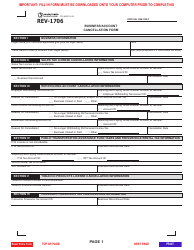

This version of the form is not currently in use and is provided for reference only. Download this version of

Form REV-203D

for the current year.

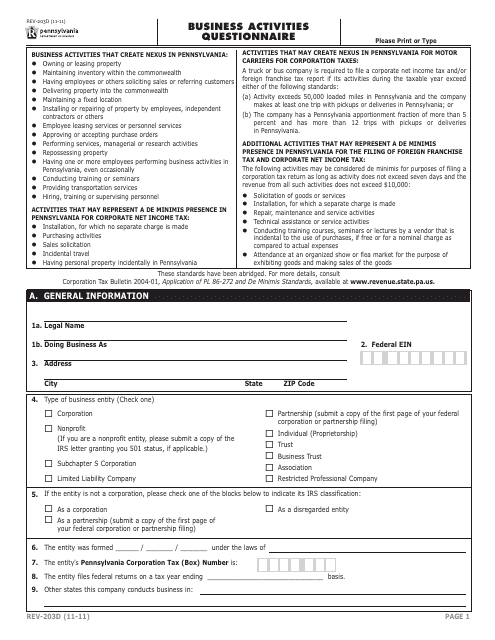

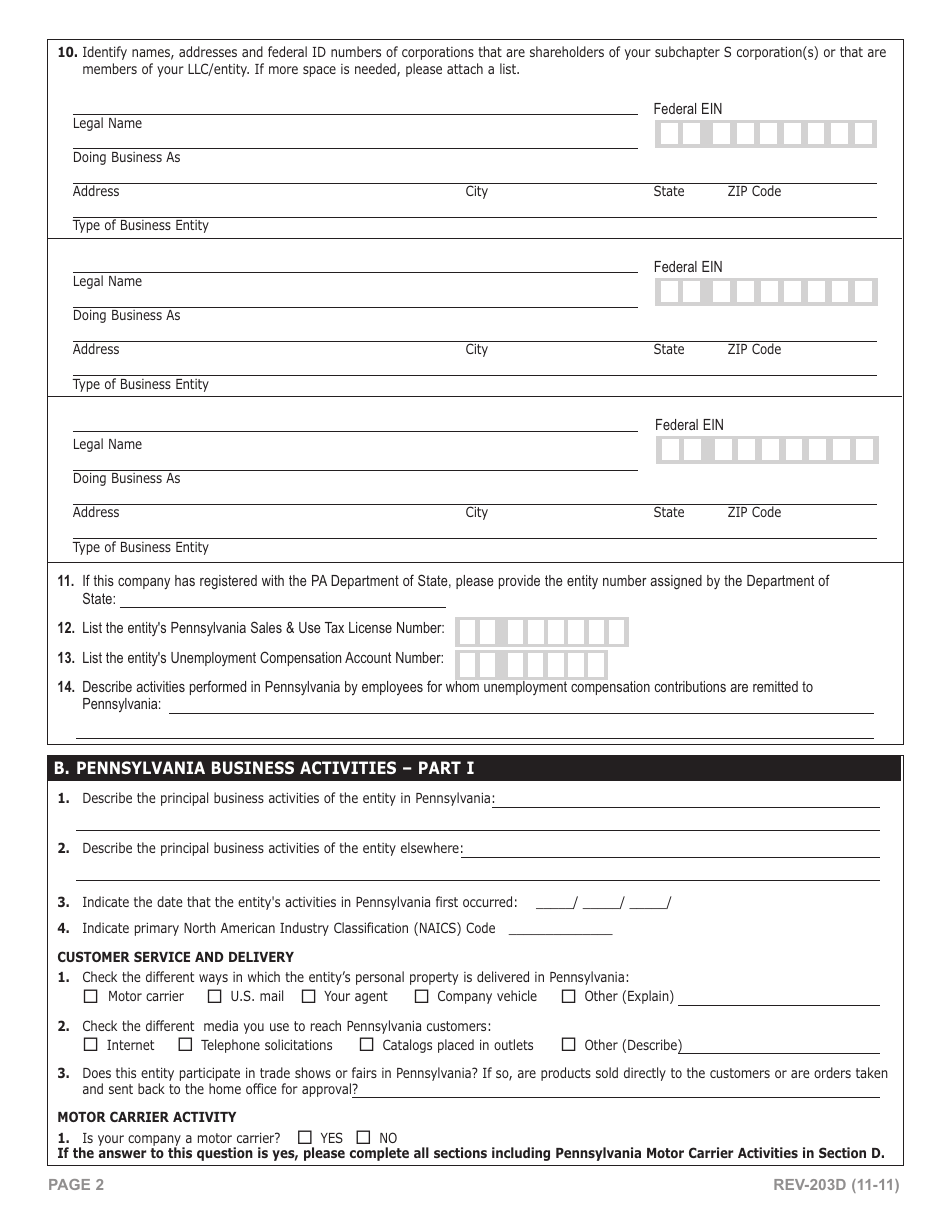

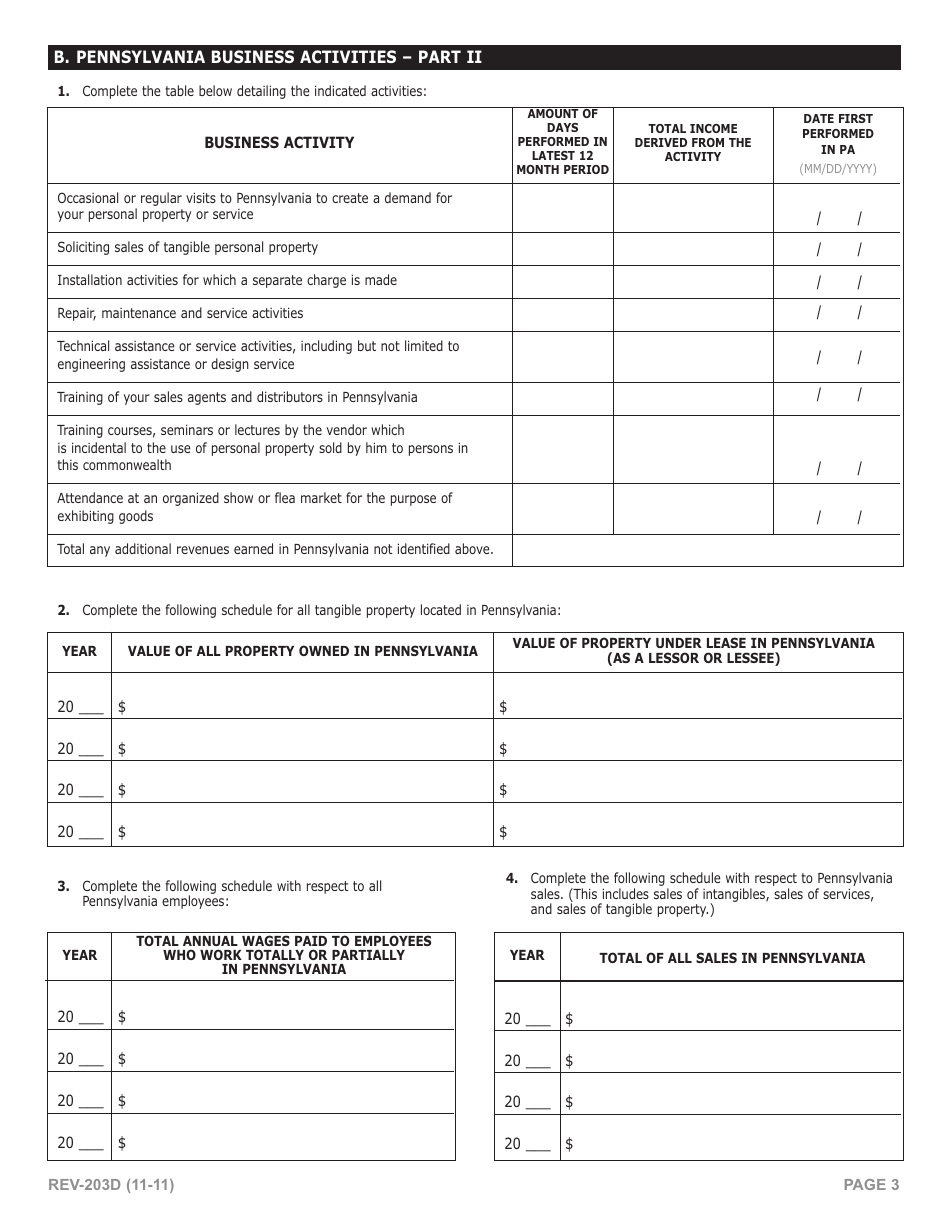

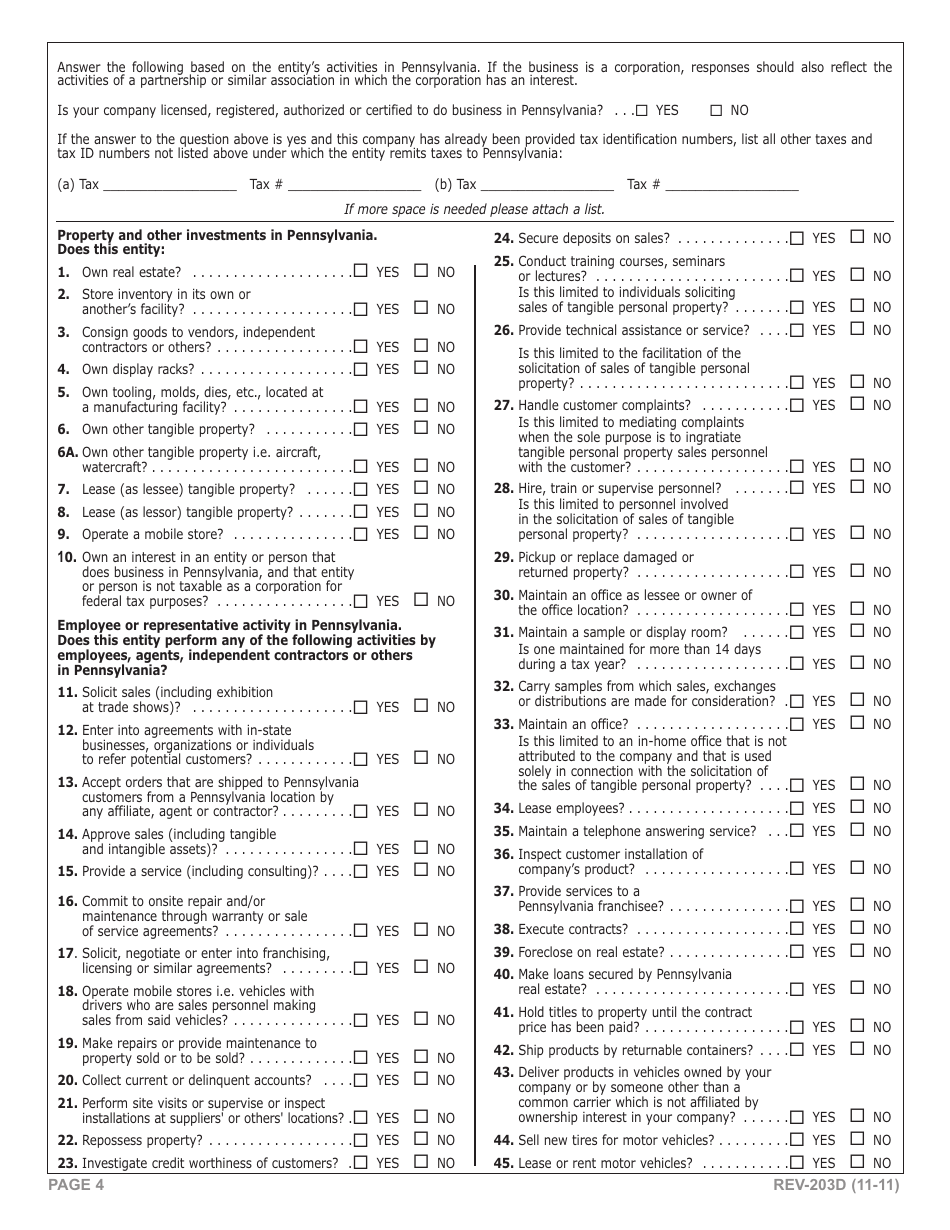

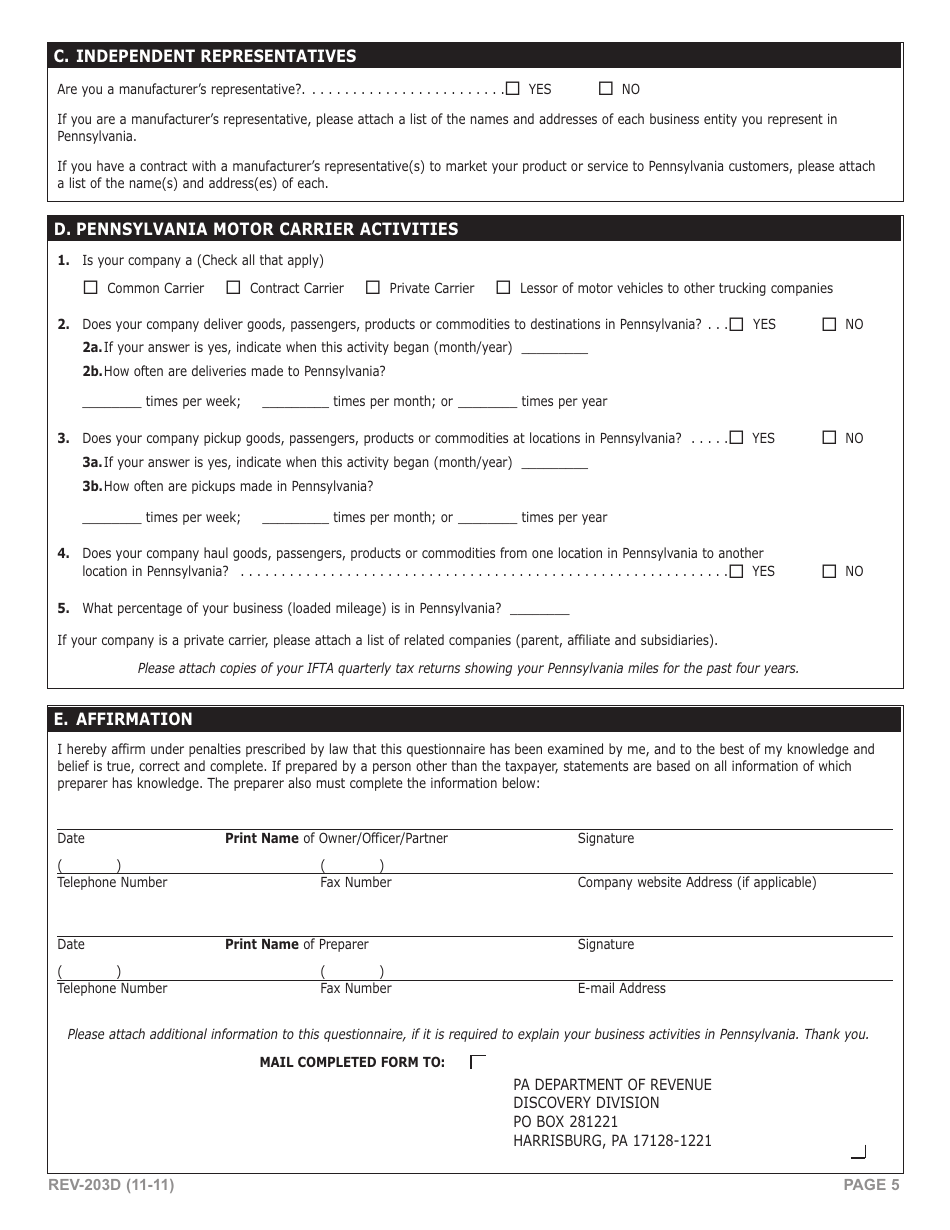

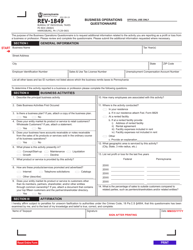

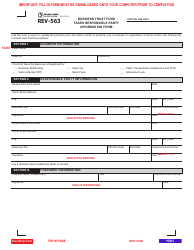

