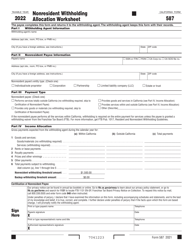

This version of the form is not currently in use and is provided for reference only. Download this version of

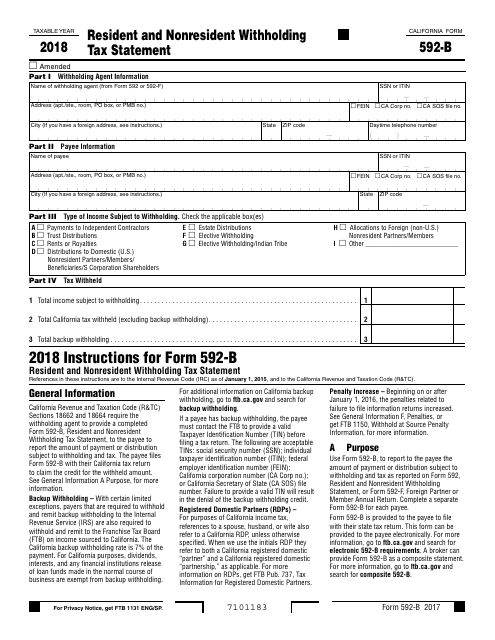

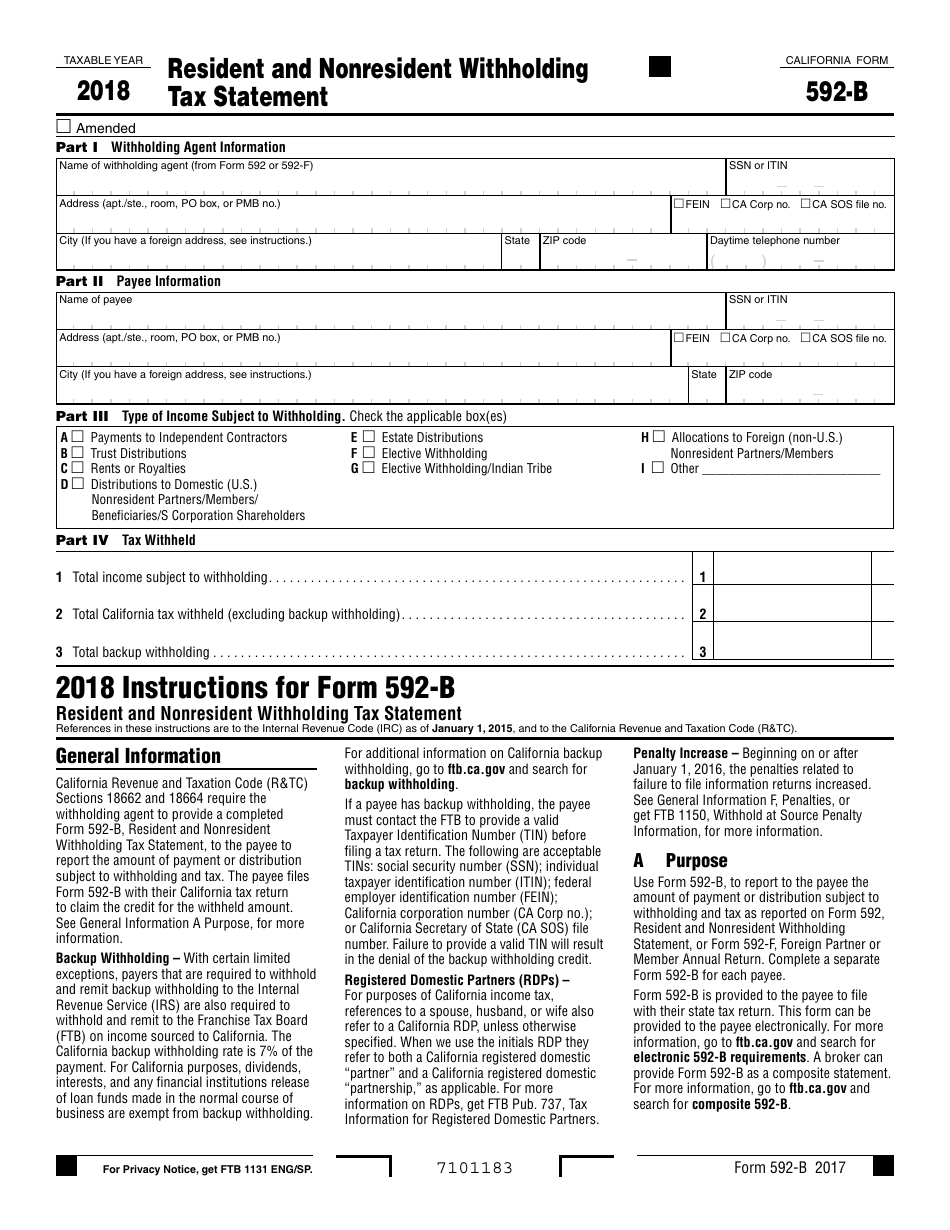

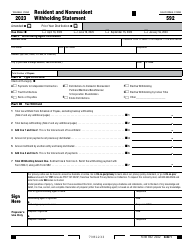

Form 592-B

for the current year.

