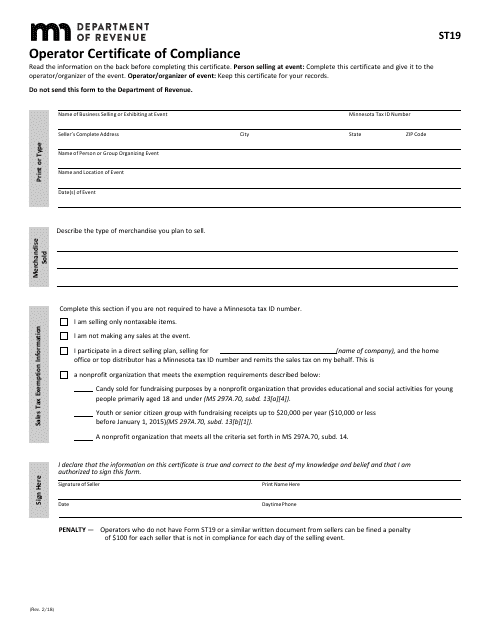

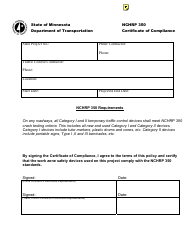

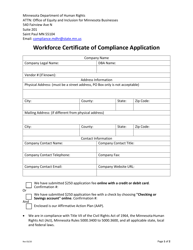

Form ST19 Operator Certificate of Compliance - Minnesota

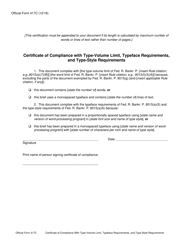

What Is Form ST19?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

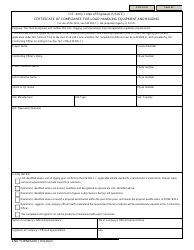

Q: What is Form ST19?

A: Form ST19 is the Operator Certificate of Compliance for the state of Minnesota.

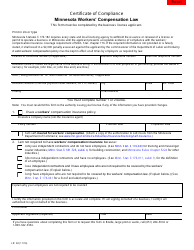

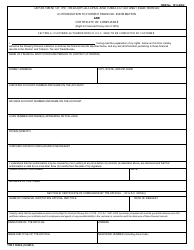

Q: Who needs to file Form ST19?

A: Operators who are liable for sales and use tax in Minnesota need to file Form ST19.

Q: What is the purpose of Form ST19?

A: Form ST19 is used to certify that the operator has complied with all tax laws and regulations in the state of Minnesota.

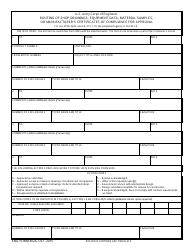

Q: How often do I need to file Form ST19?

A: Form ST19 must be filed annually.

Q: What information do I need to provide on Form ST19?

A: You will need to provide your business information, gross sales for the reporting period, and any necessary supporting documentation.

Q: Is there a deadline for filing Form ST19?

A: Yes, Form ST19 must be filed by the due date indicated on the form, usually April 15th.

Q: What happens if I don't file Form ST19?

A: Failure to file Form ST19 or providing false information may result in penalties and interest.

Q: Can I file Form ST19 electronically?

A: Yes, you can file Form ST19 electronically through the Minnesota Department of Revenue's e-Services portal.

Q: Can I request an extension to file Form ST19?

A: Yes, you can request an extension to file Form ST19 by contacting the Minnesota Department of Revenue.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST19 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.