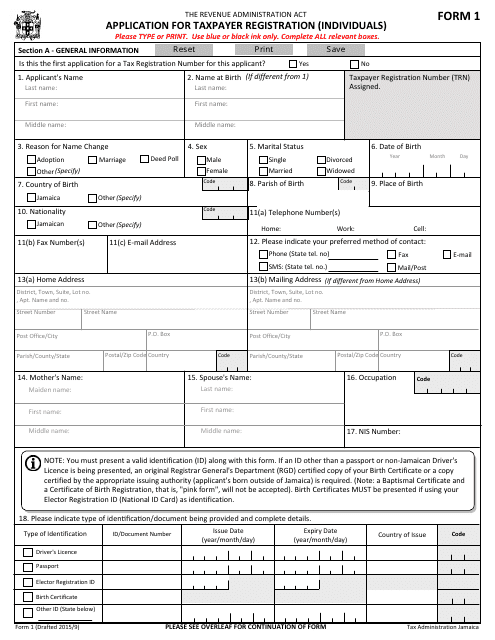

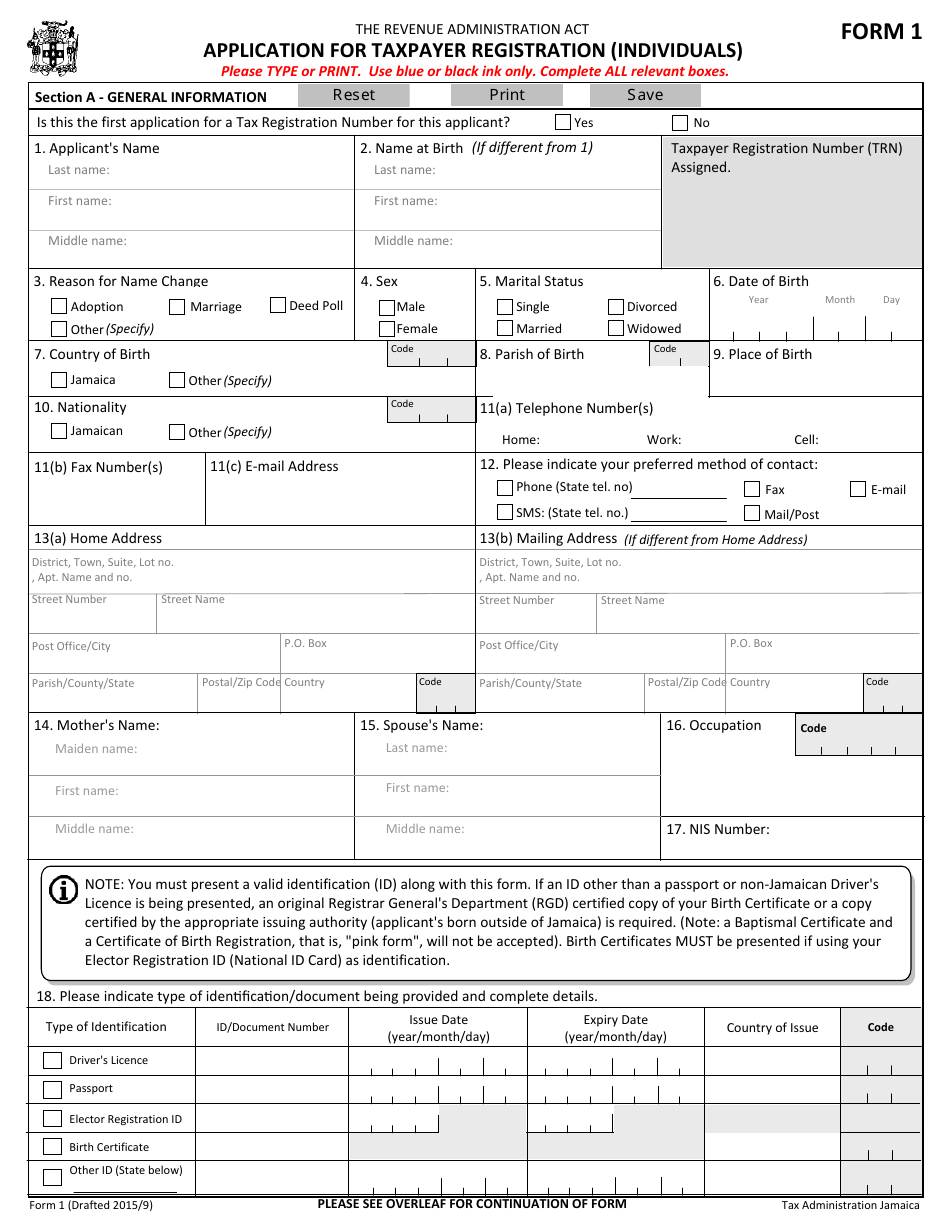

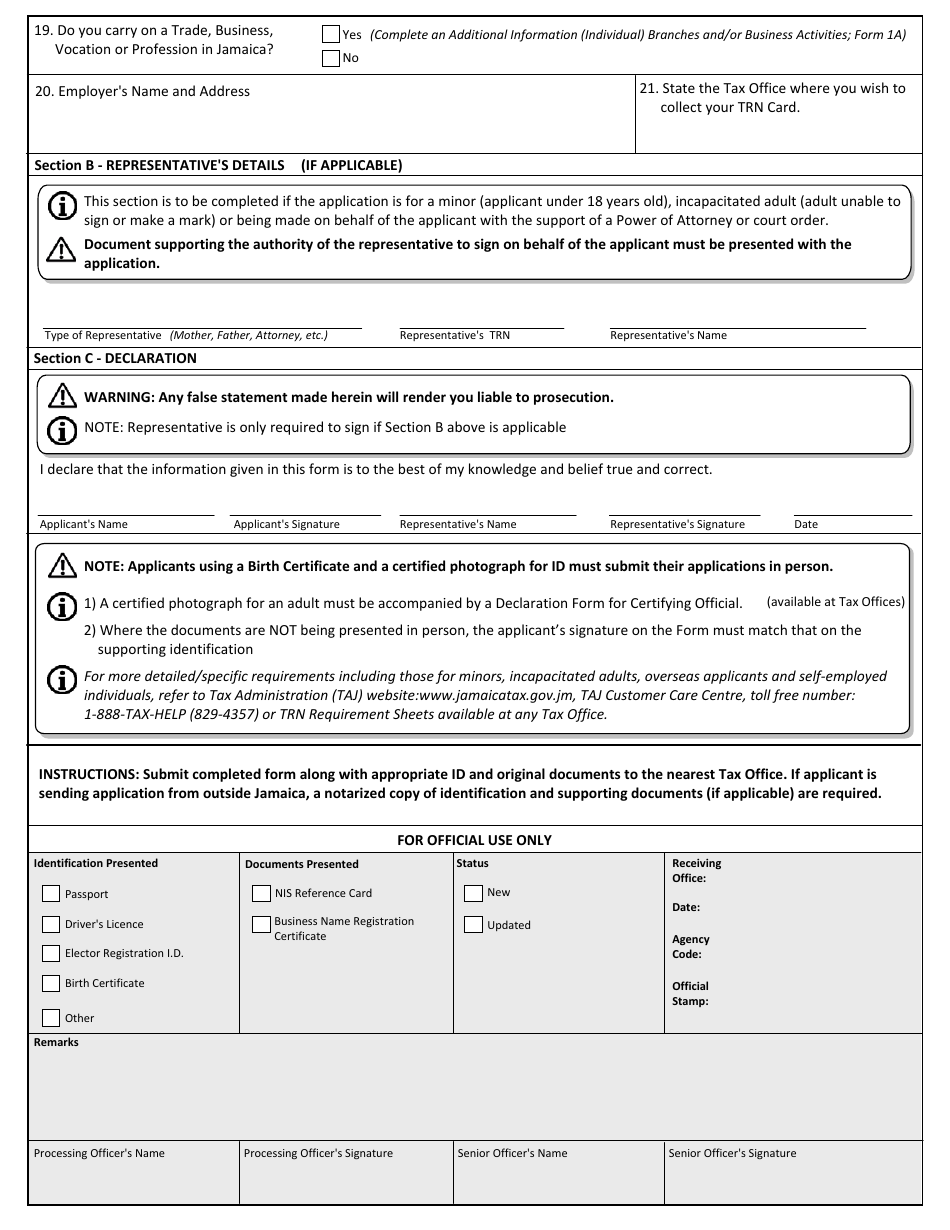

Form 1 Application for Taxpayer Registration (Individuals) - Jamaica

The Form 1 Application for Taxpayer Registration (Individuals) in Jamaica is used to register individuals for tax purposes. It serves as a means for individuals to provide their personal information, including their name, address, and taxpayer identification number, to the tax authorities in Jamaica. This form is necessary for individuals who are required to fulfill their tax obligations within the country. By submitting this application, individuals can ensure that they are properly registered and can meet their tax responsibilities in Jamaica.

In Jamaica, the Form 1 Application for Taxpayer Registration (Individuals) is filed by individuals themselves. Individuals who are liable for taxation in Jamaica need to complete and submit this form to the tax authorities for tax registration purposes. It is the responsibility of the individual taxpayers to ensure that they fulfill their tax obligations and provide accurate information on the Form 1 application.

FAQ

Q: What is the Form 1 Application for Taxpayer Registration?

A: The Form 1 Application for Taxpayer Registration is a document used in Jamaica to register individuals for tax purposes.

Q: Who should use the Form 1 Application for Taxpayer Registration?

A: Any individual who needs to register for tax purposes in Jamaica should use the Form 1 Application for Taxpayer Registration.

