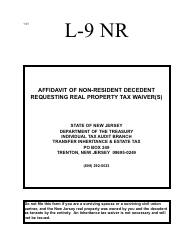

This version of the form is not currently in use and is provided for reference only. Download this version of

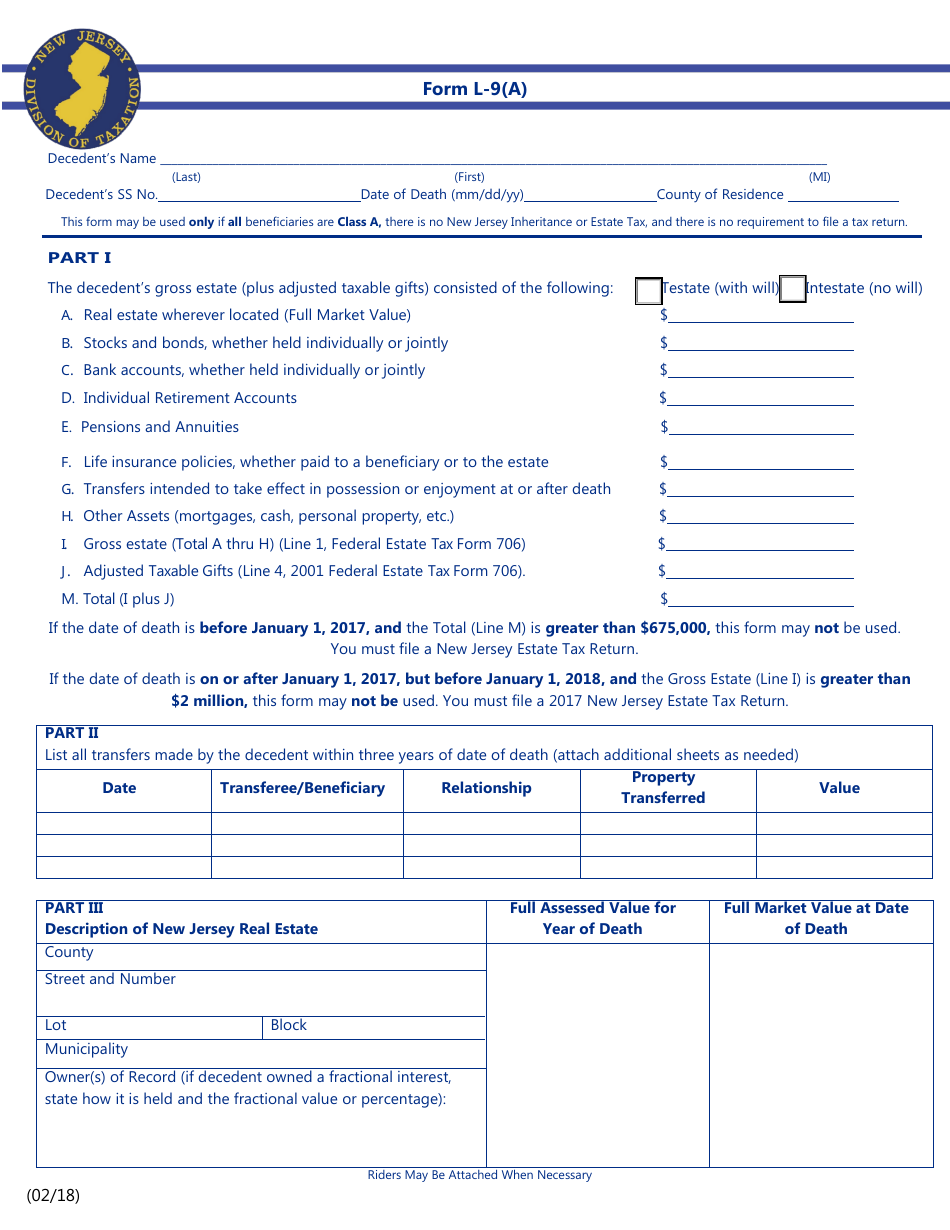

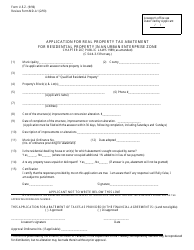

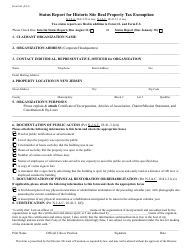

Form L-9(A)

for the current year.

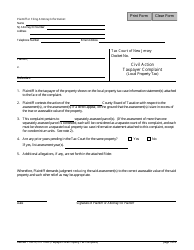

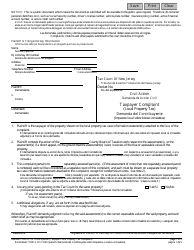

Form L-9(A) Affidavit for Real Property Tax Waiver(S): Resident Decedent - New Jersey

What Is Form L-9(A)?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

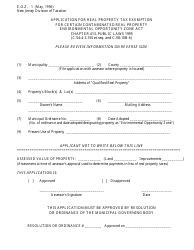

Q: What is Form L-9(A)?

A: Form L-9(A) is the Affidavit for Real Property Tax Waiver(S) for Resident Decedent in New Jersey.

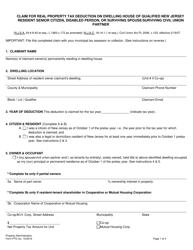

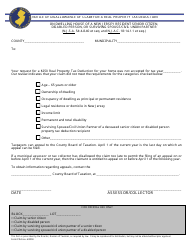

Q: Who needs to fill out Form L-9(A)?

