This version of the form is not currently in use and is provided for reference only. Download this version of

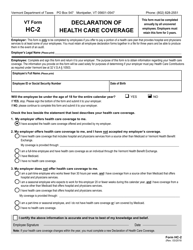

VT Form HC-1

for the current year.

VT Form HC-1 Health Care Contributions Worksheet - Vermont

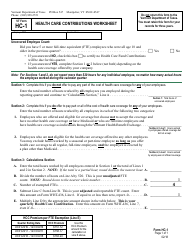

What Is VT Form HC-1?

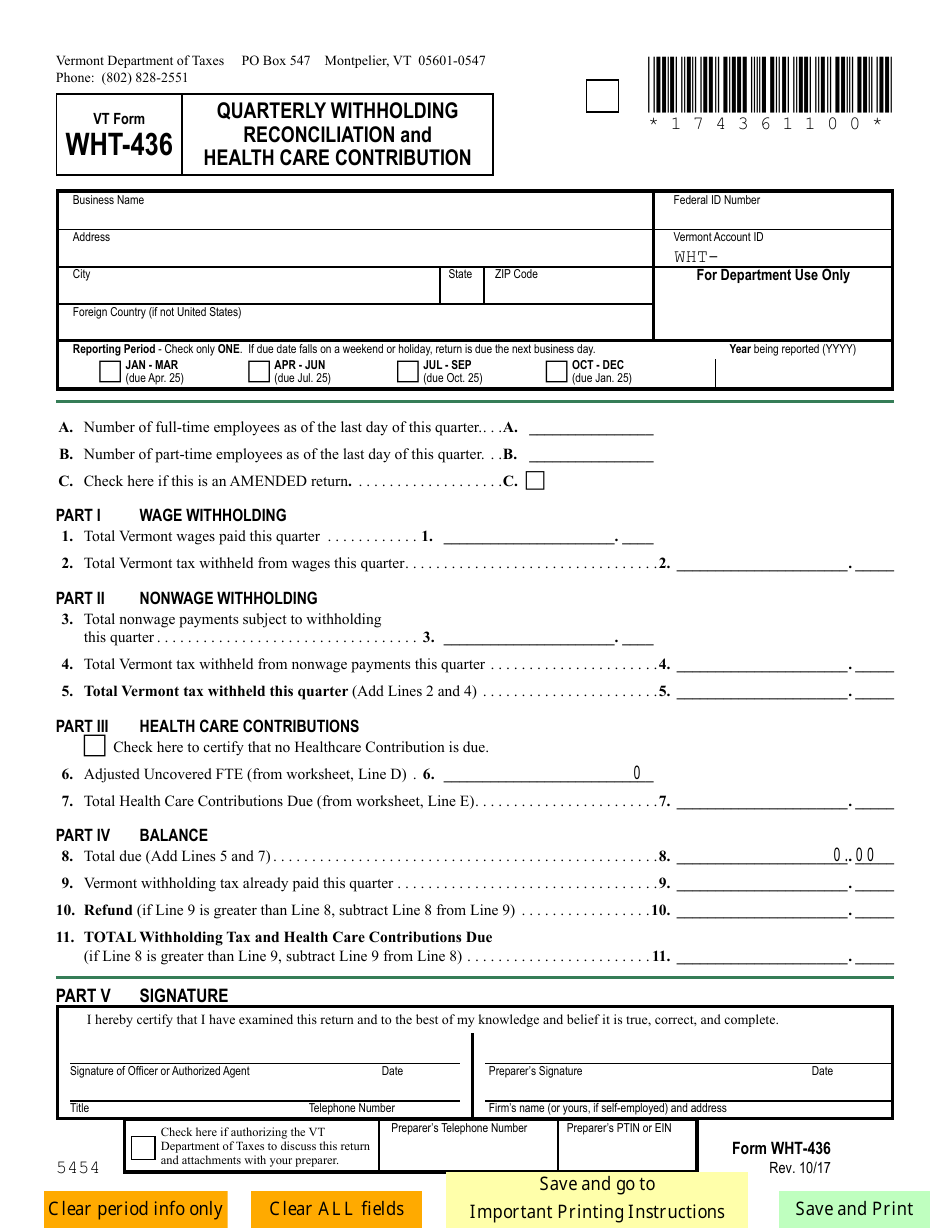

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form HC-1?

A: VT Form HC-1 is the Health Care Contributions Worksheet for residents of Vermont.

Q: Who needs to complete VT Form HC-1?

A: Residents of Vermont who need to calculate their health care contributions.

Q: What is the purpose of VT Form HC-1?

A: VT Form HC-1 is used to determine the amount of health care contributions that residents of Vermont are required to pay.

Q: What information is needed to complete VT Form HC-1?

A: You will need your federal adjusted gross income, federal taxable social security and railroad retirement benefits, and information about your health care coverage.

Q: When is the deadline to submit VT Form HC-1?

A: The deadline for submitting VT Form HC-1 is typically April 15th, the same as the federal income tax deadline.

Q: Are there any penalties for not submitting VT Form HC-1?

A: Yes, if you fail to submit VT Form HC-1 or if the form is incomplete or inaccurate, you may be subject to penalties and interest.

Q: What if I have questions or need assistance with VT Form HC-1?

A: If you have questions or need assistance with VT Form HC-1, you can contact the Vermont Department of Taxes directly or consult with a tax professional.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form HC-1 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.