Q: What information is required on the Form 1 Application for Taxpayer Registration?

A: The Form 1 Application for Taxpayer Registration requires information such as the individual's name, address, contact information, date of birth, and nationality. It also asks for details about the individual's employment or business.

Q: Are there any fees associated with submitting the Form 1 Application for Taxpayer Registration?

A: No, there are no fees associated with submitting the Form 1 Application for Taxpayer Registration.

Q: How long does it take to process the Form 1 Application for Taxpayer Registration?

A: The processing time for the Form 1 Application for Taxpayer Registration can vary, but it generally takes a few weeks to complete the registration.

Q: What should I do if there are changes to the information provided on the Form 1 Application for Taxpayer Registration?

A: If there are any changes to the information provided on the Form 1 Application for Taxpayer Registration, you should notify the Tax Administration Jamaica (TAJ) so that they can update your records.

Q: Is the Form 1 Application for Taxpayer Registration only for Jamaican citizens?

A: No, the Form 1 Application for Taxpayer Registration can be used by both Jamaican citizens and non-citizens who need to register for tax purposes in Jamaica.

Q: What is the purpose of the Form 1 Application for Taxpayer Registration?

A: The purpose of the Form 1 Application for Taxpayer Registration is to collect specific information about individuals for tax administration purposes in Jamaica.