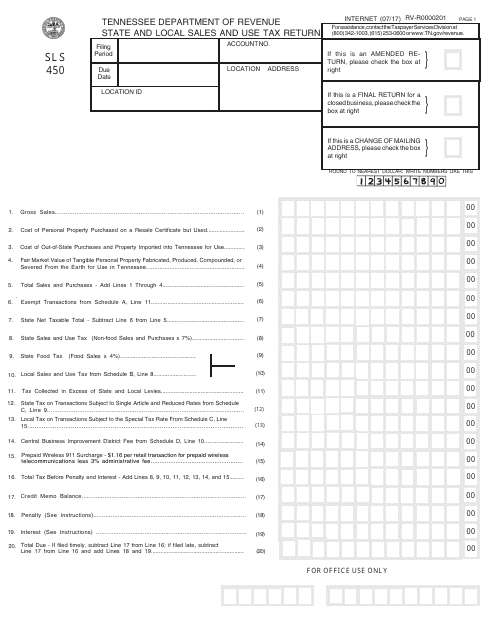

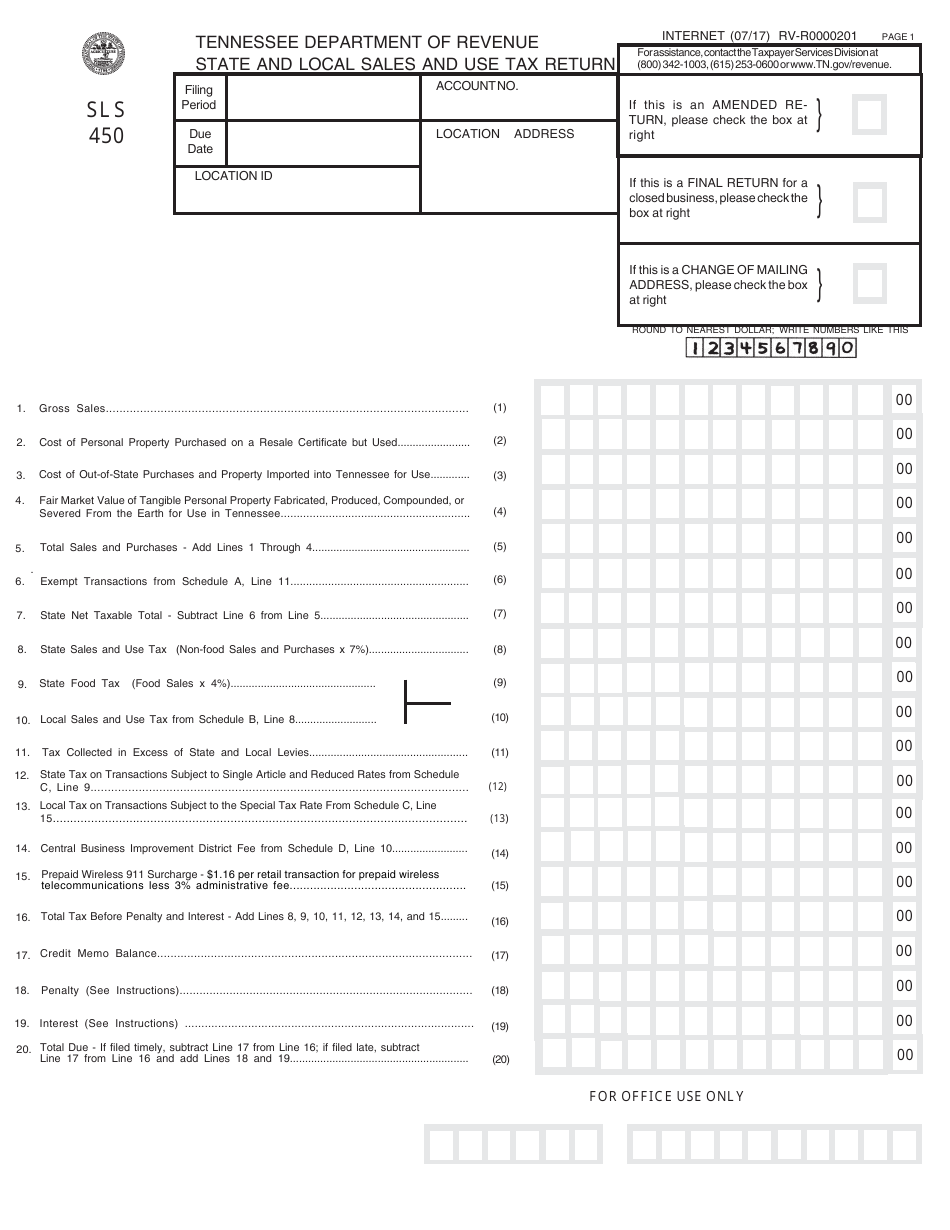

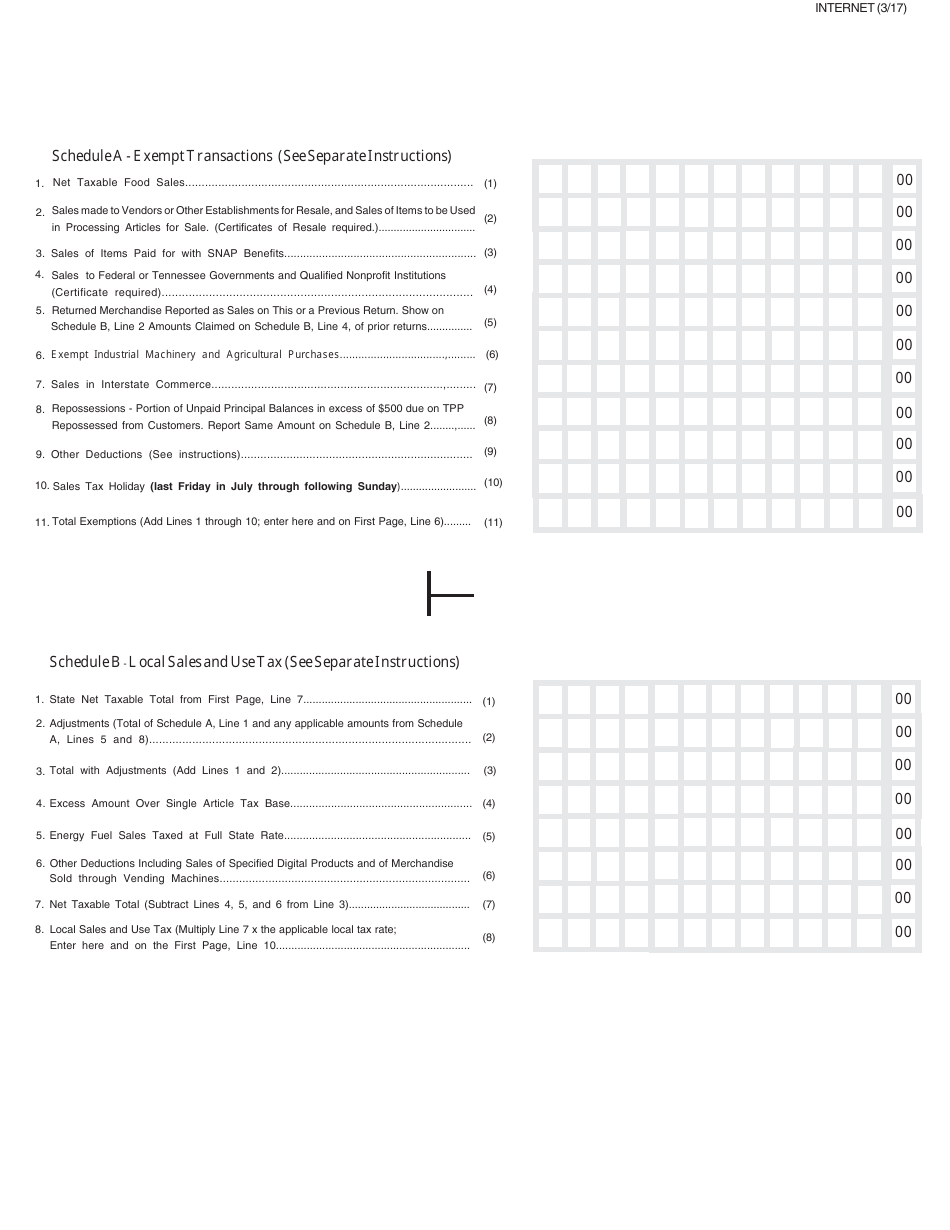

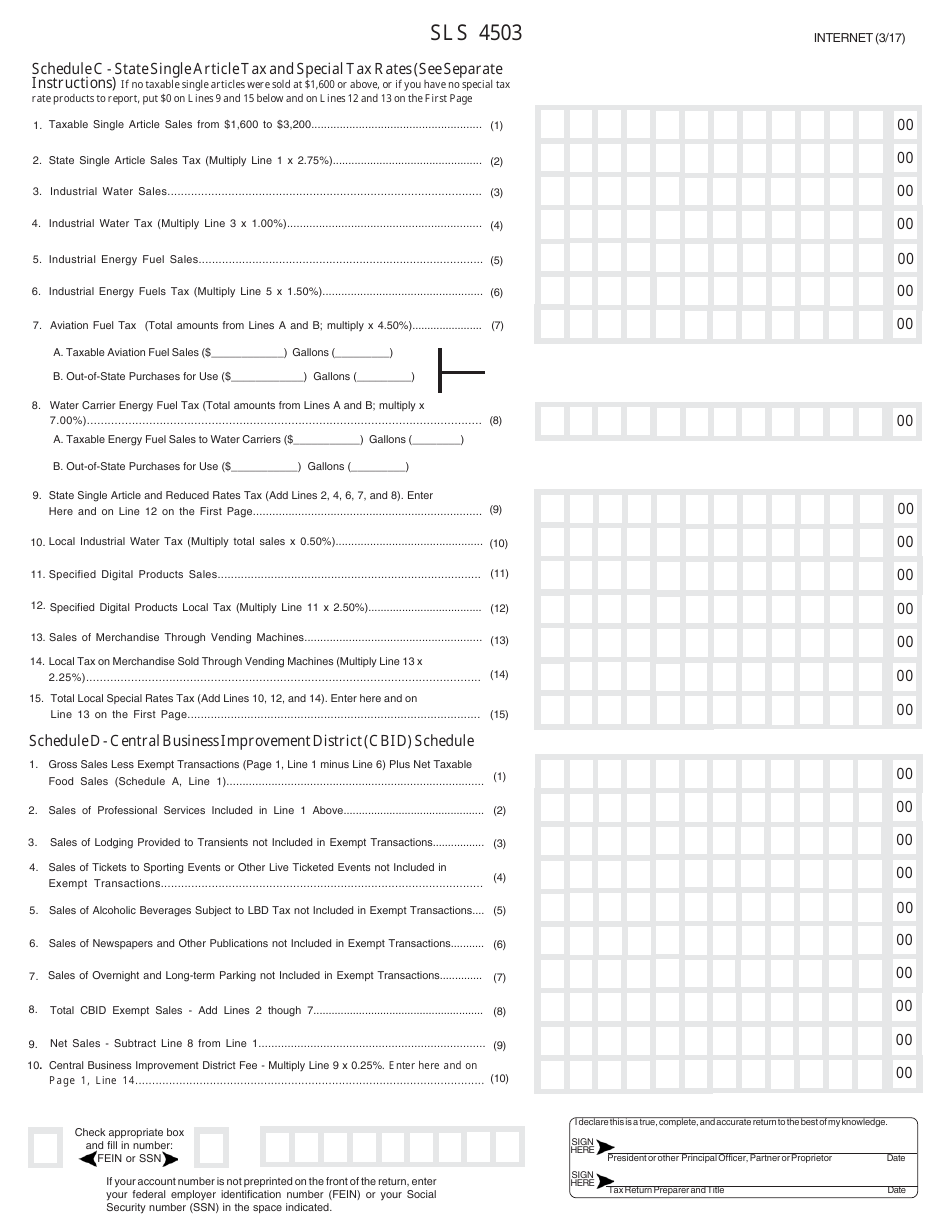

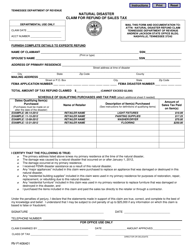

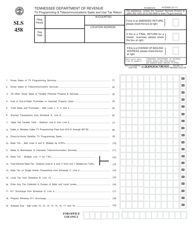

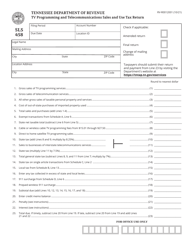

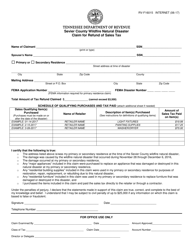

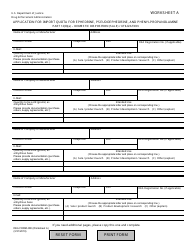

Form SLS450 State and Local Sales and Use Tax Return - Tennessee

What Is Form SLS450?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form SLS450?

A: Form SLS450 is the State and Local Sales and Use Tax Return for the state of Tennessee.

Q: Who needs to file Form SLS450?

A: Businesses and individuals who have collected sales tax or are liable for use tax in Tennessee must file Form SLS450.

Q: What is the purpose of Form SLS450?

A: The purpose of Form SLS450 is to report and remit the state and local sales and use taxes that have been collected.

Q: How often do I need to file Form SLS450?

A: Form SLS450 is generally filed on a monthly, quarterly, or annual basis, depending on the volume of sales and use tax collected.

Q: What information do I need to complete Form SLS450?

A: You will need information about your sales and use tax collections, as well as any applicable exemptions or deductions.

Q: When is Form SLS450 due?

A: The due date for Form SLS450 varies depending on the filing frequency, but it is generally due by the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing of Form SLS450?

A: Yes, there are penalties for late filing, as well as interest charges on any unpaid tax amounts.

Q: Who can I contact for help with Form SLS450?

A: For assistance with Form SLS450, you can contact the Tennessee Department of Revenue or consult with a tax professional.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SLS450 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.