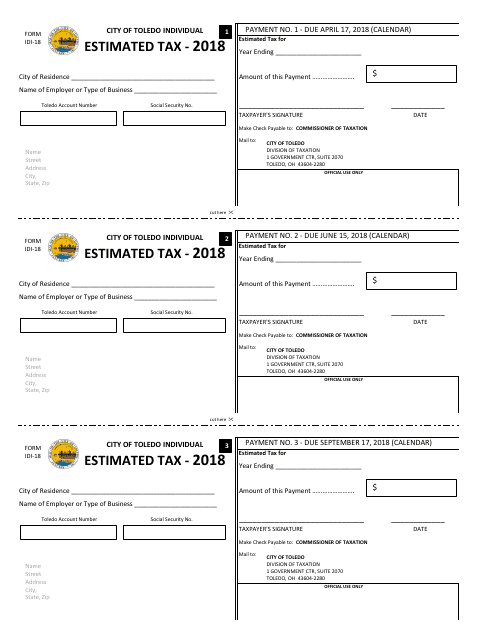

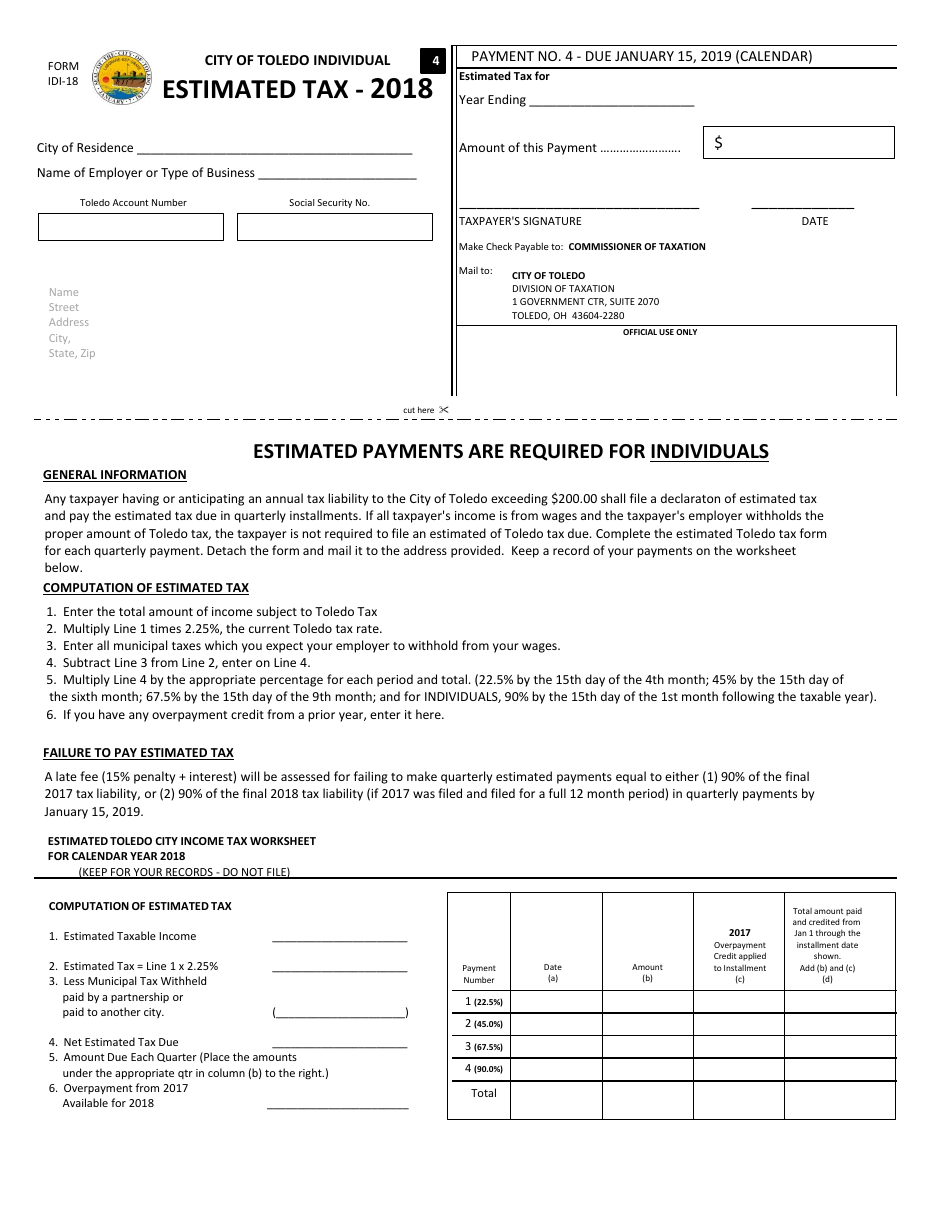

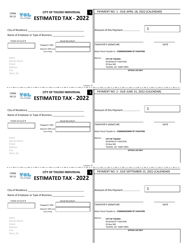

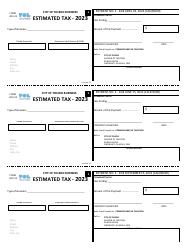

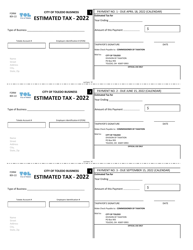

Form IDI-18 Individual Estimated Tax - City of Toledo, Ohio

What Is Form IDI-18?