Form REV-203D Business Activities Questionnaire - Pennsylvania

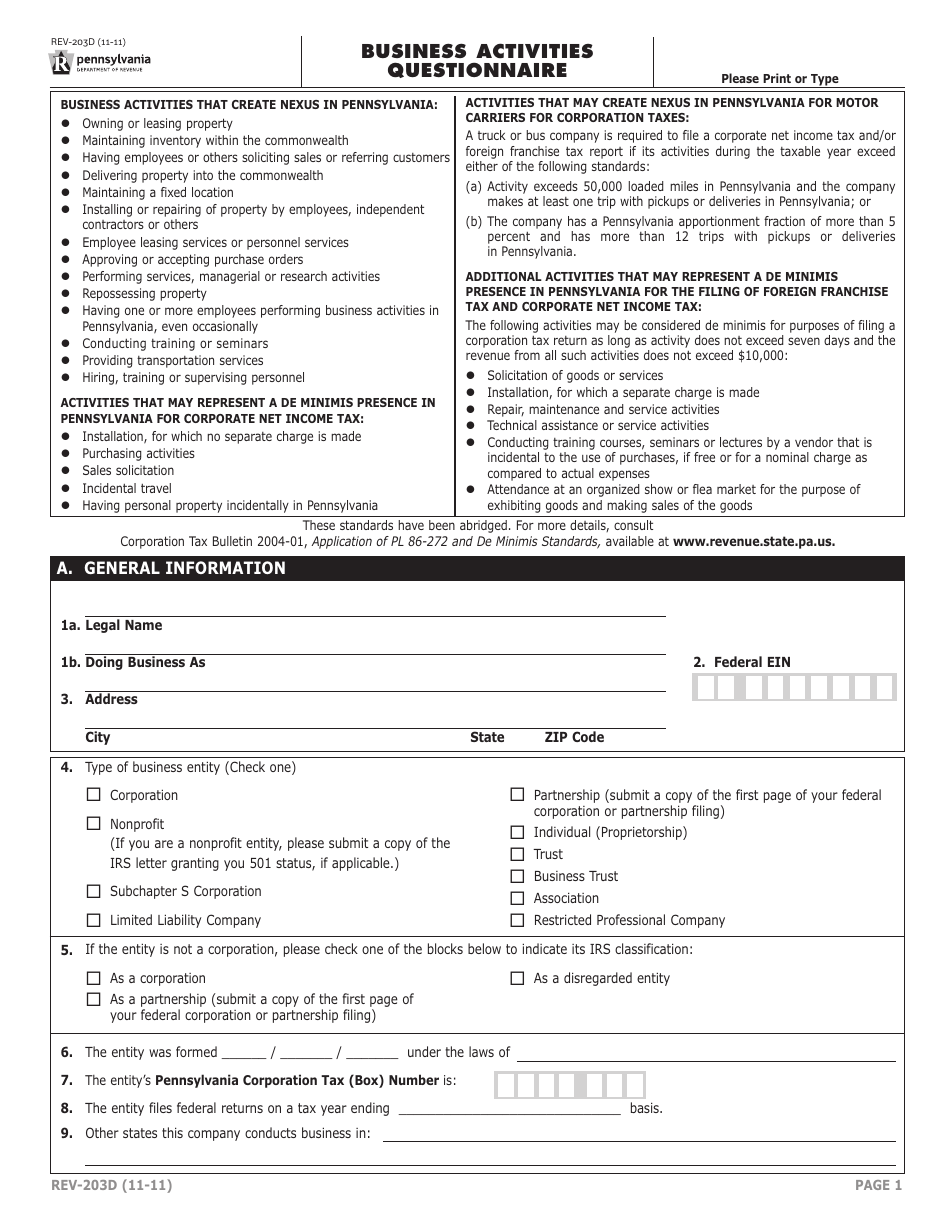

What Is Form REV-203D?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the REV-203D Business Activities Questionnaire?

A: The REV-203D Business Activities Questionnaire is a form used in Pennsylvania to gather information about a business's activities.

Q: Why do I need to fill out the REV-203D form?

