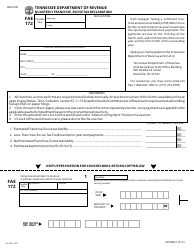

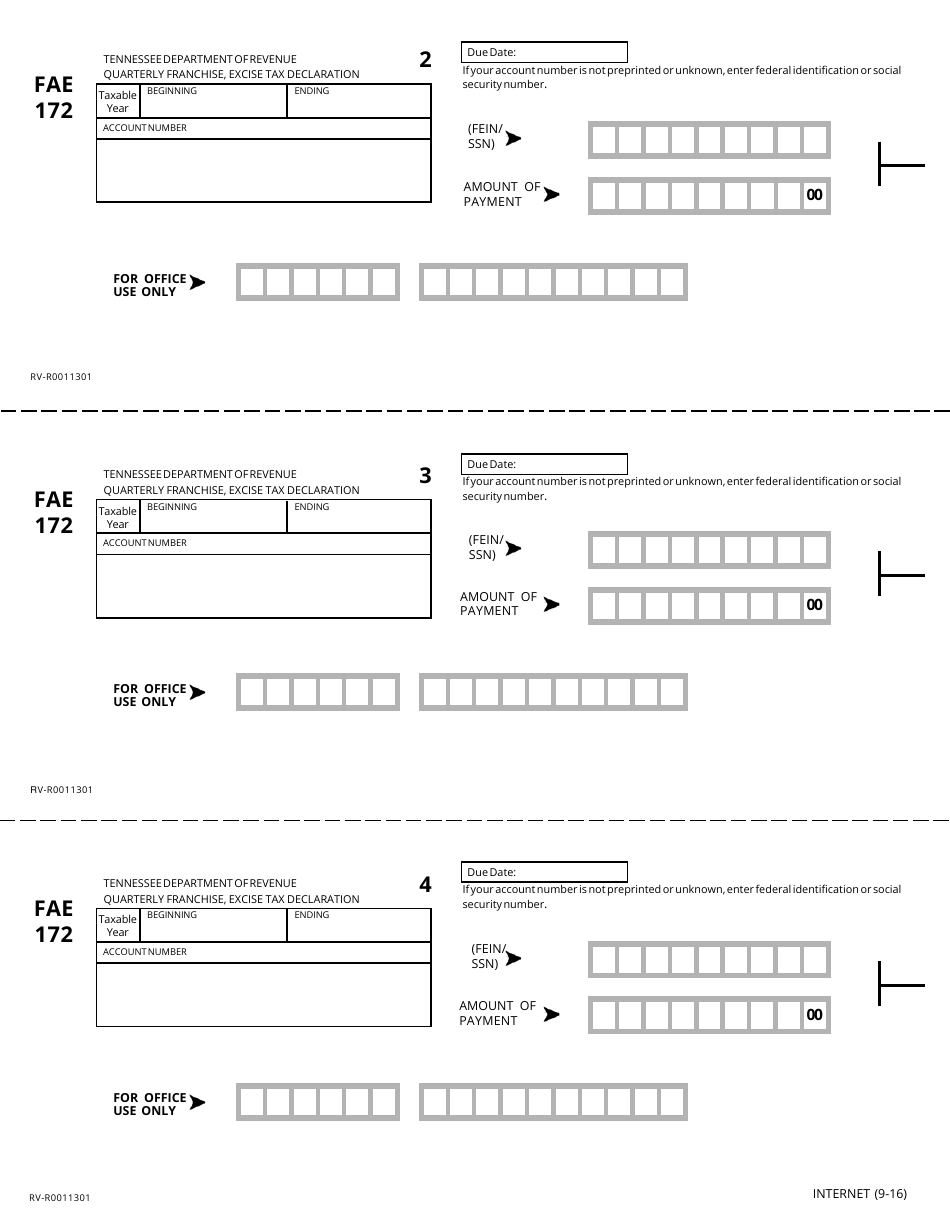

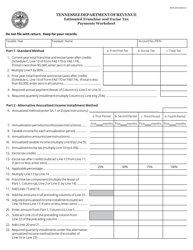

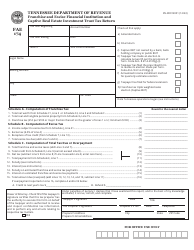

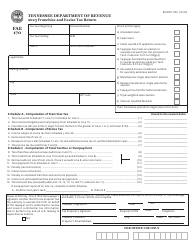

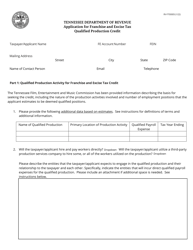

Form FAE172 Quarterly Franchise, Excise Tax Declaration - Tennessee

What Is Form FAE172?

