This version of the form is not currently in use and is provided for reference only. Download this version of

Form G-7

for the current year.

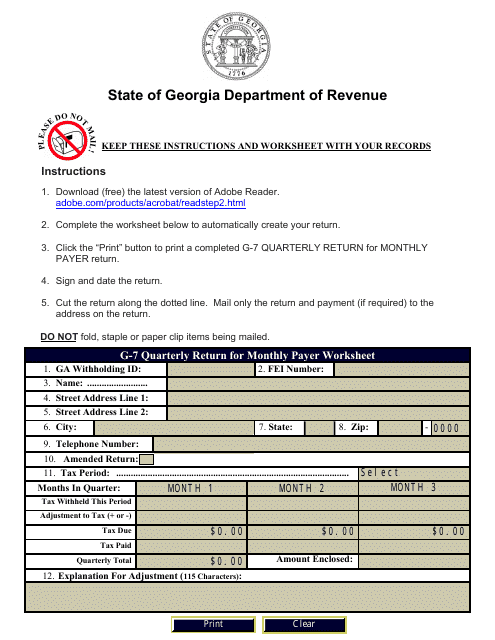

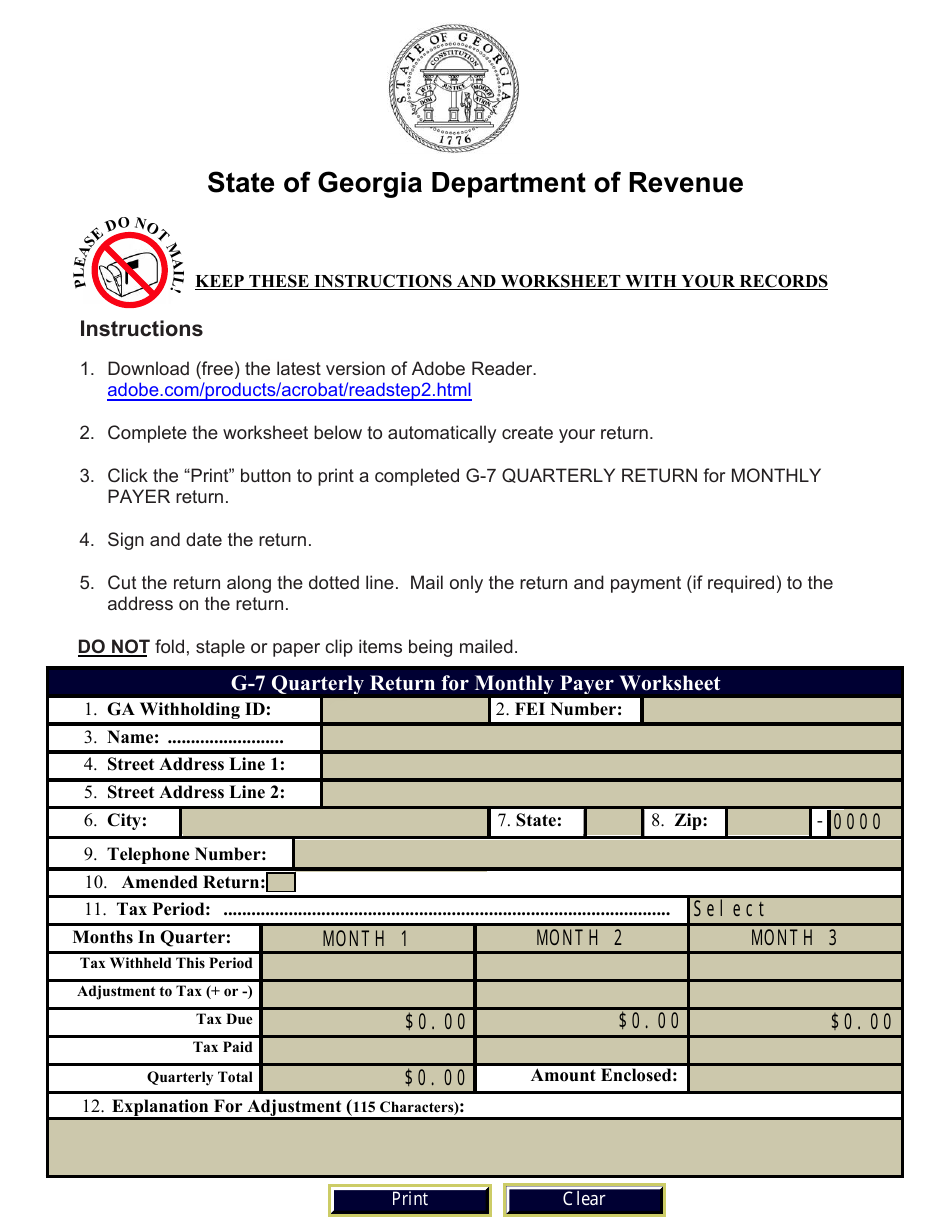

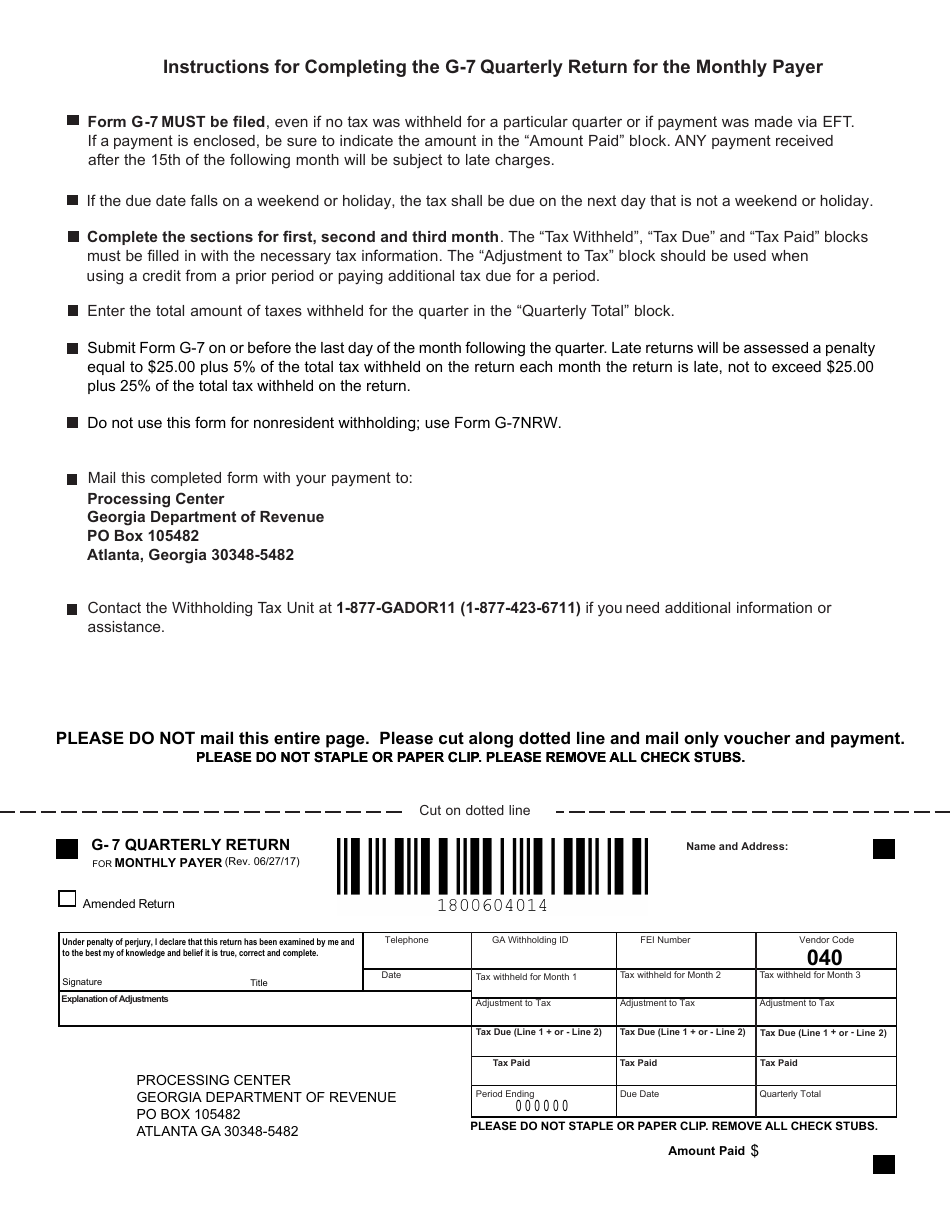

Form G-7 Quarterly Return for Monthly Payer - Georgia (United States)

What Is Form G-7?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-7?

A: Form G-7 is a quarterly return form for monthly payers in the state of Georgia, United States.

Q: Who needs to file Form G-7?

A: Monthly payers in Georgia need to file Form G-7.

Q: What is the purpose of Form G-7?

A: The purpose of Form G-7 is to report and remit sales and use tax collected by monthly payers in Georgia.

Q: How often is Form G-7 filed?

A: Form G-7 needs to be filed on a quarterly basis.

Q: Are there any exceptions to filing Form G-7?

A: Some businesses may be exempt from filing Form G-7. It is recommended to consult the Georgia Department of Revenue for specific exemptions.

Form Details:

- Released on June 27, 2017;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-7 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.