A: You may need to fill out the REV-203D form if you operate a business in Pennsylvania and are required to report information about your business activities to the Department of Revenue.

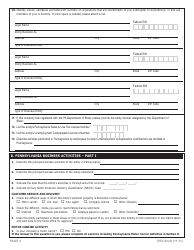

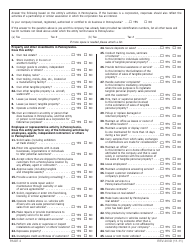

Q: What information is requested on the REV-203D form?

A: The REV-203D form asks for details such as the nature of your business, the types of products or services you offer, and information about your sales and employees.

Q: Is the REV-203D form mandatory for all businesses in Pennsylvania?

A: No, the REV-203D form is not mandatory for all businesses. However, certain businesses may be required to complete and submit the form.

Q: Are there any penalties for not filing the REV-203D form?

A: Failure to file the REV-203D form or providing false information may result in penalties imposed by the Pennsylvania Department of Revenue.

Q: When is the deadline for filing the REV-203D form?

A: The deadline for filing the REV-203D form varies and is determined by the Pennsylvania Department of Revenue. It is important to check the specific deadline for your business.

Q: Who can I contact for assistance with the REV-203D form?

A: For assistance with the REV-203D form, you can contact the Pennsylvania Department of Revenue's customer service.

Form Details:

- Released on November 1, 2011;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-203D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.