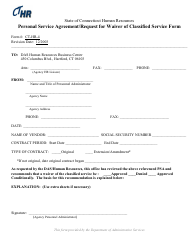

This version of the form is not currently in use and is provided for reference only. Download this version of

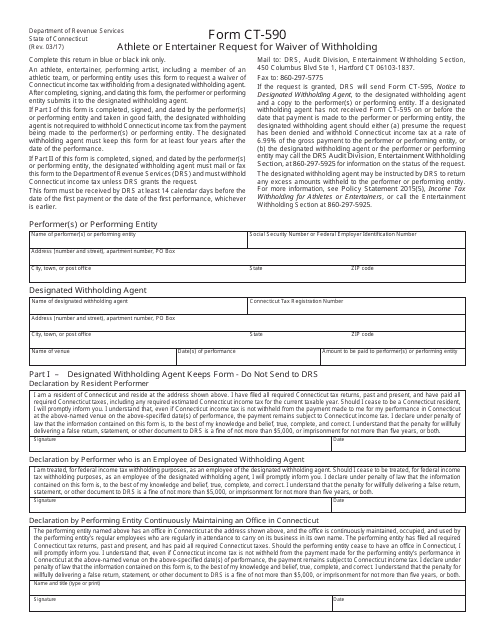

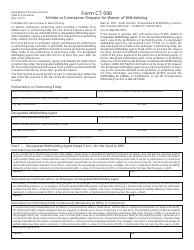

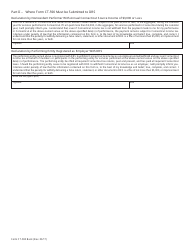

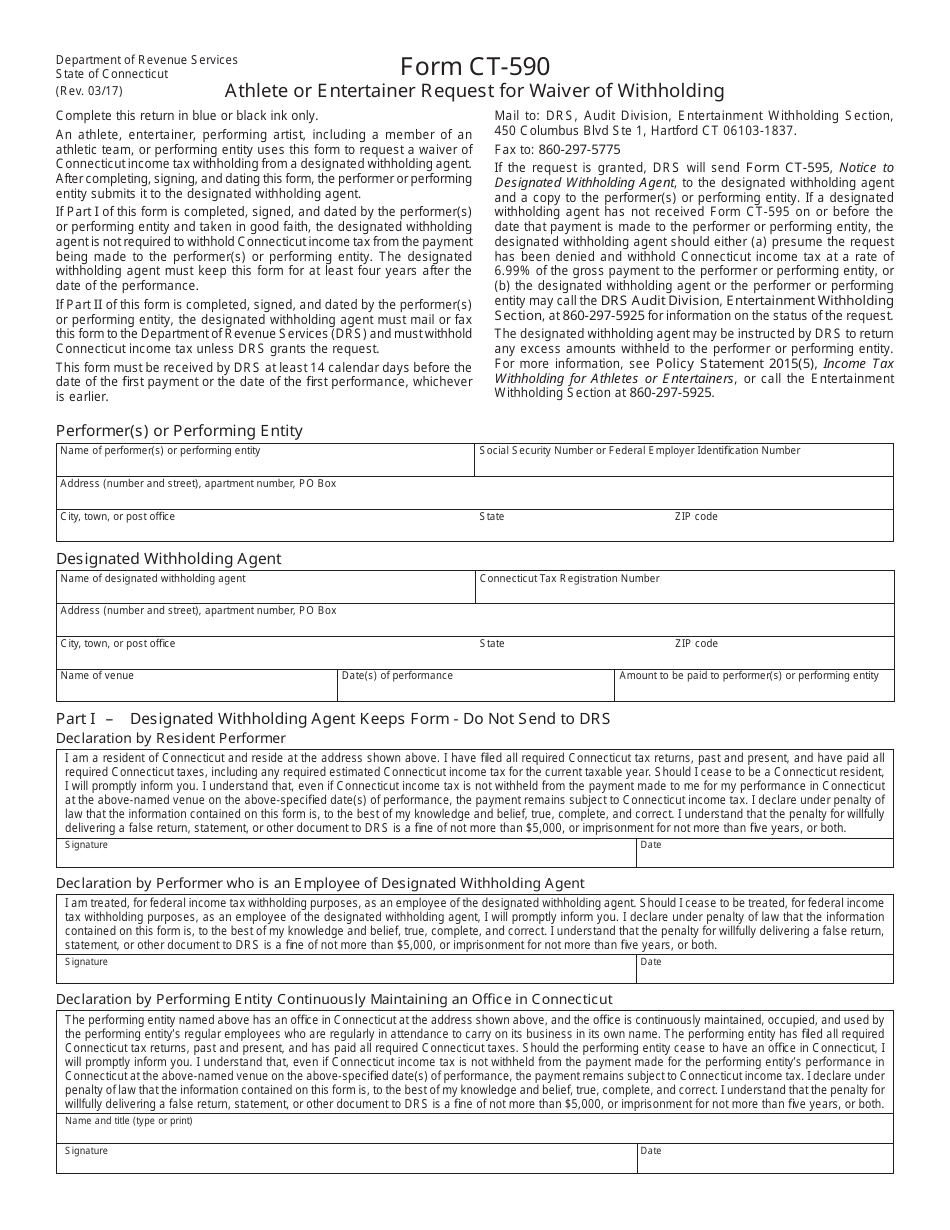

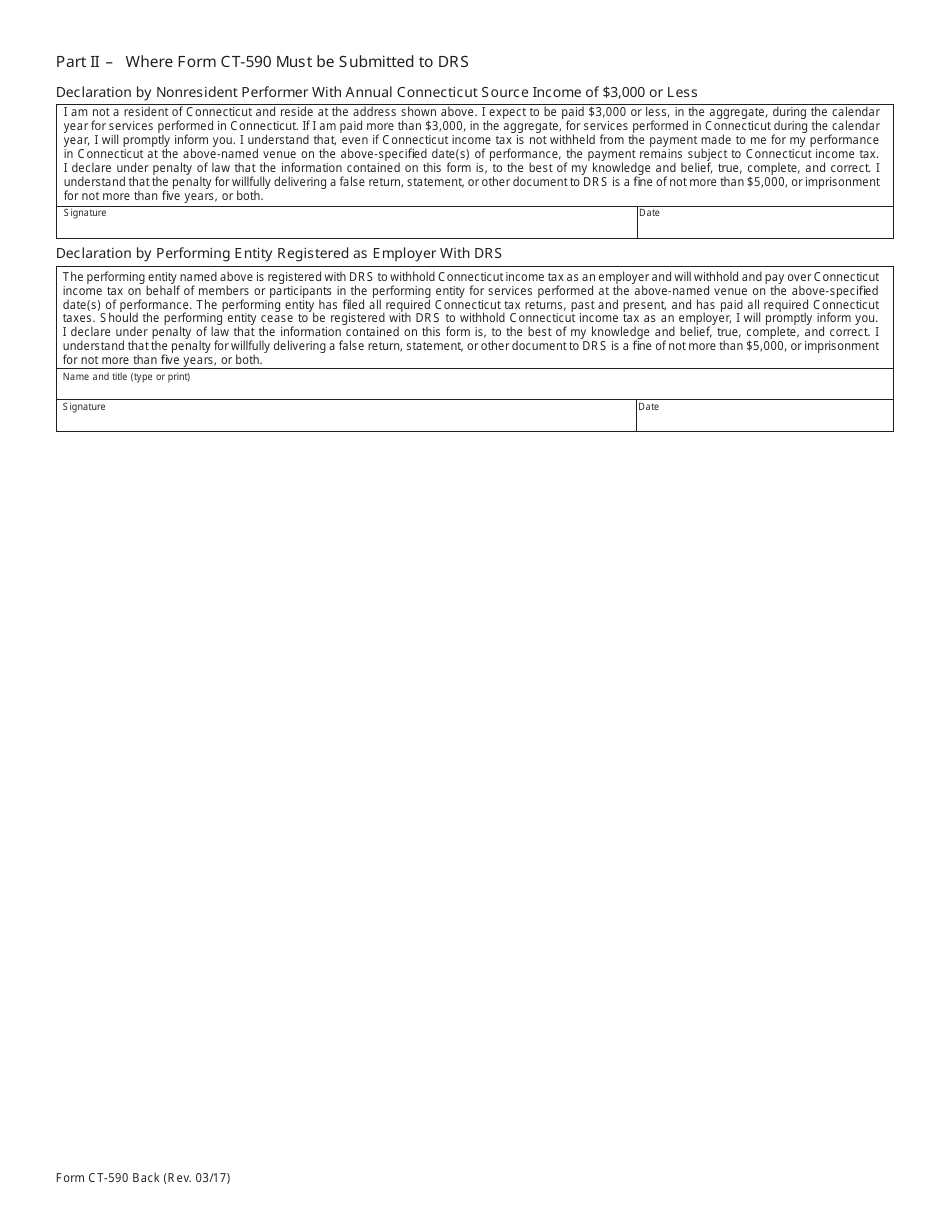

Form CT-590

for the current year.

Form CT-590 Athlete or Entertainer Request for Waiver of Withholding - Connecticut

What Is Form CT-590?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-590?

A: Form CT-590 is a form used in Connecticut for athletes or entertainers to request a waiver of withholding.

Q: Who can use Form CT-590?

A: Form CT-590 can be used by athletes or entertainers who want to request a waiver of withholding in Connecticut.

Q: What is a waiver of withholding?

A: A waiver of withholding is a request to not have taxes withheld from a person's income.

Q: How do I fill out Form CT-590?

A: You need to provide your personal information, the details of your income, and the reason for your waiver request on Form CT-590.

Q: Are there any fees associated with filing Form CT-590?

A: No, there are no fees associated with filing Form CT-590.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-590 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.