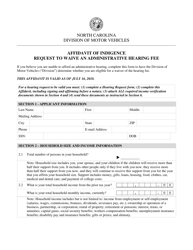

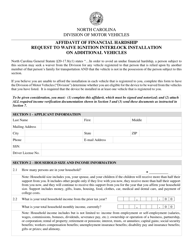

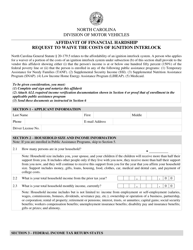

This version of the form is not currently in use and is provided for reference only. Download this version of

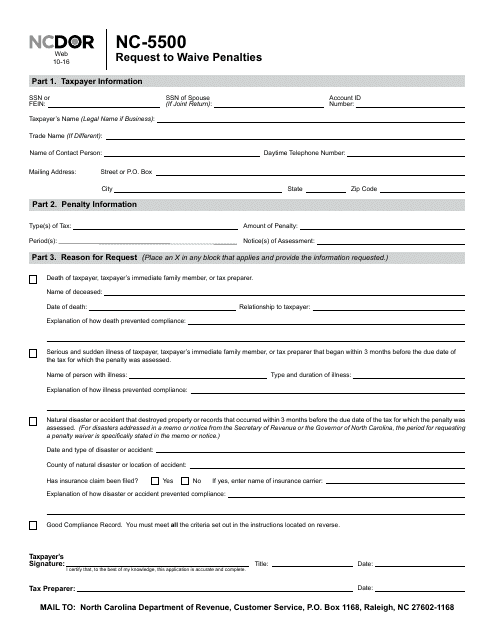

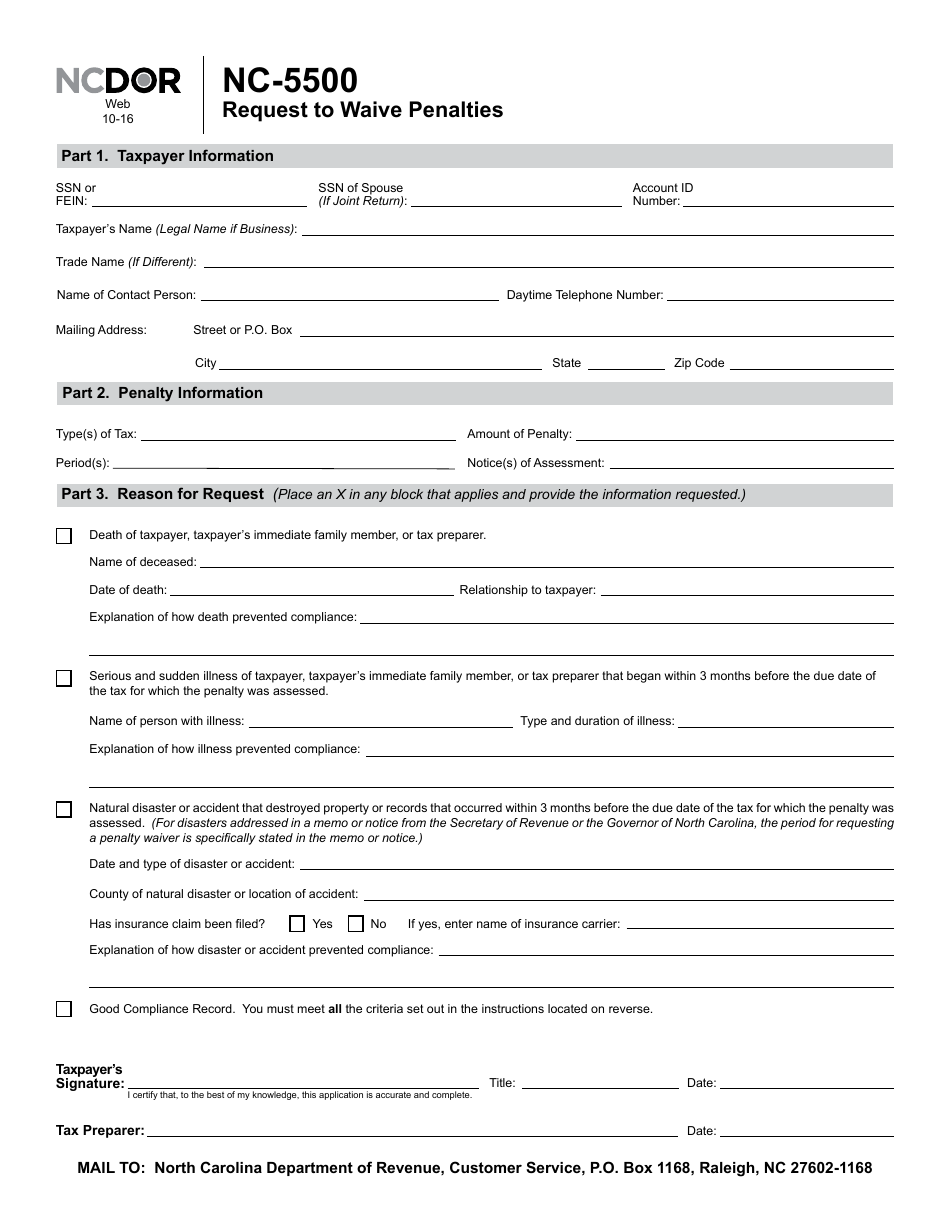

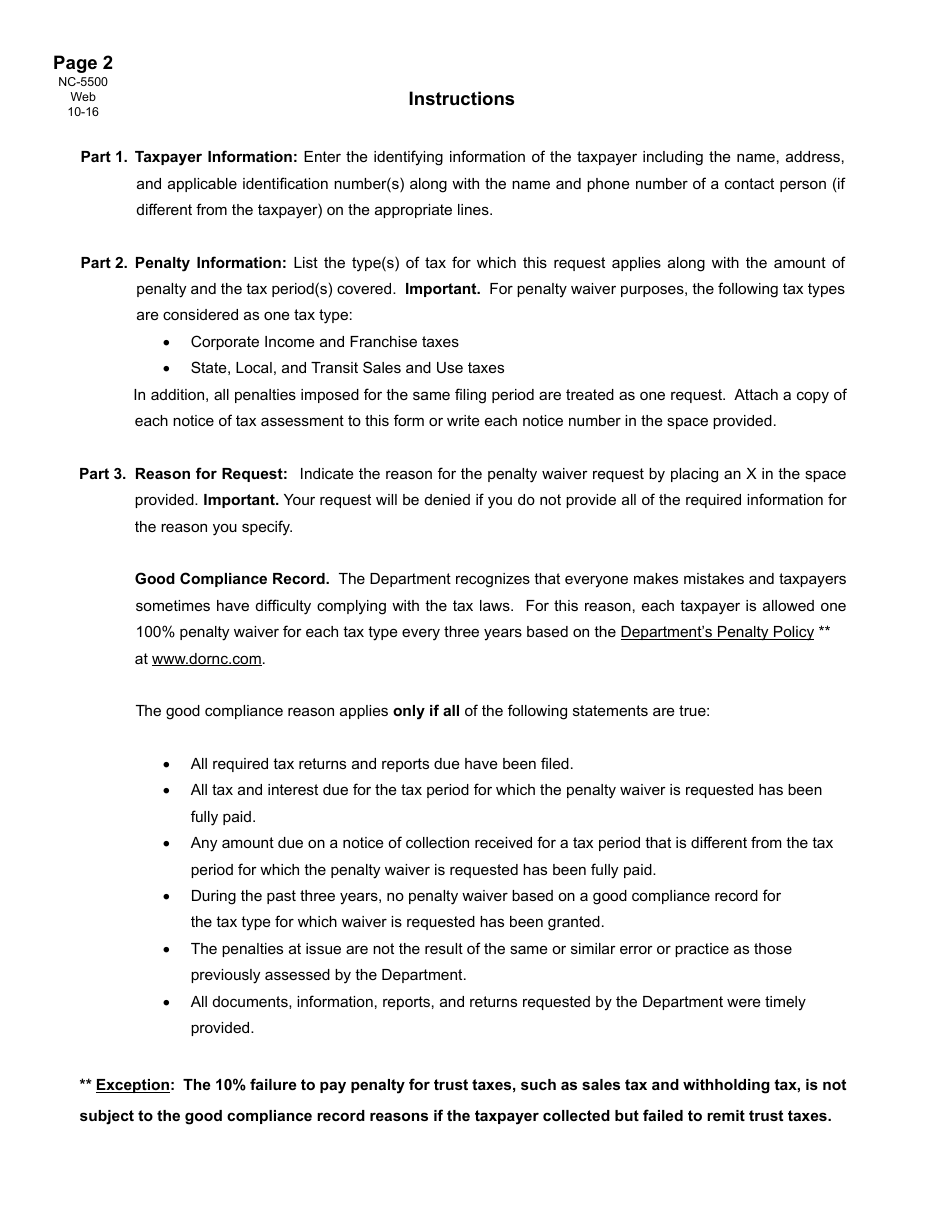

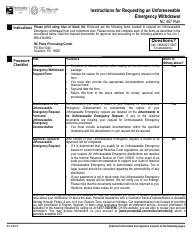

Form NC-5500

for the current year.

Form NC-5500 Request to Waive Penalties - North Carolina

What Is Form NC-5500?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

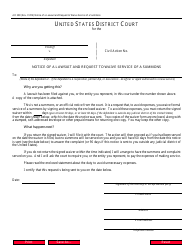

Q: What is Form NC-5500?

A: Form NC-5500 is a Request to Waive Penalties form used in North Carolina.

Q: When should I use Form NC-5500?

A: You should use Form NC-5500 if you need to request a waiver for penalties imposed by the North Carolina Department of Revenue.

Q: What penalties can be waived using Form NC-5500?

A: Form NC-5500 can be used to request a waiver for various penalties including late filing, late payment, and failure to file penalties.

Q: Is there a deadline for submitting Form NC-5500?

A: Yes, you should submit Form NC-5500 within one year from the date the penalty was assessed.

Q: Are there any fees associated with submitting Form NC-5500?

A: No, there are no fees associated with submitting Form NC-5500.

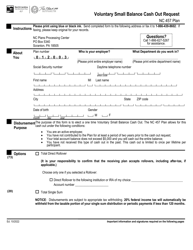

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-5500 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.