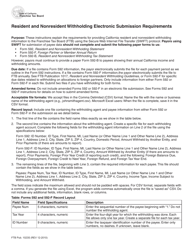

Form 592-B Resident and Nonresident Withholding Tax Statement - California

What Is Form 592-B?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

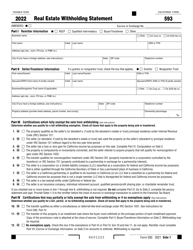

Q: What is Form 592-B?

A: Form 592-B is a Resident and Nonresident Withholding Tax Statement used in California.

Q: Who needs to file Form 592-B?

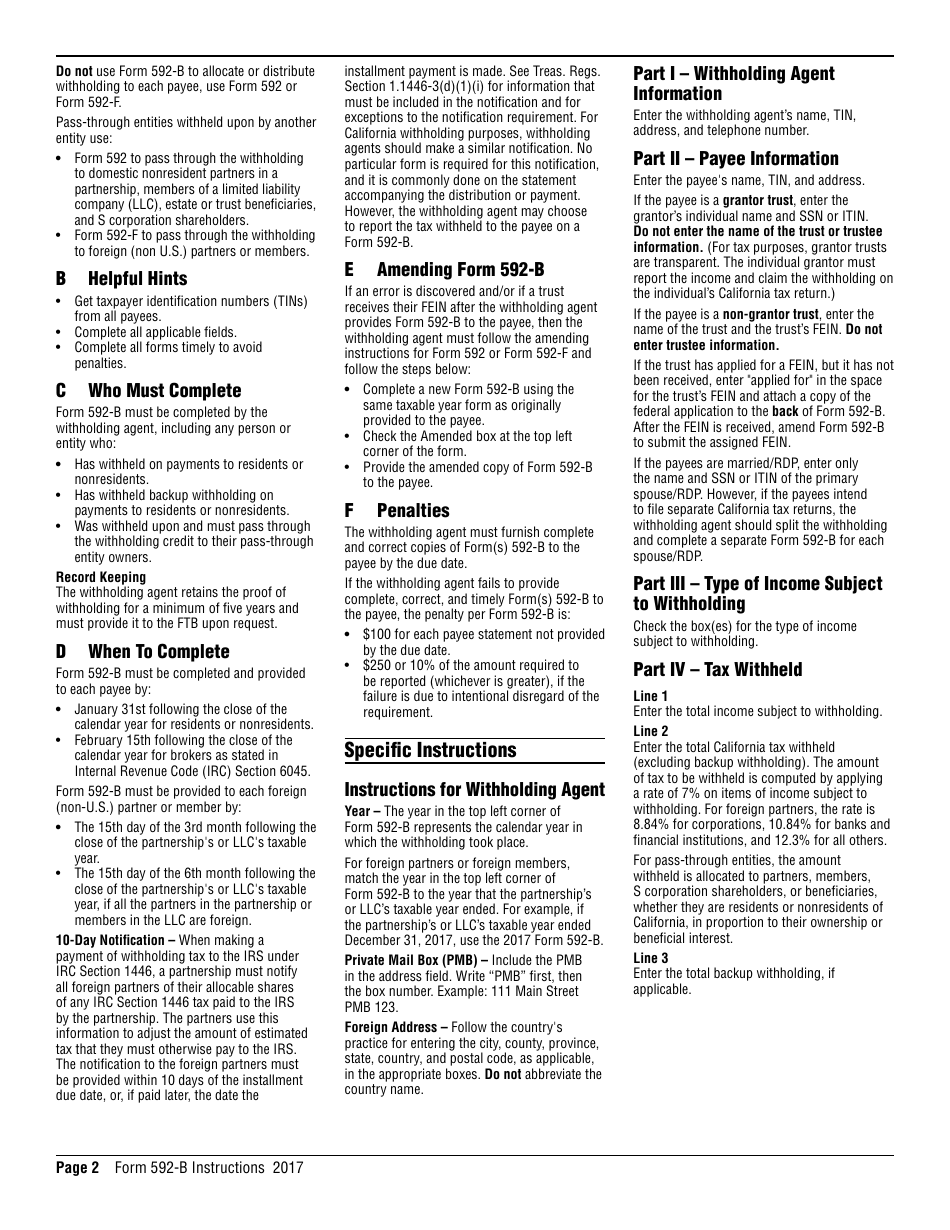

A: Form 592-B needs to be filed by individuals or businesses that have withheld income tax from California source payments made to payees who are either California residents or nonresidents.

Q: What is the purpose of filing Form 592-B?

A: The purpose of filing Form 592-B is to report and remit the withheld income tax to the California Franchise Tax Board.

Q: What information is required on Form 592-B?

A: Form 592-B requires information about the withholding agent, payee, and the amount of income tax withheld.

Q: When is Form 592-B due?

A: Form 592-B is due by January 31st of the year following the calendar year in which the income was paid.

Q: Are there any penalties for not filing Form 592-B?

A: Yes, there are penalties for not filing Form 592-B or for filing it late. The penalties can vary depending on the amount of income tax withheld and the length of the delay in filing.

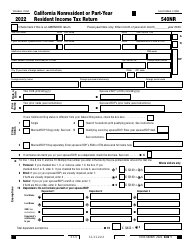

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592-B by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.