This version of the form is not currently in use and is provided for reference only. Download this version of

VT Form MRT-441

for the current year.

VT Form MRT-441 Meals and Rooms Tax Return - Vermont

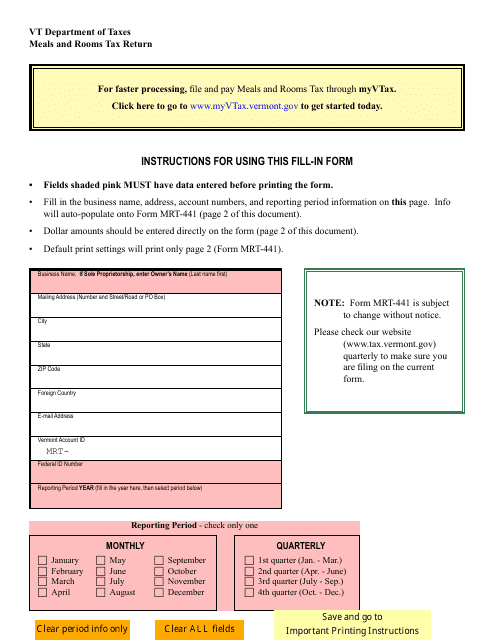

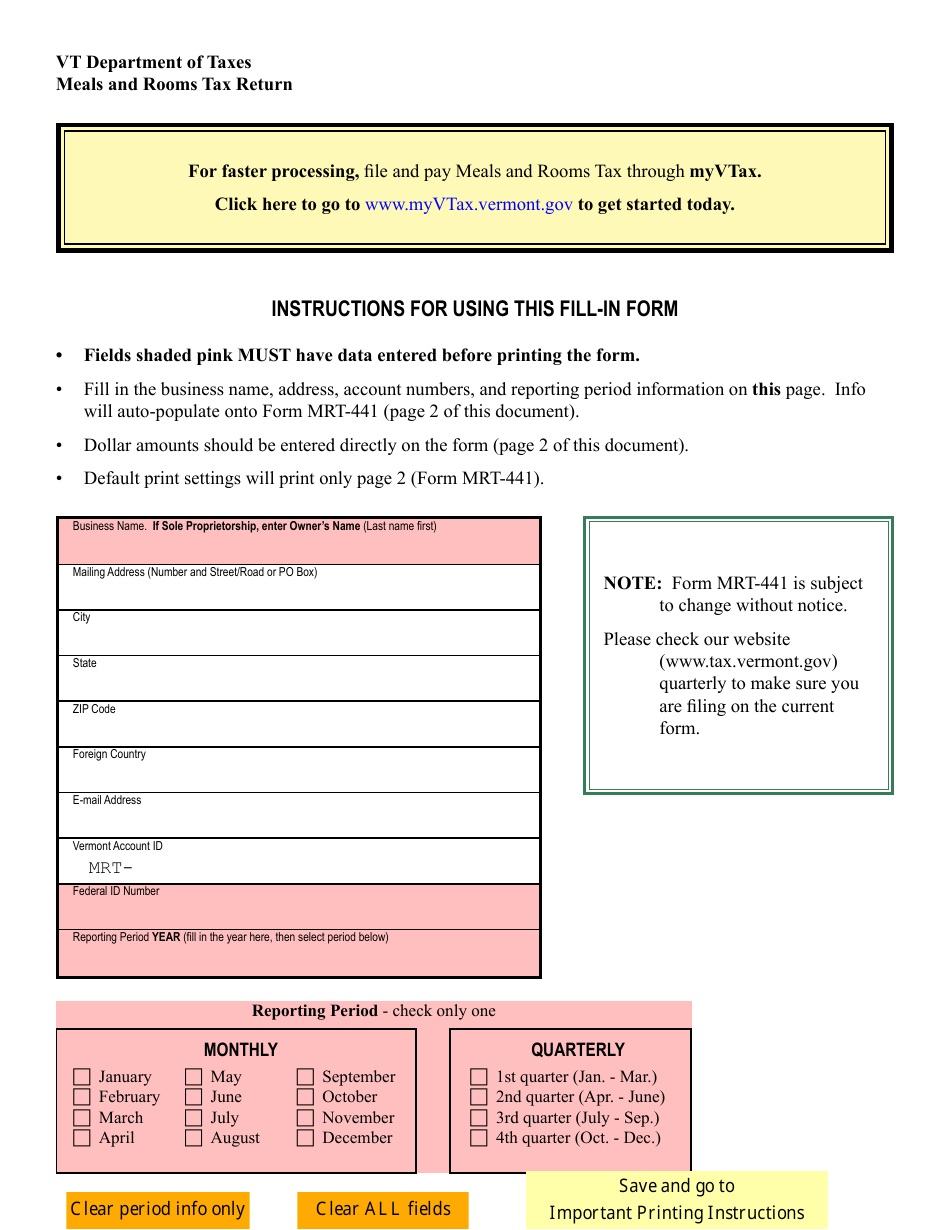

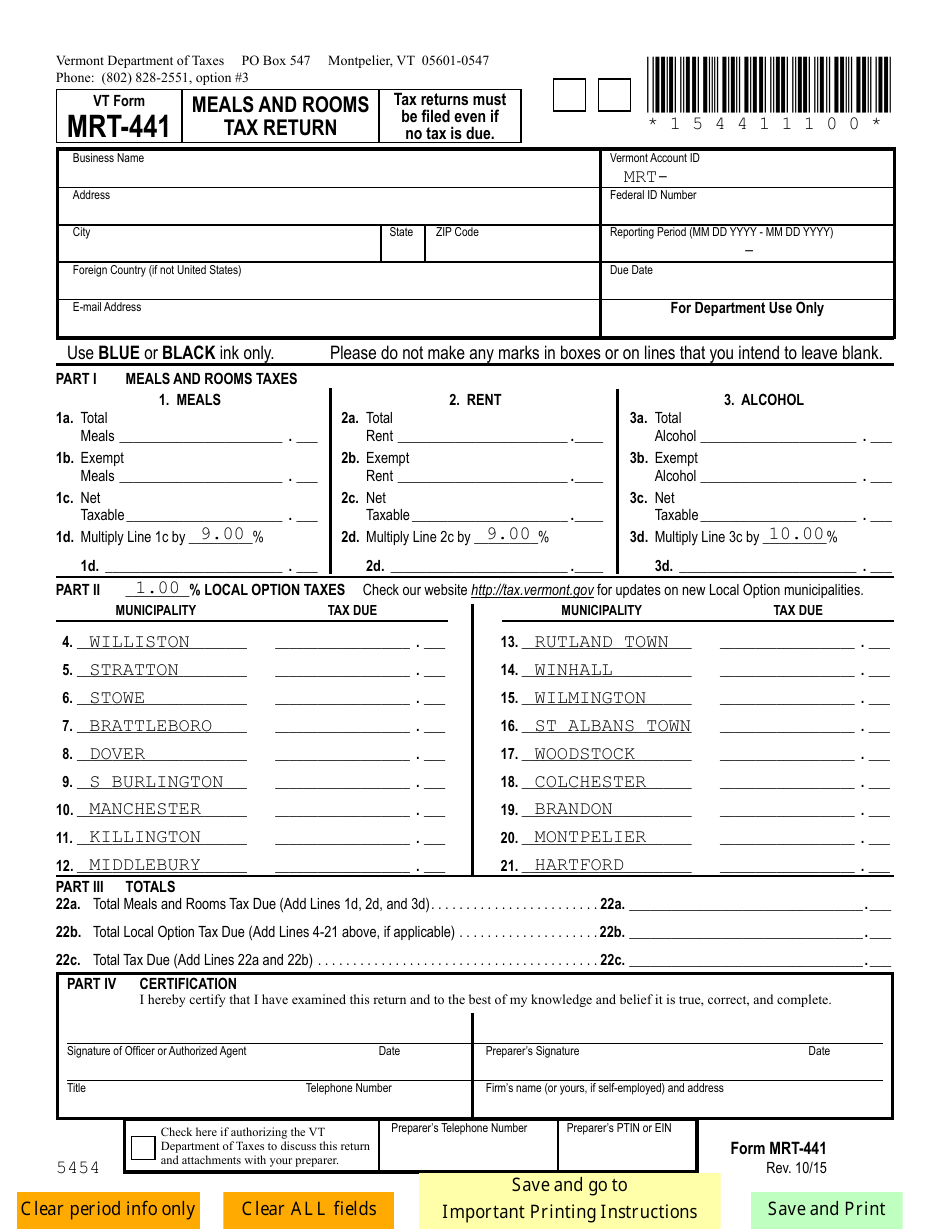

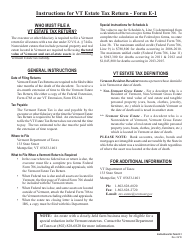

What Is VT Form MRT-441?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VT Form MRT-441?

A: VT Form MRT-441 is the Meals and Rooms Tax Return form for the state of Vermont.

Q: Who needs to file VT Form MRT-441?

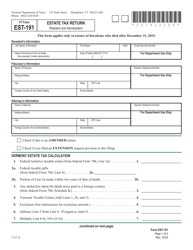

A: Businesses in Vermont that are required to collect Meals and Rooms Tax must file VT Form MRT-441.

Q: What is the purpose of VT Form MRT-441?

A: VT Form MRT-441 is used to report and remit the Meals and Rooms Tax collected by businesses in Vermont.

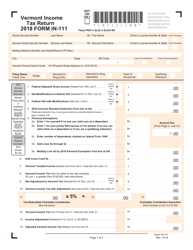

Q: What information is required on VT Form MRT-441?

A: VT Form MRT-441 requires businesses to provide information about their gross sales, taxable sales, and the amount of Meals and Rooms Tax collected.

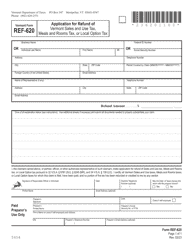

Q: When is VT Form MRT-441 due?

A: VT Form MRT-441 must be filed and paid by the 25th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing VT Form MRT-441?

A: Yes, failure to file VT Form MRT-441 or pay the Meals and Rooms Tax on time can result in penalties and interest.

Q: Is VT Form MRT-441 only for businesses in Vermont?

A: Yes, VT Form MRT-441 is specifically for businesses operating in the state of Vermont.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form MRT-441 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.