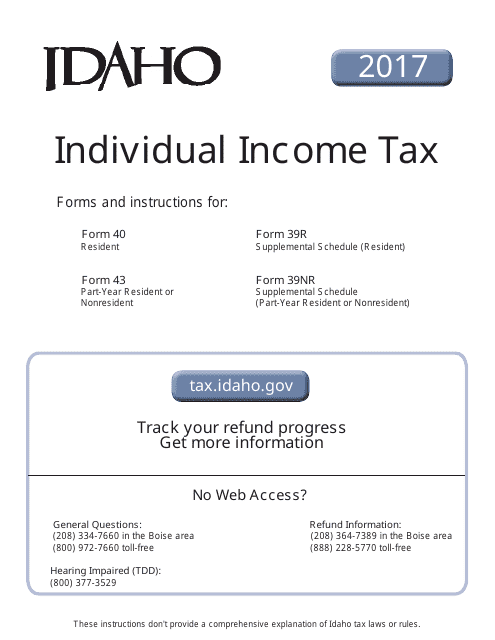

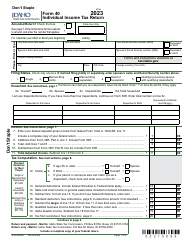

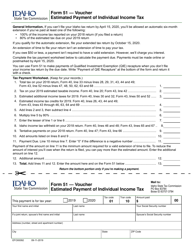

Instructions for Form 40, 43, 39R, 39NR Individual Income Tax - Idaho

This document contains official instructions for Form 40 , Form 43 , Form 39R , and Form 39NR . All forms are released and collected by the Idaho State Tax Commission. An up-to-date fillable Form 40 is available for download through this link.

FAQ

Q: What is Form 40?

A: Form 40 is the individual income tax form for Idaho residents.

Q: What is Form 43?

A: Form 43 is the individual income tax form for non-residents of Idaho who earned income from Idaho sources.

Q: What is Form 39R?

A: Form 39R is the individual income tax form for Idaho residents who are in the military.