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. The form may be used strictly within City of Toledo. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IDI-18?

A: Form IDI-18 is the Individual Estimated Tax form for residents of the City of Toledo, Ohio.

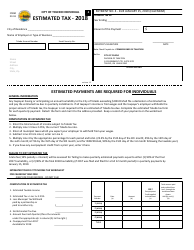

Q: Who is required to file Form IDI-18?

A: Residents of the City of Toledo, Ohio who have income that is not subject to withholding tax are required to file Form IDI-18.

Q: What is the purpose of Form IDI-18?

A: The purpose of Form IDI-18 is to report and pay estimated tax on income that is not subject to withholding tax.

Q: Do I need to file Form IDI-18 if my income is subject to withholding tax?

A: No, if your income is subject to withholding tax, you do not need to file Form IDI-18. The withholding tax will be deducted from your paycheck.

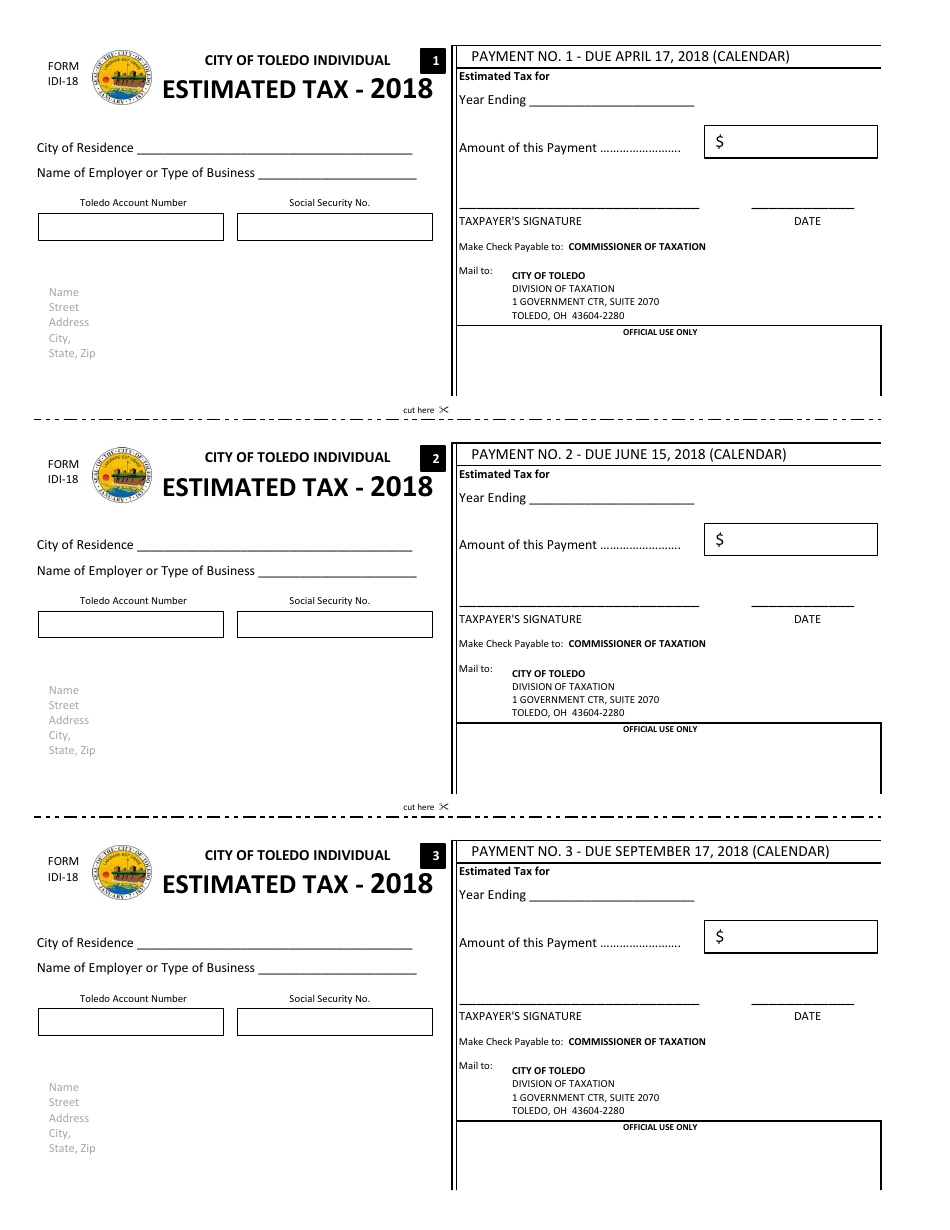

Q: How often do I need to file Form IDI-18?

A: Form IDI-18 must be filed quarterly. The due dates are April 15, June 15, September 15, and January 15 of the following year.

Q: Is there a penalty for late filing of Form IDI-18?

A: Yes, there is a penalty for late filing of Form IDI-18. The penalty is 15% of the tax due.

Q: How do I make a payment for Form IDI-18?

A: Payment can be made by check or money order payable to the City of Toledo, Ohio. The payment should be mailed along with the completed Form IDI-18.

Q: What if I overpaid my estimated tax on Form IDI-18?

A: If you overpaid your estimated tax on Form IDI-18, you can request a refund on your next quarterly filing or apply the overpayment to the next year's estimated tax.

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IDI-18 by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (Rita).