This version of the form is not currently in use and is provided for reference only. Download this version of

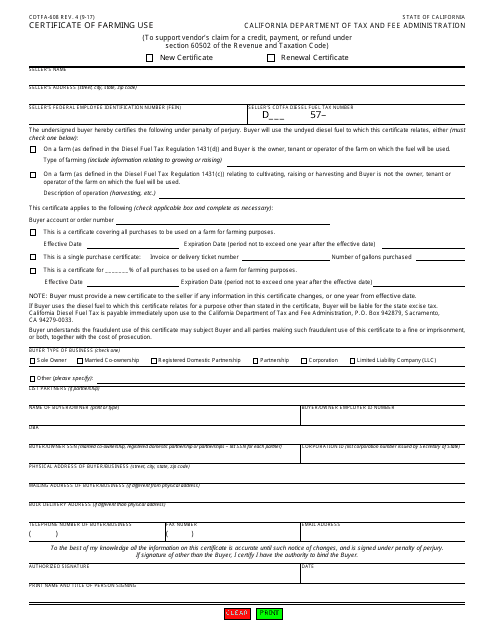

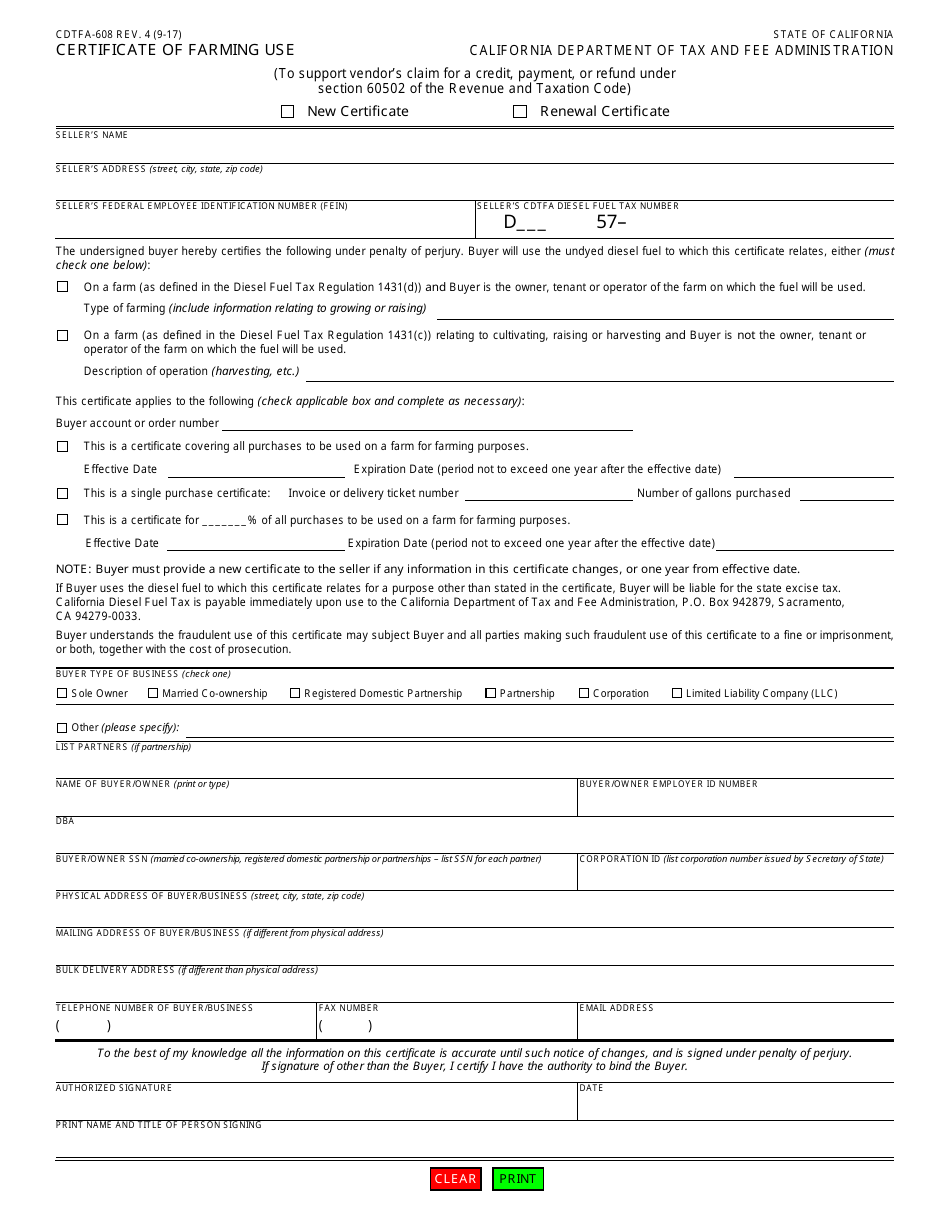

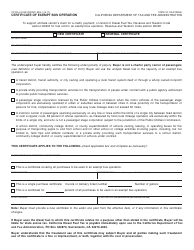

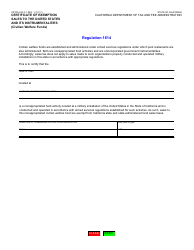

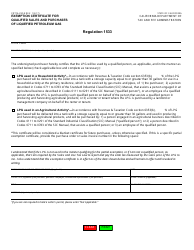

Form CDTFA-608

for the current year.

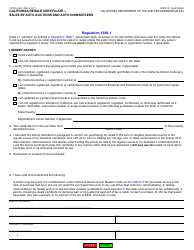

Form CDTFA-608 Certificate of Farming Use - California

What Is Form CDTFA-608?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-608?

A: Form CDTFA-608 is the Certificate of Farming Use in California.

Q: What is the purpose of Form CDTFA-608?

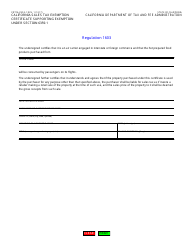

A: The purpose of Form CDTFA-608 is to claim an exemption from certain taxes for qualified farming activities.

Q: Who must file Form CDTFA-608?

A: Farmers engaged in qualified farming activities in California must file Form CDTFA-608.

Q: What taxes does Form CDTFA-608 exempt?

A: Form CDTFA-608 exempts qualified farming activities from certain taxes, such as sales and use taxes.

Q: What information is required on Form CDTFA-608?

A: Form CDTFA-608 requires basic information about the farmer and details about qualified farming activities.

Q: When is Form CDTFA-608 due?

A: Form CDTFA-608 is due annually by the end of the farmer's fiscal year.

Q: Are there any fees associated with filing Form CDTFA-608?

A: There are no fees associated with filing Form CDTFA-608.

Q: How long should I keep a copy of Form CDTFA-608?

A: It is recommended to keep a copy of Form CDTFA-608 for at least four years for record-keeping purposes.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-608 by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.