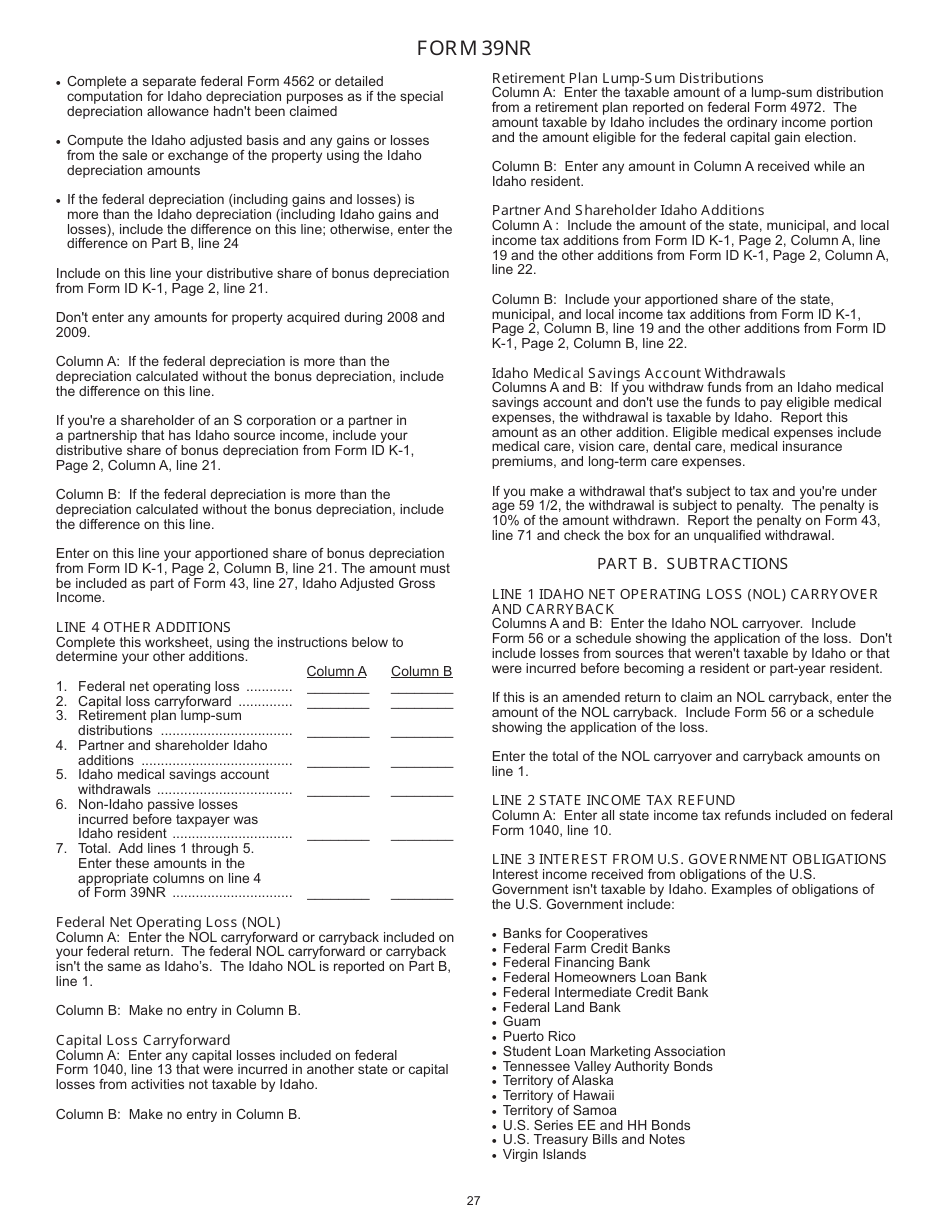

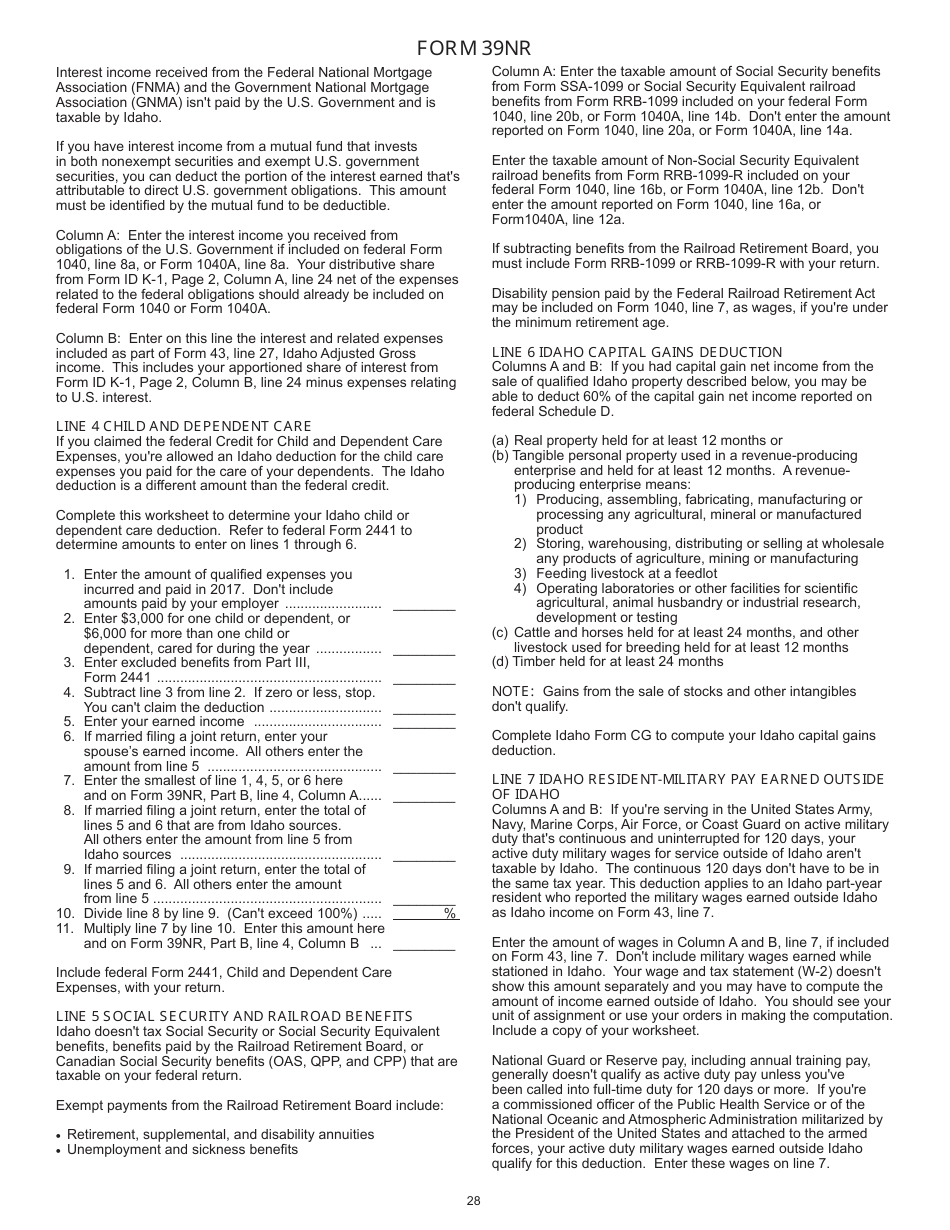