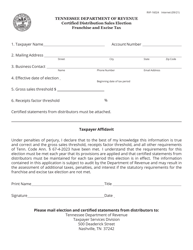

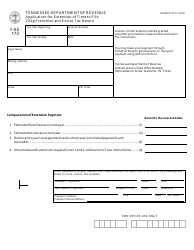

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

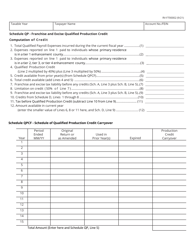

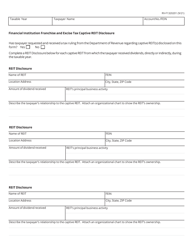

Q: What is the FAE172 Quarterly Franchise, Excise Tax Declaration?

A: The FAE172 form is a quarterly tax declaration form used to report franchise and excise taxes in Tennessee.

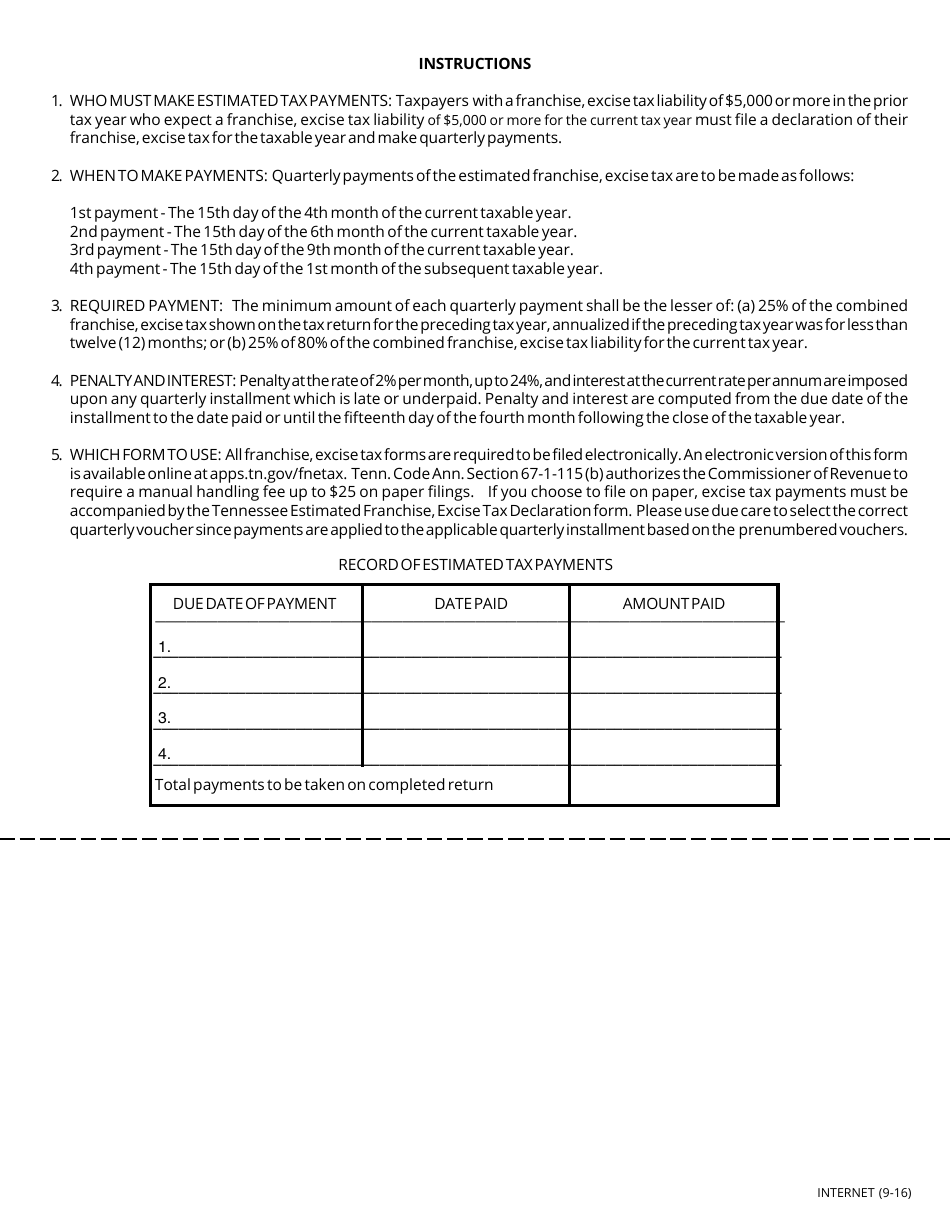

Q: Who needs to file the FAE172 form?

