-031 (OR-LB-31) is a document that contains detailed requirements for Oregon.

Q: Who needs to fill out Form 150-504-031 (OR-LB-31)?

A: Form 150-504-031 (OR-LB-31) needs to be filled out by individuals or businesses in Oregon who are required to provide detailed information.

Q: What information is required on Form 150-504-031 (OR-LB-31)?

A: Form 150-504-031 (OR-LB-31) requires detailed information about income, expenses, deductions, and other tax-related details.

Q: When is Form 150-504-031 (OR-LB-31) due?

A: The due date for Form 150-504-031 (OR-LB-31) varies depending on the tax year. It is usually due on or before the tax filing deadline for Oregon.

Q: What happens if I don't fill out Form 150-504-031 (OR-LB-31)?

A: Failure to fill out Form 150-504-031 (OR-LB-31) accurately and on time may result in penalties or additional tax liabilities.

Q: Can I file Form 150-504-031 (OR-LB-31) electronically?

A: Yes, you can file Form 150-504-031 (OR-LB-31) electronically if you meet the requirements for e-filing in Oregon.

Q: Are there any exemptions or special considerations for Form 150-504-031 (OR-LB-31)?

A: There may be exemptions or special considerations depending on individual circumstances. It is advisable to consult with a tax professional or refer to the official instructions for Form 150-504-031 (OR-LB-31).

Q: Can I amend Form 150-504-031 (OR-LB-31) if I made a mistake?

A: Yes, you can amend Form 150-504-031 (OR-LB-31) if you made a mistake or need to make changes. This can be done by filing an amended return.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-504-031 (OR-LB-31) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.