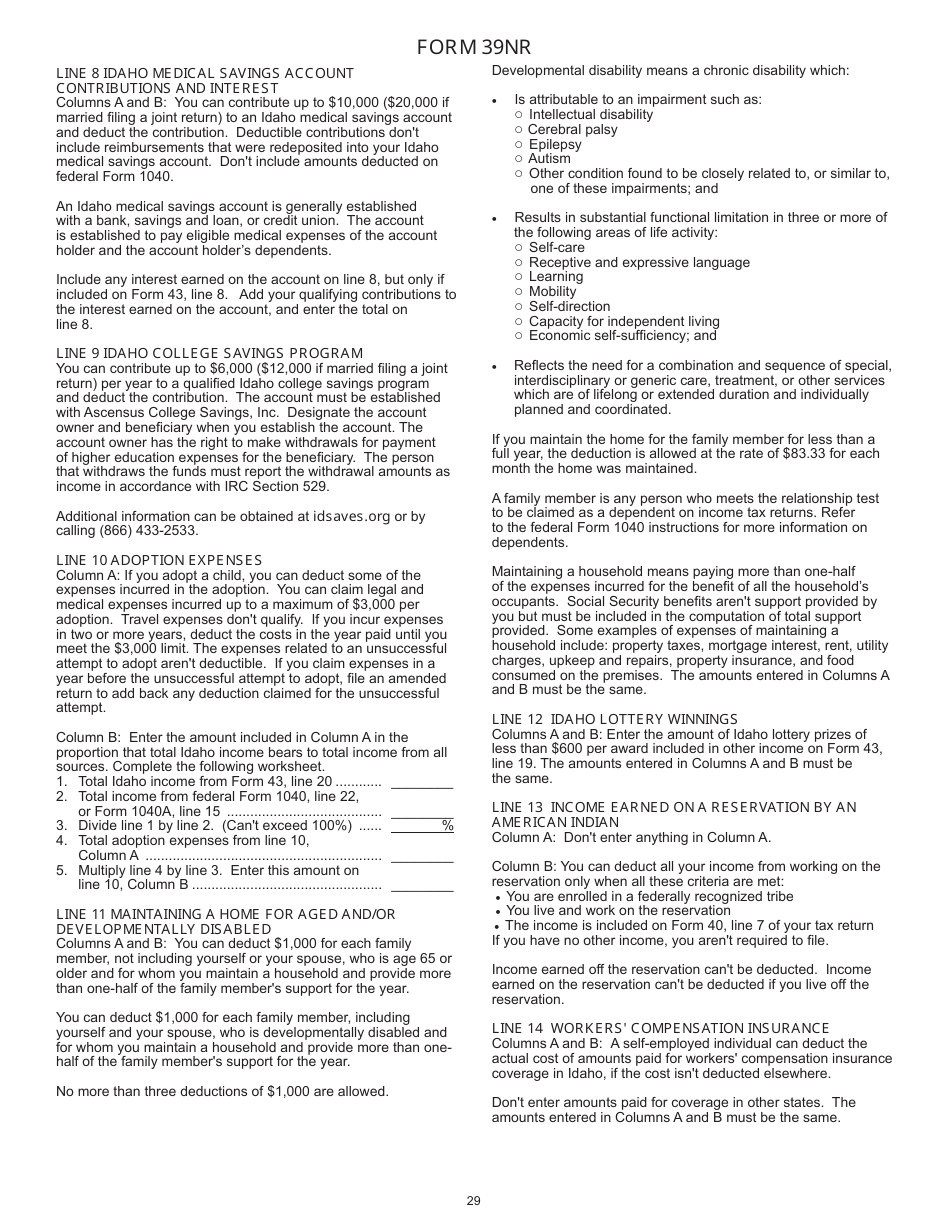

