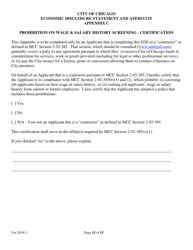

This version of the form is not currently in use and is provided for reference only. Download this version of

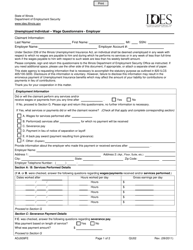

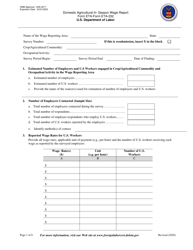

Form UI3/40

for the current year.

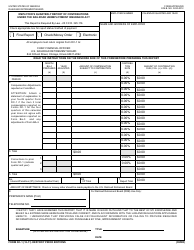

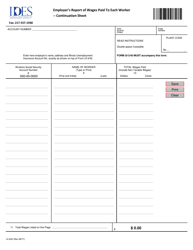

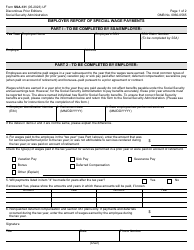

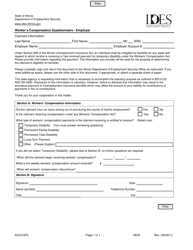

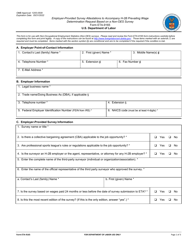

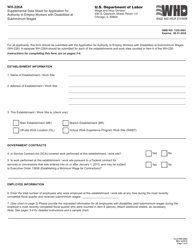

Form UI3 / 40 Employer's Contribution and Wage Report - Illinois

What Is Form UI3/40?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UI3/40?

A: Form UI3/40 is the Employer's Contribution and Wage Report in Illinois.

Q: Who needs to file Form UI3/40?

A: All employers in Illinois are generally required to file Form UI3/40.

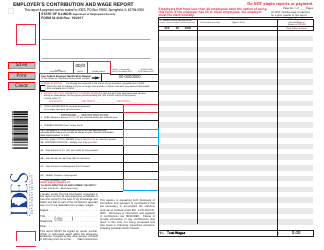

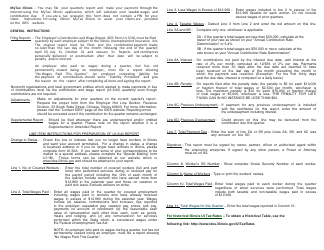

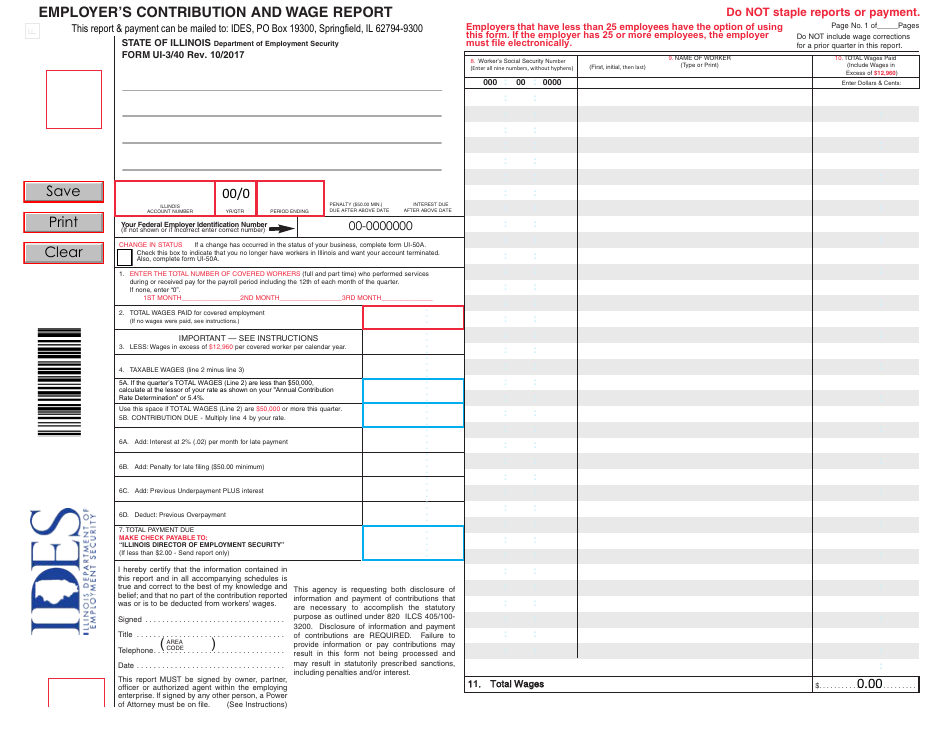

Q: What information is reported on Form UI3/40?