A: All businesses subject to franchise and excise taxes in Tennessee must file the FAE172 form.

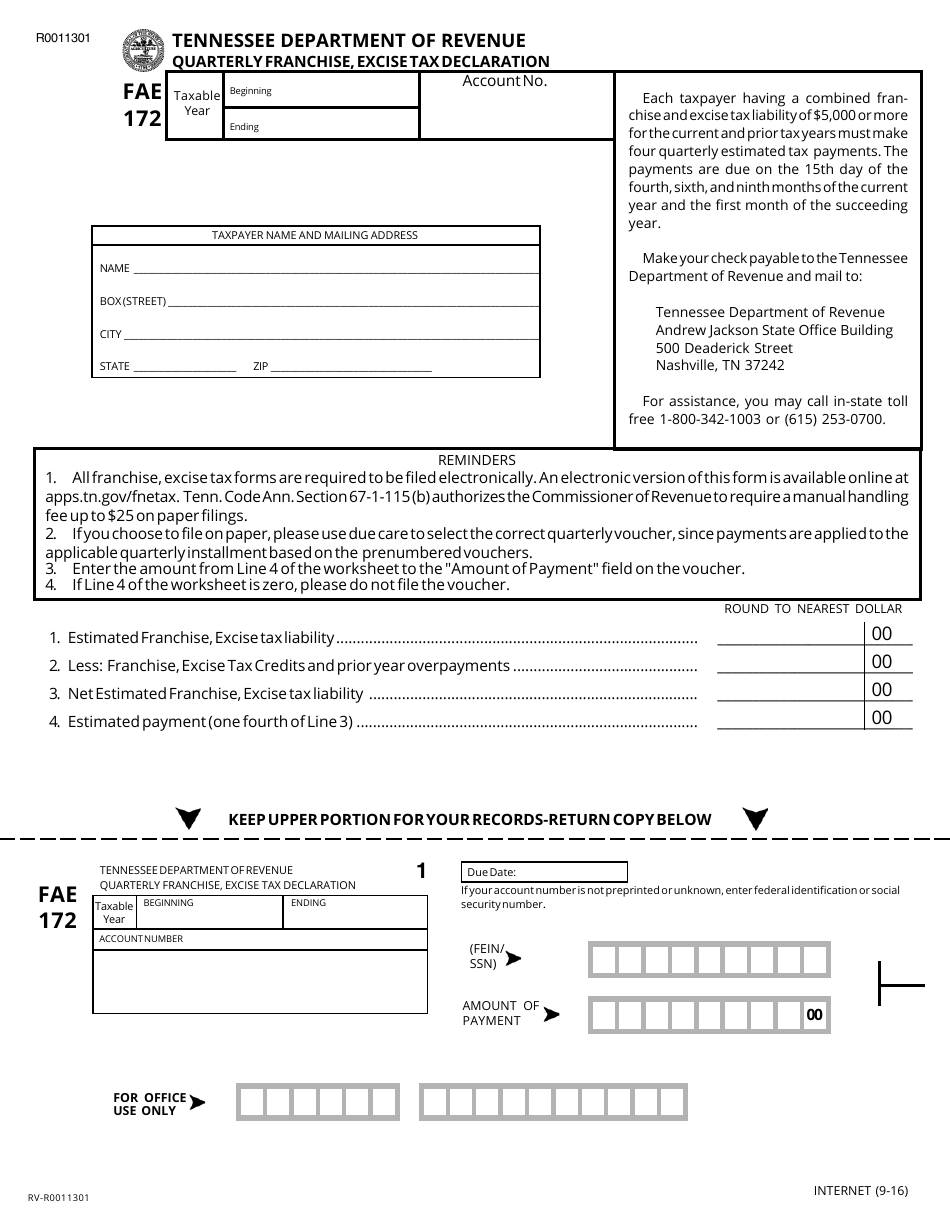

Q: When is the FAE172 form due?

A: The FAE172 form is due on or before the 15th day of the fourth month following the end of the taxable quarter.

Q: What information do I need to provide on the FAE172 form?

A: You will need to provide your business information, including income and deduction details, to complete the FAE172 form.

Q: What happens if I don't file the FAE172 form or pay the taxes owed?

A: Failure to file the FAE172 form or pay the taxes owed can result in penalties and interest charges.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FAE172 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.