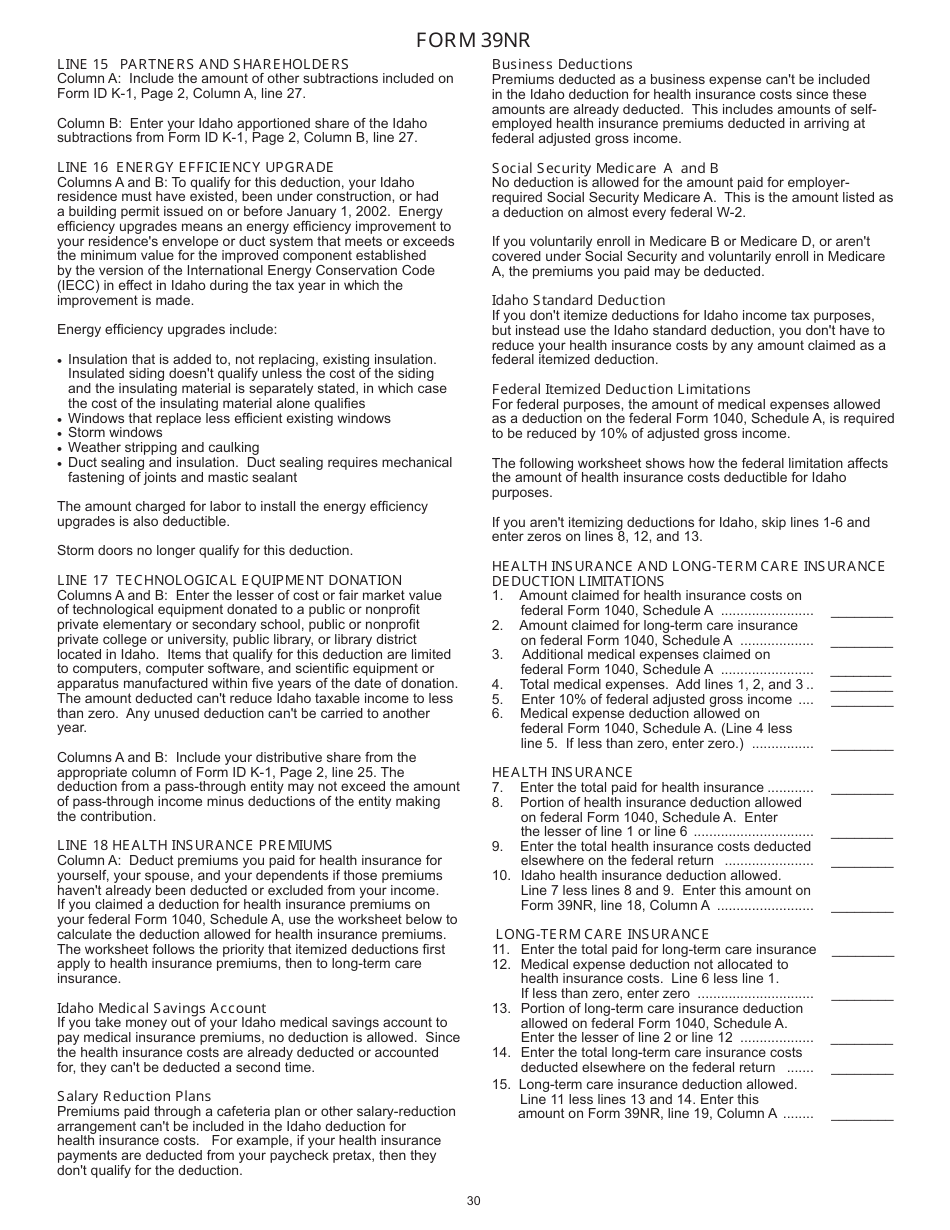

Q: What is Form 39NR?

