This version of the form is not currently in use and is provided for reference only. Download this version of

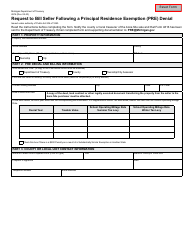

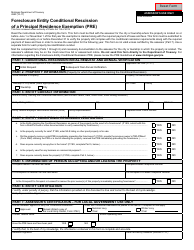

Form 2368

for the current year.

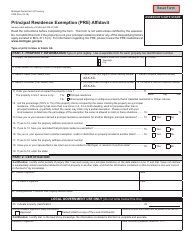

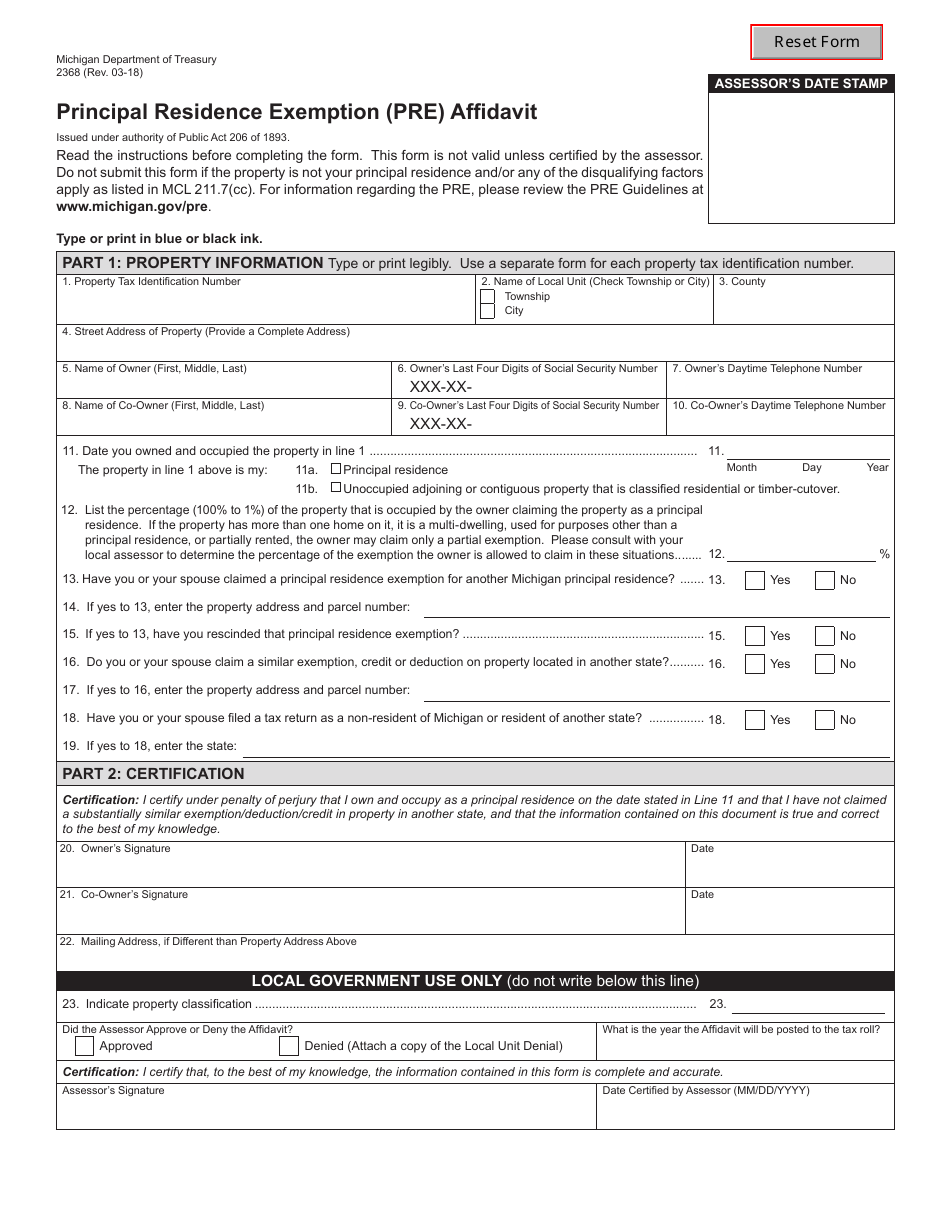

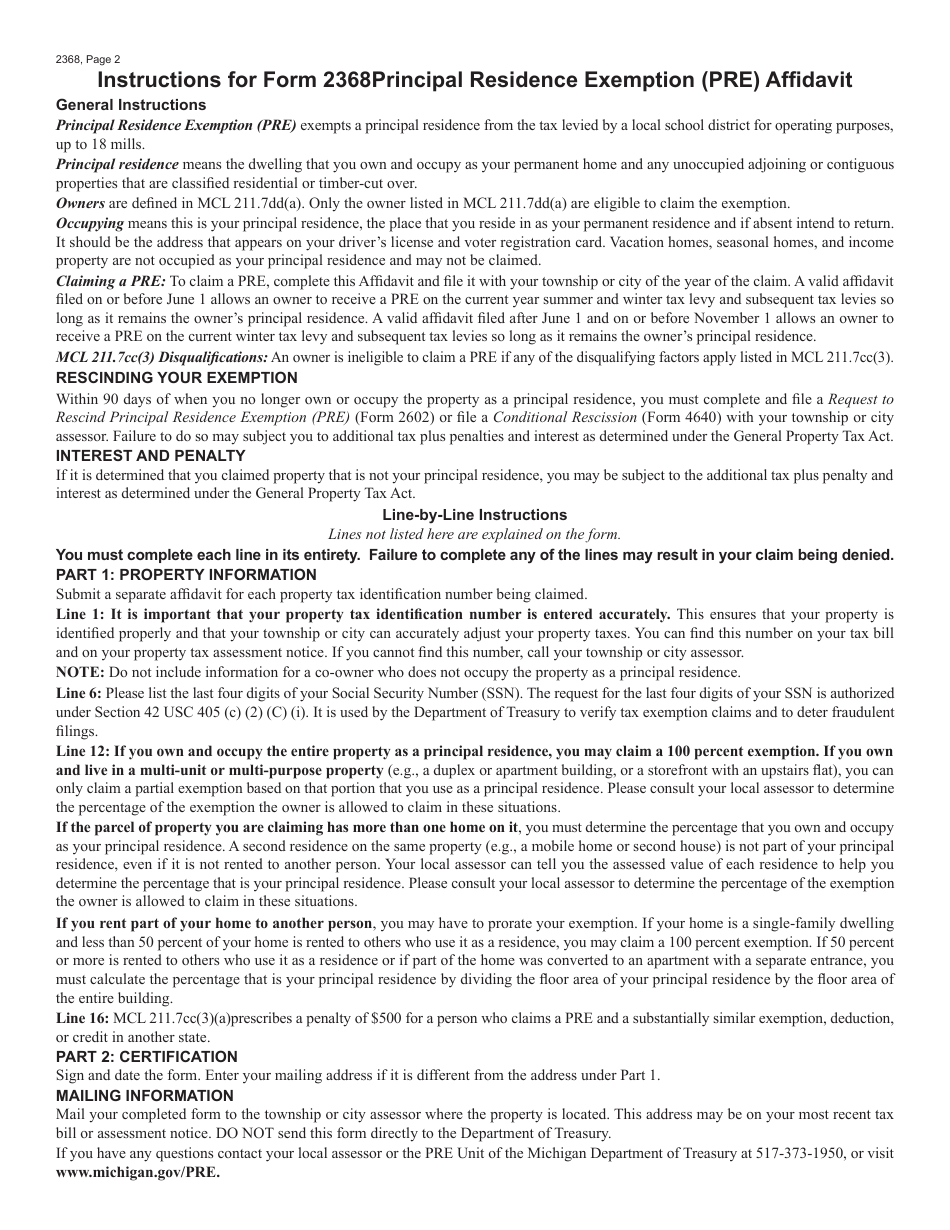

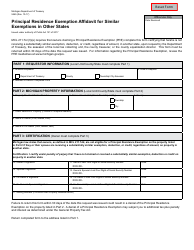

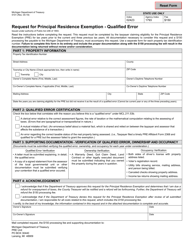

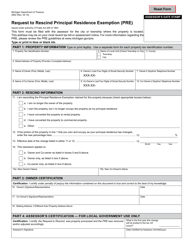

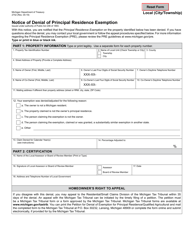

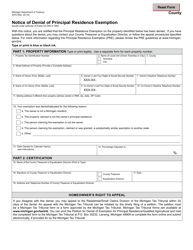

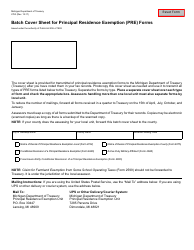

Form 2368 Principal Residence Exemption (Pre) Affidavit - Michigan

What Is Form 2368?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

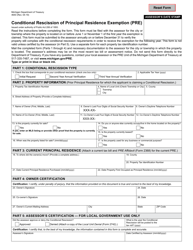

Q: What is Form 2368?

A: Form 2368 is the Principal Residence Exemption (PRE) Affidavit.

Q: What is the purpose of Form 2368?

A: The purpose of Form 2368 is to claim a principal residence exemption for property taxes in Michigan.

Q: Who can use Form 2368?

A: Michigan residents who own and occupy a property as their primary residence can use Form 2368.

Q: What is a principal residence exemption?

A: A principal residence exemption is a reduction in property taxes for the homeowner's primary residence.

Q: How often do I need to file Form 2368?

A: Form 2368 needs to be filed only once, unless there is a change in ownership or occupancy of the property.

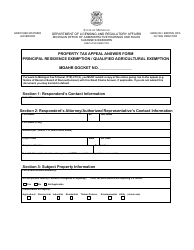

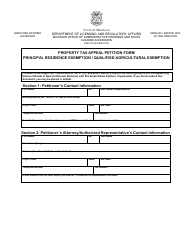

Q: What information do I need to provide on Form 2368?

A: You will need to provide your personal information, property details, and certify that the property is your principal residence.

Q: When is the deadline to file Form 2368?

A: The deadline to file Form 2368 is on or before May 1st of the year in which you wish to claim the exemption.

Q: What happens if I fail to file Form 2368?

A: Failure to file Form 2368 may result in the denial of the principal residence exemption and the full property taxes will be assessed.

Q: Are there any exceptions to the May 1st deadline?

A: Yes, there are exceptions for newly-purchased properties and properties that undergo a physical transfer of ownership during the year.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2368 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.