A: Form L-9(A) needs to be filled out by the estates of deceased residents in New Jersey.

Q: What is the purpose of Form L-9(A)?

A: The purpose of Form L-9(A) is to request a real propertytax waiver for a deceased resident's property.

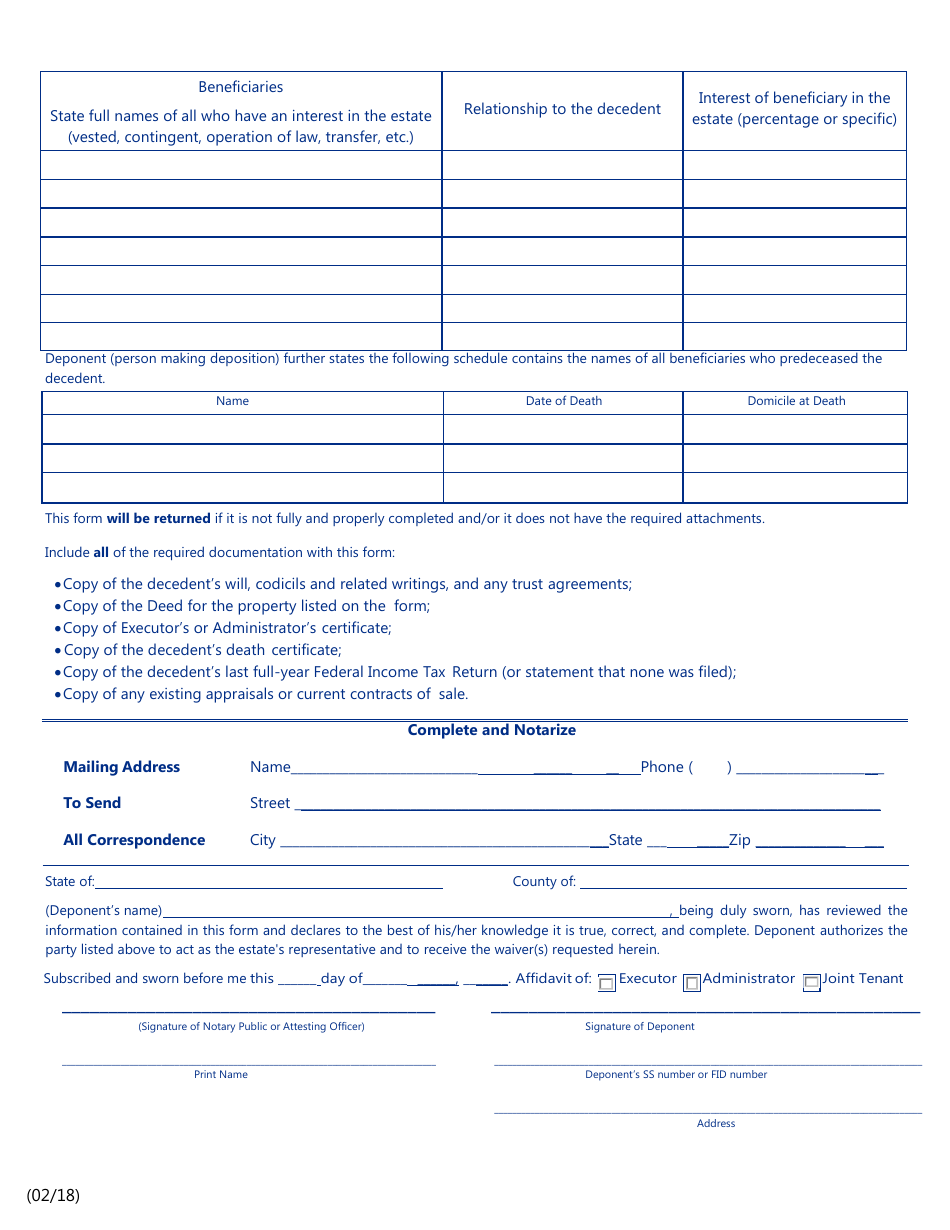

Q: What documents are required to be submitted with Form L-9(A)?

A: The required documents include a copy of the decedent's death certificate, a copy of the will (if applicable), and any other relevant supporting documents.

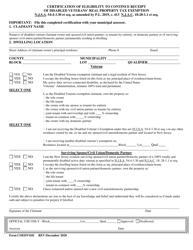

Q: Is there a fee for submitting Form L-9(A)?

A: Yes, there is a fee associated with submitting Form L-9(A). The exact fee amount can be found on the form or by contacting your local tax collector's office.

Q: What is the deadline for submitting Form L-9(A)?

A: Form L-9(A) should be submitted within 8 months from the date of death of the resident.

Q: What happens after I submit Form L-9(A)?

A: After you submit Form L-9(A), the tax collector's office will review your application and determine whether a real property tax waiver will be granted.

Q: Can I appeal if my application for a real property tax waiver is denied?

A: Yes, if your application is denied, you can appeal the decision by following the instructions provided by the tax collector's office.

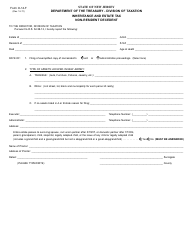

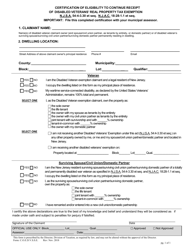

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-9(A) by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.