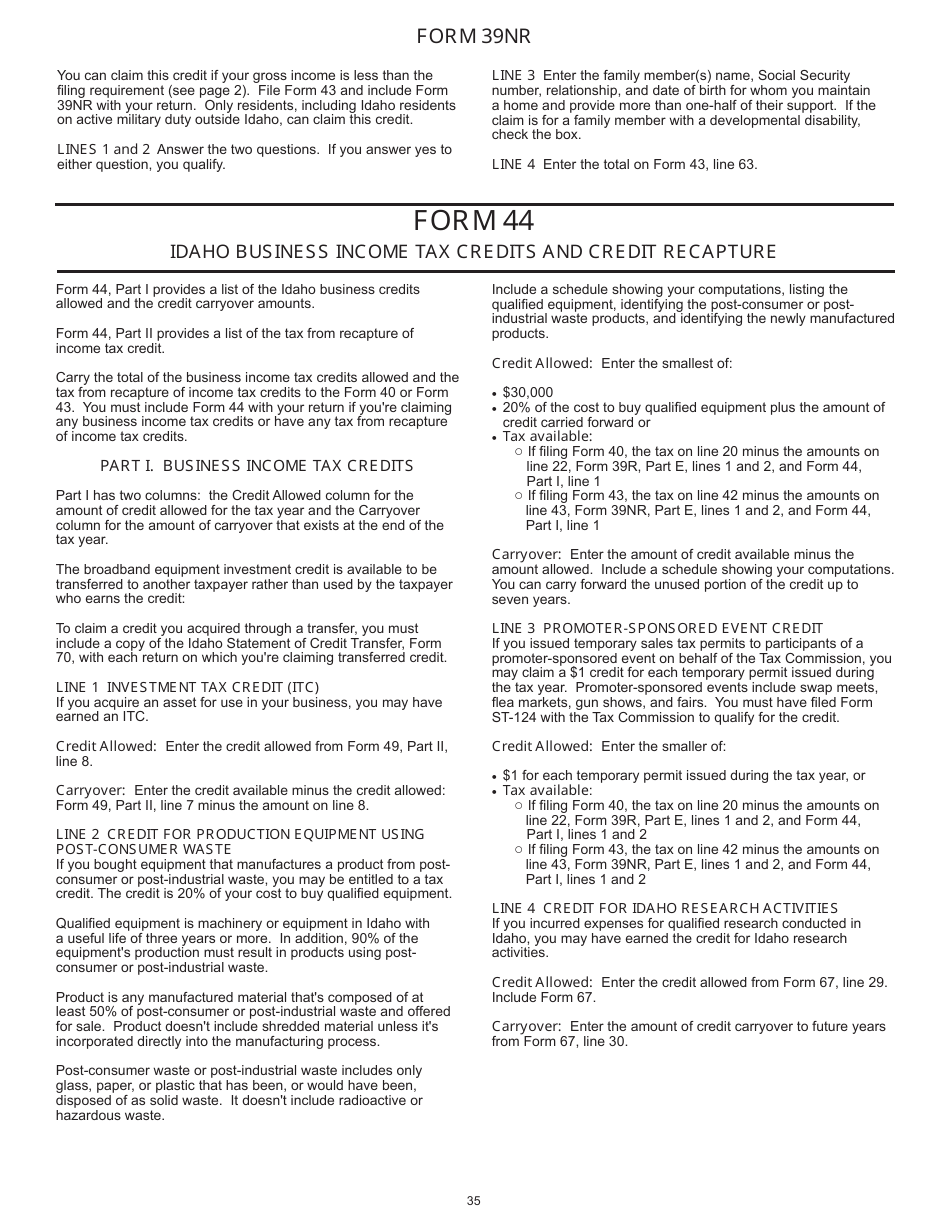

A: Form 39NR is the individual income tax form for non-residents of Idaho who are in the military.

