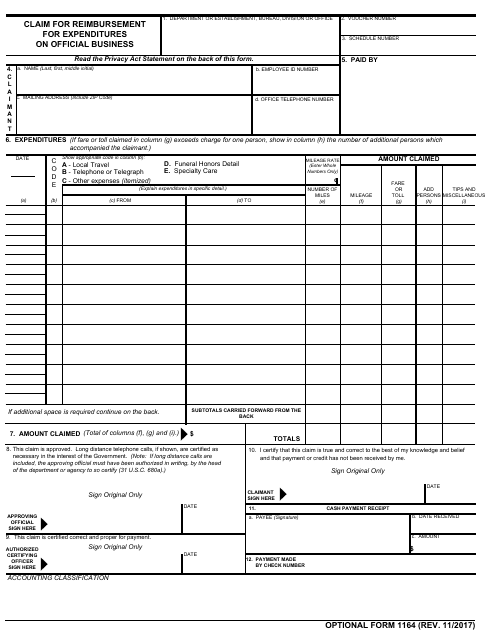

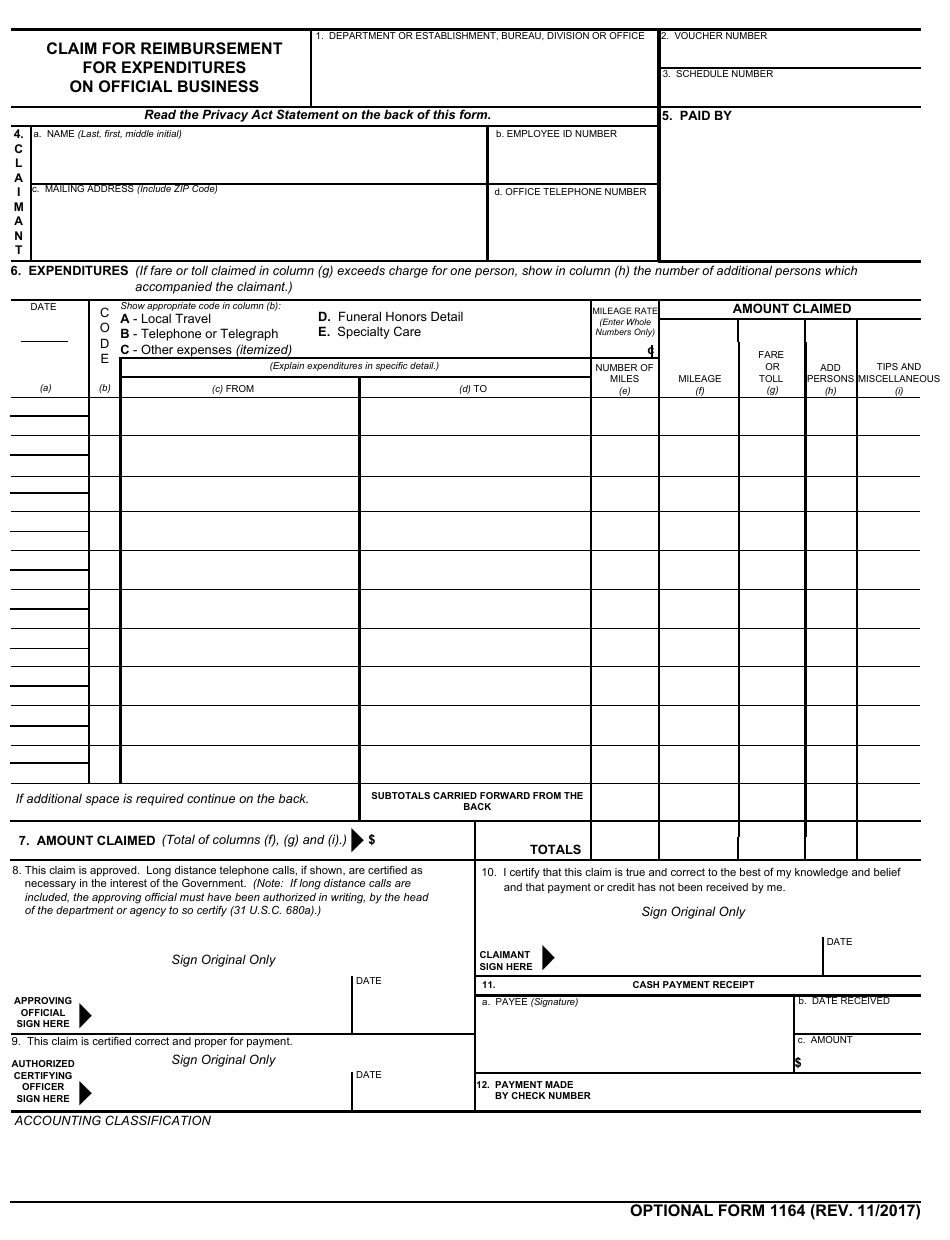

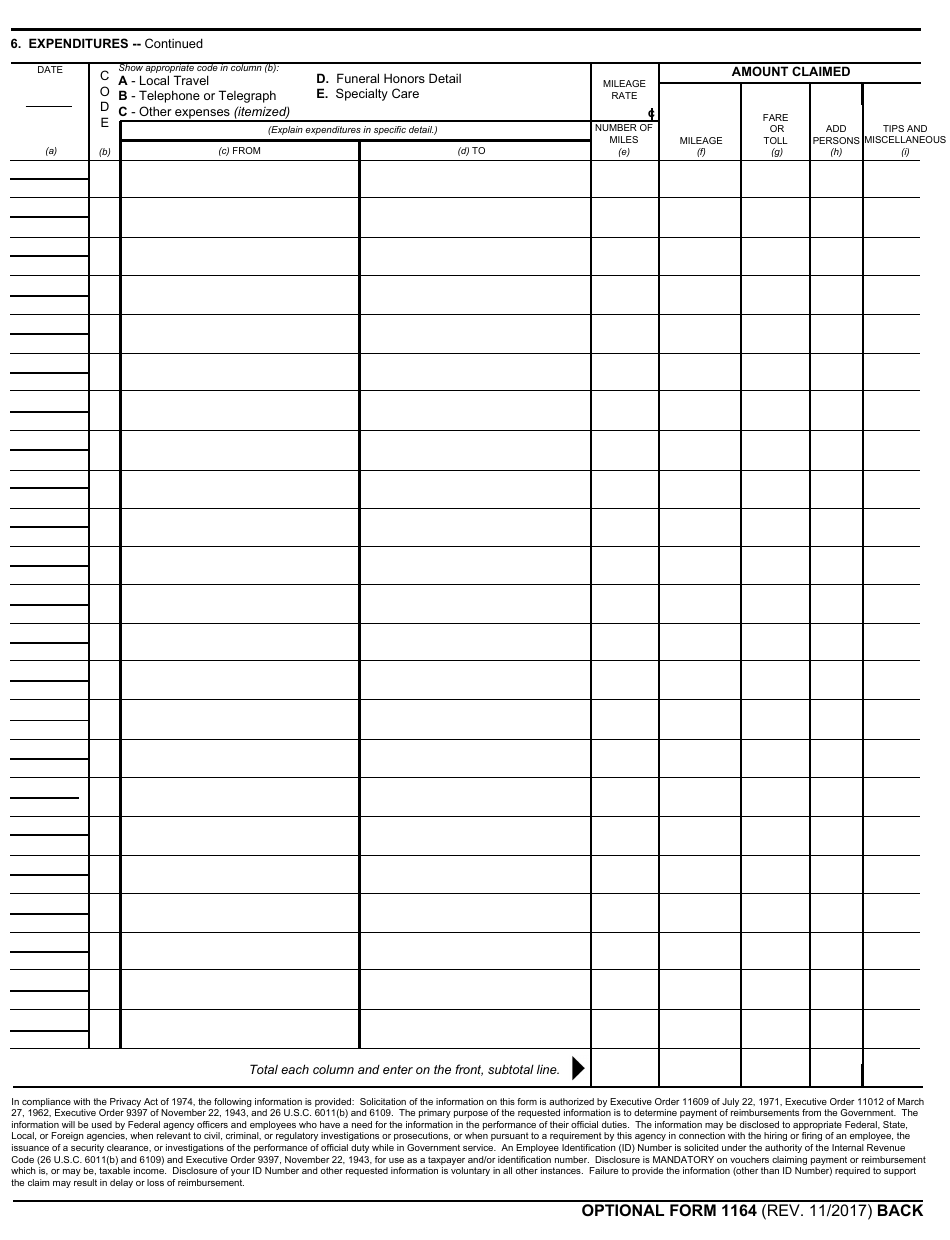

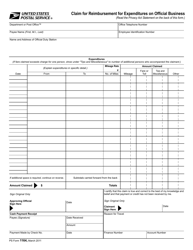

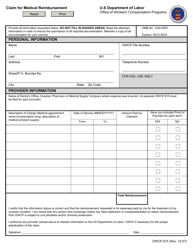

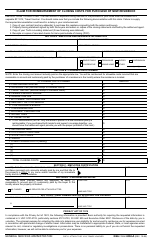

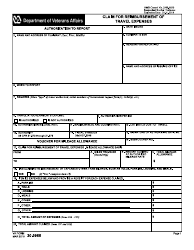

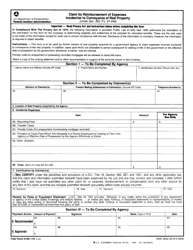

Optional Form 1164 Claim for Reimbursement for Expenditures on Official Business

What Is Optional Form 1164?

This is a legal form that was released by the U.S. General Services Administration on November 1, 2017 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1164?

A: Form 1164 is a claim for reimbursement for expenditures on official business.

Q: Who can use Form 1164?

A: Form 1164 can be used by individuals who have incurred expenses on official business.

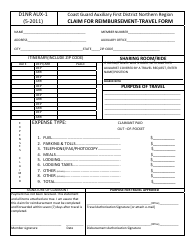

Q: What expenses can be claimed on Form 1164?

A: Expenses such as travel, lodging, meals, and other business-related costs can be claimed on Form 1164.

Q: How do I submit Form 1164?

A: Form 1164 can be submitted to the appropriate department or agency for approval and reimbursement.

Q: Is there a deadline for submitting Form 1164?

A: The deadline for submitting Form 1164 may vary depending on the department or agency's policies and guidelines.

Q: Can I claim expenses incurred outside of official business on Form 1164?

A: No, Form 1164 is specifically for claiming expenses related to official business only.

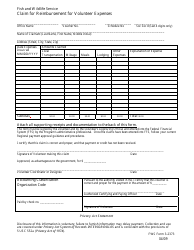

Q: Are there any supporting documents required for Form 1164?

A: Yes, supporting documents such as receipts or invoices may be required to substantiate the claimed expenses on Form 1164.

Form Details:

- Released on November 1, 2017;

- The latest available edition released by the U.S. General Services Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Optional Form 1164 by clicking the link below or browse more documents and templates provided by the U.S. General Services Administration.