A: Form UI3/40 is used to report employer contribution and wage information, including the total wages paid to employees and the amount of contributions made to the Illinois Unemployment Insurance Fund.

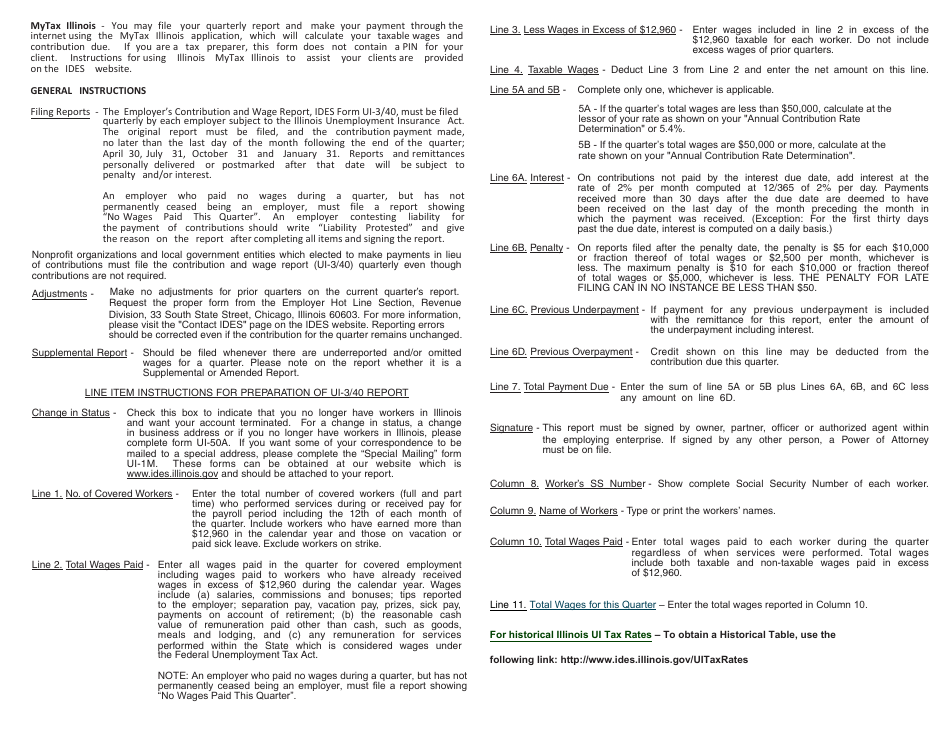

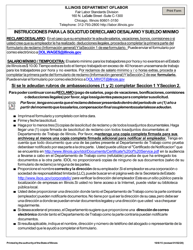

Q: When is Form UI3/40 due?

A: Form UI3/40 is due on a quarterly basis. The due dates vary depending on the calendar year.

Q: Are there any penalties for not filing Form UI3/40?

A: Yes, there may be penalties for not filing Form UI3/40 or for filing it late. It is important to file the form on time to avoid any potential penalties.

Q: What should I do if I have questions or need assistance with Form UI3/40?

A: If you have questions or need assistance with Form UI3/40, you can contact the Illinois Department of Employment Security directly for support.

Q: Is Form UI3/40 only applicable to employers in Illinois?

A: Yes, Form UI3/40 is specific to employers in Illinois and is used to report employment and wage information for employees in the state.

Q: Can I amend Form UI3/40 if I made a mistake?

A: Yes, if you made a mistake on a previously filed Form UI3/40, you can file an amended return to correct the error.

Q: Do I need to include employee information on Form UI3/40?

A: Yes, Form UI3/40 requires the reporting of employee information, including names, social security numbers, and wages earned.

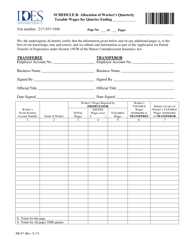

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UI3/40 by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.