This version of the form is not currently in use and is provided for reference only. Download this version of

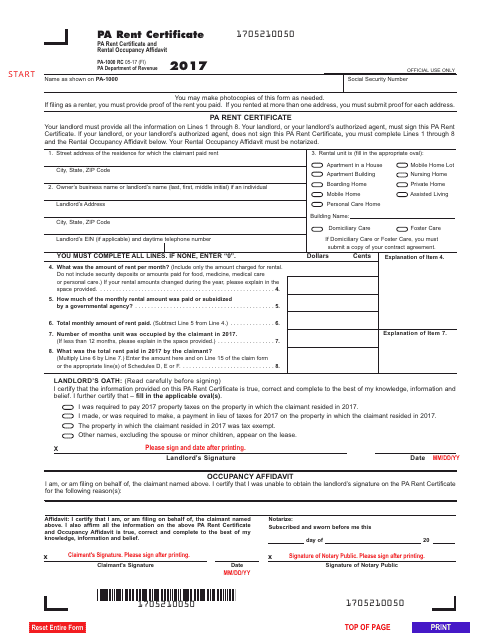

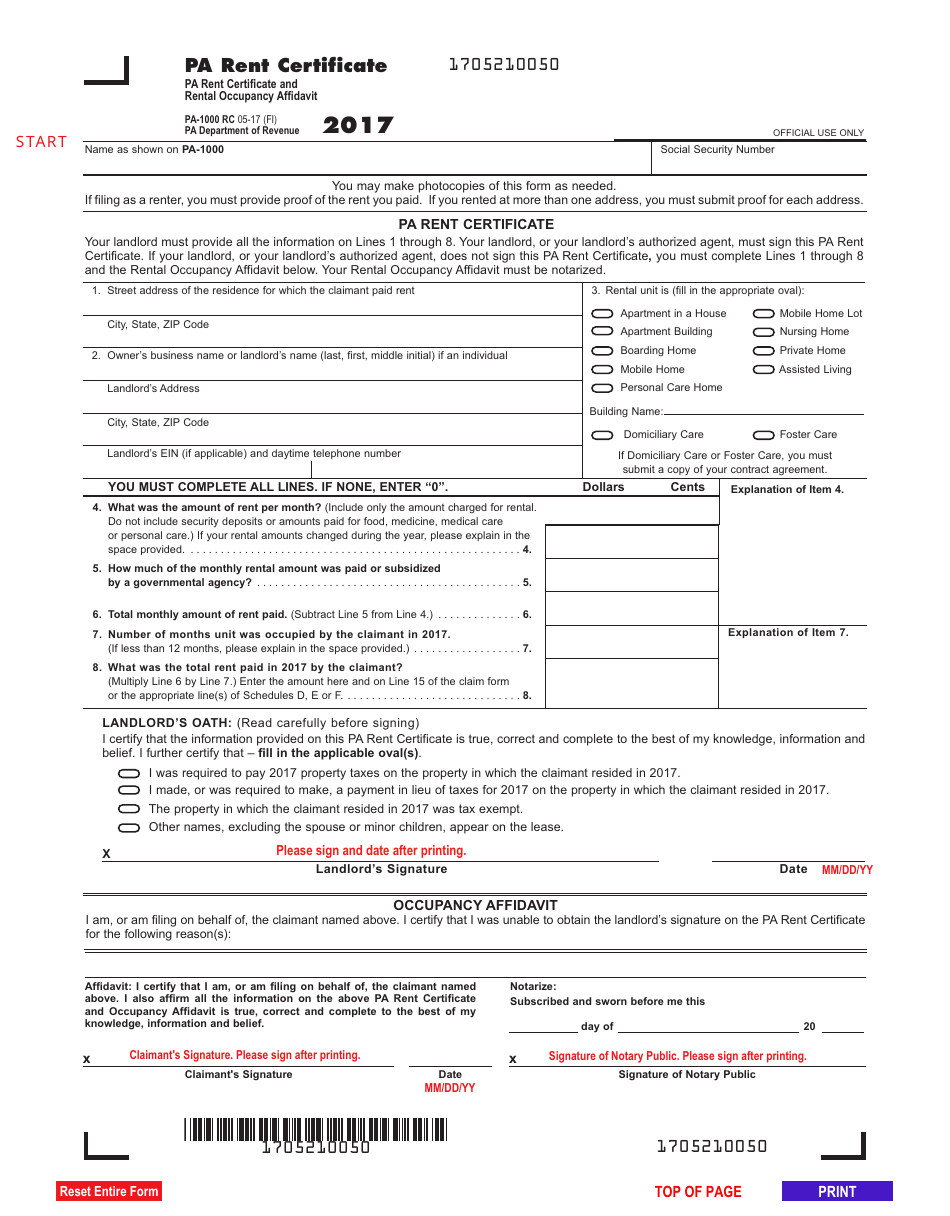

Form PA-1000 RC

for the current year.

Form PA-1000 RC Pa Rent Certificate and Rental Occupancy Affidavit - Pennsylvania

What Is Form PA-1000 RC?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-1000 RC?

A: Form PA-1000 RC is the Pennsylvania Rent Certificate and Rental Occupancy Affidavit.

Q: What is the purpose of Form PA-1000 RC?

A: Form PA-1000 RC is used to determine the eligibility of renters for property tax relief in Pennsylvania.

Q: Who needs to fill out Form PA-1000 RC?

A: Renters in Pennsylvania who meet certain eligibility requirements need to fill out Form PA-1000 RC.

Q: What information is required on Form PA-1000 RC?

A: Form PA-1000 RC requires renters to provide details about their rental unit, their lease, and their household income.

Q: When is the deadline to submit Form PA-1000 RC?

A: The deadline to submit Form PA-1000 RC is typically June 30th of each year.

Q: Is there a fee to file Form PA-1000 RC?

A: No, there is no fee to file Form PA-1000 RC.

Q: What happens after I submit Form PA-1000 RC?

A: After you submit Form PA-1000 RC, the Pennsylvania Department of Revenue will review your application and determine your eligibility for property tax relief.

Q: Are there any income limits to qualify for property tax relief?

A: Yes, there are income limits to qualify for property tax relief in Pennsylvania. These limits vary depending on the number of people in your household.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-1000 RC by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.