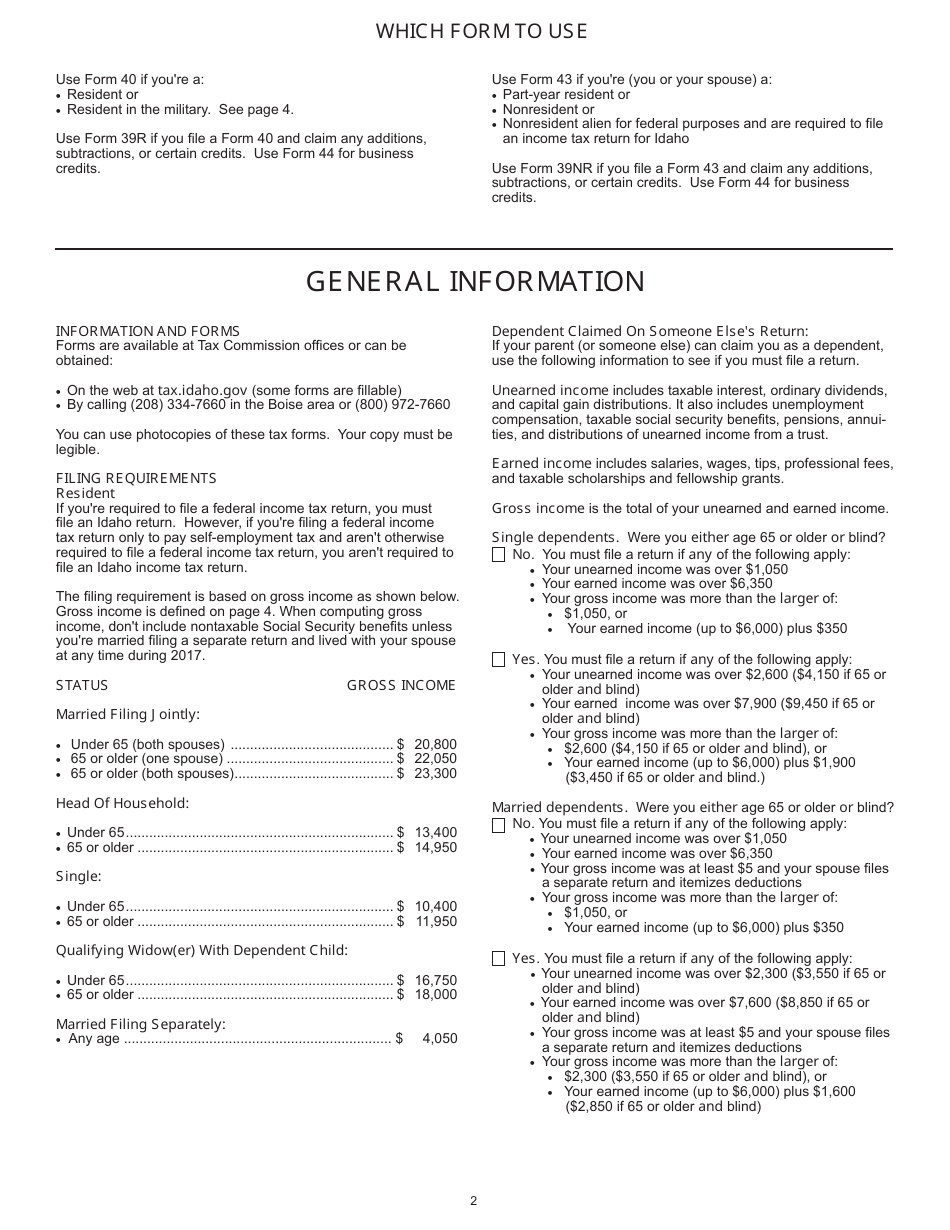

Q: Who needs to file Form 40?

A: Idaho residents who earned income during the tax year need to file Form 40.

Q: Who needs to file Form 43?

A: Non-residents of Idaho who earned income from Idaho sources during the tax year need to file Form 43.

Q: Who needs to file Form 39R?

A: Idaho residents who are in the military and earned income during the tax year need to file Form 39R.

Q: Who needs to file Form 39NR?

A: Non-residents of Idaho who are in the military and earned income from Idaho sources during the tax year need to file Form 39NR.

Instruction Details:

- This 49-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Idaho State Tax Commission.